- Home

- »

- Consumer F&B

- »

-

Mustard Oil Market Size, Share, Growth, Trends Report 2030GVR Report cover

![Mustard Oil Market Size, Share & Trends Report]()

Mustard Oil Market (2025 - 2030) Size, Share & Trends Analysis Report By Processing Type (Edible, Non-Edible), By Packaging, By End Use (Residential, Commercial), By Distribution Channel (Foodservice, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-437-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mustard Oil Market Summary

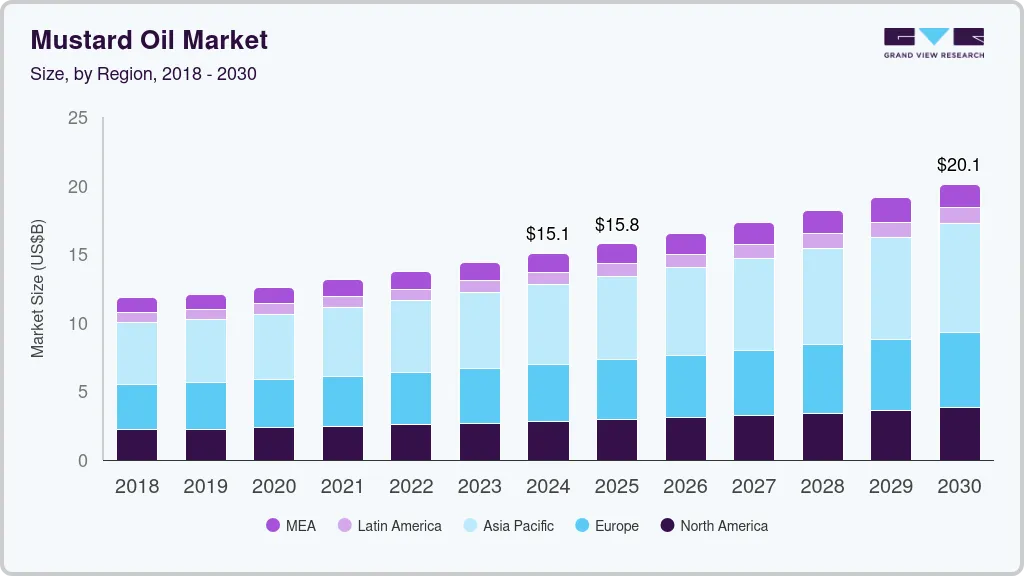

The global mustard oil market size was estimated at USD 15.05 billion in 2024 and is projected to reach USD 20.10 billion by 2030, growing at a CAGR of 5% from 2025 to 2030. The market demand and consumption of mustard oil are on the rise, driven by several key factors and emerging trends. One of the primary drivers is the growing focus on health and wellness.

Key Market Trends & Insights

- North America mustard oil market held the largest revenue share of 18.7% in 2023.

- The mustard oil market in Asia Pacific is expected to grow at a CAGR of 5.4% from 2024 to 2030.

- By processing type, the edible mustard oil segment led the market with a revenue share of 80.3% in 2023.

- By end use, the commercial segment held the largest revenue share of 67.6% in 2023.

- By distribution channel, the foodservice segment led with the largest revenue share of 56.2% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 15.05 Billion

- 2030 Projected Market Size: USD 20.10 Billion

- CAGR (2025-2030): 5%

- North America: Largest market in 2023

As consumers become more health-conscious, there is an increasing preference for natural and unrefined oils. Mustard oil, particularly the cold-pressed (Kachhi Ghani) variety, is perceived as a healthier alternative due to its rich content of monounsaturated fatty acids (MUFAs), omega-3 fatty acids, and antioxidants. The oil is traditionally believed to offer various health benefits, such as improving heart health, enhancing skin and hair quality, and providing anti-inflammatory and antibacterial properties. These perceived benefits have significantly contributed to the rising demand among health-conscious consumers.

Culinary preferences and cultural significance also play a crucial role in the increasing consumption of mustard oil. The oil is deeply rooted in the culinary traditions of South Asian countries like India, Bangladesh, and Nepal, where it is a key ingredient in many regional dishes. Its strong, pungent flavor enhances the taste of food, making it a preferred choice for cooking in these regions. Beyond its use in cooking, mustard oil is integral to various cultural and religious practices, including massages and traditional medicine, which further sustain its demand across different cultural contexts.

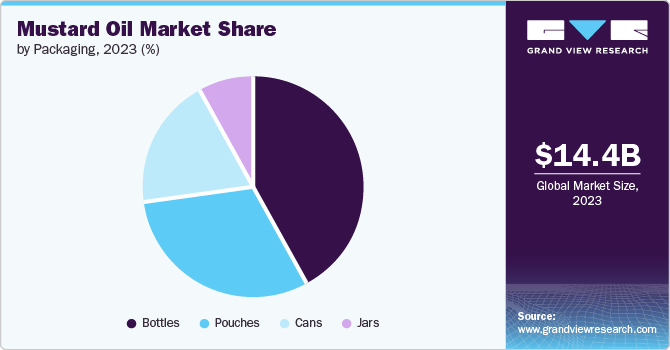

The rise in consumer awareness and the broader accessibility of mustard oil have also contributed to its growing market. Increased awareness about the health and culinary benefits of mustard oil, fueled by media, health experts, and targeted marketing campaigns, has led to a surge in its consumption. The oil is now more widely available in different packaging forms-bottles, pouches, and cans-and through diverse distribution channels, including supermarkets, grocery stores, and online platforms. This increased availability has made mustard oil more accessible to a broader range of consumers, particularly in urban areas where there is a shift towards healthier eating habits.

Urbanization and changing lifestyles are further driving the demand for mustard oil. As more consumers, especially in urban settings, adopt healthier eating habits, they are increasingly choosing oils like mustard oil that offer perceived health benefits. Its versatility in cooking-suitable for frying, sautéing, and pickling-combined with convenient packaging, makes it an appealing choice for the modern consumer with a busy lifestyle. Additionally, the expansion of mustard oil into new markets, including among the South Asian diaspora in Western countries and through increasing export opportunities, is contributing to the overall growth of the market.

Processing Type Insights

Edible mustard oil accounted for a revenue share of 80.3% in 2023. There is a growing trend among consumers to choose natural and unrefined oils, which are perceived as healthier alternatives to heavily processed oils. Cold-pressed mustard oil, in particular, is favored for its purity and traditional extraction methods, which retain more nutrients and flavor. This shift is driving the increased consumption of edible mustard oil.

Non-edible mustard oil is expected to grow at a CAGR of 5.3% from 2024 to 2030. Non-edible mustard oil is widely used in traditional and Ayurvedic medicine for its therapeutic properties. It is commonly used in massages to alleviate muscle pain, improve blood circulation, and treat joint stiffness. As interest in natural and holistic health remedies grows, more consumers are turning to non-edible mustard oil for its medicinal benefits.

Packaging Insights

Bottles accounted for a revenue share of 42.4% in 2023. Bottled mustard oil is easy to handle, pour, and store, making it convenient for both home use and commercial kitchens. The packaging allows for easy dispensing and minimizes spills. Glass bottles, in particular, help preserve the freshness and quality of the oil by protecting it from light and air, which can cause oxidation and spoilage. PET bottles, while less protective than glass, are still preferred for their ability to keep the oil sealed and safe.

Pouches is expected to grow at a CAGR of 5.5 % from 2024 to 2030. Pouches generally cost less to produce and transport compared to rigid packaging like glass bottles or plastic containers. This cost savings can be passed on to consumers, making pouches a more economical option. Modern pouches are designed to be leak-proof and secure, minimizing the risk of spills and ensuring the oil remains clean and uncontaminated. This makes them a practical choice for both home use and transport.

End Use Insights

Commercial accounted for a revenue share of 67.6% in 2023. The food industry, particularly in regions with a high consumption of traditional and ethnic cuisines, uses mustard oil for its distinct flavor and culinary properties. Commercial kitchens, restaurants, and food processing units utilize mustard oil in large quantities for cooking, pickling, and food preparation. The oil’s unique taste and high smoke point make it suitable for various cooking methods, driving its demand in the food service sector.

Residential is expected to grow at a CAGR of 5.2% from 2024 to 2030. Mustard oil is valued for its health benefits, including its high content of monounsaturated fatty acids (MUFAs), omega-3 fatty acids, and antioxidants. Consumers are increasingly aware of these benefits and are choosing mustard oil for its potential to improve heart health, reduce inflammation, and support overall wellness. This growing health consciousness drives its use in home cooking.

Distribution Channel Insights

Foodservice accounted for a revenue share of 56.2% in 2023. Food services typically purchase mustard oil in large quantities, which is more cost-effective compared to buying smaller amounts. This is particularly beneficial for commercial kitchens and restaurants that use oil extensively. Food services may offer specialty oils that are not commonly available in retail stores. This includes oils with specific flavor profiles or culinary properties that are essential for certain types of cuisine or cooking techniques

Retail is expected to grow at a CAGR of 5.2% from 2024 to 2030. As these cuisines gain popularity globally and in multicultural regions, the demand for mustard oil through retail channels has increased. Consumers looking to replicate authentic flavors in their cooking are turning to mustard oil, available through retail outlets. Retail channels have expanded their offerings to include a wider range of cooking oils, including mustard oil. With greater availability in supermarkets, specialty stores, and online platforms, consumers find it more convenient to purchase mustard oil. This increased accessibility contributes to its rising demand.

Regional Insights

The mustard oil market in North America accounted for a revenue share of 18.7% in 2023 of the global market. The increasing diversity in North America, particularly with the growing South Asian diaspora, has led to a higher demand for traditional ingredients like mustard oil. As more people explore and appreciate South Asian cuisine, mustard oil, which is a staple in many of these dishes, is becoming more widely used.

U.S. Mustard Oil Market Trends

The demand for mustard oil in U.S. is increasing. The expansion of the food service sector, including restaurants and fast-food chains, contributes to higher demand for mustard oil. As the demand for functional foods that offer health benefits beyond basic nutrition grows, mustard oil is being recognized for its medicinal and therapeutic properties. This interest is driving its use not just in cooking but also in dietary supplements and natural remedies.

Europe Mustard Oil Market Trends

The mustard oil market in Europe is expected to grow at a CAGR of 4.7% during the forecast period. The increasing South Asian population in Europe, particularly in the U.K., has led to a higher demand for traditional products, including mustard oil. As these communities maintain their culinary practices, the demand for mustard oil continues to grow, and its availability in mainstream retail channels is expanding. Additionally, mustard oil is gaining attention for its potential health benefits, such as being rich in omega-3 fatty acids and antioxidants, which appeal to those looking to incorporate healthier cooking oils into their diets.

Asia Pacific Mustard Oil Market Trends

The mustard oil market in Asia Pacific is expected to grow at a CAGR of 5.4% from 2024 to 2030. Mustard oil has deep cultural and culinary roots in many Asia-Pacific countries, particularly in India, Bangladesh, Nepal, and parts of Southeast Asia. It is a staple cooking oil in these regions, used in a wide variety of traditional dishes. The strong, pungent flavor of mustard oil is integral to the cuisine, and its use continues to be passed down through generations, maintaining its high demand.

Additionally, mustard oil is valued for its perceived health benefits, such as its anti-inflammatory properties, ability to improve skin and hair health, and its role in traditional massages. As awareness of these benefits grows, particularly among younger generations, the consumption of mustard oil continues to rise.

Key Mustard Oil Company Insights

The mustard oil market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Mustard Oil Companies:

The following are the leading companies in the mustard oil market. These companies collectively hold the largest market share and dictate industry trends.

- V.V.S.V. & Sons Edible Oil Mill

- Cargill, Incorporated

- Emami Agrotech Ltd.

- Adani Wilmar Limited

- K. S. Oils Limited

- Marico

- Puri Oil Mills Limited

- Dabur India Ltd.

- Bansal Oil Mill Ltd.

- Patanjali Ayurved

Recent Developments

-

In May 2024, Adani Wilmar Limited (AWL) launched Fortune Pehli Dhaar First-Pressed Mustard Oil, a premium product aimed at elevating the mustard oil category in India. The oil is crafted from the finest mustard seeds sourced from Rajasthan and extracted using the traditional wooden kolhu technique, which preserves the oil's natural essentials. This results in a rich mustard aroma, deep color, and enhanced flavor that promises to elevate cooking experiences.

-

In December 2023, Emami Agrotech launched Emami Healthy & Tasty Kachchi Ghani Mustard Oil with three distinct pungency levels: Mild (Jhaanjh level: .24%), Strong (Jhaanjh level: .30%), and Super Strong (Jhaanjh level: .36%). This innovative concept, tailored to individual taste preferences, aims to redefine the mustard oil landscape in India.

Mustard Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.76 billion

Revenue forecast in 2030

USD 20.10 billion

Growth rate

CAGR of 5% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Processing type, packaging, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

V.V.S.V. & Sons Edible Oil Mill; Cargill, Incorporated; Emami Agrotech Ltd.; Adani Wilmar Limited; K. S. Oils Limited; Marico; Puri Oil Mills Limited; Dabur India Ltd.; Bansal Oil Mill Ltd.; Patanjali Ayurved

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Mustard Oil Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global mustard oil market report based on processing type, packaging, end use, distribution channel, and region:

-

Processing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Edible

-

Non-Edible

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Pouches

-

Cans

-

Jars

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mustard oil market size was estimated at USD 14.39 billion in 2023 and is expected to reach USD 15.06 billion in 2024.

b. The global mustard oil market is expected to grow at a compounded growth rate of 4.9% from 2024 to 2030 to reach USD 20.10 billion by 2030.

b. Edible mustard oil accounted for a market share of 80.2% in 2023. Mustard oil is increasingly recognized for its health benefits, including its high content of monounsaturated fatty acids (MUFAs), omega-3 fatty acids, and antioxidants. These components are associated with improved heart health, anti-inflammatory effects, and overall well-being. As consumers become more health-conscious, they are opting for oils like mustard oil that offer both flavor and nutritional benefits.

b. Some key players operating in mustard oil market include V.V.S.V. & Sons Edible Oil Mill, Cargill, Incorporated, Emami Agrotech Ltd., Adani Wilmar Limited, and others.

b. Key factors that are driving the market growth include rising popularity of ethnic and Asian cuisines and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.