- Home

- »

- Advanced Interior Materials

- »

-

Motor Lamination Market Size, Share & Trends Report, 2030GVR Report cover

![Motor Lamination Market Size, Share & Trends Report]()

Motor Lamination Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Technology (Welding, Bonding, Stamping), By Material, By Application (Electrical Stators/Rotors), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-387-6

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Motor Lamination Market Summary

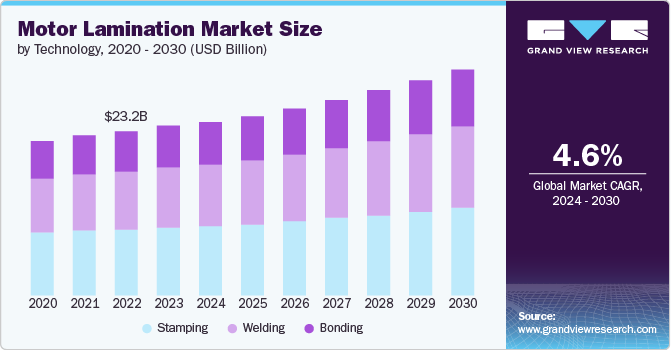

The global motor lamination market size was estimated at USD 23.90 billion in 2023 and is projected to reach USD 31.98 billion by 2030, growing at a CAGR of 4.6% from 2024 to 2030. The market is experiencing robust growth driven by the burgeoning demand for advanced electronic devices such as smartphones, electric vehicles, and renewable energy systems.

Key Market Trends & Insights

- The North American motor lamination market is significantly fuelled by the region's strong focus on energy efficiency and the rapid adoption of electric vehicles.

- The Asia Pacific region holds a significant share of the global motor lamination market, primarily attributed to the region's booming industrial and automotive sectors.

- Based on technology, the stamping segment led the market and accounted for 40.1% of the global revenue share in 2023.

- Based on end-use, the manufacturing segment accounted for 52% of the global market revenue share in 2023.

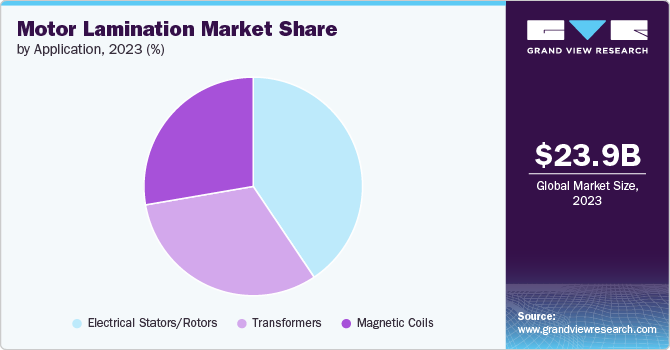

- Based on application, the Magnetic coils accounted for around 27% of the global revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 23.90 Billion

- 2030 Projected Market USD 31.98 Billion

- CAGR (2024-2030): 4.6%

- North America: Largest market in 2023

The market is also experiencing significant growth due to the increasing demand for energy-efficient motors in various industries, including automotive, aerospace, and consumer electronics, among others. Technological advancements in electrical steel grades and lamination manufacturing processes, along with the rising emphasis on electric vehicles and renewable energy applications, are further propelling this market forward.

Motor lamination is a crucial process in the manufacturing of electric motors and transformers, which involves the stacking of thin sheets of electrical steel to form a core. This technique is essential because it significantly reduces eddy current losses, which in turn improves the efficiency and performance of these devices. The sheets used in lamination are coated with an insulating film, and the precise geometry of the laminations is designed to support the efficient operation of the motor by directing the magnetic flux smoothly. By minimizing energy losses, motor lamination enhances the operational capacity of motors, longevity and reliability in various industrial and commercial applications.

As more companies and governments worldwide invest in sustainable practices and technologies, the demand for high-efficiency electric motors will further drive the motor laminations market. This scenario is fostering innovations and expansions within the motor lamination industry, making it a dynamic and rapidly evolving market with substantial opportunities for manufacturers and suppliers.

Drivers, Opportunities & Restraints

Governments worldwide are implementing stricter regulations and providing incentives for the use of energy-efficient electric motors, which inherently require high-quality laminations to minimize eddy current losses and improve performance. Additionally, the burgeoning electric vehicle (EV) market, which relies heavily on efficient and powerful electric motors, is significantly contributing to the demand for motor laminations. These factors, coupled with technological advancements in materials and manufacturing processes that enable more precise and efficient lamination production, are propelling the growth of the market.

The continuous innovations in material science, such as the development of non-oriented electrical steels and improved insulation coatings, present lucrative prospects for manufacturers to offer more efficient and tailored lamination solutions. Additionally, the expanding scope of automation and robotics across various industries further amplifies the market opportunity, requiring more specialized and high-performance motor laminations to fulfill these advanced application needs.

The high cost associated with the production of high-grade electrical steel and the sophisticated manufacturing processes required for lamination production are expected to restrain market growth. This is particularly challenging for manufacturers trying to balance cost-efficiency with the demand for higher performance and energy-efficient motors.

Technology Insights

“The demand for bonding segment is expected to grow at a CAGR of 5% from 2024 to 2030 in terms of revenue”

The stamping segment led the market and accounted for 40.1% of the global revenue share in 2023. Stamping is a critical manufacturing process that significantly impacts the efficiency and performance of electric motors. This process involves cutting and shaping laminations from sheets of electrical steel, a step crucial for creating the magnetic cores of motors and minimizing energy losses. As electric vehicle adoption rises and the focus on energy efficiency grows across industries, the stamping method stands as a key enabler in the market.

The bonding method within the market represents an innovative approach to enhancing the efficiency and reliability of electric motors. This technique involves the use of adhesives or other bonding materials to securely join individual laminations together, forming a solid core without conventional welding or interlocking methods. Bonding eliminates the risk of insulation failure between laminations, significantly reducing eddy current losses and improving the motor's overall performance.

Material Insights

“The demand for cold-rolled lamination steel segment is expected to grow at a CAGR of 5.3% from 2024 to 2030 in terms of revenue”

Cobalt alloys accounted for around 36% of the global market revenue share in 2023. The use of cobalt alloys in the motor lamination market is becoming increasingly significant due to their exceptional magnetic properties, which are crucial for the performance of high-efficiency motors, particularly in applications requiring strong magnetic fields at high temperatures. Cobalt alloys, notable for their high saturation magnetization and low power loss characteristics, are ideal for demanding applications such as electric vehicles (EVs), aerospace, and high-performance industrial motors where efficiency and reliability are paramount.

Nickel alloys are distinguished by their excellent thermal and electrical properties, including high corrosion resistance and a high Curie temperature, making them suitable for use in environments that are challenging for conventional silicon steel laminations. These alloys are particularly beneficial in high-performance applications, such as in aerospace, defense, and high-speed electric vehicle motors, where operating conditions can be extreme. The demand for nickel alloys in motor lamination is expected to grow as manufacturers seek to improve motor efficiency and thermal management in more demanding applications, showcasing the material's potential to play a pivotal role in the future of electric motor design.

End-use Insights

“The demand for automotive segment is expected to grow at a CAGR of 4.7% from 2024 to 2030 in terms of revenue”

The manufacturing segment accounted for 52% of the global market revenue share in 2023. The market is a critical component in the manufacturing end-use sector, serving as the backbone for a wide range of machinery and equipment across various industries, including automotive, aerospace, and consumer electronics. As manufacturers increasingly focus on enhancing the efficiency, reliability, and longevity of their products, the demand for high-quality motor laminations has surged. These laminations, typically made from specialized grades of electrical steel, are essential in minimizing energy loss due to eddy currents and improving the performance of electromechanical devices.

The motor lamination market is experiencing a significant surge in demand within the automotive sector, primarily driven by the rapid transition toward electric vehicles (EVs) and hybrid electric vehicles (HEVs). Motor laminations are essential components in the electric motors used in these vehicles, as they help to reduce eddy current losses, thereby improving the efficiency and performance of the vehicles. With global environmental concerns pushing the automotive industry toward more sustainable solutions, the demand for high-efficiency electric motors is at an all-time high. This shift is not only fostering innovation in the types of electrical steel used for laminations but also in the manufacturing processes, with a focus on reducing waste and enhancing performance.

Application Insights

“The demand for magnetic coils application segment is expected to grow at a significant CAGR of 4.9 % from 2024 to 2030 in terms of revenue”

Magnetic coils accounted for around 27% of the global revenue share in 2023. The market plays a crucial role in the manufacturing of magnetic coils, which are fundamental components of various electric motors and generators. Motor laminations are thin pieces of electrical steel stacked together to form the core of magnetic coils in motors. These laminations are designed to minimize eddy current losses, thereby enhancing the efficiency and performance of the motor. With growing awareness and regulatory pressures to reduce energy consumption, there is a significant demand for high-efficiency motors that use high-quality laminations in their magnetic coils.

Motor lamination plays a pivotal role in the transformers sector, reflecting the demand for improved efficiency and reliability in electrical power distribution and transmission. In transformers, motor laminations are used to construct the core, which is essential for reducing eddy current losses and enhancing the transformer's performance. As electrical systems worldwide continue to evolve toward smarter and more energy-efficient solutions, the demand for high-quality laminations in transformers has seen significant growth.

Regional Insights

North American motor lamination market is significantly fuelled by the region's strong focus on energy efficiency and the rapid adoption of electric vehicles. With stringent environmental regulations and policies aimed at reducing carbon emissions, manufacturers are increasingly investing in the development of high-efficiency motors used in both industrial and automotive applications. The U.S. has seen a surge in the demand for EVs, driven by government incentives and a growing consumer preference for sustainable transportation options. As a result, the North American market is witnessing substantial growth, with companies focusing on innovations in motor design and manufacturing processes to meet the evolving requirements for higher efficiency and performance.

Asia Pacific Motor Lamination Market Trends

“China to witness fastest market growth at 5.2% CAGR”

Asia Pacific region holds a significant share of the global motor lamination market, primarily attributed to the region's booming industrial and automotive sectors. This area, known for its rapid technological advancements and substantial investments in infrastructure development, has become a hub for manufacturing activities, including those related to electric vehicles (EVs) and energy-efficient appliances. Countries like China, Japan, and India are leading the charge, driven by government policies favoring eco-friendly transportation and energy solutions, alongside growing consumer demands for high-efficiency electrical motors.

The motor lamination market in China is estimated to grow at a significant CAGR of 5.5% over the forecast period driven by the country's rapidly expanding automotive and electrical machinery sectors. As the world's largest automotive market, China's push toward electrification of vehicles is a key factor fuelling demand for high-efficiency motor laminations. Additionally, China's ambitious initiatives to upgrade its industrial capabilities and increase its reliance on renewable energy sources further bolster the need for advanced motor lamination technologies.

Europe Motor Lamination Market Trends

The motor lamination market in Europe is predominantly driven by the region's concerted efforts toward energy efficiency and sustainability, along with strict regulatory standards. European Union directives aimed at reducing energy consumption and CO2 emissions have been pivotal in shaping the market. These regulations mandate the use of energy-efficient electric motors in industrial, commercial, and consumer applications, which, in turn, drives the motor lamination market.

Key Motor Lamination Company Insights

Some of the key players operating in the market include Eurogroup S.P.A, Lake Air Companies, Lamination Specialties Incorporated among others.

-

Eurogroup S.p.A. is a prominent player in the global motor lamination market, renowned for its specialized manufacturing and supply of electrical steel laminations. With its base in Italy, the company caters to a diverse array of industries, including automotive, energy, and industrial sectors, by providing high-quality, precision-engineered lamination products. Eurogroup S.p.A. leverages cutting-edge technology and innovative manufacturing processes to produce motor laminations that enhance the efficiency and performance of electric motors and generators.

-

Lake Air Companies is a key player in the motor lamination market, distinguished by its comprehensive metal fabrication solutions that cater to a wide range of industries, including aerospace, defense, medical, and particularly automotive sectors. Leveraging state-of-the-art technology and deep expertise in precision metal stamping and fabrication, the company offers custom and complex lamination stacks that meet the specific needs of their clients.

Partzsch Elektromotoren E.K., Pitti Laminations Ltd., Polaris Laser Laminations, LLC., are some of the emerging market participants in the motor lamination market.

-

Partzsch Elektromotoren e.K. stands as a vital participant in the motor lamination market, distinguishing itself with a strong focus on the repair, maintenance, and optimization of electric motors and generators. Based in Germany, this company has carved a niche in the global market through its dedication to quality, reliability, and innovation in the field of electric motor technology. Its services and products cater to a wide range of applications, from small specialized motors to large industrial units, emphasizing the importance of efficient motor lamination in enhancing the performance and longevity of electric motors. With decades of experience, advanced technology, and a skilled workforce.

-

Pitti Laminations Ltd.caters to a diverse spectrum of industries including automotive, power generation, aerospace, and industrial machinery. With its products being integral to the functioning of critical machinery across various sectors, Pitti Engineering stands as a key contributor to the global motor lamination industry, driven by excellence and a forward-looking approach.

Key Motor Lamination Companies:

The following are the leading companies in the motor lamination market. These companies collectively hold the largest market share and dictate industry trends.

- Eurogroup S.P.A

- Lake Air Companies

- Lamination Specialties Incorporated

- Partzsch Elektromotoren E.K.

- Pitti Laminations Ltd.

- Polaris Laser Laminations, LLC.

- R. Bourgeois

- Tempel

- Thomas Laminations

- Wingard & Co., Inc.

- LCS Company

- Precision Micro Ltd

- Hyundai Rotem Co

Recent Developments

-

In January 2024, Eurogroup S.P.A., recently announced plans to significantly bolster its presence in Mexico with a nearly USD 50 million investment intended to expand its production capacity. This strategic move underscores the company's commitment to enhancing its service capabilities for the thriving automotive industry.

-

In March 2024, Hyundai Rotem Co. unveiled a new lamination press for electric vehicle motor cores at company Dangjin facility. This sophisticated lamination press marks a considerable expansion in the company's production capability, meticulously engineered to cater to the increasing needs for highly efficient, high-performance EV motor cores.

Motor Lamination Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.45 billion

Revenue forecast in 2030

USD 31.98 billion

Growth rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, material, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Eurogroup S.P.A, Lake Air Companies, Lamination Specialties Incorporated, Partzsch Elektromotoren E.K., Pitti Laminations Ltd., Polaris Laser Laminations, LLC., R. Bourgeois, Tempel, Thomas Laminations, Wingard & Co., Inc., LCS Company, Precision Micro Ltd, Hyundai Rotem Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Motor Lamination Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the motor lamination market on the basis of technology, material, application, end use and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Welding

-

Bonding

-

Stamping

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Nickel Alloys

-

Cold-Rolled lamination Steel

-

Cobalt Alloys

-

Silicon Steel

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electrical Stators/Rotors

-

Magnetic Coils

-

Transformers

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Electronics

-

Manufacturing

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The motor lamination market is experiencing robust growth driven by the burgeoning demand for advanced electronic devices such as smartphones, electric vehicles, and renewable energy systems. The motor lamination market is experiencing significant growth, driven by the increasing demand for energy-efficient motors in various industries, including automotive, aerospace, and consumer electronics, among others.

b. The global motor lamination market size was estimated at USD 23.90 billion in 2023 and is expected to reach USD 24.45 billion in 2024

b. The global motor lamination market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 31.98 billion by 2030.

b. Asia Pacific dominated the motor lamination market with a revenue share of 49.6% in 2023. The Asia Pacific region holds a significant share in the global motor lamination market, primarily attributed to the region's booming industrial and automotive sectors. This area, known for its rapid technological advancements and substantial investments in infrastructure development, has become a hub for manufacturing activities, including those related to electric vehicles (EVs) and energy-efficient appliances.

b. Some of the key players operating in the motor lamination market include Eurogroup S.P.A, Lake Air Companies, Lamination Specialties Incorporated, Partzsch Elektromotoren E.K., Pitti Laminations Ltd., Polaris Laser Laminations, LLC., R. Bourgeois, Tempel, Thomas Laminations, Wingard & Co., Inc., LCS Company, Precision Micro Ltd, Hyundai Rotem Co.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.