- Home

- »

- IT Services & Applications

- »

-

Multi-Vendor Support Services Market Size Report, 2030GVR Report cover

![Multi-Vendor Support Services Market Size, Share & Trends Report]()

Multi-Vendor Support Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service Type, By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-392-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Multi-Vendor Support Services Market Summary

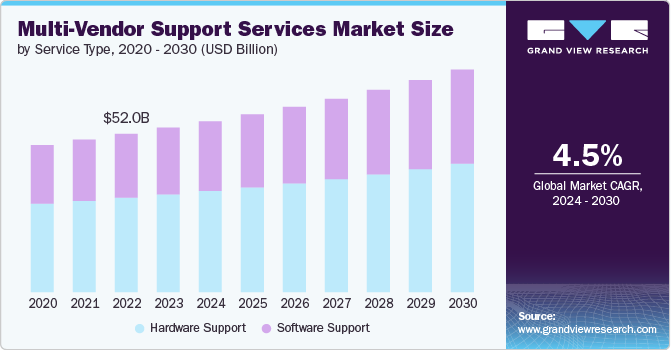

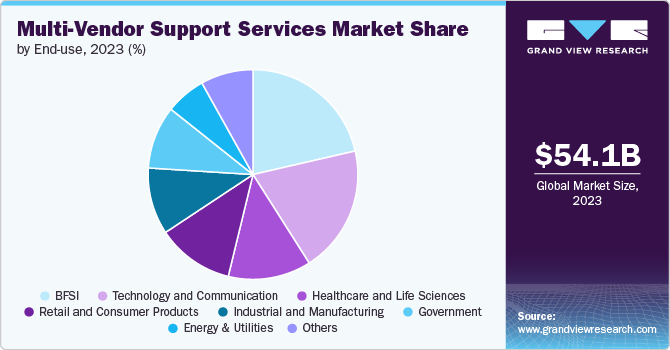

The global multi-vendor support services market size was estimated at USD 54.14 billion in 2023 and is expected to reach USD 73.20 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. The multi-vendor support services market is primarily driven by the increasing complexity and heterogeneity of IT environments in modern organizations.

Key Market Trends & Insights

- North America held the major share of over 41% of the multi-vendor support services market in 2023.

- U.S. is expanding rapidly due to the heightened focus on cost optimization and operational efficiency.

- By service type, the hardware support segment accounted for the largest market share of over 59% in 2023.

- By application, the IT operations segment accounted for the largest market share of over 39% in 2023.

- By enterprise size, the large enterprises size segment accounted for the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 54.14 Billion

- 2030 Projected Market Size: USD 73.20 Billion

- CAGR (2024-2030): 4.5%

- North America: Largest market in 2023

As businesses adopt a diverse array of hardware, software, and networking solutions from various manufacturers, the need for integrated support services that can manage and optimize these multi-vendor ecosystems becomes critical. In addition, the demand for cost-effective and streamlined operations compels organizations to seek unified support services, reducing the logistical burden of coordinating with multiple vendors. The rapid pace of technological advancements and the proliferation of cloud-based solutions further amplify the necessity for comprehensive multi-vendor support, ensuring uninterrupted performance and facilitating seamless integration and innovation across diverse IT landscapes.The multi-vendor support services market encompasses specialized companies' services to manage, maintain, and optimize equipment and software from multiple manufacturers. These services include technical support, repair, maintenance, and IT infrastructure management to ensure seamless interoperability and peak performance across diverse technological ecosystems. Businesses leverage multi-vendor support services to streamline operations, reduce downtime, and minimize the complexity of dealing with multiple vendors, enhancing efficiency and cost-effectiveness. This market is driven by the growing complexity of IT environments and the need for comprehensive, integrated solutions that can adapt to rapidly evolving technological landscapes.

The increasing complexity and heterogeneity of IT environments in modern organizations significantly drive the multi-vendor support services market by necessitating comprehensive management solutions that can handle diverse technologies. As businesses integrate various hardware, software, and networking components from multiple vendors to meet specific operational needs, the intricacy of maintaining and optimizing these disparate systems grows.

This complexity results in heightened challenges for internal IT departments, which may need more specialized knowledge to manage all aspects effectively. Consequently, organizations turn to multi-vendor support services to ensure seamless interoperability, reduce the risk of downtime, and streamline troubleshooting processes. These services offer the expertise and unified approach needed to navigate the multifaceted IT landscapes, enhancing operational efficiency and enabling businesses to focus on core activities while ensuring their technological infrastructure remains robust and reliable.

Service Type Insights

The hardware support segment accounted for the largest market share of over 59% in 2023 in the multi-vendor support services market. The demand for hardware support multi-vendor support services is driven by the proliferation of diverse and sophisticated hardware solutions within organizations. As businesses deploy a wide range of devices and equipment from various manufacturers to address specific operational requirements, the complexity of managing, maintaining, and repairing these heterogeneous hardware components increases. Internal IT teams often face challenges in keeping up with each vendor's technical specifications and support protocols.

Consequently, organizations seek multi-vendor hardware support services to ensure efficient and consistent management of their hardware assets. These services provide specialized expertise, streamlined maintenance processes, and comprehensive support, enabling organizations to minimize downtime, extend the lifecycle of their hardware investments, and optimize overall performance.

The software support segment is anticipated to grow at the highest CAGR over the forecast period. The demand for software support multi-vendor support services is propelled by the diverse array of software applications and platforms utilized by modern businesses. As organizations adopt many software solutions to enhance productivity, streamline operations, and foster innovation, the need for cohesive management and support of these applications becomes critical. Internal IT departments may need help to keep pace with the updates, patches, and specific support requirements of each software vendor.

Multi-vendor software support services address this challenge by offering centralized and expert management of software ecosystems, ensuring compatibility, seamless integration, and timely updates. These services help organizations maintain the stability and security of their software environments, reduce the complexity of managing multiple vendor relationships, and enable IT teams to focus on strategic initiatives rather than routine maintenance tasks.

Enterprise Size Insights

The large enterprises size segment accounted for the largest market share in 2023. Large enterprises' adoption of multi-vendor support services is primarily driven by the scale and complexity of their IT environments. Large enterprises typically operate extensive and diverse technological infrastructures, incorporating various hardware, software, and networking solutions from multiple vendors. These components' sheer volume and variety necessitate a unified support approach to ensure seamless integration, efficient troubleshooting, and optimal performance. Multi-vendor support services provide large enterprises with the expertise and comprehensive management needed to handle the intricacies of such complex ecosystems, enabling them to reduce downtime, enhance operational efficiency, and focus on strategic business objectives without the burden of managing numerous vendor relationships and support protocols.

The small & medium enterprises segment is anticipated to expand at a compound annual growth rate of over 4% during the forecast period. The adoption of multi-vendor support services by small and medium-sized enterprises (SMEs) is driven by the need for cost-effective and efficient IT management. SMEs often need more resources and specialized IT personnel to maintain and support a diverse set of technologies from various vendors. By leveraging multi-vendor support services, SMEs can access a centralized and expert resource for managing their IT infrastructure, which helps to streamline operations, minimize costs, and ensure reliability. These services offer SMEs the ability to scale their support needs in line with business growth, providing flexibility and reducing the administrative and operational burden of dealing with multiple support channels.

Application Insights

The IT operations segment accounted for the largest market share of over 39% in 2023. Adopting multi-vendor support services for IT operations applications is driven by the need for streamlined management and optimized performance of diverse and complex IT infrastructures. IT operations encompass many critical functions, including network management, server maintenance, data storage, and cybersecurity. Managing these disparate systems becomes increasingly challenging as organizations integrate various IT solutions from multiple vendors to meet their operational needs. Multi-vendor support services offer a cohesive and expert approach to ensure interoperability, reduce downtime, and enhance the overall efficiency of IT operations.

The finance & accounting segment is anticipated to grow at the highest CAGR during the forecast period. The adoption of multi-vendor support services for finance and accounting applications is driven by the imperative for accuracy, compliance, and seamless integration within financial processes. Finance and accounting applications often involve complex and sensitive data that require robust support to ensure integrity, security, and compliance with regulatory standards. As organizations employ a variety of financial software from different vendors, the need for integrated support services becomes paramount. Multi-vendor support services offer the expertise to effectively manage and troubleshoot these applications, ensuring that financial data is accurate, systems are up-to-date, and compliance requirements are met.

End-use Insights

The BFSI end use segment accounted for the largest market share in 2023. The adoption of multi-vendor support services in the Banking, Financial Services, and Insurance (BFSI) sector is primarily driven by the need for enhanced security, compliance, and operational efficiency. The BFSI industry handles vast amounts of sensitive financial data and operates under stringent regulatory requirements. Managing diverse IT systems from multiple vendors to meet these demands requires specialized expertise and comprehensive support. Multi-vendor support services provide BFSI institutions with a unified approach to maintaining and securing their IT infrastructure, ensuring compliance with regulatory standards, and minimizing the risk of data breaches.

The technology and communication segment is anticipated to grow at a CAGR of over 5% during the forecast period. In the technology and communication industries, the adoption of multi-vendor support services is driven by the rapid pace of technological advancement and the need for seamless integration of cutting-edge solutions. Companies in these sectors rely on various vendors' hardware, software, and networking products to remain competitive and innovative. The complexity of managing and supporting such diverse and evolving technological ecosystems necessitates a specialized and cohesive support strategy. Multi-vendor support services offer the expertise to ensure interoperability, optimize performance, and quickly resolve technical issues.

Regional Insights

North America held the major share of over 41% of the multi-vendor support services market in 2023. The multi-vendor support services market in North America is experiencing significant growth, driven by the increasing complexity of IT infrastructures and the need for streamlined operations. Businesses seek comprehensive solutions from various manufacturers to manage diverse systems and equipment. The U.S. is at the forefront of this trend, strongly emphasizing reducing downtime and enhancing system efficiency. The presence of significant technology hubs and a high adoption rate of advanced IT solutions contribute to the robust demand in this region.

U.S. Multi-Vendor Support Services Market Trends

The multi-vendor support services market in the U.S. is expanding rapidly due to the heightened focus on cost optimization and operational efficiency. Enterprises are leveraging these services to handle the complexity of multi-vendor environments, ensuring seamless integration and maintenance of heterogeneous systems. The demand is further propelled by technological advancements and the increasing reliance on digital transformation initiatives, which necessitate robust support infrastructures.

Europe Multi-Vendor Support Services Market Trends

The multi-vendor support services market in Europe is growing significantly at a CAGR of over 3% from 2024 to 2030. A growing inclination towards outsourcing IT marks Europe's multi-vendor support services market support to specialized providers. This trend is fueled by the need to manage diverse IT ecosystems more effectively and cost-efficiently. Countries such as Germany, the UK, and France are leading this shift, driven by stringent regulatory requirements and the push for enhanced data security and compliance. In addition, the increasing adoption of cloud computing and IoT technologies necessitates proficient multi-vendor support services.

Asia Pacific Multi-Vendor Support Services Market Trends

The multi-vendor support services market in the Asia Pacific is growing significantly at a CAGR of over 5% from 2024 to 2030. The Asia Pacific region is witnessing a burgeoning demand for multi-vendor support services, attributed to rapid digitalization and the expansion of IT infrastructure. Countries such as China, India, and Japan are at the forefront, with businesses increasingly adopting these services to manage the growing complexity of their IT environments. The rising number of SMEs seeking cost-effective solutions to maintain and optimize their multi-vendor systems and the region's focus on technological innovation and development also support market growth.

Key Multi-Vendor Support Services Company Insights

Key players operating in the network emulator market include Atos SE, Cisco Systems, Inc., Dell Inc., DXC Technology Company, Fujitsu, Hewlett Packard Enterprise Development LP, Hitachi, Ltd., International Business Machines Corporation, Oracle, and Unisys. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Atos announced the launch of its Atos Virtual Infrastructure Proficiency (VIP) Advisory services. This innovative technology consulting offering is designed to assist companies in evaluating their current virtual infrastructure and defining a strategic roadmap to achieve their future vision. Whether clients choose to retain their existing solutions, remain on-premises, or migrate to a different cloud provider, these pioneering virtual infrastructure consulting services will offer guidance on optimizing virtual infrastructure costs and enhancing security, while embracing new technology trends and advancing corporate sustainability objectives. This offering is offered in the U.S., Central Europe, the UK, Benelux, France.

-

In May 2024, DXC Technology Company, announced its new DXC Fast RISE with SAP service. This offering enables customers to significantly expedite their S/4HANA projects, allowing them to realize the extensive benefits more swiftly than ever before. With DXC Fast RISE with SAP, customers can complete SAP deployments in under twelve months, thereby achieving a quicker time-to-value. The service is designed to be scalable, enabling clients to adapt and expand with minimal disruption. By streamlining the execution process, businesses can reduce their aggregate cost of ownership correlated with SAP adoption.

Key Multi-Vendor Support Services Companies:

The following are the leading companies in the multi-vendor support services market. These companies collectively hold the largest market share and dictate industry trends.

- Atos SE

- Cisco Systems, Inc.

- Dell Inc.

- DXC Technology Company

- Fujitsu

- Hewlett Packard Enterprise Development LP

- Hitachi, Ltd.

- International Business Machines Corporation

- Oracle

- Unisys

Multi-Vendor Support Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 56.23 billion

Revenue forecast in 2030

USD 73.20 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Actual data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, enterprise size, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Atos SE; Cisco Systems, Inc.; Dell Inc.; DXC Technology Company; Fujitsu; Hewlett Packard Enterprise Development LP; Hitachi, Ltd.; International Business Machines Corporation; Oracle; Unisys

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multi-Vendor Support Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global multi-vendor support services market report based on service type, enterprise size, application, end use, and region:

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware Support

-

Software Support

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance & Accounting

-

Sales & Marketing

-

IT Operations

-

Human Resource

-

Production

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare & Life Sciences

-

Retail & Consumer Products

-

Technology & Communication

-

Industrial & Manufacturing

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global multi-vendor support services market size was estimated at USD 54.14 billion in 2023 and is expected to reach USD 56.23 billion in 2024.

b. The global multi-vendor support services market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 73.20 billion by 2030.

b. Several key factors are driving the growth of the multi-vendor support services market. The multi-vendor support services market is primarily driven by the increasing complexity and heterogeneity of IT environments in modern organizations. As businesses adopt a diverse array of hardware, software, and networking solutions from various manufacturers, the need for integrated support services that can manage and optimize these multi-vendor ecosystems becomes critical

b. North America dominated the multi-vendor support services market with a market share of 41.0% in 2023. The multi-vendor support services market in North America is experiencing significant growth, driven by the increasing complexity of IT infrastructures and the need for streamlined operations. Businesses seek comprehensive solutions from various manufacturers to manage diverse systems and equipment. The U.S. is at the forefront of this trend, strongly emphasizing reducing downtime and enhancing system efficiency

b. Some key players operating in the multi-vendor support services market include Atos SE, Cisco Systems, Inc., Dell Inc., DXC Technology Company, Fujitsu, Hewlett Packard Enterprise Development LP, Hitachi, Ltd., International Business Machines Corporation, Oracle, and Unisys.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.