- Home

- »

- Renewable Chemicals

- »

-

Nanocellulose Market Size, Share And Growth Report, 2030GVR Report cover

![Nanocellulose Market Size, Share & Trends Report]()

Nanocellulose Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Cellulose Nanofibers, Bacterial Cellulose, Crystalline Nanocellulose), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-985-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nanocellulose Market Summary

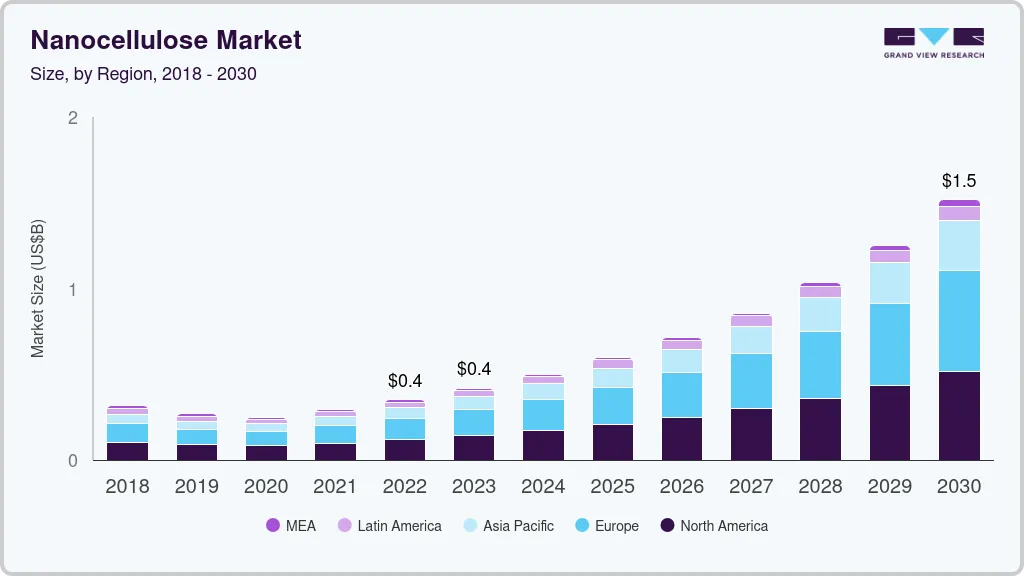

The global nanocellulose market size was estimated at USD 351.5 million in 2022 and is projected to reach USD 1,517.5 million by 2030, growing at a CAGR of 20.1% from 2023 to 2030. The growth is attributable to the rise in demand for various applications and the shifting trend for using bio-based goods are the factors responsible to drive demand for product.

Key Market Trends & Insights

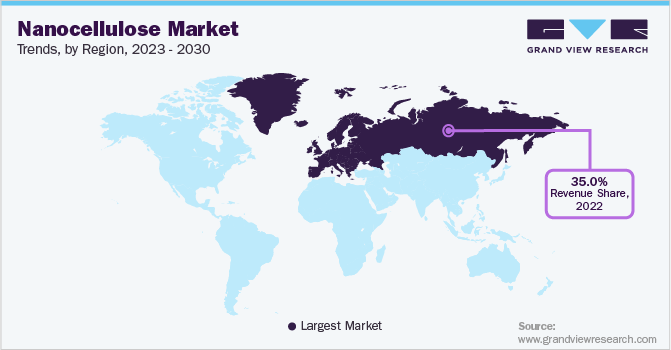

- In terms of region, Europe was the largest revenue generating market in 2022.

- Country-wise, UK is expected to register the significant CAGR from 2023 to 2030.

- By type, Cellulose Nanofibers (CNF) dominated the market with a revenue share of 51% in 2022.

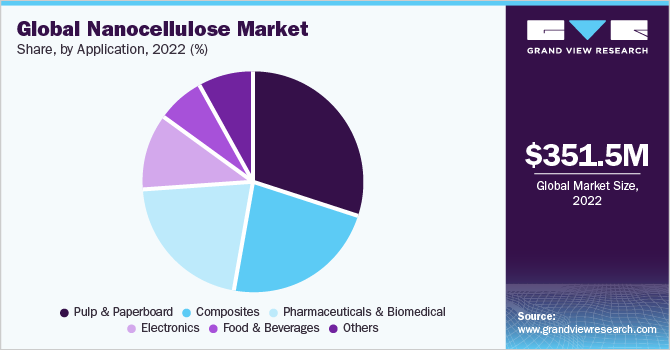

- By application, Pulp & paperboard application dominated the market with a revenue share of 25% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 351.5 Million

- 2030 Projected Market Size: USD 1,517.5 Million

- CAGR (2023-2030): 20.1%

- Europe: Largest market in 2022

Due to its various qualities, such as increased paper machine efficiency, better filler content, lighter base mass, and higher freeness, nanocellulose is suitable for the producing a wide range of products. The paper industry uses nanocellulose as a prominent sustainable nanomaterial additive owing to its high strength, strong oxygen barrier performance, low density, mechanical qualities, and biocompatibility among the available bio-based resources. Additionally, the construction of materials, aqueous coating, and others are some of the major uses of nanocellulose composite materials.

The U.S. is the largest market for nanocellulose in North America contributing a considerable amount to global revenue. People in the U.S. are concerned about their health, which has greatly aided the use of MFC (Micro fibrillated Cellulose) and CNF (Cellulose nanofibers) in the production of functional food products thus increasing the demand for nanocellulose in the country.

The food & beverage, and paper & pulp industry are majorly driving product growth in the country. Demand in the country is majorly driven by the increasing awareness and insistence on highly advanced sustainable products along with paper-based packaging in the food & beverage industries.

The pulp & paper business heavily utilizes nanocellulose as an ingredient to create light and white paper that further accelerates the market growth. Owing to its benign qualities it is used in healthcare applications such as biomedicines and personal hygiene products. Additionally, owing to its superior adsorption abilities, Nanocellulose is a suitable constituent for sanitary napkins and wound dressings. The market has been further stimulated by expanding product research activity.

Type Insights

Cellulose Nanofibers (CNF) dominated the market with a revenue share of more than 51% in 2022.The highest market share is attributable to the product’s easy availability and improved tensile properties. MFC and NFC (Nano Fibrillated Cellulose) are generally made from wood through mechanical and chemical processing of the cellulose bulk. The availability of wood-based pulp simplifies the manufacturing of these products.

Varied characteristics, such as lighter basic mass, improved paper machine efficiency, increased filler content, and higher freeness, makes it suitable for a wide range of commodities. Positive government involvement in promoting the use of bio-degradable Nanocellulose and rising awareness among enterprises in various industries will be beneficial for the market growth.

Bacterial Nanocellulose, which is created by the metabolism of different bacteria and lacks lignin and other extracts, is a three-dimensional network structure with great crystalline. This structure gives the product some distinctive qualities such as high crystalline, greater purity, excessive water retention value, non-toxicity, increased mechanical strength, and antibacterial capabilities that are useful in many different industries.

Application Insights

Pulp & paperboard application dominated the market with a revenue share of over 25% in 2022.This is attributed to the growing customer desire for packaging items with little to no processing and no preservatives. The paper industry uses nanocellulose as a prominent sustainable nanomaterial additive owing to its high strength, strong oxygen barrier performance, low density, mechanical qualities, and biocompatibility among the available bio-based resources.

Due to the enormous product mass of paper, paper and board is the most promising sector. In the paper industry, nanocellulose can be used as a dry or wet form for coating paper, manufacturing paper, packing, and making hygienic and absorbent products.

Additionally, it creates smooth paper surfaces for printing, enhancing print quality. Transparent nanocellulose paper has drawn a lot of interest in the sector of electronics including mobile phones, TVs, computers, solar cells, touch sensors, paper-based generators, and others owing to its optical, biodegradable, light-weight, affordable, and recyclable qualities.

Additionally, between 2020 and 2021, paper and board consumption surged by 5.8%, according to Cepi (Confederation of European Paper). Production increased by 6.1% within the same period, while paper mill operating rates increased to 90.0% from 85.0% in 2020.

Earlier in 2020, the organization had predicted a dip in the production and consumption of the paper and board associated to the pandemic, but majority of the mills continued to operate effectively apart from reduced operating speeds in low-demand situations. Owing to demand for the paper and paperboard in packaging the consumption of nanocellulose is anticipated to surge during the forecast period.

Regional Insights

Europe dominated the market with a revenue share of more than 35% in 2022. This is attributable to the growing demand for pulp and paper combined with prohibitions on single-use plastic packaging, which is anticipated to propel the demand for nanocellulose packaging materials.

Due to its high consumption potential, rising manufacturing capacity, increasing economic development rate, increasing need for lightweight passenger cars, and desire for environmentally friendly food and beverage packaging, North America is expected to be the second largest consumer followed by Europe.

U.K. is the largest consumer in Europe. The market in the U.K. is expected to grow exponentially as a result of a shift in customer demand for plant-based ingredients in food & beverages, medicinal products, electronics, and other applications. Facility expansions, acquisitions, and collaborations, as well as R&D expenditure, are some of the important factors that are anticipated to propel the demand for the product.

In developing economies of Asia Pacific such as South Korea, India, and others owing to the rapid uptake for the environmentally friendly coating, composites, and paints the demand for light-weight and heavy-duty vehicles is increasing, which is further anticipated to propel the demand in Asia Pacific.

Key Companies & Market Share Insights

The market is consolidated owing to the existence of a few major players in the market including Cellu Force, Fiber Lean, Kruger INC., and others. Manufacturers operating in the market engage in strategic mergers & acquisitions, geographical expansion, product developments, and innovation in order to strengthen their positions, increase profitability, and simultaneously generate innovations and advancements.

When compared to other nanotechnology high-performance materials, nanocellulose offers a lower cost and the potential to replace many products made from petrochemicals. It has exceptional qualities like biodegradability, transparency, flexibility, high mechanical strength, and barrier characteristics, among others. Growing interest in health issues and the food & beverage industries will both have a significant impact on the market share in the years to come.

Consequently, the focus on manufacture of the product has increased owing to increasing awareness about health and environmental concerns arising from harmful chemical products. The global market has witnessed several new product developments, mergers & acquisitions and joint ventures due to several industrial challenges. Some prominent players in the global nanocellulose market include:

-

Cellu Force

-

Fiber Lean

-

NIPPON PAPER INDUSTRIES CO., LTD.

-

Kruger INC

-

Borregaard AS

-

CelluComp

-

Melodea Ltd

-

Blue Goose Refineries

-

GranBio Technologies

-

Stora Enso Biomaterials

Nanocellulose Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 419.1 million

Revenue forecast in 2030

USD 1,517.5 million

Growth Rate

CAGR of 20.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; The Netherlands; Finland; France; Norway; Sweden; Switzerland; Spain; China; India; Japan; South Korea; Australia; Thailand; Malaysia; Singapore; Brazil; Colombia; Chile; Israel; Saudi Arabia; Iran; South Africa

Key companies profiled

Cellu Force; Fiber Lean; NIPPON PAPER INDUSTRIES CO.; LTD.; Kruger INC; Borregaard AS; CelluComp; Melodea Ltd; Blue Goose Refineries; GranBio Technologies; Stora Enso Biomaterials

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

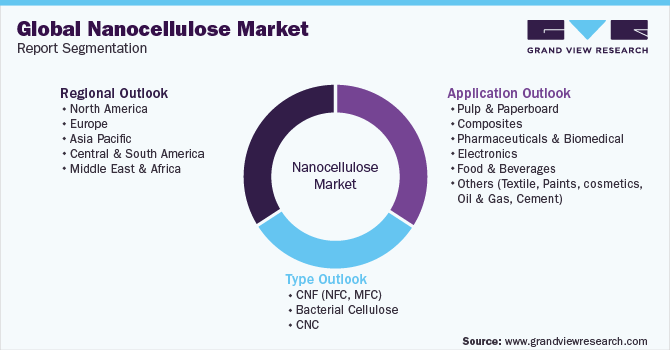

Global Nanocellulose Market Report Segmentation

This report forecasts revenue growth at a global, regional & country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nanocellulose market report based on the type, application, and region:

-

Type Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

CNF (NFC, MFC)

-

Bacterial Cellulose

-

CNC

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Pulp & Paperboard

-

Composites

-

Pharmaceuticals & Biomedical

-

Electronics

-

Food & Beverages

-

Others (Textile, Paints, cosmetics, Oil & Gas, Cement)

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

Netherlands

-

France

-

Finland

-

Norway

-

Sweden

-

Switzerland

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Singapore

-

-

Central & South America

-

Brazil

-

Colombia

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Israel

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global nanocellulose market size was estimated at USD 351.5 million in 2022 and is expected to reach USD 419.1 million in 2023.

b. The global nanocellulose market is expected to grow at a compound annual growth rate of 20.1% from 2023 to 2030 to reach USD 1,517.5 million by 2030.

b. CNF type segment dominated the market with a share of over 51% in 2022. This is attributable to the product’s easy availability and improved tensile properties.

b. Some key players operating in the nanocellulose market CelluForce, FiberLean, NIPPON PAPER INDUSTRIES CO., LTD., Kruger INC, Borregaard AS, CelluComp, Melodea Ltd, Blue Goose Refineries, GranBio Technologies, Stora Enso Biomaterials

b. The rise in cellulose demand for various applications and the shifting trend for using bio-based goods are the factors responsible to drive the demand for the product.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.