- Home

- »

- Consumer F&B

- »

-

Mushroom Drinks Market Size, Share & Growth Report, 2030GVR Report cover

![Mushroom Drinks Market Size, Share & Trends Report]()

Mushroom Drinks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Mushroom Coffee, Mushroom Tea), By Form (Liquid, Powder), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-415-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mushroom Drinks Market Summary

The global mushroom drinks market size was estimated at USD 3.92 billion in 2024 and is projected to reach USD 5.78 billion by 2030, growing at a CAGR of 6.8% from 2025 to 2030. Mushroom drinks are rapidly gaining popularity in the functional beverages sector, where consumers are increasingly seeking health benefits beyond basic nutrition.

Key Market Trends & Insights

- North America dominated the global mushroom drinks market with a revenue share of 40.29% in 2023.

- By product, the mushroom coffee segment led the market, with a revenue share of 76.45% in 2023.

- By form, the powdered form segment led the market, with a revenue share of 85.22% in 2023.

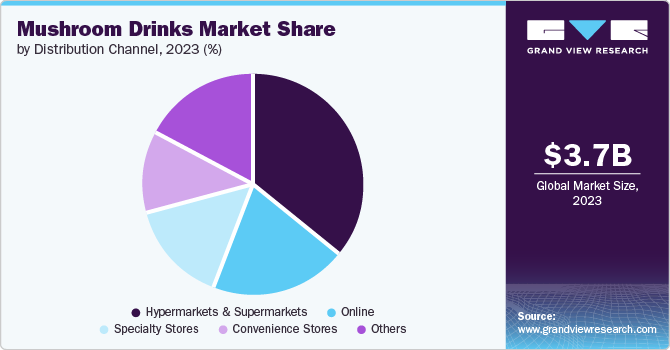

- By distribution channel, the Sales through hypermarkets & supermarkets accounted for a revenue share of 35.85% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 3.92 Billion

- 2030 Projected Market Size: USD 5.78 Billion

- CAGR (2025-2030): 6.8%

- North America: Largest market in 2023

The market for mushroom drinks includes a wide range of products, including mushroom coffee, teas, elixirs, and other beverages infused with medicinal mushrooms, such as reishi, lion's mane, chaga, and cordyceps. This market is driven by a combination of health-conscious consumers, innovative product launches, and a growing interest in natural and organic products, which, thus, are expected to augment the mushroom drinks growth and demand during the forecast period.

One of the most significant drivers of the market is the increasing consumer focus on health and wellness. As more people become aware of the potential health benefits associated with medicinal mushrooms, demand for these functional beverages has surged. Medicinal mushrooms are believed to offer a range of health benefits, including immune support, cognitive enhancement, anti-inflammatory properties, and stress reduction.

For instance, the lion's mane mushroom is known for its neuroprotective properties and its potential to enhance cognitive function and memory. Studies have shown that compounds found in lion's mane can stimulate the growth of nerve cells, which may help in the prevention and treatment of neurodegenerative diseases such as Alzheimer's. Consumers who prioritize brain health are increasingly turning to mushroom drinks containing lion's mane as a natural way to boost cognitive function. Similarly, reishi mushroom, often referred to as the "mushroom of immortality," is known for its adaptogenic properties that help the body manage stress. The global rise in mental health awareness and the search for natural remedies to combat stress and anxiety have contributed to the popularity of reishi-infused beverages.

Furthermore, the market for mushroom drinks is a part of the broader trend toward functional and superfood beverages, which is gaining traction as consumers seek out products that offer more than just hydration. Functional beverages are designed to provide specific health benefits, such as improved energy levels, enhanced cognitive function, or better digestive health. For instance, Cordyceps mushroom, known for its ability to enhance energy and stamina, has found its way into various energy drinks and pre-workout supplements.

The shift toward natural and organic products is further expected to drive market growth. Consumers are increasingly looking for clean-label products that are free from artificial additives, preservatives, and synthetic ingredients. Medicinal mushrooms, often grown in controlled, organic environments, align well with this demand. In response, manufacturers are capitalizing on this trend by offering mushroom drinks that are certified organic and sustainably sourced. For example, Four Sigmatic, one of the leading brands in the market, emphasizes the use of organic, wild-harvested mushrooms in its products. This commitment to sustainability and transparency resonates with eco-conscious consumers who are concerned about the environmental impact of their purchases.

Product Insights

Mushroom coffee held a revenue share of 76.45% in 2023. One of the primary drivers of mushroom coffee's popularity is its appeal as a healthier alternative to regular coffee. Traditional coffee consumption has been associated with various health concerns, such as increased anxiety, digestive issues, and disrupted sleep patterns, due to its high caffeine content. Mushroom coffee, typically made by blending coffee with medicinal mushrooms such as lion's mane, chaga, and reishi, offers a reduced caffeine option while providing additional health benefits.

Mushroom coffee can be easily integrated into daily routines as a direct replacement for regular coffee, which makes it an easy choice for consumers who are already accustomed to drinking coffee. The taste profile of mushroom coffee is also similar to that of regular coffee, which reduces the barrier to entry for consumers who might be hesitant to try entirely new flavors.

In addition, Leading brands in the mushroom drinks market have played a significant role in popularizing mushroom coffee. Companies such as Four Sigmatic and MUD\WTR have effectively marketed mushroom coffee as a superfood-enhanced beverage that offers more than just a caffeine boost. Their marketing strategies often emphasize the health benefits, organic and sustainably sourced ingredients, and the convenience of single-serve sachets or ready-to-drink formats. These efforts have resonated with health-conscious consumers, driving the widespread adoption of mushroom coffee and solidifying its position as the market leader.

The mushroom tea market is expected to grow at a CAGR of 9.6% from 2024 to 2030. Mushroom tea offers a unique combination of traditional tea benefits with the added advantages of medicinal mushrooms. As consumers become more educated about the specific health benefits of different mushrooms, such as reishi for relaxation or chaga for immune support, the demand for mushroom tea has increased significantly in recent years. Furthermore, mushroom tea provides a wide range of flavors and health benefits, depending on the type of mushroom used. This diversity allows consumers to choose teas based on flavors that align with their specific health goals, such as improving cognitive function, enhancing immune health, or reducing stress, which is expected to further augment its market growth during the forecast period.

Form Insights

The powdered form held a revenue share of 85.22% in 2023. Powdered mushroom drinks offer unparalleled versatility, as they can be easily mixed into a variety of beverages, including smoothies, coffee, tea, and even water. This flexibility allows consumers to customize their intake of medicinal mushrooms according to their preferences and health goals. Furthermore, another key advantage of powdered mushroom drinks is their shelf stability. Unlike liquid forms, which may require refrigeration and have a shorter shelf life, powdered mushrooms can be stored at room temperature for extended periods without losing their potency. This makes powdered mushroom drinks more convenient for consumers driving its demand and growth during the forecast period.

The liquid form is expected to grow at a CAGR of 9.0% from 2024 to 2030. The modern consumer's preference for convenience is a major factor driving the growth of liquid mushroom drinks. Ready-to-drink (RTD) beverages, which require no preparation, are becoming increasingly popular among busy consumers who seek health benefits without the time and effort involved in preparing powdered drinks. The grab-and-go nature of liquid mushroom drinks makes them an attractive option for on-the-go consumption, particularly among urban dwellers and working professionals, which is expected to further augment its market growth during the forecast period.

Furthermore, brands are introducing a wide range of RTD options, including mushroom-infused coffees, teas, and even functional mushroom beverages with added adaptogens and superfoods. This variety caters to different consumer preferences and occasions, driving the overall growth of liquid mushroom drinks during the forecast period.

Distribution Channel Insights

Sales through hypermarkets & supermarkets accounted for a revenue share of 35.85%. Hypermarkets and supermarkets offer a wide range of mushroom drinks, providing consumers with numerous options to choose from. These large retail formats typically carry various brands and product types, including mushroom coffee, tea, elixirs, and powders, making it easy for consumers to find the products they need. Furthermore, the ability to compare different products in one location is a significant advantage for consumers who value variety and choice, thus augmenting the sales of mushroom drinks through this channel.

Furthermore, manufacturers often collaborate with hypermarkets & supermarkets to create eye-catching displays, offer discounts, and provide free samples, all of which encourage consumers to try new products. The high foot traffic in these retail environments ensures that mushroom drinks receive significant exposure, further driving sales.

Sales of mushroom drinks through online channels are expected to grow at a CAGR of 8.4% from 2024 to 2030. The global e-commerce boom has significantly impacted the market for mushroom drinks, with more consumers turning to online platforms for their purchases. The convenience of shopping from home, access to a wider range of products, and the ability to compare prices across different retailers are some of the key reasons for the growing popularity of online sales. In addition, the COVID-19 pandemic accelerated the shift to online shopping, as consumers sought to minimize in-store visits and take advantage of home delivery services.

Regional Insights

North America mushroom drinks market accounted for a global revenue share of 40.29% in 2023. The rising popularity of functional beverages, increasing consumer awareness of the health benefits of mushrooms, and the strong presence of innovative brands are among the key factors driving the market for mushroom drinks in the region during the forecast period. Consumers in this region are increasingly seeking beverages that offer more than just hydration; they are looking for drinks that provide additional health benefits, such as improved cognitive function, enhanced immunity, and stress reduction. Mushroom drinks, which are often infused with medicinal mushrooms like reishi, lion's mane, and chaga, align perfectly with this trend. These drinks are marketed as superfood beverages that can enhance mental clarity, boost the immune system, and promote overall well-being, which is expected to augment its demand during the forecast period.

U.S. Mushroom Drinks Market Trends

The mushroom drinks market in the U.S. is expected to grow at a CAGR of 6.1% from 2024 to 2030. The health and wellness culture in the U.S. is a major driver of the market growth. American consumers are increasingly prioritizing their health and are willing to invest in products that promise functional benefits. The rising awareness of the adverse effects of synthetic ingredients and artificial additives has led to a growing preference for natural and organic products. Mushroom drinks, which are often marketed as natural remedies with immune-boosting, anti-inflammatory, and stress-relieving properties, have found a receptive audience in the U.S. market.

Asia Pacific Mushroom Drinks Market Trends

The Asia Pacific mushroom drinks market is expected to grow at a CAGR of 7.6% from 2024 to 2030. Western health trends have had a significant impact on the market in Asia Pacific. As consumers in the region become more exposed to global health and wellness trends, there is a growing interest in products that are popular in the West, such as mushroom coffees and elixirs. This trend is particularly strong in urban areas, where younger consumers are more likely to be influenced by global trends and are open to trying new and innovative products. The influence of Western health trends has contributed to the diversification of the mushroom drinks market in the region, with more products being introduced to cater to different consumer preferences, thus augmenting the market growth in the region during the forecast period.

Europe Mushroom Drinks Market Trends

The Europe mushroom drinks market is expected to grow at a CAGR of 7.0% from 2024 to 2030.The growing interest in plant-based diets and sustainability in Europe has contributed to the growth of the market. Consumers are becoming more mindful of the environmental impact of their food choices and are seeking products that are plant-based and sustainably produced. Mushrooms, which are grown using sustainable farming practices and have a low environmental footprint, are increasingly being viewed as an eco-friendly alternative to animal-based products. This trend is particularly strong in countries like the Netherlands and Scandinavia, where sustainability is a key consideration for consumers and, thus, expected to drive the demand for mushroom drinks in the region during the forecast period.

Key Mushroom Drinks Company Insights

The global mushroom drinks industry is characterized by numerous well-established and emerging players. Manufacturers are continually introducing new products to capture consumer interest. This includes a variety of mushroom-infused beverages such as coffees, teas, elixirs, and ready-to-drink options. For example, brands like Four Sigmatic have pioneered the mushroom coffee category, combining the health benefits of mushrooms with the popularity of coffee. Furthermore, companies are experimenting with different types of mushrooms, such as reishi, lion's mane, chaga, and cordyceps, each offering unique health benefits. Some products blend multiple mushrooms to provide a broad spectrum of functional benefits, like immune support, stress relief, and cognitive enhancement.

Key Mushroom Drinks Companies:

The following are the leading companies in the mushroom drinks market. These companies collectively hold the largest market share and dictate industry trends.

- Four Sigmatic Foods, Inc.

- MUD\WTR, Inc.

- Laird Superfood, Inc.

- Odyssey Wellness LLC

- Peak State Coffee, Inc.

- Tamim Teas Company

- RYZE Superfoods, LLC

- Mushroom Cups International

- Real Mushrooms

- Laird Superfood, Inc.

- NeuRoast Company

- La Republica Superfoods

Recent Developments

-

In August 2024, UK-based brand Vybey introduced a new mushroom-based coffee alternative called Braincare Smart Focus. This product is designed to combat brain fog without the potential negative effects associated with coffee. It contains lion’s mane, believed to enhance concentration and brain health; maca root, known for boosting energy and endurance; chaga mushroom, recognized as a powerful antioxidant; and turmeric, which helps reduce inflammation. The alternative is available in two flavors: cacao and matcha.

-

In June 2024, Artizan Coffee Roasters launched the world’s first USDA Organic Mushroom Coffee Capsules compatible with Nespresso machines. These capsules combine organic specialty-grade Arabica coffee with organic mushrooms, aiming to improve mental clarity and cognitive function and provide stress support.

-

In May 2024, Antioxi, a brand known for organic certified mushroom supplements, launched its first trio of functional mushroom teas: Gut Tea, Vitality Tea, and Calm Tea. The company aims to highlight the health benefits of mushrooms by offering teas that deliver essential nutrients, minerals, vitamins, and active compounds to support the body in adapting to stress and enhancing overall well-being. According to the brand, these teas can improve immune function, gut health, and sleep quality.

Mushroom Drinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.17 billion

Revenue forecast in 2030

USD 5.78 billion

Growth rate (Revenue)

CAGR of 6.8% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Four Sigmatic Foods, Inc.; MUD\WTR, Inc.; Laird Superfood, Inc.; Odyssey Wellness LLC; Peak State Coffee, Inc.; Tamim Teas Company; RYZE Superfoods, LLC; Mushroom Cups International; Real Mushrooms; Laird Superfood, Inc.; NeuRoast Company; La Republica Superfoods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Mushroom Drinks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mushroom drinks market report based on product, form, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mushroom Coffee

-

Mushroom Tea

-

Mushroom Elixirs

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mushroom drinks market size was estimated at USD 3.70 billion in 2023 and is expected to reach USD 3.93 billion in 2024.

b. The global mushroom drinks market is expected to grow at a compounded growth rate of 6.7% from 2024 to 2030 to reach USD 5.78 billion by 2030.

b. Mushroom coffee dominated the mushroom drinks market with a share of 76.45% in 2023. Its appeal as a healthier alternative to regular coffee is expected to drive its sales during the forecast period. Furthermore, it offers health benefits like improved mental clarity and stress reduction, further driving its demand.

b. Some key players operating in mushroom drinks market include Four Sigmatic Foods, Inc.; MUD\WTR, Inc.; Laird Superfood, Inc.; Odyssey Wellness LLC; Peak State Coffee, Inc.; Tamim Teas Company; RYZE Superfoods, LLC; Mushroom Cups International; Real Mushrooms; Laird Superfood, Inc.; NeuRoast Company; and La Republica Superfoods.

b. Key factors driving market is driven by rising health consciousness and the demand for functional beverages. Consumers seek natural products with benefits like immune support, stress relief, and cognitive enhancement. The growing popularity of adaptogens and wellness trends boosts demand for mushroom drinks, which offer both traditional health benefits and innovative formats.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.