Motorbike Riding Gear Market Size, Share & Trends Analysis Report By Product (Protective Gear, Clothing, Footwear), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-997-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Motorbike Riding Gear Market Size & Trends

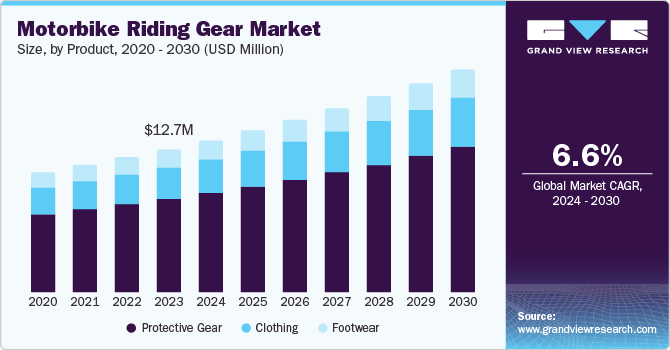

The global motorbike riding gear market size was estimated at USD 13.18 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. Rising awareness of rider safety due to increasing motorcycle accidents is a key driver of the motorbike riding gear industry. Governments and organizations have intensified campaigns promoting protective gear like helmets, jackets, gloves, and boots, while mandatory safety regulations have made certified gear a legal requirement in many countries, driving the market of motorbike riding gear during the forecast period. In addition, the expanding global motorcycle market, especially in regions like Asia-Pacific, where motorbikes are common for daily transport, has further boosted demand for affordable and durable riding gear.

The adoption of motorbike riding gear among consumers has been steadily increasing due to a combination of safety concerns, regulatory requirements, technological advancements, and evolving consumer preferences.

One of the key drivers of this adoption is the growing awareness of the risks associated with motorcycling. As consumers become more conscious of the potential dangers, they are increasingly investing in protective gear to reduce the risk of injury. Helmets, jackets, gloves, boots, and other protective equipment are now seen as essential for safety. In many countries, including Brazil, the implementation of mandatory helmet laws and safety regulations further encourages riders to adopt these safety measures. As these regulations are enforced, they not only ensure compliance but also promote a broader culture of safety among motorcyclists.

The use of helmets has seen a significant surge in recent years as riders increasingly recognize their importance in ensuring road safety. Helmets are often the most basic and essential piece of protective gear, with studies consistently showing their effectiveness in reducing head injuries and fatalities in accidents. Governments worldwide have made helmet use mandatory, imposing fines for non-compliance, which has contributed to their widespread adoption. Public awareness campaigns and educational efforts have also emphasized the life-saving benefits of helmets, making them a non-negotiable accessory for motorbike riders.

In 2023, the adoption of DOT-compliant motorcycle helmets in the U.S. reached a record high of 73.8%, a notable increase from 66.5% in 2022. This rise reflects a growing awareness of safety among motorcyclists and highlights significant improvements in specific traffic conditions. For instance, helmet use among riders in light traffic increased substantially from 35.5% in 2022 to 66.0% in 2023. The National Occupant Protection Use Survey (NOPUS) monitored 945 motorcyclists in total, representing a slight increase in the number of observations compared to the previous year.

The data further indicated a marked decline in the use of non-compliant helmets. Usage among motorcyclists in slow traffic decreased from 16.9% in 2022 to 7.7% in 2023, while in light traffic, it fell from 21.1% to 7.8%. These findings underscore a positive trend towards safer riding practices and greater compliance with helmet regulations. They also emphasize the critical role of ongoing education and strict enforcement of helmet laws in enhancing rider safety across the nation.

Motorcycling has increasingly become a lifestyle choice rather than just a mode of transportation, which has also contributed to the growing market for riding gear. The rise of motorcycle touring, off-road biking, and sports riding has created a demand for specialized gear tailored to different riding conditions and preferences. Consumers are no longer just concerned with safety but also seek gear that complements their personal style and identity. As a result, there has been a surge in the availability of fashionable and functional riding gear that appeals to a wide range of riders. This trend has led to greater consumer adoption as riders seek gear that reflects both their safety needs and their lifestyle choices.

Consumer Insights

The rising number of road accidents globally is driving the demand for helmets as safety becomes a top priority for motorbike riders. According to the World Health Organization, road traffic injuries are a leading cause of death, with motorcyclists being particularly vulnerable. In response, many countries have implemented strict helmet laws to reduce fatalities.

For instance, India mandates helmets for both riders and pillion passengers, with fines for non-compliance, while Brazil enforces helmet use under its NBR 7471 safety standard. Similarly, Australia and most European Union countries, including Germany and France, require helmets conforming to specific safety certifications, demonstrating a global shift toward enhanced road safety measures.

Government regulations and policies have further accelerated this trend. Many countries have introduced laws mandating the use of helmets and certified riding gear, with penalties for non-compliance. In some cases, governments even provide subsidies or tax incentives for purchasing high-quality safety equipment, encouraging riders to adhere to these regulations.

In the U.S., motorcycle safety measures are crucial due to the unique risks associated with riding. Key statistics highlight the importance of adopting effective safety practices. There are over 6.2 million registered motorcycles, and a significant number of crashes occur at intersections, where approximately 70% of motorcycle collisions happen. To enhance safety, riders are encouraged to complete motorcycle training courses, which improve skills and awareness. Wearing protective gear, including DOT-approved helmets, gloves, and high-visibility clothing, is essential for reducing injuries in the event of an accident.

Advancements in riding gear technology have made these products more appealing. Modern gear is designed to be lightweight, breathable, and comfortable for both short and long rides while offering superior protection with features such as reinforced armor, abrasion-resistant fabrics, and airbag systems integrated into jackets. These innovations have made safety gear not only functional but also desirable.

The increase in disposable incomes, particularly in emerging economies, has also contributed to this demand. With more spending power, riders are willing to invest in premium riding gear that ensures their safety while also enhancing their style. Social influences have amplified this trend, with motorbike clubs, influencers, and media platforms advocating for the use of safety gear.

Riders now view protective equipment as both a necessity and a fashion statement, further normalizing its adoption. Urbanization and increased traffic congestion in cities have also heightened the perceived risk of accidents, prompting riders to take additional precautions in high risk.

Product Insights

Protective gear accounted for a revenue share of 75.8% in 2024. The market for motorbike protective gear is experiencing robust growth, driven by increasing awareness about rider safety and the implementation of stringent safety regulations worldwide. Governments and road safety organizations are mandating the use of protective gear such as helmets, goggles, gloves, elbow guards, and knee guards, fueling demand. Rising motorbike ownership, especially in emerging markets, is further contributing to the expansion of this market.

Technological advancements in protective gear design, including lightweight materials, superior impact resistance, and integrated features like airbags and connectivity, are also attracting consumers.

Clothing is expected to grow at a CAGR of 6.0% from 2025 to 2030. The market for motorbike clothing is witnessing significant growth, driven by a combination of safety concerns, lifestyle trends, and advancements in material technology. Increasing awareness about the importance of protective gear has led riders to invest in motorbike-specific clothing, such as jackets, pants, and riding suits, which offer both safety and comfort. Many countries have introduced regulations mandating protective gear for motorcyclists, further boosting demand.

The rising popularity of motorbike sports and adventure riding has fueled the demand for specialized clothing designed for durability and extreme weather conditions. Innovations in materials, such as abrasion-resistant fabrics, moisture-wicking technology, and built-in armor, have enhanced the functionality and appeal of motorbike clothing. In August 2024, Royal Enfield partnered with Netherlands-based Rev'IT to launch a new range of premium riding gear in India. This limited-edition collection is the result of extensive research and development conducted by adventure riding experts over the past year. The range includes riding jackets, pants, and gloves designed for various weather and terrain conditions, catering to both men and women.

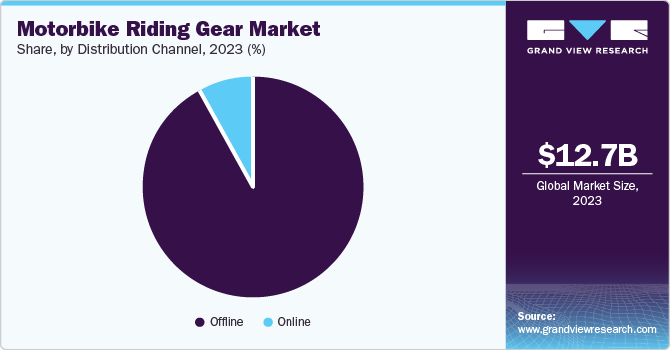

Distribution Channel Insights

Sales through offline channels accounted for a revenue share of 84.2% in 2024. People often choose to buy motorbike riding gear offline due to the ability to physically test the fit and comfort of the products. Riding gear, including helmets, jackets, gloves, and boots, must fit perfectly to ensure both safety and comfort. Trying on gear in person allows customers to assess sizing, fit, and ease of movement, which are critical for long rides and protection during potential accidents.

Offline shopping also allows customers to immediately take home the products, avoiding delivery times or issues like receiving the wrong item. In addition, buyers can inspect the quality of the gear in person, checking details like material strength, stitching, and certifications to ensure they meet safety standards. This hands-on evaluation reduces concerns about counterfeit or low-quality products, which can sometimes be an issue online.

Sales of motorbike riding gear through online channels are expected to grow at a CAGR of 7.0% from 2025 to 2030. People increasingly prefer to buy motorbike riding gear online due to the convenience, variety, and competitive pricing that e-commerce platforms offer. Online shopping eliminates the need to visit multiple stores, making it especially appealing for those in remote or less urbanized areas where specialized stores may not be available. With just a few clicks, customers can browse and purchase a wide range of gear, including helmets, jackets, gloves, and footwear, from the comfort of their homes. Another significant advantage of online shopping is the extensive variety of products available. E-commerce platforms provide access to numerous brands, styles, and price points, offering far more choices than traditional brick-and-mortar stores.

Regional Insights

The North America motorbike riding gear industry is expected to grow at a CAGR of 5.2% from 2025 to 2030. Motorcycling has evolved into a popular lifestyle activity, particularly for leisure and adventure purposes. Riders view motorbiking not just as transportation but as a means of exploring scenic highways and diverse landscapes. With the rise in motorbike ownership, particularly among younger enthusiasts and older hobbyists, the demand for protective gear has surged. In addition, the increasing popularity of specialized motorcycling activities, such as dirt biking, motocross, and long-distance touring, has created a demand for purpose-built gear that ensures both safety and style. Events like motorbike rallies and community rides also foster a culture where riding gear is seen as essential.

U.S. Motorbike Riding Gear Market Trends

The motorbike riding gear industry in the U.S. is expected to grow at a CAGR of 4.9% from 2025 to 2030. The American Motorcyclist Association's initiatives promoting rider education and safety standards have heightened consumer awareness. Furthermore, the growing trend of motorcycle touring and participation in racing events drives demand for advanced protective gear. Moreover, with a diverse range of products, including smart helmets and high-performance clothing, U.S. consumers increasingly invest in quality gear that enhances safety and riding experience.

Europe Motorbike Riding Gear Market Trends

The Europe motorbike riding gear industry accounted for a revenue share of 33.5% in 2024. European governments are actively emphasizing road safety through stringent regulations and awareness campaigns. Many countries have adopted policies mandating the use of protective gear, such as helmets, gloves, and jackets, that comply with European safety standards like CE certification. Initiatives like Vision Zero, aimed at eliminating road fatalities and severe injuries, highlight the importance of motorcyclist safety. Governments also conduct campaigns to educate riders on the benefits of using certified protective gear and adhering to traffic rules, resulting in increased adoption among motorcyclists.

The motorbike riding gear industry in UK is expected to grow at a CAGR of 4.5% from 2025 to 2030. The growth in the UK market is rising due to increasing motorcycle adoption for commuting and leisure, driven by rising fuel costs and urban congestion. Stricter safety regulations and growing awareness of protective gear are boosting demand. In addition, the popularity of motorbike touring and adventure riding, along with a strong culture of premium and branded riding apparel, is fueling market growth.

Asia Pacific Motorbike Riding Gear Market Trends

The Asia Pacific motorbike riding gear industry is expected to grow at a CAGR of 6.1% from 2025 to 2030. The market for motorbike riding gear is expanding rapidly in the Asia Pacific, driven by multiple factors such as increasing motorbike ownership, rising government emphasis on road safety, and growing awareness among riders about the importance of protective gear. Motorbikes are a primary mode of transport in many Asian countries due to their affordability, ease of use, and ability to navigate congested urban areas. As the number of motorbike users grows, so does the demand for helmets, gloves, jackets, and other protective equipment to ensure rider safety.

The motorbike riding gear industry in China is expected to grow at a CAGR of 5.6% from 2025 to 2030. The market in China is rising due to the increasing popularity of motorcycling for both commuting and leisure. Growing urban traffic congestion has led more people to adopt motorcycles, boosting demand for protective gear. In addition, rising safety awareness, government regulations on rider protection, and the influence of global motorbike culture are driving sales. The expanding middle class with higher disposable income also fuels demand for premium and stylish riding gear.

Key Motorbike Riding Gear Company Insights

Many manufacturers are integrating IoT technology into motorbike riding gear, developing smart helmets, jackets, and gloves that connect with mobile apps or virtual assistants. This allows riders to access navigation, communication, and safety features like crash detection and emergency alerts. In addition, to appeal to style-conscious consumers, companies are offering customizable options such as interchangeable visors, color variations, and modular protective padding. These modular designs enable riders to upgrade specific components without replacing the entire gear, enhancing both functionality and personalization.

Key Motorbike Riding Gear Companies:

The following are the leading companies in the motorbike riding gear market. These companies collectively hold the largest market share and dictate industry trends.

- Alpinestars S.p.A.

- RST

- FLY Racing

- Dainese

- Arai Helmet

- FOX Racing

- Schuberth GmbH

- SHOEI

- Bell Helmets

- RYNOX GEARS

View a comprehensive list of companies in the Motorbike Riding Gear Market

Recent Developments

-

In November 2024, Alpinestars company launched a limited edition Martinator S-R10 Racing Helmet and Supertech R Vented Boots in Collaboration with MotoGP World Champion Jorge Martin. Engineered to deliver top-tier performance, the Limited Edition Martinator Supertech R10 Racing Helmet and Supertech R Vented Boots provide advanced protection and enhanced safety.

-

In November 2024, Triumph Motorcycles company and Arai came together for the launch of a range of co-branded helmets. With four models: the modern classic Concept-XE, the sporty Quantic, the off-road MX-V Evo, and the adventurous Tour X-5, they provide performance and protection during bike riding.

-

In August 2024, Alpinestars company launched an all-new off-road goggle range with five options, including youth, a wide range of colors, roll-offs, and a full catalog of accessories.

-

In July 2024, SHOEI company launched the Neotec 3 Helmet With Sena SLR3 Integrated Bluetooth Unit. The shell is an intermediate oval head shape, which is longer front to back and has narrower sides. It is still constructed using the Aim+ (Advanced Integrated Matrix Plus) design, which uses fiberglass, organic fiber, and resin to create the structure.

Motorbike Riding Gear Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.82 billion |

|

Revenue forecast in 2030 |

USD 18.08 billion |

|

Growth Rate (Revenue) |

CAGR of 5.5% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, thousand units/ billion, volume in thousand units, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Benelux, Nordics, China, Japan, India, Brazil, Argentina, South Africa |

|

Key companies profiled |

Alpinestars S.p.A., RST, FLY Racing, Dainese, Arai Helmet, FOX Racing, Schuberth GmbH, SHOEI, Bell Helmets, and RYNOX GEARS. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Motorbike Riding Gear Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global motorbike riding gear market report based on product, distribution channel, and region.

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Protective Gear

-

Clothing

-

Footwear

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global motorbike riding gear market size was estimated at USD 13.18 billion in 2024 and is expected to reach USD 13.82 billion in 2025.

b. The global motorbike riding gear market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 18.08 billion in 2030.

b. Protective gear dominated the market and accounted for the largest revenue share of 75.8% in 2024, which was attributed to the increasing safety awareness among riders and the rising incidence of road accidents. As motorcyclists face a higher risk of severe injuries, there is a growing emphasis on using protective equipment such as helmets, kneecaps, and spine guards.

b. Some key players operating in the motorbike riding gear market include Alpinestars S.p.A., LeMans Corporation, FLY Racing, Dainese S.p.A, Arai Helmet, FOX, Schuberth GmbH, SHOEI CO. LTD., SULLIVAN'S INC., and RYNOX GEARS.

b. Key factors that are driving the market growth include increasing number of motorbike riding enthusiasts, rising global awareness regarding road safety, and rising popularity of premium & innovative riding gears.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."