Nail Care Products Market Size, Share & Trends Analysis Report By Product (Nail Polish, Artificial Nail & Accessories), By End Use (Salon, Household), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-978-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

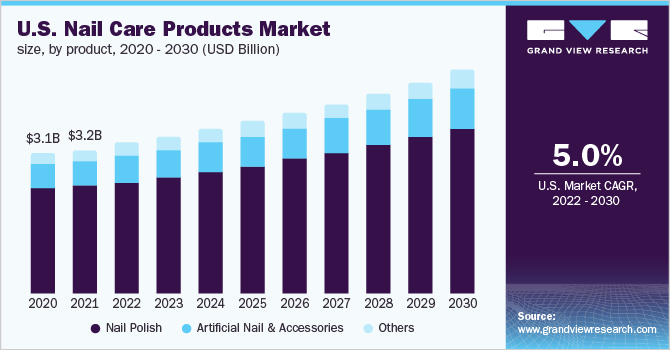

The global nail care products market size was valued at USD 19.10 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. Nail care has become an integral part of personal grooming, with nail polish and nail art becoming particularly popular in the corporate and fashion industries. This trend is expected to remain a prominent factor in augmenting the product demand throughout the forecast period. Furthermore, key companies have been amplifying their product portfolios by incorporating new and innovative products in the market to gain momentum for the growing trend.

The COVID-19 (coronavirus) outbreak has slowed down the demand for nail care products across the globe. The early onslaught of the pandemic had an adverse impact on the market in worst-hit countries such as the U.S., India, Brazil, Russia, and the U.K. China has historically been one of the major suppliers of key raw materials and ingredients for manufacturing various types of nail care products. Although, the increased penetration of new nail care trends on social media platforms such as Instagram drove the sales of nail care products through online platforms.

The market has witnessed key developments with regard to product distribution over the years. Several brands have been capitalizing on the widening distribution channels for nail polish through technological integration. For instance, in February 2021, L’Oréal Groupe launched a new virtual try-on experience for its Essie nail care brand, which allows people to test Essie’s nail polishes virtually by uploading a photo or using a back-facing smartphone camera to track nail shape and finger movement. Consumers can further add products to their cart on Essie.com and are redirected to select Essie retailers, including Target, Ulta, and CVS, to finalize their purchases. Such innovations are likely to bode well for the industry growth in the future.

Additionally, rising awareness regarding the various advantages of organic products over synthetic products has resulted in increased demand in the last few years. Organic and natural products have gained a lot of acceptance among consumers of cosmetic, wellness, and beauty products. Organic nail products such as nail polish are manufactured from natural ingredients extracted from plants under eco-friendly conditions. These products do not contain synthetic chemicals such as parabens, phthalates, petrochemical, and aluminum salts. For instance, in October 2021, Marina Miracle-beauty and personal care brand in collaboration with Tone Lise known as Norway's 'nail queen' launched Essential Nail Elixir formulated with organic ingredients including oil from grape seeds, sea buckthorn, and apricot active extracts from green tea, rosemary, and artic cranberries.

An increasing number of young and millennial women have been spending more time shopping for nail care products at retail stores, experimenting with DIY new trends at home, while also indulging in manicures and nail spas on a frequent basis. Innovative product launches and rising brand consciousness among women are expected to further augment product demand. For instance, in November 2021, Olive & June, a U.S.-based nail care company, launched a wide range of Instant Mani press-on nails. These are available in up to 21 different sizes with 42 total nails included in each set, reusable, and made from recycled materials.

Companies are focusing on strategic acquisitions to expand their presence and reinforce their positions in the market. In the near term, global market players are likely to acquire small- and medium-sized companies operating in the market in a bid to facilitate regional expansion. For instance, in June 2021, MiniLuxe, Inc., a Boston-based company acquired Paintbox-New York-based nail care brand to expand the certified pool of empowered nail designers. The acquisition would further benefit through the expansion of collaborations and the acceleration of product development.

Product Insights

The nail polish segment led the market in 2021 with a revenue share of over 70.0%. This can be attributed to the growing nail art trends at home, mainly among the millennial population. Increasing product launches in the vegan and chemical-free categories are further complementing the overall product demand. For instance, in March 2020, Coty Inc.’s brand Sally Hansen launched a 100% vegan, first plant-based nail polish collection called Good.Kind.Pure. The product is available in more than 30 shades, such as Sun Tastic, Lava Rocks, Laven Dear, and Cherry Amore.

The introduction of gel-based nail polish by new entrants and key players is likely to bode well for the segment growth in the future. For instance, in February 2022, British nail brand- Pure Nails launched the latest color collection to its Halo Gel Polish range called-The ‘Once Upon a Time' collection, which is vegan and cruelty-free. Similarly, in December 2021, Glitterbels launched a hema-free (an additive used in many nail products to aid adhesion and polymerization) gel polish range for consumers in Manchester. The product range includes Custard Mustard and Champagne Sparkle.

The artificial nail and accessories segment is expected to expand at the fastest CAGR of 5.7% from 2022 to 2030. Artificial nails and accessories have become statement-making fashion accessories for millennial women and young girls. For instance, in April 2022, Lottie London- a U.K.-based nail polish brand collaborated with Chaun Legend-manicurist to launch a new collection of press on artificial nails. The nails come in a gel finish with an easy application using either vegan nail glue or adhesive pads, which are super easy to remove. The press-on nails are made from 94% PCR (recycled plastic) and the outer packaging is made from recyclable materials, which are vegan, PETA-approved, and cruelty-free.

End-use Insights

The household segment held the largest revenue share of over 65.0% in 2021 and is expected to expand at the fastest CAGR from 2022 to 2030. Factors including price, ease of application, and easy availability of products affect consumers’ buying decisions and product adoption. The wide availability of products in retail shops, beauty salons, pharmacies, supermarkets, and company-owned stores has immensely helped product segments to be in the mainstream. However, online sales are increasing on the back of the rising influence of social media marketing and other factors such as free product delivery, easy payment methods, and availability of a variety of products.

The salon segment is expected to expand at a CAGR of 4.8% from 2022 to 2030. The number of salons providing professional services is growing rapidly across the globe. The rising number of such service providers, coupled with the growing number of mobile-based apps that provide doorstep salon services, is expected to fuel industry growth over the forecast period. These services have been promoting products of various brands as first-time consumers mostly prefer to get manicures done by professionals who have a better understating of the anatomy/structure of the hand.

Regional Insights

Asia Pacific held the largest revenue share of over 35.0% in 2021. The increasing popularity of various trends and new product launches in the emerging markets of Indonesia, India, and China are likely to have a positive impact on the industry growth. For instance, in October 2021, Ciaté London, a beauty brand, was launched in India via the online beauty app, Nykaa. The brand offers gel-based paint pots in various shades.

New product development, along with the growing number of startups focused on offering new and improved products to consumers, has been driving the overall market in Asia Pacific countries. For instance, in April 2022, Pokémon Co. collaborated with makeup company Maybelline for a series of Pokémon-themed makeup items, including nail polish. The product line included six types of gel-based nail polishes based on Pokémon personalities: Meowth, Eevee, Piplup, Pikachu, Jigglypuff, and Scorbunny. The nail polishes consist of a vegan formula, which is quick-drying and moisturizing. Such product launches bode well for industry growth in the future.

Europe held the second-largest share in 2021. The increasing number of nail care services and salons in the emerging markets of Germany, France, and the U.K., new product launches, and rising job opportunities for women are likely to positively influence the industry growth in Europe. Europe is one of the top markets for cosmetic and personal beauty products globally owing to the rising demand for these products from countries such as the U.K. and France. For instance, in August 2021, Hermès launched a new gel-based nail polish line with 24 different shades, containing ultrafine, bio-sourced pigments.

Key Companies & Market Share Insights

Key players in this market face intense competition from each other as some of them are among the top manufacturers of beauty and cosmetic products, including various types of nail care products. These companies have large customer bases for their products in both, regional and international markets. Moreover, these market players have strong and vast distribution networks, which help them reach a larger customer base.

- In June 2022, Velveeta, a popular cheese brand, collaborated with Nails.INC, a London-based female-owned trailblazing brand, to launch Velveeta Pinkies Out Polish, a red and yellow colored cheese-scented polish.

- In May 2022, Nails.INC, a beauty firm partnered with Magnum Ice Cream to launch a range of six chocolate-scented nail polish colors inspired by the new Magnum ice cream Duet Bars.

- In September 2021, Creative Nail Design, Inc. launched its holiday collection including shades such as Glitter Sneakers, Signature Lipstick, Silk Slip Dress, White Button Down, Statement Earrings, and High Waisted Jeans.

Some prominent players in the global nail care products market include:

-

L'Oréal Groupe

-

AMERICAN INTERNATIONAL INDUSTRIES

-

Coty Inc.

-

Olive & June

-

ORLYInternational, Inc.

-

The Estée Lauder Companies

-

Creative Nail Design Inc.

-

NSI Nails

-

LCN USA

-

Cosnova GmbH (essence)

Nail Care Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 20.02 billion |

|

Revenue forecast in 2030 |

USD 30.08 billion |

|

Growth Rate |

CAGR of 5.2% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Singapore; Brazil; South Africa |

|

Key companies profiled |

L'Oréal Groupe; AMERICAN INTERNATIONAL INDUSTRIES; Coty Inc.; Olive & June; ORLY International, Inc.; The Estée Lauder Companies; Creative Nail Design Inc.; NSI Nails; LCN USA; Cosnova GmbH (essence) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

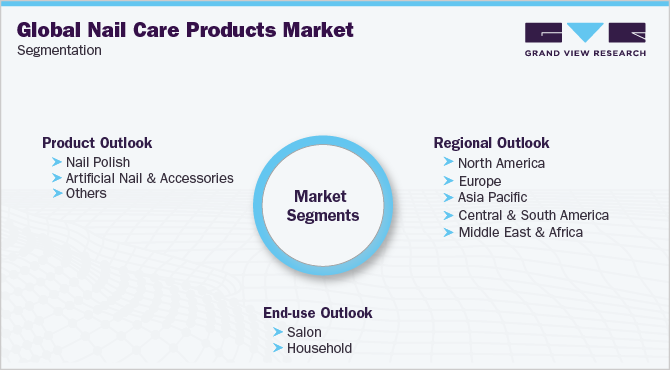

Global Nail Care Products Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global nail care products market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Nail Polish

-

Artificial Nail & Accessories

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Salon

-

Household

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nail care products market size was estimated at USD 19.10 billion in 2021 and is expected to reach USD 20.02 billion in 2022.

b. The global nail care products market is expected to grow at a compound annual growth rate of 5.2% from 2022 to 2030 to reach USD 30.08 billion by 2030.

b. The Asia Pacific dominated the nail care products market with a share of more than 35% in 2021. The increasing number of product offerings through various brands is driving the demand for nail care products in the region.

b. Some of the key players in the nail care products market are L'Oréal Groupe; AMERICAN INTERNATIONAL INDUSTRIES, Coty Inc.; Olive & June; ORLY International, Inc.; The Estée Lauder Companies; Creative Nail Design Inc.; NSI Nails; LCN USA; and Cosnova GmbH (essence)

b. Key factors that are driving the nail care products market growth include growing nail care trends among millennial women coupled with increasing product launches

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."