- Home

- »

- Nutraceuticals & Functional Foods

- »

-

N-Acetyl-L-Cysteine Supplements Market Size Report, 2030GVR Report cover

![N-Acetyl-L-Cysteine Supplements Market Size, Share & Trends Report]()

N-Acetyl-L-Cysteine Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Gummies), By Type (Dietary, Therapeutic), By Distribution Channel (Pharmacies, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-347-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global N-Acetyl-L-Cysteine supplements market size was estimated at USD 616.7 million in 2023 and is expected to grow at a CAGR of 8.2% from 2024 to 2030.The global market is experiencing significant growth, driven by several key factors. One of the primary drivers is the increasing awareness of the health benefits associated with N-Acetyl-L-Cysteine (NAC).

As a powerful antioxidant, NAC plays a crucial role in replenishing levels of glutathione, one of the body's most important antioxidants. This has made NAC popular for its potential to boost immune health, detoxify the liver, and support respiratory function. The rising prevalence of chronic diseases, such as liver disorders and respiratory conditions, has further propelled the demand for NAC supplements as a preventive and therapeutic aid.

Additionally, the growing trend towards preventive healthcare and wellness is fueling the market. Consumers are becoming more proactive about their health, seeking supplements that can help them maintain overall wellness and prevent illnesses. This shift is particularly evident in the aging population, which is more susceptible to oxidative stress and chronic diseases.

NAC's role in supporting cellular health and reducing oxidative damage makes it a favored supplement among older adults. Moreover, the increased incidence of mental health issues such as anxiety and depression has led to research highlighting NAC's potential benefits in supporting mental well-being, further expanding its consumer base.

The market is also driven by advancements in supplement formulations and the expansion of distribution channels. Manufacturers are developing innovative NAC supplement products in various forms, such as capsules, tablets, powders, and gummies, to cater to different consumer preferences.

This product diversification, along with the growth of e-commerce and online retail platforms, has made NAC supplements more accessible to a broader audience. The convenience of online shopping, coupled with the availability of detailed product information and customer reviews, has significantly influenced purchasing decisions, driving market growth. Furthermore, increasing investments in research and development are contributing to the market's expansion. Ongoing studies exploring NAC's potential therapeutic applications in areas such as neuroprotection, fertility, and cardiovascular health are generating interest and opening new avenues for market growth.

Regulatory support and endorsements from health organizations also play a crucial role in bolstering consumer confidence in NAC supplements. As scientific evidence supporting the efficacy and safety of NAC continues to grow, its adoption as a mainstream dietary supplement is likely to increase, driving the market forward. Another critical driver for the global NAC supplements market is the increasing focus on environmental and lifestyle factors contributing to health issues. The rising levels of pollution, exposure to toxins, and unhealthy lifestyle choices such as smoking and poor diet have heightened the need for supplements that can mitigate their adverse effects.

NAC’s ability to support detoxification processes and protect against oxidative stress makes it an attractive option for individuals looking to counteract these environmental and lifestyle-related health challenges. Moreover, the increasing prevalence of infectious diseases and the recent COVID-19 pandemic have underscored the importance of maintaining a robust immune system. NAC has gained attention for its potential role in supporting respiratory health and mitigating symptoms associated with respiratory infections.

Studies have suggested that NAC may help reduce the severity of respiratory conditions, including those caused by viruses. This has led to a surge in consumer interest in NAC supplements as a preventive measure to bolster immune defenses and manage respiratory health.

Form Insights

N-Acetyl-L-Cysteine tablets and capsules segment accounted for a share of 59.9% in 2023. NAC is valued for its potent health benefits, particularly its role as a precursor to glutathione, a crucial antioxidant in the body. The naturally sourced variants are often marketed as having better bioavailability and efficacy, which appeals to consumers looking for maximum health benefits. The emphasis on the effectiveness of natural NAC supplements in supporting immune health, detoxification, respiratory function, and overall wellness contributes to their significant market share.

N-Acetyl-L-Cysteine gummies segment is expected to grow at a CAGR of 9.3% from 2024 to 2030. One of the primary drivers of the NAC gummies market is the increasing consumer preference for convenient and palatable supplement forms. Gummies are an appealing alternative to traditional tablets and capsules, particularly for individuals who have difficulty swallowing pills or prefer a more enjoyable way to consume their supplements. The pleasant taste and ease of consumption make gummies an attractive option for both adults and children, broadening the demographic reach of NAC supplements.

Type Insights

N-Acetyl-L-Cysteine supplements for dietary consumption accounted for a revenue share of 62.3% in 2023. This dominance can be attributed to several factors. Firstly, NAC is renowned for its antioxidant properties and its role as a precursor to glutathione, a critical antioxidant in the body. As consumers become increasingly aware of the benefits of antioxidants in supporting overall health and well-being, NAC has emerged as a favored supplement choice for its potential to combat oxidative stress, boost immune function, and promote detoxification.

N-Acetyl-L-Cysteine supplements for therapeutic usage is expected to grow at a CAGR of 8.7% from 2024 to 2030. One of the primary drivers behind this growth is the increasing prevalence of chronic diseases and health concerns that NAC is known to address effectively. For instance, NAC's role in supporting liver health, respiratory function, and mental well-being has garnered attention among healthcare professionals and consumers alike. As awareness grows about NAC's therapeutic benefits in mitigating symptoms and improving outcomes for conditions such as chronic obstructive pulmonary disease (COPD), acetaminophen overdose, and psychiatric disorders, demand for therapeutic NAC supplements is expected to rise.

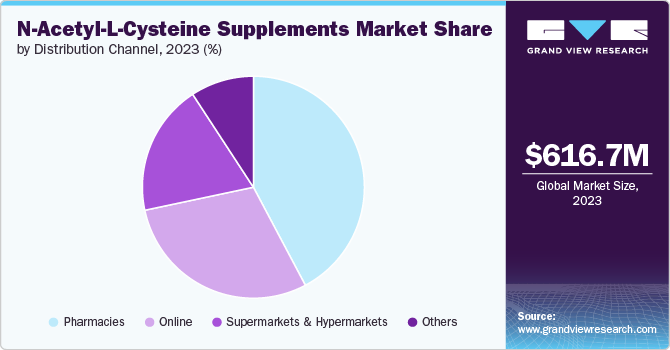

Distribution Channel Insights

Pharmacies segment accounted for a revenue share of 42.2% in 2023. Pharmacies serve as trusted outlets for health and wellness products, making them a preferred destination for consumers seeking NAC supplements. The presence of trained pharmacists allows for informed recommendations and guidance on supplement usage, which enhances consumer confidence in the product. This professional endorsement plays a crucial role in driving sales, particularly for consumers looking for evidence-based advice on supplement choices.

Online sales channels segment is expected to grow at a CAGR of 9.1% from 2024 to 2030. The increasing prevalence of e-commerce platforms and online retailing has transformed the way consumers shop for health and wellness products, including dietary supplements like NAC. Online channels offer convenience, accessibility, and a wide variety of product choices, allowing consumers to compare prices, read reviews, and make informed purchasing decisions from the comfort of their homes.

Also, the global trend towards digitalization and the growing penetration of smartphones and internet access have expanded the reach of online sales channels. Consumers, particularly younger demographics and tech-savvy individuals, prefer the ease of ordering supplements online and having them delivered directly to their doorstep. This convenience factor drives the migration of NAC supplement sales from traditional brick-and-mortar stores to online platforms.

Regional Insights

The market in North America captured a revenue share of over 42.1% in 2023. North America is characterized by a robust healthcare infrastructure and a strong emphasis on preventive healthcare and wellness. Consumers in the region are increasingly proactive about managing their health, which drives the demand for dietary supplements like NAC known for their antioxidant properties and various health benefits.

The region's well-established dietary supplement market and regulatory framework support the availability and distribution of NAC supplements. Clear guidelines and quality standards ensure that products meet stringent safety and efficacy requirements, enhancing consumer confidence and market penetration.

Moreover, North America benefits from extensive research and development activities focused on dietary supplements. Ongoing studies and clinical trials exploring NAC's therapeutic applications in areas such as respiratory health, liver support, and mental well-being contribute to its popularity and adoption among healthcare professionals and consumers alike.

U.S. NAC Supplements Market Trends

The market in the U.S. is a pivotal segment within the broader dietary supplement industry, characterized by significant consumer demand and regulatory oversight. NAC, known for its antioxidant properties and various health benefits, has gained popularity among consumers seeking preventive healthcare solutions and support for respiratory, liver, and immune functions. This growing consumer awareness of NAC's potential health benefits has propelled its adoption across different demographic groups, including health-conscious individuals, aging populations, and athletes looking to enhance performance and recovery.

The U.S. market benefits from a well-established healthcare infrastructure and stringent regulatory standards that ensure the safety, efficacy, and quality of dietary supplements, including NAC. Regulatory bodies such as the FDA oversee the manufacturing, labeling, and marketing of dietary supplements, providing consumers with confidence in the products they purchase. This regulatory framework also encourages transparency and accountability among manufacturers, fostering trust in the NAC supplements available in the U.S. market.

Europe NAC Supplements Market Trends

The market in Europe is a significant segment within the global dietary supplement industry, characterized by a diverse consumer base, stringent regulatory standards, and evolving health trends. NAC, renowned for its antioxidant properties and various health benefits, has gained traction among consumers across Europe seeking to enhance their overall well-being and address specific health concerns.

One of the key drivers of the market in Europe is the increasing consumer awareness and adoption of preventive healthcare practices. As individuals become more proactive about managing their health, there is a growing interest in dietary supplements like NAC that support immune function, respiratory health, and detoxification processes. This trend is particularly pronounced in countries with aging populations and a strong emphasis on holistic wellness.

Regulatory oversight in Europe ensures that NAC supplements meet high standards of safety, quality, and efficacy. Regulatory bodies such as the European Food Safety Authority (EFSA) evaluate and approve health claims associated with dietary supplements, providing consumers with confidence in the benefits advertised. This regulatory framework also promotes transparency in labeling and manufacturing practices, enhancing consumer trust in NAC supplements available in the European market.

Asia Pacific N-Acetyl-L-Cysteine Supplements Market Trends

The market in Asia Pacific is expected to witness a CAGR of 9.2% from 2024 to 2030. Several factors contribute to this anticipated growth, reflecting evolving consumer lifestyles, increasing health awareness, and expanding access to dietary supplements.

One of the primary drivers of this growth is the region's rapidly expanding middle class and rising disposable incomes. As economies in Asia Pacific continue to develop, consumers are allocating more resources towards health and wellness products, including dietary supplements like NAC. This demographic shift towards higher spending power and heightened health consciousness is fueling demand for supplements that support immune health, detoxification, and overall well-being.

Furthermore, the Asia Pacific region is witnessing a surge in urbanization and lifestyle changes, which are contributing to health challenges such as pollution-related issues and stressful living conditions. NAC's antioxidant properties and potential benefits in combating oxidative stress and supporting respiratory health appeal to consumers seeking preventive healthcare solutions. The increasing prevalence of chronic diseases and respiratory conditions in densely populated urban areas further drives the demand for NAC supplements as a proactive health measure.

Key N-Acetyl-L-Cysteine Supplements Company Insights

Suppliers of NAC supplements typically source raw materials from various global suppliers of cysteine. The production process involves chemical synthesis or extraction methods to obtain NAC in its pure form suitable for dietary supplements. Manufacturers often emphasize the quality and purity of their raw materials to meet regulatory standards and consumer expectations.

Innovation in formulation is a key aspect of supply side dynamics. Manufacturers are continually developing new forms of NAC supplements such as capsules, tablets, powders, and increasingly popular formats like gummies and effervescent tablets. Formulation improvements focus on enhancing bioavailability, stability, and consumer convenience to meet diverse market preferences.

Compliance with regulatory standards is critical for suppliers and manufacturers in the dietary supplement industry. Regulatory requirements vary by region, with stringent guidelines in markets like North America and Europe. Suppliers must ensure adherence to Good Manufacturing Practices (GMP) and comply with specific health claims and labeling regulations set by regulatory bodies such as the FDA in the U.S. and EFSA in Europe.

Key NAC Supplements Companies:

The following are the leading companies in the NAC supplements market. These companies collectively hold the largest market share and dictate industry trends.

- NOW Foods

- JARROW FORMULAS

- Doctor’s Best

- Life Extension

- SWANSON HEALTH

- Pure Encapsulations

- Source Naturals

- Nutricost

- Thorne NAC

- Etta Vita

Recent Developments

-

In January 2024, iHerb, a global e-commerce retailer specializing in vitamins, minerals, supplements, and health and wellness products, announced a special collaboration with former heavyweight champion Mike Tyson. The collaboration featured NAC (N-acetyl-L-cysteine), 600 mg, along with vitamins and collagens. NAC is an amino acid known for its cell-protective properties against damage from free radicals, supporting healthy antioxidant levels.

-

In December 2022, JARROW FORMULAS announced the launch of N-A-C, which featured 500 mg of N-Acetyl-L-Cysteine in a vegetarian capsule form. The latest product offering was a potent antioxidant amino acid and served as a precursor in the body to glutathione - one of the body's most vital and plentiful antioxidant and detoxification agents. Specifically, N-Acetyl-L-Cysteine provided readily available L-cysteine, functioning both as an antioxidant on its own and as a precursor to glutathione.

N-Acetyl-L-Cysteine Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 667.3 million

Revenue forecast in 2030

USD 1.07 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; South Africa

Key companies profiled

NOW Foods; JARROW FORMULAS; Doctor’s Best; Life Extension; SWANSON HEALTH; Pure Encapsulations; Source Naturals; Nutricost; Thorne NAC; Etta Vita

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global N-Acetyl-L-Cysteine Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global N-Acetyl-L-Cysteine (NAC) supplements market report based on form, type, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets and Capsules

-

Powder

-

Gummies

-

Sprays

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary

-

Therapeutic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacies

-

Online

-

Supermarkets and Hypermarkets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global N-Acetyl-L-Cysteine supplements market size was estimated at USD 616.7 million in 2023 and is expected to reach USD 667.3 million in 2024.

b. The global N-Acetyl-L-Cysteine supplements market is expected to grow at a compounded growth rate of 8.2% from 2024 to 2030 to reach USD 1.07 billion by 2030.

b. The NAC supplements market in North America captured a revenue share of over 42.1% in the market. North America is characterized by a robust healthcare infrastructure and a strong emphasis on preventive healthcare and wellness.

b. Some key players operating in the market include NOW Foods, JARROW FORMULAS, Doctor’s Best, Life Extension, SWANSON HEALTH, Pure Encapsulations, Source Naturals, Nutricost, Thorne NAC, and Etta Vita

b. The market is driven by advancements in supplement formulations and the expansion of distribution channels. Manufacturers are developing innovative NAC supplement products in various forms, such as capsules, tablets, powders, and gummies, to cater to different consumer preferences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.