Multi Camera System Market Size, Share & Trends Analysis Report By Function (Park Assist, ADAS), By Vehicle (Passenger, Commercial), By Display (2D, 3D), By Automation, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-387-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Multi Camera System Market Size & Trends

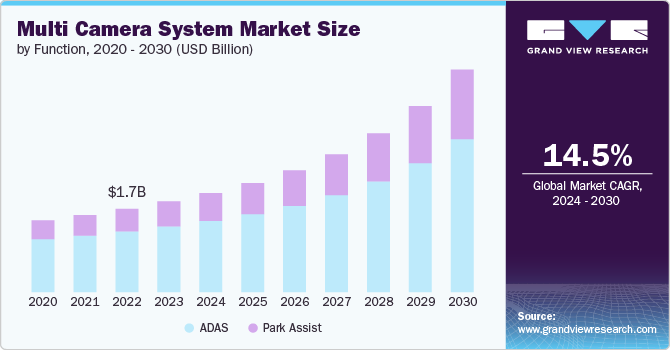

The global multi camera system market size was valued at USD 1.81 billion in 2023 and is projected to grow at a CAGR of 14.5% from 2024 to 2030. The market is propelled by rapid technological advancements, including improvements in camera resolution, sensor technology, and image processing capabilities. Enhanced camera systems now offer superior image quality, wider fields of view, and better performance in various lighting conditions. Innovations such as higher-definition cameras, real-time data processing, and integration with advanced driver assistance systems (ADAS) are driving market growth. These technological developments enable more accurate and reliable features like surround-view systems, lane-keeping assistance, and automatic emergency braking, boosting demand and adoption across the automotive industry.

Growing consumer demand for enhanced vehicle safety, convenience, and automation significantly fuels the multi-camera system market. Drivers increasingly seek advanced features that improve visibility, reduce accidents, and assist with complex driving scenarios. The popularity of high-end and luxury vehicles, which often come equipped with sophisticated multi-camera systems, reflects this trend. Additionally, rising awareness of the benefits of ADAS and the desire for a more comfortable driving experience contribute to the growing adoption of multi-camera systems, driving market expansion and innovation.

Stricter safety regulations and standards are accelerating the growth of the multi-camera system market. Governments and regulatory bodies worldwide are implementing new mandates to enhance vehicle safety and reduce road accidents, requiring advanced technologies like multi-camera systems. These regulations often mandate the inclusion of features such as blind-spot monitoring, collision avoidance, and parking assistance, which rely on multi-camera setups. Compliance with these regulations not only drives the adoption of multi-camera systems but also encourages innovation and the development of more sophisticated safety technologies in vehicles.

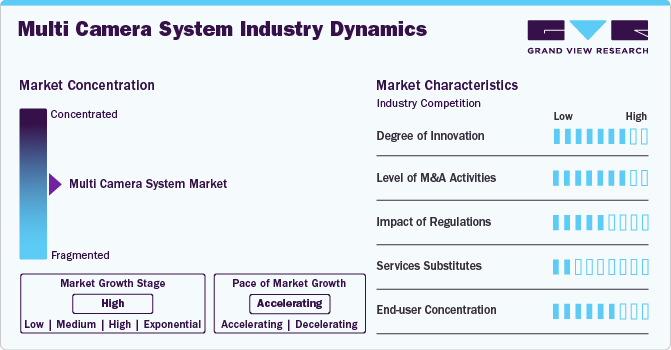

Market Concentration & Characteristics

The market growth stage is exponential, and the pace of the market growth is accelerating. This rapid development phase is driven by advancements in technology and increasing demand for enhanced vehicle safety and automation. Innovations in camera technology, integration with advanced driver assistance systems (ADAS), and regulatory pressures are fueling rapid adoption. As automakers and consumers seek more sophisticated safety features and improved driving experiences, the market for multi-camera systems continues to expand at a swift and accelerating rate, reflecting a dynamic shift in automotive technology.

The market is seeing an increasing number of merger and acquisition (M&A) activities, underscoring its exponential growth stage and ever-expanding potential. This trend reflects the industry's drive to consolidate expertise, integrate advanced technologies, and broaden market reach. Companies are pursuing strategic acquisitions to enhance their capabilities, leverage synergies, and accelerate innovation. The increasing M&A activity underscores the market's robust growth trajectory and its pivotal role in advancing automotive safety and autonomous driving technologies.

The market is also subject to moderate regulatory scrutiny and is impacted by its operations and strategic decisions. Regulations often require compliance with specific safety features and performance benchmarks, influencing market operations. Strategic decisions, such as partnerships and technology advancements, can impact compliance and market positioning. Companies must navigate these regulations while innovating and integrating new technologies to meet evolving safety and performance standards, balancing regulatory demands with operational and strategic goals to maintain competitive advantage and market growth.

Multi camera system face minimal competition from product substitutes in the market. This is due to their unique ability to provide comprehensive, multi-angle visibility and safety features that other technologies cannot match. Unlike single-camera or traditional mirror systems, multi-camera systems offer superior situational awareness, which is crucial for advanced driver assistance and autonomous driving applications. Their integration with ADAS and enhanced safety capabilities further reduces the viability of substitutes, making them a preferred choice for comprehensive vehicle safety and convenience solutions.

End-user concentration is a significant factor in the multi camera system market. This demand is heavily influenced by the automotive industry’s focus on safety and technological advancement. Major automotive manufacturers and technology firms drive market growth by integrating multi-camera systems into their vehicles, influencing the development and adoption of these technologies. Concentrated demand from a few key industry players can lead to accelerated innovation and competition, shaping market trends and driving investment in advanced camera systems for enhanced vehicle safety and functionality.

Function Insights

ADAS accounted for the largest revenue share in 2023. The market is driven by increasing consumer demand for enhanced safety, convenience, and driving comfort. Technological advancements in sensors, cameras, and artificial intelligence enable more sophisticated features like adaptive cruise control, lane-keeping assist, and collision avoidance. Stringent safety regulations and standards are pushing automakers to integrate ADAS into their vehicles. Additionally, the rise of semi-autonomous and autonomous driving technologies is fueling investment in ADAS. The growing focus on reducing road accidents and improving overall driving experience further drives market expansion.

Park Assists are expected to register the fastest CAGR from 2024 to 2030. The market is driven by the increasing demand for convenience and ease of parking in urban environments. These systems enhance driver safety by providing features such as automatic parallel and perpendicular parking, obstacle detection, and maneuvering assistance. Consumer preference for advanced vehicle technologies and luxury features, along with the trend of increasing vehicle sizes and complexity of parking scenarios, boosts demand. Additionally, the integration of park assist with other driver assistance systems and connected car technologies further propels market growth.

Vehicle Insights

Passenger vehicles accounted for the largest market share of 65.8% in 2023. The market is driven by the increasing demand for advanced safety and driver assistance features. Consumers are seeking enhanced security, convenience, and comfort, leading to the widespread adoption of technologies like surround-view systems and automatic parking. Stringent safety regulations and mandates for advanced driver assistance systems (ADAS) further push automakers to integrate multi-camera systems. Additionally, the rise in connected car technologies and the trend toward semi-autonomous driving capabilities fuel the market for multi-camera systems in passenger vehicles.

Commercial vehicle segment is expected to register the fastest CAGR of 14.0%% from 2024 to 2030. The market is driven by the need for improved safety, operational efficiency, and compliance with stringent regulations. Fleet operators are increasingly investing in advanced safety technologies to reduce accidents and enhance driver assistance. Multi-camera systems provide critical benefits like blind-spot detection, enhanced maneuverability, and cargo monitoring. The growth of e-commerce and the resulting increase in delivery and logistics services further boost demand. Additionally, the potential for lowering insurance premiums and minimizing downtime through accident prevention propels the adoption of commercial vehicles.

Automation Insights

The level 1 segment accounted for the largest market revenue share in 2023. The market is driven by the increasing demand for enhanced safety and convenience features in vehicles. The integration of features like adaptive cruise control, lane-keeping assist, and automated braking enhances driving safety and comfort. Regulatory mandates for safety technologies in new vehicles, along with growing consumer awareness about vehicle safety, further propel the adoption of Level 1 automation. The cost-effectiveness and ease of integration of these systems in mass-market vehicles also contribute to their widespread adoption.

The level 4 segment is expected to grow at a CAGR from 2024 to 2030. The market is driven by advancements in artificial intelligence, sensor technologies, and connectivity. Investments from automotive and tech companies in developing and testing autonomous vehicles accelerate progress. Regulatory support for autonomous driving trials and the potential for significant safety and efficiency improvements in transportation drive interest. Additionally, the potential for reducing traffic congestion, emissions, and transportation costs through autonomous vehicle deployment fuels the market for Level 4 automation.

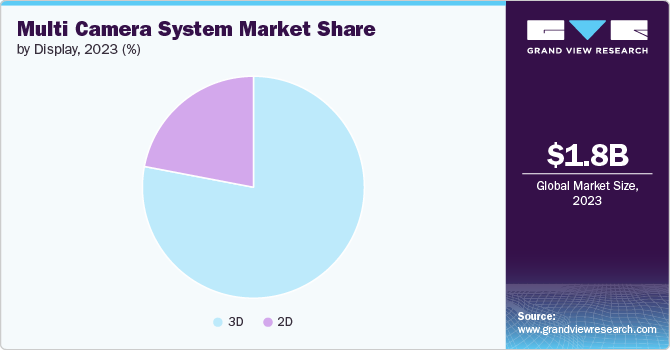

Display Insights

3D accounted for the largest market share in 2023. The market is driven by the increasing demand for enhanced user experiences and advanced visualization capabilities. 3D displays offer improved depth perception and spatial understanding, making them ideal for navigation, parking assistance, and augmented reality applications. Technological advancements in display technologies and the integration of 3D graphics in head-up displays and instrument clusters enhance their adoption. Consumer preference for cutting-edge infotainment and driver assistance systems, coupled with rising demand for luxury and high-end vehicles, further boosts the market.

2D is expected to register the fastest CAGR from 2024 to 2030. This rapid growth is due to their cost-effectiveness, reliability, and widespread adoption in various vehicle segments. The growth is driven by the increasing demand for digital instrument clusters, infotainment systems, and touchscreen interfaces. Advancements in display technology, such as higher resolution and improved visibility under different lighting conditions, enhance their functionality. The integration of 2D displays in entry-level and mid-range vehicles, along with the growing trend of connected cars and smart dashboards, propels the market for 2D displays.

Regional Insights

North America multi camera system market accounted for the highest market revenue share in 2023, driven by the increasing adoption of advanced driver assistance systems (ADAS) and autonomous vehicles. The presence of major automotive manufacturers and technology innovators, coupled with stringent safety regulations, fosters the demand for sophisticated camera systems. Additionally, consumer preference for enhanced vehicle safety and convenience features propels market growth.

U.S. Multi Camera System Market Trends

The multi camera system market in the U.S. is expected to have a notable CAGR from 2024 to 2030, fueled by strong investments in autonomous driving technology and ADAS. Regulatory mandates for vehicle safety and high penetration of luxury vehicles with advanced safety features drive demand. The presence of leading automotive companies and tech giants further accelerates market expansion through continuous innovation and partnerships.

Asia Pacific Multi Camera System Market Trends

The multi camera system market in Asia Pacific accounted for a significant revenue share in 2023. The market is growing due to the rapid expansion of the automotive industry and increasing vehicle production. Rising disposable incomes and growing consumer awareness about vehicle safety drive demand for advanced driver assistance systems. Additionally, government initiatives promoting the adoption of electric and autonomous vehicles boost the market.

Japan multi camera system market is estimated to grow significantly from 2024 to 2030. The growth is driven by its advanced automotive industry and strong emphasis on vehicle safety and innovation. Leading automotive manufacturers' focus on integrating cutting-edge technology into vehicles and government regulations promoting road safety and reducing accidents contribute to market growth. Japan's early adoption of ADAS and autonomous driving technologies further fuels demand.

The multi camera system market in India is estimated to record a notable CAGR from 2024 to 2030. The market growth is propelled by rising vehicle production and increasing demand for advanced safety features. Growing urbanization and disposable incomes lead to higher vehicle ownership, driving the adoption of multi-camera systems. Government initiatives promoting road safety and stricter safety regulations enhance the market's expansion.

China multi camera system market had the largest revenue share in 2023. The market rapid growth due to the country's position as the world's largest automotive market. High vehicle production rates, increasing adoption of electric and autonomous vehicles, and government policies supporting advanced vehicle safety technologies drive demand. Consumer preference for enhanced safety features in vehicles further boosts the market.

Europe Multi Camera System Market Trends

The multi camera system market in Europe is anticipated to grow at a moderate CAGR from 2024 to 2030. The market growth is driven by stringent safety regulations and the presence of leading automotive manufacturers. The region's focus on reducing road accidents and promoting vehicle safety through advanced technologies like ADAS and autonomous driving contributes to market growth. High consumer demand for luxury vehicles with sophisticated safety features also fuels expansion.

France multi camera system market accounted for a significant revenue share in 2023. The market is influenced by strong government regulations promoting vehicle safety and innovation in automotive technology. The presence of major automotive manufacturers and a high demand for advanced driver assistance systems drive growth. Consumer preference for enhanced safety features and comfort in vehicles further boosts the market.

The multi camera system market in the U.K. is estimated to grow at the highest CAGR from 2024 to 2030. The market is driven by stringent vehicle safety regulations and a high adoption rate of advanced driver assistance systems. The presence of leading automotive companies and technology innovators contributes to market growth through continuous research and development. Consumer demand for enhanced vehicle safety and convenience features also propels the market.

Germany multi camera system market is estimated to grow at a moderate CAGR from 2024 to 2030. The market is bolstered by its strong automotive industry and focus on innovation and safety. The presence of major automotive manufacturers and suppliers, coupled with stringent safety regulations, drives demand for advanced driver assistance systems. Consumer preference for high-end vehicles with sophisticated safety features further fuels market growth.

Middle East & Africa Multi Camera System Market Trends

The multi camera system market in the Middle East and Africa (MEA) region is estimated to grow significantly from 2024 to 2030. The market is driven by increasing vehicle sales and growing awareness about road safety. Government initiatives to improve road infrastructure and promote advanced safety features in vehicles contribute to market expansion. The rising adoption of luxury and high-end vehicles with advanced safety technologies also boosts demand.

Saudi Arabia multi camera system market accounted for a considerable revenue share in 2023. The market is driven by increasing vehicle sales and a growing emphasis on road safety. Government initiatives to reduce road accidents and promote the adoption of advanced driver assistance systems contribute to market growth. Rising disposable incomes and consumer preference for vehicles with enhanced safety features further propel the market.

Key Multi Camera System Company Insights

Some of the key players operating in the market include Bosch, Continental AG and Delphi Technologies.

-

Bosch's growth in the multi-camera system market is driven by its advanced sensor technology, robust AI algorithms, and integration with ADAS (Advanced Driver Assistance Systems). The company leverages its expertise in automotive electronics to provide high-resolution imaging and superior object recognition. Strategic partnerships and a focus on R&D ensure continuous innovation, keeping Bosch at the forefront of the market.

-

Continental AG's growth in the multi-camera system market is driven by its advanced sensor technology, integration of artificial intelligence, and focus on safety and automation. The company leverages robust R&D capabilities, strategic partnerships, and a strong global presence to innovate and deliver comprehensive camera solutions for vehicles, enhancing driver assistance systems and autonomous driving functionalities. This focus on innovation and strategic collaboration positions Continental AG as a key player in the multi-camera system market.

Valeo, and Aptiv are some of the emerging market participants in the multi camera system market.

-

Valeo's growth in the multi-camera system market is driven by its innovative technologies, strategic partnerships, and focus on advanced driver assistance systems (ADAS). The company's expertise in sensor fusion and artificial intelligence enhances vehicle safety and autonomous driving capabilities. By continuously investing in research and development, Valeo stays ahead of industry trends, offering cutting-edge solutions that meet the increasing demand for sophisticated automotive camera systems. Their global presence and collaboration with leading automakers further bolster their market position.

-

Aptiv's growth in the multi-camera system market is driven by its advanced driver-assistance systems (ADAS) and autonomous driving technologies. The company leverages cutting-edge sensor fusion, software algorithms, and scalable platforms to enhance vehicle safety and performance. Strategic partnerships, continuous innovation, and investments in R&D further bolster Aptiv's competitive edge, enabling it to meet the rising demand for integrated multi-camera solutions in modern vehicles.

Key Multi Camera System Companies:

The following are the leading companies in the multi camera system market. These companies collectively hold the largest market share and dictate industry trends.

- Bosch

- Continental AG

- Delphi Technologies

- Denso Corporation

- Valeo

- Magna International

- NVIDIA

- Panasonic

- Aptiv

- Mobileye

- Ambarella

- OmniVision Technologies

Recent Developments

-

In March 2024, Volkswagen Group partnered with Mobileye to advance automated and autonomous driving. Mobileye provided technologies for partially and highly automated driving based on its SuperVision and Chauffeur platforms. Audi, Bentley, Lamborghini, and Porsche brands planned to use these technologies for premium-oriented driving functions, including automated overtaking and automatic stopping at red lights.

-

In January 2024, OMNIVISION announced its new 1.3-megapixel OX01J image sensor for automotive 360-degree surround-view systems and rear-view cameras. The OX01J features top-tier LED flicker mitigation and 140 dB high dynamic range. This raw image sensor provides automotive OEMs flexibility to use their own backend image signal processor architecture.

Multi Camera System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.97 billion |

|

Revenue forecast in 2030 |

USD 4.43 billion |

|

Growth rate |

CAGR of 14.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Function, vehicle, display, automation, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

Bosch; Continental AG; Delphi Technologies; Denso Corporation; Valeo; Manga International; NVIDIA; Panasonic; Aptiv; Mobileye; Ambarella; OmniVision Technologies |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Multi Camera System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global multi camera system market report based on function, vehicle, display, automation, and region.

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Park Assist

-

ADAS

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger

-

Commercial

-

-

Display Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D

-

-

Automation Outlook (Revenue, USD Million, 2018 - 2030)

-

Level 1

-

Level 2 & 3

-

Level 4

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global multi camera system market size was estimated at USD 1.81 billion in 2023 and is expected to reach USD 1.97 billion in 2024.

b. The global multi camera system market is expected to grow at a compound annual growth rate of 14.5% from 2024 to 2030 to reach USD 4.43 billion by 2030.

b. North America accounted for the highest market revenue share in 2023, driven by the increasing adoption of advanced driver assistance systems (ADAS) and autonomous vehicles. The presence of major automotive manufacturers and technology innovators, coupled with stringent safety regulations, fosters the demand for sophisticated camera systems.

b. Some key players operating in the multi camera system market include Bosch, Continental AG, Delphi Technologies, Valeo, Aptiv and among others

b. Enhanced camera systems now offer superior image quality, wider fields of view, and better performance in various lighting conditions. Innovations such as higher-definition cameras, real-time data processing, and integration with advanced driver assistance systems (ADAS) are driving market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."