- Home

- »

- IT Services & Applications

- »

-

Multiexperience Development Platforms Market Report, 2030GVR Report cover

![Multiexperience Development Platforms Market Size, Share & Trends Report]()

Multiexperience Development Platforms Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Platforms, Services), By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-989-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

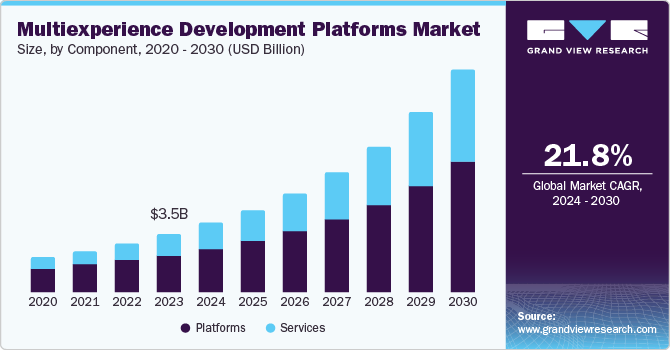

The global multiexperience development platforms market size was valued at USD 3.48 billion in 2023 and is projected to grow at a CAGR of 21.8% from 2024 to 2030. A steady worldwide increase in the number of users of digital devices such as smartphones, tablets, wearables, and laptops, along with rising demand for personalized user experiences, has led to strong market growth. Additionally, increasing digital transformation in sectors such as manufacturing, BFSI, healthcare, IT, and consulting, and advancements in technology due to the advent of artificial intelligence (AI) and machine learning (ML) have acted as major growth drivers.

The increasing adoption of digital technologies across industries is driving the demand for MXDPs. Businesses seek to create immersive and personalized experiences for their customers across various devices such as smartphones, tablets, laptops, and wearables, as well as channels including websites and smartphone applications. For instance, the IBM MobileFirst Platform Foundation is a tool that helps businesses create and manage mobile apps. It aids in building, securely deploying, and managing apps for organizations. This includes tools for developers, a platform for apps to run on, a private app store, and a system to monitor and analyze app performance. Additionally, customers expect consistent experiences across different touchpoints, such as websites, mobile apps, voice interfaces, and augmented reality (AR) or virtual reality (VR) applications. MXDPs enable businesses to deliver a seamless omnichannel experience to these customers.

The evolution of technologies such as AI, ML, and the Internet of Things (IoT) is fueling the development of more sophisticated MXDPs. These platforms can now handle complex interactions and data analysis to provide personalized experiences. For instance, in March 2024, OutSystems introduced a new tool called AI Agent Builder. This tool makes it easier for IT professionals to create AI-powered applications. It is designed to help businesses transform their operations using AI while ensuring these AI applications are secure and standardized. Furthermore, organizations recognize the importance of providing an elevated customer experience as a competitive differentiator. MXDPs help businesses create engaging experiences that drive customer loyalty and satisfaction.

Component Insights

The platforms segment dominated the market with a revenue share of 62.7% in 2023. This is owing to the increasing demand for comprehensive and integrated solutions that enable businesses to design, develop, and deploy multiexperience applications efficiently. Platforms provide a unified foundation for building, managing, and optimizing multiexperience applications, offering a range of tools, frameworks, and services that streamline the development process. By leveraging MXD platforms, businesses can accelerate time-to-market, reduce development costs, and improve the overall quality of their applications. Moreover, their scalability and flexibility allow businesses to adapt to changing market conditions and evolving customer needs, which has led to their increased adoption in this market.

The services segment is expected to register the fastest growth over the forecast period. This is attributed to the increasing need for expert guidance, support, and customization in the development and deployment of multiexperience applications. As businesses navigate the complexities of creating user-friendly omnichannel experiences, they require specialized services to ensure the successful implementation and integration of multiexperience development platforms. Services, including consulting, implementation, and maintenance, offer tailored support to address unique business requirements, leveraging expertise in platform configuration, customization, and optimization.Additionally, growing demand for continuous innovations, iterative developments, and DevOps practices is expected to fuel the adoption of related services in the coming years.

Deployment Insights

The hosted segment accounted for a largest market revenue share in 2023. The increasing preference for cloud-based solutions that offer scalability, flexibility, and cost-effectiveness to organizations is accountable for a larger segment share. Hosted deployment enables businesses to access MXDPs over the internet, eliminating the need for on-premise infrastructure and its required maintenance. This model provides instant access to the latest features, updates, and security patches, ensuring that businesses can rapidly develop and deploy multiexperience applications without significant upfront investments. Additionally, hosted deployment offers effortless integration with existing cloud-based services and tools, facilitating a unified development environment. These factors are expected to propel a steady segment growth over the forecast period.

On-premise deployment is anticipated to register a significant growth from 2024 to 2030. This is owing tothe specific requirements of businesses that necessitate direct control over their infrastructure, data, and security. On-premise deployment enables organizations to install and manage MXDPs within their own premises, ensuring complete ownership and governance of their development environment. This deployment model is particularly in demand among businesses operating in highly regulated industries, such as BFSI, government, and healthcare, where data sensitivity and compliance requirements compel the use of on-premise solutions.

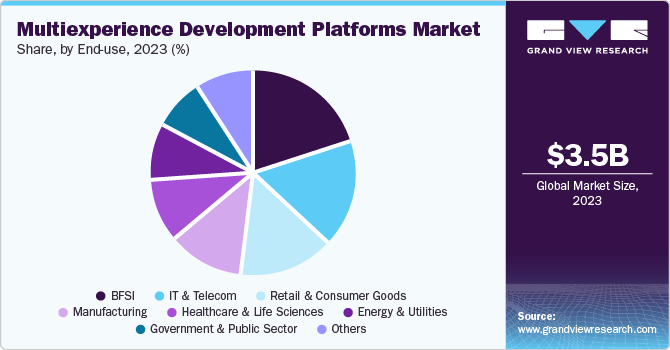

End Use Insights

BFSI accounted for the largest revenue share in 2023. The sector's significant investments in digital transformation initiatives aimed at improving customer satisfaction, reducing operational costs, and mitigating risks have contributed to its dominant share in the market. MXDPs enable BFSI organizations to design, develop, and deploy personalized, engaging, and secure experiences across various touchpoints, including mobile, web, and wearables. For instance, in February 2023,OutSystems collaborated with the Government Service Insurance System (GSIS) in the Philippines to create the GSIS Touch Mobile App. This app allows GSIS members and pensioners to easily access various services, such as loan applications, offered by the agency. The requirement for robust security, scalability, and reliability in the BFSI sector aligns with the capabilities of MXDPs, which provide advanced features such as encryption, authentication, and data analytics. For instance, in October 2023, Pegasystems announced a new tool called the Pega Financial Crime and Alerts Investigation Management Accelerator. This unified solution helps banks and other financial institutions manage the growing number of alerts related to financial crimes such as fraud and money laundering.

The government and public sector segment anticipated to register the fastest growth from 2024 to 2030. This is owing totheir increasing focus on digital transformation, citizen engagement, and service delivery optimization.MXDP providers offer these organizations a flexible, scalable, and secure solution to design, develop, and deploy personalized experiences for citizens. The growing demand for digital services, online portals, and mobile applications in the public sector, coupled with the need to modernize legacy systems and processes, has fueled the adoption of MXDPs. For instance, in April 2024, the Victoria Police in Australia selected OutSystems to enhance its operational processes and improve user experience by leveraging the digital platform offered by OutSystems and PhoenixDX. An increasing emphasis on citizen-focused services, open data initiatives, and smart city projects has further accelerated growth in this segment.

Enterprise Size Insights

Large enterprises held a leading revenue share in the market in 2023. This is attributed totheir significant investments in digital transformation initiatives and a constant need for scalable, robust, and secure solutions to support their complex operations. These organizations require multiexperience development platforms that can handle high volumes of data, users, and transactions while ensuring seamless integration with their existing infrastructure and systems. Large enterprises also demand advanced features such as analytics, AI, and machine learning to gain a competitive edge and improve customer experiences, which has resulted in their dominant share in this market.

The small and medium enterprises (SMEs) segment are expected to register the fastest CAGR during the forecast period. This is owing toan increasing adoption of digital technologies by such companies to enhance customer engagement, improve operational efficiency, and drive business growth. SMEs are recognizing the importance of delivering innovative and unified experiences to maintain business competitiveness and are leveraging MXDPs to achieve these objectives. Providers are offering SMEs a cost-effective, agile, and scalable solution to develop and deploy their multiexperience applications without requiring significant investments in infrastructure or resources. As technological advancements continue to drive down the cost of MXDPs, steady segment growth is anticipated during the forecast period.

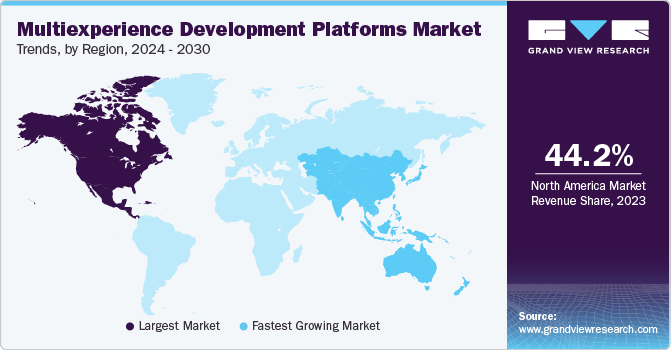

Regional Insights

North America led the global market with a revenue share of 44.2% in 2023. This is attributed to the region's early adoption of digital technologies, robust IT infrastructure, and high demand for personalized customer experiences. Regional economies such as the U.S. and Canada have a strong presence of large enterprises, SMEs, and startups, driving the adoption of MXDPs to stay competitive. For instance, in June 2024, KPMG’s Canada business announced its partnership with OutSystems to develop innovative and AI-driven business applications to augment its efforts towards digital transformation. Furthermore, the region's highly developed financial, healthcare, and retail sectors, which are among the primary adopters of these platforms, have also contributed to its dominant share.

U.S. Multiexperience Development Platforms Market Trends

The U.S. held the largest revenue share of the regional market in 2023. The presence of leading technology vendors, innovation hubs, and a skilled workforce in the U.S. has facilitated the development and deployment of cutting-edge multiexperience solutions. The economy's focus on customer experience, digital transformation, and innovation, coupled with its high spending on cloud adoption, IT, and digital technology, has created a strong base for the growth of the MXDPs market. For instance, in May 2024, the infrastructure software provider Progress announced that its DataDirect connectors were leveraged by PruTech to accelerate and scale its cloud migrations. These solutions helped PruTech's customers save significant development time, especially for those with sensitive data.

Europe Multiexperience Development Platforms Market Trends

Europe accounted for a substantial share of the global market in 2023. The region benefits from a robust technological infrastructure and a high level of digital adoption across various industries, which has facilitated the integration of advanced digital solutions. European businesses are increasingly seeking to enhance customer engagement through seamless and personalized experiences, driving the demand for MXDPs that can deliver consistent interactions across multiple channels, including mobile, web, and immersive technologies such as AR/VR. Furthermore, the fast proliferation of 5G technology in the region has accelerated the adoption of these platforms by enabling faster and more reliable connections, which are essential for delivering high-quality multiexperience solutions.

The UK held a notable share of the European market in 2023. This is attributed to the efforts taken by organizations in the economy towards digital transformation to enhance customer experiences and streamline their organizational processes. For instance, in June 2024, PwC UK announced its collaboration with Appian to ensure optimization and process improvement in the insurance sector via the Appian platform. The presence of numerous innovative tech companies in the economy, coupled with substantial investments in digital transformation initiatives, are expected to offer favorable avenues for future market growth.

Asia Pacific Multiexperience Development Platforms Market Trends

Asia Pacific is expected to register the fastest growth rate over the forecast period. This is attributed to the rapid digital transformation across various industries in this region, which has significantly increased the demand for seamless and integrated customer experiences. Businesses are increasingly adopting MXDPs to create omnichannel solutions that cater to the diverse preferences of consumers engaging through multiple platforms, including mobile, web, and voice interfaces. Furthermore, prominent companies are establishing regional offices to cater to the requirements of the market. For instance, in May 2024, Appian opened its new office in Melbourne, Australia, to improve its partner and customer engagement.

The Indian market benefits from a steadily growing base of budding startups and small- and medium-sized enterprises (SMEs) leveraging MXDPs to enhance operational efficiencies and accelerate application development. The country’s increasing investment in advanced technologies such as AI, machine learning, and augmented reality is also propelling the adoption of MXDPs as businesses seek to provide more interactive user experiences. This trend is further fueled by the proliferation of mobile devices and internet accessibility, which enhances the need for applications that function consistently across various environments.

Key Multiexperience Development Platforms Company Insights

Some key companies involved in the multiexperience development platforms market include Appian, Mendix Technology BV, and OutSystems, among others.

-

Appian is an American enterprise software and cloud computing company. The company's flagship product, the Appian AI Process Platform, comes with a set of AI-powered capabilities for building intelligent applications, including machine learning, natural language processing, and predictive analytics. The platform supports the creation of applications that function seamlessly across multiple devices and modalities, including web, mobile, augmented reality (AR), and voice interfaces. In April 2024, Appian announced its strategic partnership with Amazon Web Services (AWS) to enhance its generative AI capabilities.

-

Mendix Technology BV, a subsidiary of Siemens, is a prominent provider of low-code application development solutions, specializing in multiexperience development platforms. Mendix's platform facilitates rapid application development through a visual interface, enabling users to create applications without extensive coding knowledge. In June 2024, Mendix announced the release of the Mendix 10.12 AI-assisted platform for application development.

Key Multiexperience Development Platforms Companies:

The following are the leading companies in the multiexperience development platforms market. These companies collectively hold the largest market share and dictate industry trends.

- Appian

- GeneXus

- IBM

- Mendix Technology BV

- Clover Infotech Private Limited

- OutSystems

- Pegasystems Inc.

- Progress Software Corporation

- Salesforce, Inc.

- ServiceNow

Recent Developments

-

In August 2024, Appianreleased the 24.3 version of the Appian Platform, which helps businesses organize their data and automate their processes. The new version includes enhanced application-building capabilities, support for more AI applications, and better compliance with regulations, making it easier for businesses to use AI.

-

In May 2024, Proximus, a notable Belgian telecommunications company, partnered with Mendix to create a new application called ‘Proximus+.’ This app is an integrated, centralized shop for customers to access various services offered by the company to its suppliers and partners, including telecommunications. It combines six existing React Native apps into a single, easy-to-use mobile experience.

-

In February 2024, Progress announced the release of the latest version of the Progress OpenEdge application development platform. The platform now comes with enhanced capabilities such as OpenTelemetry integration to better manage applications, incremental build support, integration with Apache Kafka to enable real-time messaging and streaming, and dynamic data masking, among other features.

Multiexperience Development Platforms Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.14 billion

Revenue Forecast in 2030

USD 13.51 billion

Growth Rate

CAGR of 21.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, deployment, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Appian; GeneXus; IBM; Mendix Technology BV; Clover Infotech Private Limited; OutSystems; Pegasystems Inc.; Progress Software Corporation; Salesforce, Inc.; ServiceNow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multiexperience Development Platforms Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the multiexperience development platforms market report based on component, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platforms

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecom

-

Retail and Consumer Goods

-

Manufacturing

-

Energy and Utilities

-

Healthcare and Life Sciences

-

Government and Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.