- Home

- »

- Pharmaceuticals

- »

-

Naltrexone And Buprenorphine Market Size Report, 2030GVR Report cover

![Naltrexone And Buprenorphine Market Size, Share & Trends Report]()

Naltrexone And Buprenorphine Market Size, Share & Trends Analysis Report By Product, By Route of Administration (Oral, Injectable) By Application, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-342-4

- Number of Report Pages: 202

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Naltrexone And Buprenorphine Market Trends

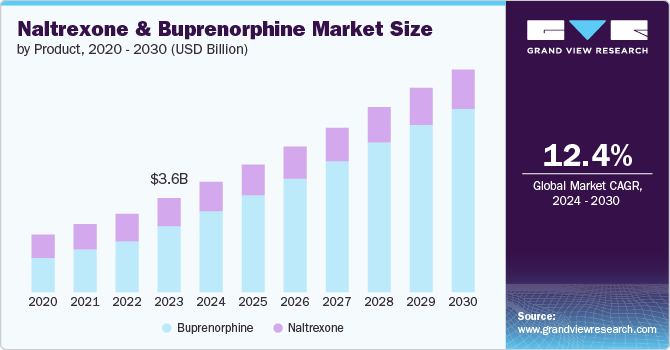

The global naltrexone and buprenorphine market size was estimated at USD 3.56 billion in 2023 and is projected to grow at a CAGR of 12.41% from 2024 to 2030. The growth of the market can be attributed to the increasing prevalence of substance use disorders, expanding government initiatives to combat the crisis, and the rising awareness of opioid use disorder treatment. These factors are expected to propel market growth significantly over the forecast period, driving innovation and accessibility in addiction care solutions.

The growing prevalence of substance use disorders (SUD) serves as a significant driver for the market of medications such as naltrexone and buprenorphine. This increase in the number of individuals affected by substance use disorders creates a greater demand for effective treatments, thereby influencing market dynamics and encouraging pharmaceutical advancements in addiction medicine. The 2022 National Survey on Drug Use and Health (NSDUH), released by the Substance Abuse and Mental Health Services Administration (SAMHSA), provides comprehensive insights into substance use and mental health trends in the U.S.

In 2022, 59.8% of people aged 12 or older used tobacco, alcohol, or illicit drugs; 70.3 million used illegal drugs in the past year, with marijuana being the most common; and 48.7 million had a substance use disorder (SUD), including alcohol & drug use disorders. Moreover, 23.1% of adults had a mental illness, and 19.5% of adolescents experienced a major depressive episode. The report highlights the prevalence of mental health challenges and substance use issues nationwide, guiding policy and resource allocation efforts to effectively address these public health concerns.

Furthermore, increasing government initiatives are emerging as pivotal drivers for the market, growing awareness, accessibility, and affordability of addiction treatment options worldwide. These initiatives prioritize expanding access to treatment and recovery services, enhancing public health interventions, and increasing law enforcement efforts to reduce illicit drug supplies. They also emphasize education and awareness campaigns to prevent substance misuse and promote safe prescribing practices among healthcare providers.

Furthermore, these efforts involve strengthening collaborations between federal, state, and local agencies, as well as integrating evidence-based strategies to address the complex challenges posed by opioid addiction in communities across the country. For instance, in July 2023, The Department of Health and Human Services (HHS) via SAMHSA allocated USD 47.8 million across five grant programs to combat substance misuse and the overdose epidemic.

These grants support prevention, treatment, recovery, and harm reduction efforts under the HHS Overdose Prevention Strategy and Biden-Harris Administration’s National Drug Control Strategy. Programs include expanding access to Medications for Opioid Use Disorder (MOUD), alternatives to opioids in emergency departments, preventing underage drinking, aiding adult reentry from incarceration with SUDs, and enhancing services for pregnant & postpartum women with substance use issues:

Moreover, increasing awareness of opioid use disorder treatment is crucial for expanding the reach and impact of medications like naltrexone and buprenorphine, heralding a transformative era in addiction care and recovery. Global initiatives and governmental schemes are crucial in raising awareness and promoting effective treatment for OUD. In India, the Nasha Mukt Bharat Abhiyaan represents this effort. Through extensive awareness campaigns and community involvement, NMBA has engaged over 110 million individuals, trained 8,000 master volunteers, and reached 33.6 million youth. Leveraging technology and social media, NMBA collaborates with organizations such as the All-World Gayatri Pariwar to foster a drug-sensitive society and holistic well-being. Moreover, mentioned below are some global and national efforts to combat the opioid crisis, improve treatment access, and support recovery efforts across different sectors.

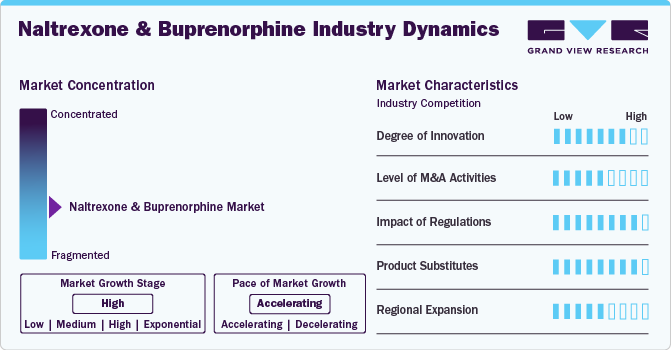

Market Concentration & Characteristics

The degree of innovation for naltrexone and buprenorphine is marked by significant advancements such as faster XR-naltrexone initiation methods highlighted in the SWIFT study of March 2023, FDA support for MAT, and ongoing developments in combination therapies and personalized treatment plans. These innovations aim to enhance treatment outcomes and efficiency in managing opioid use disorder, reflecting a transformative shift in addiction medicine.

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in May 2024, Purdue Pharma acquired the rights to a novel buprenorphine transdermal system, demonstrating its interest in expanding its portfolio of buprenorphine-based pain medications.

Regulatory measures significantly influence the growth and development of naltrexone and buprenorphine in opioid use disorder treatment. They ensure safety, efficacy, and quality standards, bolstering confidence among healthcare providers and patients. However, strict regulations may create barriers to access and increase costs, affecting affordability and market dynamics. However, regulations stimulate innovation in formulation and combination therapies, aiming to enhance treatment outcomes and reduce misuse risks. Balancing regulatory oversight with accessibility is crucial for optimizing the impact of these medications in addressing opioid addiction.

Product substitutes such as methadone and behavioral therapies pose competitive threats to naltrexone and buprenorphine in treating opioid addiction. These alternatives offer different mechanisms of action and treatment approaches, influencing market dynamics and pricing strategies. Methadone, a full opioid agonist, and behavioral therapies provide alternative paths to managing addiction, potentially impacting the adoption and utilization of naltrexone and buprenorphine. This moderate threat of substitutes highlights the need for pharmaceutical companies and healthcare providers to differentiate and effectively communicate the unique benefits of naltrexone and buprenorphine in opioid use disorder treatment.

The naltrexone and buprenorphine market is poised for significant regional expansion driven by the worldwide imperative to tackle the rising prevalence of opioid use disorder (OUD), highlighting the importance of regional strategies in the development and delivery of effective therapeutics. For instance, in October 2023, Indivior PLC secured exclusive global rights to develop, produce, and market a range of long-acting injectable medicines for Alar Pharmaceuticals Inc. These formulations included various durations for the release of a buprenorphine prodrug, notably featuring the long-acting injectable candidate, ALA-1000. By obtaining these rights, Indivior aims to expand its market presence globally in the field of opioid use disorder treatment, potentially broadening its product offerings and geographical reach.

Product Insights

The buprenorphine segment led the market and accounted for 70.02% of the global revenue in 2023. The segment’s growth is driven by its key role in treating opioid dependence and its increasing adoption among healthcare providers & patients. Buprenorphine is a partial opioid agonist used primarily for opioid dependence treatment. It reduces withdrawal symptoms and cravings, offering a safe alternative to full opioid agonists. Buprenorphine stands out for its efficacy in treating opioid dependence, curbing cravings, and enhancing quality of life. Its role in alleviating withdrawal symptoms and normalizing brain function makes it a pivotal medication in addiction treatment strategies.

The naltrexone segment is projected to witness a significant CAGR from 2024 to 2030. Naltrexone is an opioid antagonist medication, approved by the FDA for treating opioid and alcohol use disorders. It blocks opioid receptors, reducing cravings and preventing euphoria from opioids. The segment growth can be attributed to the various strategies from market players, regulatory approvals, clinical trials proving efficacy, & other factors that enhance treatment initiation rates. According to the study published by JAMA N Network Open in May 2024, initiating extended-release injectable naltrexone (XR-naltrexone) for OUD within 5 to 7 days of seeking treatment, rather than 10 to 15 days, significantly increases treatment initiation rates. However, the rapid approach requires intensive medical supervision due to potential safety concerns, the study suggests this method could enhance XR-naltrexone’s adoption despite initial withdrawal management challenges. Future research should address its sustainability and economic implications.

Distribution Channel Insights

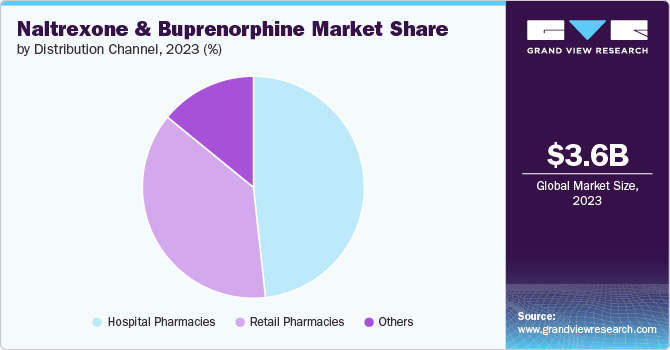

Hospital pharmacies led the market with a revenue share of 48.26% in 2023 due to their key role in administering parenteral OUD treatments, such as buprenorphine, ensuring physician-supervised care, and facilitating access to essential medications. Hospitals, as primary care institutions, boast a robust presence of well-trained professionals who facilitate effective treatment delivery. The adoption of prescribed therapies in hospital settings ensures physician-supervised drug administration, significantly boosting opioid sales through hospital pharmacies. In 2024, Vermont’s syndromic surveillance shows lower opioid overdose ED visit rates than the 3-year average. Males aged 30-39 have the highest rates, and Caledonia County stands out with significantly higher rates, requiring targeted interventions. The data shows potential segment growth driven by increased treatment demand amid targeted interventions and heightened awareness of opioid-related issues.

The retail pharmacies segment is projected to witness a significant CAGR from 2024 to 2030. Retail pharmacies are pivotal for the OUD treatment, facilitating widespread access to medications, such as naltrexone and buprenorphine. They offer convenient locations for patients to obtain prescriptions, support adherence through counseling, and contribute significantly to public health initiatives aimed at combatting the opioid crisis. Their accessibility and community presence make retail pharmacies integral to enhancing treatment accessibility and patient outcomes in OUD care.

Route of Administration Insights

Buprenorphine segment is sub segmented into oral, injectable, and implantable administration. Among these, the injectable administration segment held the majority share of 65.0% in 2023. Buprenorphine injectable administration is an important route for delivering this opioid agonist-antagonist medication to treat OUD and pain. The use of injectable buprenorphine formulations has witnessed an uptick in recent years.

Naltrexone segment is sub segmented into oral, injectable, and implantable administration. Among these, the oral administration segment held the majority share of 55.87% in 2023. Oral naltrexone is the most prescribed formulation. The recommended dose is 50 mg once daily, taken with or without food. Oral naltrexone is effective in reducing heavy drinking days and increasing abstinence rates in patients with AUD. In addition, it is used off-label at higher doses up to 150 mg/day in some cases. Vivitrol is an extended-release injectable suspension of naltrexone given as 380 mg intramuscular gluteal injection every 4 weeks. It was approved by the FDA in 2006 for treating alcohol dependence and in 2010 for the prevention of relapse to opioid dependence. Vivitrol has been shown to improve treatment outcomes compared to placebo in clinical trials for alcohol & opioid dependence.

Application Insights

The Opioid use disorder (OUD) application in the Buprenorphine segment led the market and accounted for 70.02% of the global revenue in 2023. Buprenorphine is a partial opioid agonist approved by the FDA for treating acute & chronic pain, as well as opioid dependence. It is available in various formulations, including sublingual tablets, buccal films, transdermal patches, and injectable forms. For treating opioid dependence, buprenorphine is commonly used as an alternative to methadone, as it has a better safety profile with a lower risk of overdose and respiratory depression. Buprenorphine is often combined with naloxone, a non-selective opioid receptor antagonist, to reduce the potential for abuse. This combination product, known as Suboxone, is approved for the maintenance treatment of opioid dependence as part of a comprehensive treatment plan that includes counseling and psychosocial support.

Naltrexone segment has two applications namely, opioid use disorder (OUD) and alcohol use disorder (AUD). Among these the Opioid use disorder (OUD) application held the largest revenue share of the market in 2023. The use of naltrexone for treating AUD & OUD is expected to surge as healthcare providers and patients seek effective medication-assisted treatments. For instance, in 2021, the FDA approved a new long-acting injectable formulation of naltrexone called Vivitrol, which only needs to be administered once per month. This has made naltrexone more convenient for patients and improved adherence.

Regional Insights

North America naltrexone and buprenorphine market accounted for 39.39% share in 2023. The North America naltrexone and buprenorphine market is anticipated to grow steadily during the forecast period driven by increasing prevalence of substance use disorders including Opioid Use Disorder (OUD). In addition, favorable reimbursement policies, increasing awareness of current treatment, and improved patient affordability are expected to further propel market growth. Several factors such as overprescription of opioids, chronic pain, high consumption of alcohol, and inability to access treatment are among the major factors contributing to OUD.

U.S. Naltrexone And Buprenorphine Market Trends

The U.S. naltrexone and buprenorphine market is witnessing significant developments and a positive growth trend, owing to various factors such as high awareness among healthcare experts about drugs available for treating OUD and a rise in disease prevalence. According to the CDC, in 2022, over 131,778,501 prescriptions related to opioids were dispensed in the U.S. Moreover, about 145,000 patients were newly diagnosed with OUD in 2022.

Europe Naltrexone And Buprenorphine Market Trends

The naltrexone and buprenorphine market in Europe is substantially changing, influenced by healthcare reforms, research advancements, and patient-focused initiatives across different countries. The prevalence of OUD is increasing due to an aging population and changing lifestyles, leading to a growing demand for effective & innovative treatment options across the continent.

The UK naltrexone and buprenorphine market is significantly growing attributed to the increasing prevalence of substance use disorders and expanding government initiatives to combat the crisis. In England, the largest country in the UK, over 50% of individuals with OUD are actively undergoing treatment, with the majority receiving Medications for Opioid Use Disorder (MOUD) such as methadone, buprenorphine, or naltrexone in 2023. In contrast, in the U.S., less than 30% of individuals with OUD are receiving care.

The naltrexone and buprenorphine market in France is poised for growth, driven by technological innovation, changing consumer trends, and the increasing prevalence of AUD.

The Germany naltrexone and buprenorphine market is marked by comprehensive research initiatives and long-term observational studies aimed at identifying treatment.

Asia Pacific Naltrexone And Buprenorphine Market Trends

The naltrexone and buprenorphine market in the Asia Pacific is experiencing significant growth, driven by the increasing prevalence of AUD, improving healthcare infrastructure, and advancements in treatment options. Excessive alcohol consumption and Alcohol Use Disorder (AUD) are prevalent issues that are often difficult to diagnose and frequently undertreated. Less than 15% of individuals with a lifetime diagnosis of AUD receive any form of treatment.

China naltrexone and buprenorphine market is witnessing significant advancements with the introduction of innovative treatments and the progression of clinical trials. Key developments have emerged recently, showcasing the evolving landscape of OUD treatment in the country.

The naltrexone and buprenorphine market in Japan is influenced by increasing geriatric population. As the population ages, there is a rising trend of SUDs among older adults. This demographic is particularly vulnerable due to various factors such as chronic pain, social isolation, and the potential for multiple medications that can lead to misuse & dependence.

Latin America Naltrexone And Buprenorphine Market Trends

The Latin America naltrexone and buprenorphine market is influenced by healthcare policies, regulatory environment, and pharmaceutical innovations. While specific country-level data may be limited, insights can be drawn from broader regional trends and developments.

The naltrexone and buprenorphine market in Brazil is significantly growing influenced by various factors such as the rising burden of OUD and alcoholism.

Middle East & Africa Naltrexone And Buprenorphine Market Trends

The Middle East & Africa (MEA) naltrexone and buprenorphine market is witnessing steady growth due to several factors, such as increasing incidence of OUD, rising awareness about early detection, and growing initiatives for alcohol addiction & opioid misuse prevention & control.

The naltrexone and buprenorphine market in Saudi Arabia is influenced by various factors, including technological advancements, increasing awareness about OUD, and the rapidly aging population. The field of substance use disorder has witnessed significant technological advancements in detecting OUD at early stages.

Key Naltrexone And Buprenorphine Company Insights

Some of the leading players operating in the market include Indivior PLC , Alkermes plc , Orexo AB and Camurus among others. These players dominate the market with their contributions to the development of new treatments.

Braeburn, Inc., BioCorRx, Inc. and Delpor, Inc. are some emerging market participants in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Naltrexone And Buprenorphine Companies:

The following are the leading companies in the naltrexone and buprenorphine market. These companies collectively hold the largest market share and dictate industry trends.

- Indivior PLC

- Collegium Pharmaceutical (BioDelivery Sciences International, Inc.)

- Alkermes, Inc.

- Orexo US, Inc. (a part of Orexo AB)

- Titan Pharmaceuticals, Inc.

- Omeros Corporation

- Camurus

- Sun Pharmaceutical Industries Ltd

Recent Developments

-

In May 2024, Novo Nordisk acquired Alkermes plc.'s development and production facilities in Athlone, Ireland, for USD 91 million. Alkermes's Wilmington, Ohio-based manufacturing plant would continue producing its exclusive commercial products, ARISTADA, VIVITROL, ARISTADA INITIO, and LYBALVI.

-

In October 2023, Indivior PLC secured exclusive global rights to develop, produce, and market a range of long-acting injectable medicines for Alar Pharmaceuticals Inc. These formulations included various durations for the release of a buprenorphine prodrug, notably featuring the long-acting injectable candidate, ALA-1000.

-

In May 2023, Camurus AB introduced Brixadi, a weekly and monthly medication containing Brixadi (buprenorphine), indicated to treat moderate-to-severe OUD. Patients receiving daily buprenorphine treatment or starting treatment with a single dose of transmucosal buprenorphine are eligible for this regimen.

Naltrexone And Buprenorphine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.17 billion

Revenue forecast in 2030

USD 8.42 billion

Growth Rate

CAGR of 12.41% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/ billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, route of administration, application, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Indivior PLC; Collegium Pharmaceutical (BioDelivery Sciences International, Inc.); Alkermes, Inc.; Orexo US, Inc. (a part of Orexo AB); Titan Pharmaceuticals, Inc.; Omeros Corporation; Camurus, Sun Pharmaceutical Industries Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Naltrexone And Buprenorphine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global naltrexone and buprenorphine market report based on product, route of administration, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Naltrexone

-

Buprenorphine

-

BELBUCA

-

Sublocade

-

Suboxone

-

Zubsolv

-

Others

-

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Naltrexone

-

Oral Administration

-

Injectable Administration

-

Implantable Administration

-

-

Buprenorphine

-

Oral Administration

-

Injectable Administration

-

Implantable Administration

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Naltrexone

-

Opioid use disorder (OUD)

- Alcohol use disorder (AUD)

-

-

Buprenorphine

-

Opioid use disorder (OUD)

-

-

-

Route of Distribution channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global naltrexone and buprenorphine market size was estimated at USD 3.56 billion in 2023 and is expected to reach USD 4.17 billion in 2024.

b. The global naltrexone and buprenorphine market is expected to grow at a compound annual growth rate of 12.41% from 2024 to 2030 to reach USD 8.42 billion by 2030.

b. North America dominated the naltrexone and buprenorphine market with a share of 39.39% in 2023. Factors such as increasing prevalence of substance use disorders, expanding government initiatives to combat the crisis, and rising awareness of opioid use disorder treatment are responsible for market growth. These factors are expected to propel market growth significantly over the forecast period, driving innovation and accessibility in addiction care solutions.

b. Some key players operating in the naltrexone and buprenorphine market include Indivior PLC, Collegium Pharmaceutical (BioDelivery Sciences International, Inc.), Alkermes, Inc., Orexo US, Inc. (a part of Orexo AB), Titan Pharmaceuticals, Inc., Omeros Corporation, Camurus, Sun Pharmaceutical Industries Ltd

b. Key factors that are driving the naltrexone and buprenorphine market growth include growing prevalence of substance use disorders, growing government initiatives to combat the crisis, and increasing awareness of opioid use disorder treatment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."