- Home

- »

- Consumer F&B

- »

-

Muffins Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Muffins Market Size, Share & Trends Report]()

Muffins Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Packaged, In-Store), By Taste (Sweet, Savoury), By Distribution Channel (Hypermarkets & Supermarkets, Sporting Goods Retailers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-339-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Muffins Market Summary

The global muffins market size was estimated at USD 10.62 billion in 2024 and is projected to reach USD 13.66 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The rise of cafe and bakery culture is fueling the demand for muffins. Cafes and bakeries offer a cozy atmosphere where consumers can enjoy freshly baked muffins alongside coffee or tea.

Key Market Trends & Insights

- North America held the dominant revenue share of 27.5% in 2023.

- The muffins market in Europe is expected to grow at a CAGR of 4.8% from 2024 to 2030.

- By type, the packaged muffins segment led the market, holding the largest revenue share of 64% in 2023.

- By taste, the sweet muffins segment led the market, holding the largest revenue share of 75% in 2023.

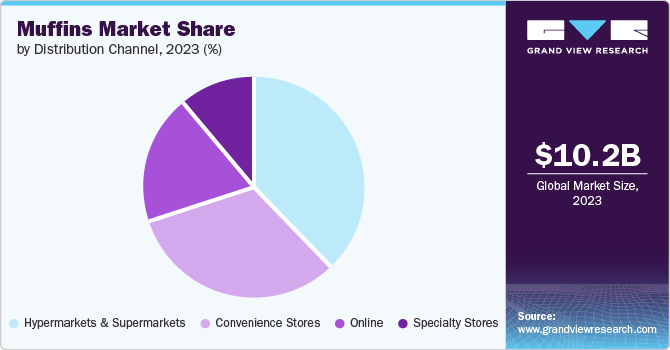

- By distribution channel, the supermarkets & hypermarkets segment led the market with the largest revenue share of 37.9% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 10.62 Billion

- 2030 Projected Market Size: USD 13.66 Billion

- CAGR (2025-2030): 4.3%

- North America: Largest market in 2023

This cultural shift toward enjoying artisanal and freshly made baked goods has driven the popularity of muffins, appealing to consumers seeking quality, variety, and a delightful snacking experience in welcoming cafe settings. Moreover, continuous innovation in muffin recipes, ingredients, and packaging techniques has played a crucial role in expanding the market. Manufacturers regularly introduce new flavors, healthier formulations, and convenient packaging solutions to attract and retain consumers in a competitive marketplace.The demand and consumption of muffins, both sweet and savory, have been steadily increasing among consumers for several compelling reasons. Muffins offer a versatile array of flavors, appealing to diverse taste preferences with options ranging from classic sweet varieties like chocolate chip and blueberry to savory options such as cheese and herb or bacon and cheddar. This versatility makes muffins suitable for various occasions, whether as a quick breakfast, a convenient snack, or a satisfying dessert.

Furthermore, there is a growing trend toward healthier eating habits, prompting consumers to seek muffins that offer better nutritional value. This has led to the development of healthier muffin options incorporating ingredients like whole grains, oats, nuts, seeds, and reduced sugar content. Health-conscious individuals appreciate these alternatives, which provide a guilt-free indulgence without sacrificing flavor or satisfaction.

Customization also plays a significant role as bakeries and cafes offer personalized muffin choices to cater to specific dietary preferences such as gluten-free, vegan, or low-fat options. This customization ensures that muffins can accommodate a wide range of dietary needs, further enhancing their appeal. Additionally, consumers are increasingly drawn to artisanal and locally sourced muffins, valuing the craftsmanship and authenticity associated with these products.

Additionally, the availability of muffins in diverse retail outlets, including supermarkets, convenience stores, coffee shops, and online platforms, has contributed to market expansion. Increased visibility and accessibility across these channels have made muffins a convenient choice for consumers seeking quality baked goods.

Type Insights

Based on type, packaged muffins accounted for a market share of over 64% in 2023. Muffins brands offer shirts and t-shirts with performance-enhancing features such as moisture-wicking fabrics, stretchability, and breathability, making them suitable for both athletic pursuits and casual wear. This versatility appeals to consumers seeking comfortable yet stylish clothing options for everyday activities.

In-store muffins are expected to grow at a CAGR of 4.7% from 2024 to 2030. In-store muffins are often made with fresher and locally sourced ingredients, which can appeal to consumers who prioritize sustainability, freshness, and supporting local businesses. The transparency in ingredient sourcing and production methods can also contribute to consumer trust and satisfaction.

Many consumers appreciate the artisanal craftsmanship and authenticity associated with in-store muffins. They may prefer supporting local bakeries or cafes that prioritize handmade baking techniques and use high-quality ingredients. This artisanal appeal often translates into a perceived higher value and better taste experience for consumers. For instance, in November 2023, Délifrance, a leading bakery brand, announced a collaboration with global brand Biscoff to launch a new product - the Biscoff Muffin. The partnership combines Délifrance's bakery expertise with the popular Biscoff spread flavor. The new vanilla muffin features a 15.2% filling of Biscoff spread, providing an indulgent taste and texture. The muffin is designed with thaw and serves technology, requiring just two hours of defrosting time, making it a convenient option for busy outlets. It comes without toppings, allowing for personalization to suit consumer preferences.

Taste Insights

Sweet muffins led the market and accounted for a revenue share of over 75% in 2023. Muffins come in a diverse array of flavors, particularly sweet varieties, which cater to a wide range of tastes and preferences. Popular sweet muffin flavors include chocolate chip, blueberry, banana nut, lemon poppy seed, pumpkin spice, and cinnamon swirl, among many others. This variety allows consumers to choose muffins that align with their favorite flavors or seasonal cravings, enhancing the appeal and versatility of this baked good.

Savory muffins are expected to grow at a CAGR of 4.6% from 2024 to 2030. Savory muffins are perceived as a healthier choice by many individuals. They often contain ingredients that contribute to nutritional value, such as vegetables, whole grains, and protein-rich additions like cheese or eggs. This nutritional profile can appeal to those conscious of their dietary intake or looking for alternatives to sugary snacks.

Distribution Channel Insights

Sales of muffins through supermarkets & hypermarkets accounted for a revenue share of 37.9% in 2023. Many supermarkets and hypermarkets have in-store bakeries that produce fresh muffins daily. This ensures higher quality and freshness compared to pre-packaged options. Additionally, these stores typically offer a wide variety of muffin flavors, styles, and sizes, catering to diverse tastes and preferences. Customers can choose from traditional options to specialty or seasonal flavors.

Sales of muffins through online channels are expected to grow at a CAGR of 5.8% from 2024 to 2030. The convenience offered by online shopping has played a pivotal role in the industry's growth. Customers can explore a diverse selection of muffin flavors from their homes, eliminating the necessity of visiting brick-and-mortar stores. This accessibility has expanded their appeal to a wider audience, including those in regions where access to premium products may be limited.

Regional Insights

North America muffins market accounted for a global revenue share of 27.5% in 2023. North America is experiencing robust growth in muffin demand due to evolving consumer preferences for innovative indulgence food products. The trend towards between-meal snacking has significantly boosted muffin consumption. Additionally, the availability of muffins in a variety of exotic flavors and fillings has further supported regional market expansion.

U.S. Muffins Market Trends

The muffins market in the U.S. is growing as there is a growing demand for healthier muffin options in the U.S. Many consumers are opting for muffins made with whole grains, reduced sugar content, or incorporating natural ingredients like fruits, nuts, and seeds. These healthier alternatives cater to health-conscious individuals looking for nutritious snacks or breakfast items. Additionally, muffins have become a part of American food culture, often enjoyed as a comforting and indulgent treat. They are commonly served at breakfast or brunch gatherings, contributing to their popularity and cultural significance.

Europe Muffins Market Trends

The muffins market in Europe is expected to grow at a CAGR of 4.8% from 2024 to 2030. The market is expected to see substantial growth in the coming years driven by increasing consumer demand for artisanal bakery products. The region benefits from a well-established bakery sector, which has contributed to its market growth. Moreover, consumers are conscious of their dietary choices and seek healthier alternatives. In-store bakeries often offer muffins with reduced sugar, whole grains, or organic ingredients, appealing to health-conscious individuals looking for indulgent treats that align with their wellness goals.

Asia Pacific Muffins Market Trends

The muffins market in Asia Pacific is expected to grow at a CAGR of 5.3% from 2024 to 2030. This growth is fueled by population increases and a growing preference, especially among younger consumers, for baked goods. Many muffin manufacturers are establishing operations in countries like India and China, recognizing them as promising markets with substantial growth potential.

Key Muffins Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the largest muffin manufacturers including McKee Foods, Britannia Industries, Grupo Bimbohave entered into the market. Along with that, in order to improve their efficiency and by using the international distribution channel, the companies have been ruling the industry.

Key Muffins Companies:

The following are the leading companies in the muffins market. These companies collectively hold the largest market share and dictate industry trends.

- McKee Foods

- Otis Spunkmeyer

- Hostess Brands, Inc.

- Grupo Bimbo

- General Mills

- Britannia Industries

- ARYZTA

- Finsbury Food Group Limited

- Foodco Group Pty Ltd

- Flowers Foods

Recent Developments

-

In April 2024, Little Bites Snacks launched two new lower-sugar options: Lower Sugar Apple Cinnamon Muffins and Lower Sugar Chocolate Muffins. These muffins contain less sugar*, real ingredients like apple and chocolate, and hidden vegetables, providing a delicious snack that doesn't compromise on taste. Perfectly pre-portioned and portable, these muffins are ideal for on-the-go families and adults, satisfying sweet cravings with less sugar compared to other market options.

-

In March 2024, Dr. Schär, a leading gluten-free food brand, launched new gluten-free products: Marble Cake and Muffins in Classic, Chocolate, and Chocolate Chip flavors. Crafted with care and precision, these muffins and the Marble Cake offer a delightful, convenient, and indulgent treat for any occasion. This launch continues Dr. Schär’s mission to provide delicious and inclusive options for those with special dietary needs. These shelf-stable, ready-to-eat treats ensure no compromise on taste.

-

In January 2024, McKee Foods, the parent company of the iconic Little Debbie brand, announced the launch of its new "Big Pack Mini Muffins" in two irresistible flavors: Chocolate Chip and Blueberry. Each pouch of the Big Pack Mini Muffins contains six bite-sized muffins, providing customers with more muffins per pack at a suggested retail price of USD 4.99. This expansion of the Little Debbie product line is a strategic move to meet the evolving preferences of shoppers, who are increasingly seeking out convenient, shareable snack options.

-

In October 2023, KaffeeHouse Saratoga introduced a new line of muffins that showcase locally sourced ingredients and celebrate the culinary heritage of Saratoga Springs. The menu includes flavors such as Sun-Dried Tomatoes with Spinach and bacon and egg options. These muffins are crafted with an emphasis on quality and nutrition, designed to complement KaffeeHouse Saratoga’s coffee and specialty beverages. They also serve as convenient on-the-go meal or snack choices, perfect for customers using the drive-through service.

Muffins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.05 billion

Revenue forecast in 2030

USD 13.66 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, taste, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, Spain, Italy, France, China, India, Japan, South Korea, Australia & New Zealand, Brazil, UAE

Key companies profiled

McKee Foods; Otis Spunkmeyer; Hostess Brands; Inc.; Grupo Bimbo; General Mills; Britannia Industries; ARYZTA; Finsbury Food Group Limited; Foodco Group Pty Ltd; Flowers Foods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Muffins Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global muffins market report based on type, taste, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Packaged

-

In-Store

-

-

Taste Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sweet

-

Savoury

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Specialty Stores

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global muffins market size was estimated at USD 10.22 billion in 2023 and is expected to reach USD 10.63 billion in 2024.

b. The global muffins market is expected to grow at a compounded growth rate of 4.3% from 2024 to 2030 to reach USD 13.66 billion by 2030.

b. Sweet muffins accounted for a share of 75.5% in 2023. Sweet muffins provide a satisfying indulgence due to their sweet flavor, making them a popular choice for those with a sweet tooth. Additionally, their individual portions and easy-to-carry packaging make them ideal for on-the-go consumption.

b. Some key players operating in muffins market include Grupo Bimbo, General Mills, Britannia Industries, ARYZTA, Finsbury Food Group Limited.

b. Key factors that are driving the market growth include increasing health consciousness among consumers and rising product innovation and flavours of muffins

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.