- Home

- »

- Beauty & Personal Care

- »

-

Nail Treatment Products Market Size And Share Report, 2030GVR Report cover

![Nail Treatment Products Market Size, Share & Trends Report]()

Nail Treatment Products Market Size, Share & Trends Analysis Report By Product (Nail Strengtheners, Base Coats, Top Coats, Cuticle Care), By End-use (Household, Professional), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-371-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Nail Treatment Products Market Trends

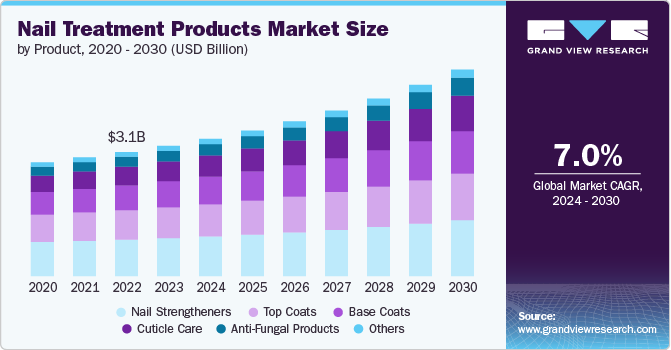

The global nail treatment products market size was valued at USD 3.23 billion in 2023 and is expected to grow at a CAGR of 7.0% from 2024 to 2030. The growing awareness of nail health as a critical aspect of overall wellness is driving significant demand for products designed to strengthen nails, promote healthy cuticles, and prevent fungal infections. Consumers are increasingly proactive in maintaining nail health, recognizing its importance beyond aesthetics. As a result, there is a surge in the market for specialized nail care products, including nourishing oils, fortified polishes, and antifungal treatments, as well as a rise in educational resources on proper nail hygiene. This trend highlights a comprehensive approach to self-care, emphasizing the importance of nail health in achieving overall wellness.

Moreover, the convenience of at-home nail care kits, combined with the easy availability of products through online and retail channels, has significantly transformed consumer behavior in the nail treatment market. These kits offer a comprehensive solution for achieving professional-quality nail care from the comfort of home, catering to the growing preference for DIY beauty routines. With a wide array of options readily accessible on e-commerce platforms and in physical stores, consumers can effortlessly purchase a variety of nail treatment products. The integration of convenience, variety, and accessibility in purchasing nail care products has thus driven a notable shift towards at-home nail treatments, likely favoring the growth of the market.

Additionally, the proliferation of nail salons and spas, offering a variety of specialized nail treatments, has significantly increased the accessibility of these services to a broader audience. With more salons and spas opening in diverse locations, professional nail care has become more convenient and available to a wider demographic. These establishments offer a broad spectrum of treatments, including basic manicures and pedicures, gel and acrylic nails, intricate nail art, and therapeutic cuticle care. The competitive nature of the market has also driven down prices, making high-quality nail treatments more affordable for a larger segment of the population. As a result, the increased availability and variety of services have contributed to the growth of the nail treatment market, appealing to both regular customers and new clients seeking professional nail care.

The increasing prevalence of fungal infections and other nail disorders is significantly improving the demand for specialized anti-fungal nail care products likely driving the nail treatment market. This trend is propelled by heightened consumer awareness regarding nail health and the necessity for effective, targeted treatments. As more individuals experience and recognize the importance of addressing such conditions are more likely to invest in specialized products that offer reliable solutions. This surge in demand is encouraging manufacturers to innovate and expand their product lines, incorporating advanced formulations that cater specifically to these needs, impacting positively to the growth of the market.

Product Insights

Nail strengtheners accounted for a market share of 28.9% in 2023. Many individuals experience weak, brittle, or easily breakable nails due to reasons such as aging, nutritional deficiencies, frequent exposure to water or chemicals, and the use of artificial nails or harsh nail products. This has created a significant market for nail strengtheners, that improve nail health and appearance. The growing awareness of nail care as part of overall personal grooming, coupled with the influence of social media and beauty trends showcasing perfect manicures, has further fueled the demand for nail strengtheners.

The demand for cuticle treatments is projected to grow at a CAGR of 8.9 % from 2024 to 2030. Cuticles play a crucial role in protecting nails from infections and maintaining their appearance, and damaged or dry cuticles can lead to various nail issues. As consumers become more educated about proper nail care, recognize the importance of maintaining healthy cuticles, likely favoring the adoption of cuticle treatment products. Moreover, the rise of professional manicure services has also highlighted the significance of cuticle care, prompting many to seek at-home solutions.

End-use Insights

The demand for nail treatment products among professional end use accounted for a market share of 71.6% in 2023. Professional nail technicians and salons require high-quality, specialized products to deliver superior services and results to their clients. These professionals have the expertise to use more advanced formulations and techniques, which often translates to better outcomes compared to at-home treatments. The salon environment also allows for the application of products that are more complex or time-consuming to use, such as professional-grade strengtheners or anti-fungal treatments. Additionally, consumers often perceive professional treatments as more effective and are willing to pay a premium for salon services. This perception drives the demand for nail treatment products in professional end use.

The demand for nail treatment products in household is anticipated to grow at a CAGR of 8.0% from 2024 to 2030. The demand for nail treatment products for household end use is driven by a combination of convenience, cost-effectiveness, and growing consumer awareness of nail health. As people become more conscious about personal grooming and nail care, they seek affordable and accessible solutions that can be easily incorporated into their daily routines at home. The rise of DIY beauty trends, amplified by social media and online tutorials, has empowered consumers to take nail care has day to day routines, as at-home treatments offer a more budget-friendly alternative to frequent salon visits.

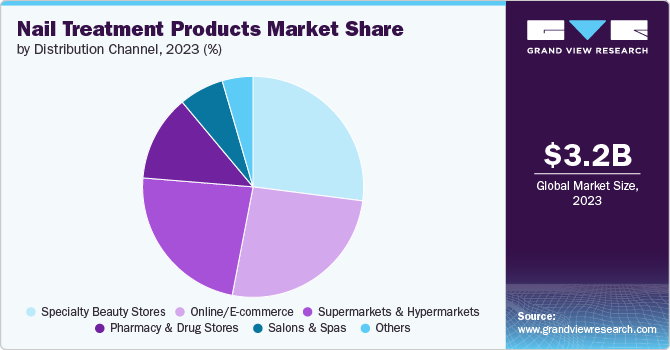

Distribution Channel Insights

The sales through specialty beauty stores accounted for a share of 27.03% in 2023. Specialty beauty stores provide a more personalized shopping experience, with knowledgeable staff who can offer expert advice on product selection and usage, catering to customers seeking specific solutions for their nail concerns. Additionally, specialty stores frequently offer exclusive brands, limited edition collections, and professional-grade products, attracting consumers looking for unique or advanced nail treatments. The ability to test products in-store, coupled with loyalty programs and personalized recommendations, fosters customer trust and loyalty, further driving sales in this channel.

The online/e-commerce sales channel is projected to grow at a CAGR of 8.5% from 2024 to 2030. Major nail treatment products manufacturers are increasingly investing in innovating technologies to enhance the online shopping experience and drive sales through digital channels, likely favoring the growth of the segment. These investments include the development and integration of virtual try-on tools. For instance, in June 2023, Sally Hansen announced the launch of its next generation of virtual nail color try-ons, leveraging advanced augmented reality (AR) technology. This innovative tool allows consumers to virtually experiment with various nail colors in real-time, enhancing the shopping experience by providing a more accurate and personalized view of how different shades will look on their nails. By integrating this technology, Sally Hansen aims to meet the growing demand for digital beauty solutions, offering customers a convenient and interactive way to explore and select nail colors from the comfort of their homes.

Regional Insights

North America accounted for a global market share of 27.9% in terms of revenue in 2023. The region's vibrant fashion and beauty industry, influenced by trends from celebrities and social media, continuously fuels demand for innovative nail care products. Additionally, the convenience of accessing a diverse range of nail treatments through both retail stores and online platforms contributes to the market's growth. Professional salon services and the growing trend of DIY nail care further bolster consumer interest, making North America a dynamic hub for the market.

U.S. Nail Treatment Products Market Trends

The nail treatment products market in the U.S. are expected to grow at a CAGR of 6.9% from 2024 to 2030. The culture of self-care and grooming has propelled demand for a variety of nail treatments including strengtheners, top coats, and cuticle care products. Additionally, innovations in product formulations, such as long-lasting and quick-drying solutions, cater to the busy lifestyles of American consumers.

Asia Pacific Nail Treatment Products Market Trends

Asia Pacific accounted for a market share of around 36% of the global revenue in 2023. revenue share of around 22.49% in the year 2023. Countries in the region, such as South Korea and Japan, are known for their advanced beauty innovations and influence on global beauty standards, which significantly impacts local preferences for nail care. The popularity of nail art and the presence of a vibrant salon culture further drive demand for a wide range of nail treatment products, including nail strengtheners, top coats, and specialized treatments.

Europe Nail Treatment Products Market Trends

Europe nail treatment products market is projected to grow at a CAGR of 8.8% from 2024 to 2030. European consumers, particularly in Western European countries, are known for their high standards in personal grooming and willingness to invest in premium beauty products. The region's aging population has also contributed to the demand for specialized nail treatments addressing age-related nail issues. Additionally, the rise of social media and influencer marketing has popularized nail art trends and increased awareness of nail health, driving consumers to seek both aesthetic and therapeutic nail care solutions, favoring the growth of the market.

Key Nail Treatment Products Company Insights

The market is characterized by intense competition among a mix of established global beauty conglomerates like L'Oréal, Revlon, and Coty, specialized nail care brands, and emerging niche players. The market also sees competition from professional salon brands that have expanded into retail channels. Key competitive factors include product innovation, quality, brand reputation, price point, and distribution networks. Companies are increasingly focusing on developing natural, organic, and vegan formulations to meet growing consumer demand for clean beauty products. Innovation in nail health technology, such as strengthening ingredients and long-lasting formulas, is a significant area of competition. Brand collaborations, celebrity endorsements, and influencer partnerships play a crucial role in marketing strategies.

Key Nail Treatment Products Companies:

The following are the leading companies in the nail treatment products market. These companies collectively hold the largest market share and dictate industry trends.

- Deborah Lippmann

- Coty Inc.

- Revlon Consumer Products LLC

- L'Oréal S.A.

- Orly International, Inc.

- Barielle

- Nailtek.com, Inc.

- Seche.com, Inc.

- Astral Brands, Inc. (butter LONDON)

- China Glaze International, Inc.

Recent Developments

-

In May 2024, LoveShackFancy and Sally Hansen launched an elegantly ethereal collection of nail polishes, featuring soft pastel shades and intricate floral designs inspired by LoveShackFancy's romantic aesthetic. This collaboration introduces a range of nail lacquers that embody the whimsical charm and feminine elegance synonymous with LoveShackFancy's fashion brand. The collection also includes a top coat designed to enhance the durability and shine of the nail polish, providing a complete and polished finish to complement the delicate, dreamy hues. By combining Sally Hansen's expertise in nail care with LoveShackFancy's distinctive style, the collection aims to attract consumers seeking sophisticated and trend-forward nail art options.

-

In March 2023, CND launched a new nail strengthening product called Strengthener RXX. This innovative formula is specifically designed to repair and restore weak, damaged nails, providing intensive care to promote healthier and stronger nail growth. CND, known for its professional nail care solutions, aims to address common nail concerns with this targeted treatment, enhancing its reputation as a leader in the nail care industry. The Strengthener RXX product offers consumers a specialized solution to improve nail health and resilience, catering to the growing demand for effective nail strengthening treatments in the beauty market.

Nail Treatment Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.41 billion

Revenue forecast in 2030

USD 5.13 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Deborah Lippmann; Coty Inc.; Revlon Consumer Products LLC; L'Oréal S.A.; Orly International, Inc.; Barielle; Nailtek.com, Inc.; Seche.com, Inc.; Astral Brands, Inc.; China Glaze International, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nail Treatment Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nail treatment products market report based on product, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Nail Strengtheners

-

Base Coats

-

Top Coats

-

Cuticle Care

-

Anti-Fungal Products

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Household

-

Professional

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Pharmacy & Drug Stores

-

Specialty Beauty Stores

-

Salons & Spas

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nail treatment products market size was estimated at USD 3.23 billion in 2023 and is expected to reach USD 3.41 billion in 2024.

b. The global nail treatment products market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 5.13 billion by 2030.

b. Asia Pacific dominated the nail treatment products market with a share of around 36% in 2023. The demand for nail treatment products in Asia Pacific is driven by increasing disposable incomes, a growing emphasis on personal grooming, and the popularity of nail art and professional salon services.

b. Some key players operating in the nail treatment products market include Deborah Lippmann, Coty Inc.,Revlon Consumer Products LLC, L'Oréal S.A., Orly International, Inc., Barielle, Nailtek.com, Inc., Seche.com, Inc., Astral Brands, Inc., and China Glaze International, Inc.

b. Key factors that are driving the nail treatment products market growth is driven by factors such as increasing beauty consciousness, innovation in product formulations, and the growing popularity of DIY nail care trends.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."