Motor Monitoring Market Size, Share & Trends Analysis Report By Offerings (Hardware, Software), By Process (On-premise, Cloud), By Deployment (Portable, Online), By End-use (Power Generation, Oil & Gas), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-537-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Motor Monitoring Market Size & Trends

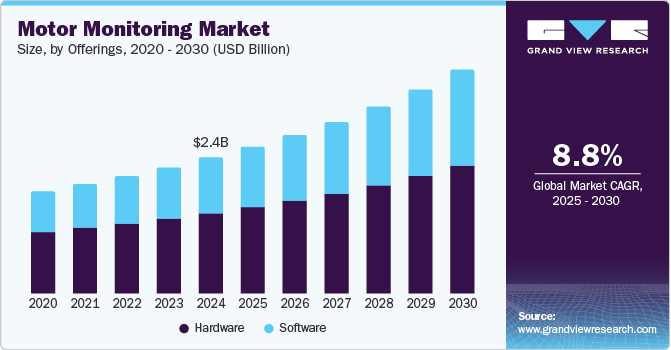

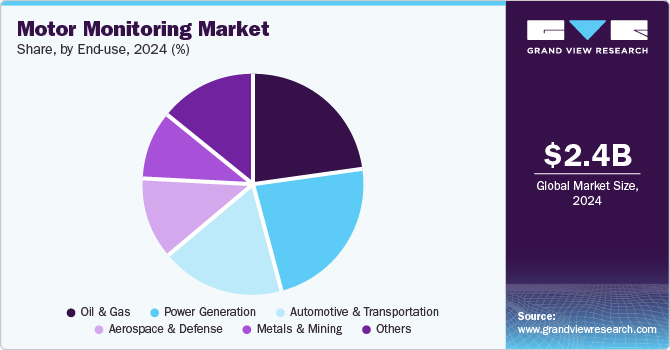

The global motor monitoring market was valued at USD 2.43 billion in 2024 and is expected to grow at a CAGR of 8.8% from 2025 to 2030. Motors play an important role in terms of components as they are directly proportional to industries’ productivity, output, and financial strength. Any error in the monitoring of the motor must be analyzed and corrected at an early stage. Motor monitoring is collecting, sorting, and analyzing streamed data with the help of detectors, sensors, diagnostic software, and so on. It has applications in several industry verticals, including oil & gas, power generation, aerospace & defense, and automotive.

Electric motors experience different operating conditions and environmental hazards, which cause thermal stress, damage to insulation, and shorten their lifecycles. The response is to monitor motors to detect potential problems. Regular monitoring will identify small changes in operation that indicate damage, such as windings, bearing problems, or insulation deterioration.

Until recently, motor failure prevention was expensive and complicated. With the decreasing price of sub meters and sensors and the evolving big data technology, motor monitoring has become both affordable and precise. These trends make the conditions suitable for considerable expansion in the motor monitoring industry worldwide as firms adopt these technologies to increase reliability, minimize operating expenses, and propel sustainability programs.

A study published in 2025 in Advances in Mechanical Engineering proposed a new method for diagnosing faults in induction motors. This method uses SURF-BoVW and an ERT classifier to detect different faults in these motors. The IRT-based method is effective, non-contact, non-intrusive, highly sensitive, and stable against various faults. Similar advancements in technology across various sectors contribute to the market’s growth.

Offerings Insights

The hardware segment led the market in 2024, accounting for 59.1% of the total revenue share. Motor monitoring hardware includes probes, detectors, and sensors used to inspect motor conditions. They monitor things like corrosion, temperature, noise, and vibration. Motor monitoring uses these devices to track important performance indicators, helping to find problems early and plan maintenance. This approach can increase the lifespan of motors and reduce downtime, which drives the segment’s demand.

The software segment is also anticipated to register considerable growth during the foreseeable years. Rising demand for data analytics to minimize motor errors and faults is expected to catapult the segment’s growth. The software helps in proper motor analysis daily, saves time and cost, and helps in making suitable decisions per industry requirements.

Process Insights

The cloud process segment had the largest market share in 2024. Cloud-based software allows industry workers to quickly find and fix equipment issues, helping to prevent downtime by providing access to data about temperature, vibration, and current from anywhere in the plant.

On-premise monitoring processes are expected to register significant growth over the forecast period. Companies prioritizing data security and control are experiencing increasing demand for this segment, as it enables managing data access and detecting unauthorized access. On-premise software solutions often require longer integration periods, domestic IT support, and domestic server hardware, providing greater control over company infrastructure and data.

Deployment Insights

The online segment dominated the market with a revenue share of 59.0% in 2024 as it employs sensors to track motor performance in real time and gives feedback on load, operating conditions, and power quality. The process’ independence from plant operations aids in detecting mechanical problems such as bearing faults and imbalances. It is mainly used in industries such as metal, oil and gas mining, and power generation, where motor failures are likely.

Portable monitoring is anticipated to witness significant growth from 2025-2030, owing to increasing demand for remote project applications and the rising need for on-site, real-time diagnostics in industries with limited infrastructure. Portable devices used in motor monitoring, such as the Fluke 810 Vibration Tester, collect on-site data and assess the motor insulation systems to predict necessary repairs, driving market demand.

End-use Insights

The oil and gas segment held the largest market share in 2024. Oil and gas activities depend significantly on equipment such as motors, pumps, and compressors, which are essential for production, processing, and transportation. Motor monitoring systems offer benefits such as reduced revenue loss caused by motor failure, predictive maintenance, and insights to make better strategic decisions.

Power generation is anticipated to grow at the fastest CAGR over the forecast period. Power generation motor monitoring makes operations efficient and reliable by pinpointing possible faults such as wear on insulation or mechanical faults. It causes motors to function efficiently, saving energy waste and costs. Its ability to detect safety risks, including overheating or electrical defects, drives its market expansion.

Regional Insights

North America held a significant market share in 2024, owing to major companies and the fast use of new technologies. Ongoing improvements in motor monitoring software and cloud computing are expected to support market growth in the region. Furthermore, key product offerings in the market include varied motor-driven equipment with multiple applications. Motor monitors help manage this complexity by tracking various motors and ensuring reliability and performance in different operations.

U.S Motor Monitoring Market Trends

The U.S. dominated the regional motor monitoring market in 2024. According to the Department of Energy (DOE) of the U.S., electric motors use about 70% of electricity in industries, highlighting their importance. In manufacturing, efficient motor operation is vital for productivity. For example, electric motors are common in the automotive sector in assembly lines, robots, and HVAC systems. A failure in these motors can cause production delays and lead to major financial losses.

Europe Motor Monitoring Market Trends

Europe motor monitoring industry is expected to grow substantially over the forecast period Europe leads in Industry 4.0 owing to its manufacturing sector, which further leads the demand for advanced products such as motor monitoring devices. The European Commission backs digital manufacturing with funding like Horizon 2020, boosting IoT, cloud computing, and AI adoption. Along with technological advancement, motor monitoring systems help manufacturers move from fixing equipment after failure to predicting and preventing issues, lowering costs, and enhancing efficiency.

Germany Motor Monitoring Market Trends

In Europe, Germany held the largest revenue share in 2024 on account of automated maintenance, which plays a key role in Industry 4.0, with motor monitoring systems playing an essential role. For instance, BMW utilizes these systems in its assembly lines to foresee failures, preventing interruptions in vehicle production. Reducing unexpected downtime is crucial in automotive plants with tightly scheduled high-speed operations.

Asia Pacific Motor Monitoring Market Trends

Asia Pacific dominated the global motor monitoring industry with a revenue share of 35.1% in 2024. The region is witnessing rapid industrial growth, making it one of the prime manufacturing centers. Many industries use motors, including automotive, electronics, chemicals, and textiles. Adopting motor monitoring technology optimizes and automates the process and further grows the market demand.

China Motor Monitoring Market Trends

China dominated the regional market in 2024. China is the world’s biggest manufacturer, making up approximately 28% of the global manufacturing sector. Its manufacturing covers many areas, such as electronics, cars, textiles, chemicals, and steel, where motors are very important. Motor monitoring technologies assist the Chinese industry in enhancing efficiency, meeting energy standards, and remaining competitive in the global market. Emphasizing advanced manufacturing processes makes motor monitoring an important element of China’s industrial modernization.

Key Motor Monitoring Company Insights

Some key companies operating in the motor monitoring industry include Emerson Electric Co.; Siemens; ABB; among others. Key players operating in the market are focusing on the development of refurbished MRI market systems in terms of sustainability and efficiency to gain a significant revenue share.

-

ABB’s Process Automation business provides many solutions for process and hybrid industries. These include automation, electrification, control technologies, software, advanced services, and measurement & analytics. With customers to create safe and smart operations. The company is a leader in automation and electrification, focusing on IoT-driven products and remote monitoring.

-

Siemens provides protection, monitoring, and control for motors like pumps, fans, and compressors. It offers detailed operation, service, and diagnostics data to support digital monitoring. Siemens plays a key role in industrial automation with its digital motor monitoring technologies, combining sensors and analytics for fault detection.

Key Motor Monitoring Companies:

The following are the leading companies in the motor monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Emerson Electric Co.

- ABB

- General Electric Company

- Siemens

- Honeywell International Inc.

- Schneider Electric

- Banner Engineering Corp.

- Wilson Transformer Company

- SKF

- Rockwell Automation

- Mitsubishi Electric Corporation

- Eaton

Recent Developments

-

In October 2024, Siemens introduced an innovative motor management system for industrial switchboards. This solution aims to enhance motor control, protection, and operational efficiency within industrial settings.

-

In August 2024, ABB acquired FODISCH Group globally, strengthening its leadership in continuous emission monitoring. This strategic move expanded the company’s environmental solutions portfolio for industrial clients.

-

In May 2024, Schneider Electric and Capgemini partnered globally to deliver energy optimization solutions, aiming to assist enterprises in achieving sustainability and operational efficiency improvements.

Motor Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.62 billion |

|

Revenue forecast in 2030 |

USD 3.99 billion |

|

Growth rate |

CAGR of 8.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Offerings, process, deployment, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Emerson Electric Co.; ABB; General Electric Company; Siemens; Honeywell International Inc.; Schneider Electric; Banner Engineering Corp.; Wilson Transformer Company; SKF; Rockwell Automation; Mitsubishi Electric Corporation; Eaton |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Motor Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global motor monitoring market report based on offerings, process, deployment, end use, and region.

-

Offerings Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Online

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil and Gas

-

Automotive & Transportation

-

Power Generation

-

Metals and Mining

-

Aerospace and Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global motor monitoring market size was estimated at USD 2.43 billion in 2024 and is expected to reach USD 2.62 billion in 2025.

b. The global motor monitoring market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030 to reach USD 3.99 billion by 2027.

b. North America dominated the motor monitoring market in 2025 with the highest market share. This is attributable to the presence of major players coupled with the adoption of advanced technologies and infrastructure networks in the region.

b. Some key players operating in the motor monitoring market include Emerson Electric Co., ABB, General Electric Company, Siemens AG, Honeywell International Inc., Schneider Electric SE, AB SKF, Rockwell Automation, Inc., and Eaton Corporation

b. Key factors that are driving the market growth include declining costs of sub-meters and sensors coupled with advancements big data technology, which have made motor monitoring accurate and affordable.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."