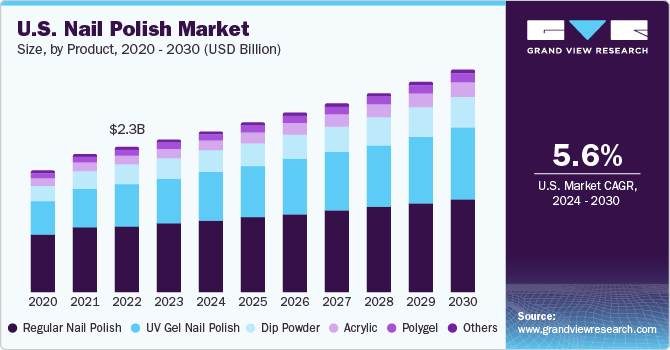

Nail Polish Market Size, Share & Trends Analysis Report By Product (Regular Nail Polish, UV Gel Nail Polish, Dip Powder, Acrylic), By Distribution Channel (Supermarkets & Hypermarkets, Salons & Spas), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-631-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Nail Polish Market Size & Trends

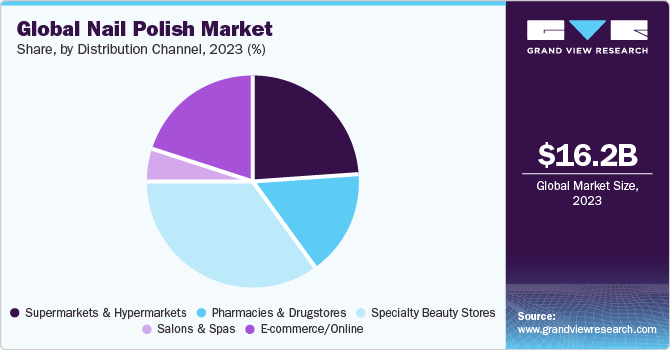

The global nail polish market size was estimated at USD 16.23 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2030. One of the primary factors driving market expansion is the growing interest in nail art and care products among consumers, especially millennials. Additionally, nail art & extensions are becoming an integral part of grooming among the millennials. This in turn is expected to boost the demand for the product during the forecast period. Furthermore, the introduction of nail polish with natural ingredients, which are non-toxic and have lesser chemical content is anticipated to bolster the demand for nail polish in the future.

The market is experiencing growth, driven by innovations in formulas that cater to evolving consumer preferences and beauty trends. The industry is witnessing a surge in dazzling colors, with vibrant and bold hues, subtle pastels, and metallic finishes remaining a top priority for consumers. These diverse color options provide consumers with a wide array of choices for self-expression.

Many brands are now focusing on long-wearing formulas that resist chipping and peeling. Gel nail polish, for instance, provides a durable and glossy finish that lasts longer than traditional polish. For instance, Essie, a nail salon expert in the U.S., offers Gel Couture, a sophisticated nail polish collection that mimics the look of gel nails without requiring a lamp or curing. The 2-step system includes 42 new colors and a proprietary topcoat, delivering up to 14 days of chip-free wear, high shine, and a professional gel nail appearance. The easy-to-apply system is suitable for both at-home and salon use, and removal is as simple as regular polish, requiring no soaking.

Collaborations between food industry manufacturers and beauty brands, as well as partnerships with celebrity nail artists, are driving the growth of the market. In June 2022, Magnum ice cream collaborated with Nails.Inc and celebrity nail artist Mei Kawajiri to launch three trendy nail art designs inspired by the new Duet Bars. The ice cream brand, known for premium ingredients and innovative products, introduced indulgent flavors like Almond, Chocolate, and Cookie. The six chocolate-scented nail polishes reflect Duet Bars' chocolate layering and allow consumers to recreate the designs at home by purchasing polishes on Nails.Inc's website.

The growing demand for substitutes such as press-on nails is attributed to the superior quality and convenience of artificial nails, as well as the wide variety of designs, lengths, and styles they offer compared to traditional nail polish. Major retailers such as CVS and Walgreens have observed a significant spike in demand for artificial nails and have expanded their product offerings in response. Brands like KISS and Dashing Diva have seen substantial growth and are meeting the increasing consumer demand for artificial nails with innovative designs and high-quality products. The growth in demand for artificial nails is likely to suppress the demand for traditional nail polishes.

An increasing number of such service providers and mobile apps offering doorstep salon services are expected to drive market growth during the forecast period. Various doorstep salon service providers such as Urban Company in India, Primp In-Home in the U.S., Fantastic Services in the U.K., Ruhee in the UAE, and many more have been promoting nail art & nail care services. These service providers use particular brands of nail polish that they have tie-ups with, increasing product adoption. A key observation in the buying behavior of consumers is that they prefer purchasing these products from online platforms due to the availability of different brands as well as added advantages such as price-specification comparison and virtual try-ons. In addition, online discounts are likely to drive product demand in the near future.

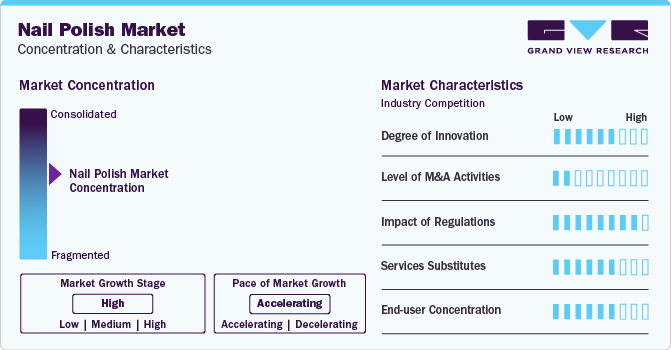

Market Concentration & Characteristics

Market growth stage is moderate, and the pace of the market growth is accelerating. The nail polish market is characterized by an increase in the adoption of natural and eco-friendly nail polish that is free from harmful chemicals.

Increasing investments in research and development, coupled with the rising trend of natural ingredients, have encouraged manufacturers to launch new products. For instance, in August 2021, OPI, one of the leading players in the market recently launched its natural, non- GMO, and vegan nail polish in the market.

New companies and start-ups in the market are targeting certifications such as PETA-certified (vegan and cruelty-free), and Non-Toxic Certified. There is an increasing focus on the safety of ingredients used in nail polish formulations, such as potentially harmful chemicals like formaldehyde, toluene, and dibutyl phthalate.

There is growing interest in artificial nails, which is likely to limit the demand for traditional nail polishes. However, the impact of competition from substitutes is perceived to be moderate as nail polishes continue to be a popular and preferred choice for consumers due to their ease of use and affordability.

End-user concentration is a significant factor in the market. Since there is a diverse end-user base with varying degrees of concentration. Understanding these demographics and their motivations is crucial for manufacturers and retailers to develop effective marketing strategies and target specific customer segments.

Product Insights

Regular nail polish segment dominated the market with a revenue share of around 47% in 2023. The benefits of regular nail polish include ease of application, low cost, and the availability of a wide range of colors, which is likely to propel their demand over the forecast period. Various key players like Coty Inc., Sally Hansen, and Essie Cosmetics, Ltd. offer regular polish with bio ingredients to meet the requirements of eco-conscious consumers. For instance, Coty Inc. offers a plant-based nail polish, “Kind & Free Plant-Based Nail Polish.” It is formulated with algae and is free from fragrance, mineral oils, and animal-based ingredients.

The UV gel nail polish segment is expected to grow at the fastest CAGR during the forecast period. Gel-based nail polish has been trending as one of the most preferred manicure products online in the last few years. These variants last longer than conventional liquid-based nail polish and are easy to apply. These benefits are driving product demand. Gel nails are also available as nail extensions, which are made using a hard gel product that hardens under ultraviolet and LED light. These nails are designed to look like natural nails and are in high demand among consumers with short nails or weak nails with poor growth and strength.

Distribution Channel Insights

The specialty beauty stores segment dominated the market with a revenue share of around 35% in 2023. Some consumers express concern about the authenticity and accuracy of online product descriptions; hence, they prefer physical stores where they can verify the quality and authenticity of the items. According to a June 2021 consumer survey by NCSolutions, a significant number of American consumers (38%) expressed their intention to increase their purchases of beauty products in physical stores rather than online, highlighting the preference for purchasing beauty and personal care products from specialty and convenience stores.

The online/e-commerce segment is expected to grow at the fastest CAGR during the forecast period. Consumer interest in online shopping is also increasing as it offers a convenient shopping experience, lucrative offers and discounts, home delivery options, and a wide variety of products. Moreover, facilities such as easy replacement, cash on delivery, and one-day delivery for members on e-commerce platforms are driving the growth of the online segment. According to brands such as Nails Inc., Butter London, and Olive+, the year 2020 experienced a significant growth in the sales and revenue of nail care-related products online.

Regional Insights

Asia Pacific dominated the market with a share of around 38% in 2023. Asia Pacific is projected to witness significant growth in nail polish sales during the forecast period. China, India, and Japan are some of the key countries accounting for a major revenue share in the region. Chinese consumers, especially in fast-paced first-tier cities, are increasingly opting for on-demand home services for various needs, including manicures, massages, and personal training. The growing demand for manicure services at home, particularly among Gen Z and millennials in China, is projected to drive the demand for nail polishes.

Middle East & Africa is expected to witness the fastest CAGR during the forecast period. The Middle East, particularly Saudi Arabia and the UAE, is emerging as a significant market for nail polish. In the UAE, where cultural and religious considerations are integral to lifestyle choices, the popularity of halal nail polishes is increasing. Consumers in the region seek beauty products that respect their religious beliefs and practices. Los Angeles, U.S.-based ORLY is one of the key brands offering halal nail polishes in the UAE, Saudi Arabia, and the rest of the Middle East. The growing demand for halal nail polishes is likely to encourage many regional and international players to obtain halal certifications to meet the required standards.

Key Companies & Market Share Insights

Coty Inc. is a major player in the market as it is known to be the manufacturer, designer, distributor, and retailer of fragrances, cosmetics, skincare, nail care, and hair care products. The company sells a wide range of products under 77 brands, which are segmented into Coty Luxury and Coty Consumer Beauty. The company offers a plant-based nail polish collection through its brand “Sally Hansen”.

butter LONDON is one of the emerging players that offers innovative products and formulations that are not harmful, such as color repertoire for eyes, lip & face, using the same ingenious carcinogen-free Crafted with Care approach to formulations. The company offers products for nails, eyes, lips, face, and body.

Key Nail Polish Companies:

- Coty, Inc.

- L'Oreal Groupe

- Revlon Consumer Products LLC

- Estee Lauder Companies, Inc.

- Shiseido Co., Ltd.

- Unilever

- Wella International Operations Switzerland Sàrl (O.P.I.)

- ZOYA Nail Polish (Art of Beauty Inc.)

- butter LONDON

- Ella+Mila, Inc.

Recent Developments

-

In September 2023, L’Oréal Groupe agreed to make a minority investment in Shinehigh Innovation, an innovative biotech company based in China, to forge a lasting partnership to jointly develop novel and environmentally sustainable beauty solutions.

-

In February 2023, Shiseido Co., Ltd., in collaboration with Shoppers Stop Ltd.'s Global SS Beauty Brands, introduced its makeup brand, NARS Cosmetics, to the Indian market. The strategic plan includes the opening of 14 stores in New Delhi and Mumbai throughout 2023, along with the promotion of NARS products through Sephora outlets.

Nail Polish Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 17.30 billion |

|

Revenue forecast in 2030 |

USD 25.82 billion |

|

Growth rate |

CAGR of 6.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

December 2023 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa |

|

Key companies profiled |

Coty, Inc.; L'Oreal Groupe; Revlon Consumer Products LLC; Estee Lauder Companies, Inc.; Shiseido Co., Ltd.; Unilever; Wella International Operations Switzerland Sàrl (O.P.I.); ZOYA Nail Polish (Art of Beauty Inc.); butter LONDON; Ella+Mila, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Nail Polish Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nail polish market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Regular Nail Polish

-

UV Gel Nail Polish

-

Dip Powder

-

Acrylic

-

Polygel

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Pharmacies & Drugstores

-

Specialty Beauty Stores

-

Salons & Spas

-

E-commerce/Online

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Middle East & Africa

-

South Africa

-

-

Central & South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global nail polish market size was estimated at USD 16.23 billion in 2023 and is expected to reach USD 17.30 billion in 2024.

b. The global nail polish market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 25.82 billion by 2030.

b. Asia Pacific dominated the nail polish market with a share of 38% in 2023. This is attributable to the rising number of working women population in countries such as China and India and their rising interest in spending on nail care fashion trends fueling the demand for nail polish.

b. Some key players operating in the nail polish market include Unilever; The Estée Lauder Companies Inc.; Shiseido; Revlon; Sally Hansen; Wella Operations US LLC (O.P.I.); L’Oréal S.A.; Cosnova GmbH (Essence); NOTE Cosmetique; and Coty Inc.

b. One of the primary factors driving nail polish market expansion is the growing interest in nail art and care products among consumers, especially millennials.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."