Motor Grader Market Size, Share & Trends Analysis Report By Vehicle Weight (< 10, 11 to 45, 46 >), By Engine Capacity, By Drive Type (Electric, ICE), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-078-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Motor Grader Market Size & Trends

The global motor grader market size was valued at USD 3.55 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. An increasing number of commercial, public, and residential construction projects and mining activities worldwide contribute to the uptick in motor grader demand. Favorable government investment in refurbishing existing public infrastructure and authorization to build new infrastructure, such as airports and roadways, is expected to instigate the growth of the motor grader industry within the forecast period. Major players within the motor grader industry landscape are investing in developing mechanically advanced motor graders.

This has resulted in extended uptime and higher efficiency while integrating automation to streamline most functions and tasks. The manufacturers are also focusing on designing modifications in the operator cab for efficient and comfortable operation. These technological reiterations are aiding in proliferating the demand for motor graders among construction contractors, thus supporting the growth of the motor grader industry.

During early 2020, the construction equipment industry, including motor graders, was adversely affected after the pandemic. The COVID-19 pandemic forced countries worldwide to enforce strict lockdown measures to restrict the spreading of the virus. The lockdown and subsequent interruption in manufacturing and construction operations worldwide compelled the motor grader manufacturers to face headwinds as other industries such as automotive, tourism, and hospitality. OEMs within the motor grader industry landscape reported losses in revenue and a reduction in production units.

Countries such as China, the USA, and India saw a sharp fall in construction activities and spending. However, as the pandemic started to abate, the construction market throughout developed and developing economies started to recover from the slump. The resumption of construction activities and the announcement of new infrastructure and mining projects instigated the demand for motor graders, thereby abetting the motor grader industry growth Additionally, post-COVID-19, the market leaders also introduced improved versions of their flagship series with design improvements and introduction to automation in the machines, which further advanced the motor grader industry growth.

The rise and growth of the motor grader market are largely attributed to innovation, international competitiveness, and new technology. To create technologically advanced, energy-efficient, and economically viable products, businesses are investing more in R&D. Original equipment manufacturers (OEMs) in this industry have employed a variety of organic and inorganic initiatives to keep ahead of the competition despite the COVID-19 pandemic, labor difficulties, supply chain problems, and shortages of semiconductors. For instance, John Deere added new technology, an auto-gain and blade stow enabling cross-sloping, to its grade pro series of motor graders to increase their capabilities.

The features include avoiding machine damage, maximizing uptime, boosting productivity, and reducing daily operating costs. With auto-gain, operators no longer need to manually alter the cross-slope gain setting because the machine automatically modifies it based on the operating conditions. By assuring precise blade movement under constantly changing circumstances, auto-gain increases efficiency for operators. Similar to this, the Caterpillar motor grader now includes mastless grade control. Cat-designed motor grader boosts automated grading systems' productivity, accuracy, and efficiency without being constrained by GPS masts. The integrated mast-less grading system can be added on-site for older machines or fitted and calibrated at the manufacturer for new machines. Retrofit kits are available for M Series vehicles manufactured between 2019 and later, with or without the attachment-ready feature.

The lack of skilled workers for operating off-road and construction equipment is a significant challenge hindering the growth of the motor grader market. Motor graders are highly complex equipment and need to be operated only by skilled and qualified operators. Skilled operators can not only help prevent accidents but also play an important role in enhancing the overall performance and productivity of the machinery. Any such lack of skilled and qualified operators can potentially restrain the regional Market's growth. The high maintenance and repair costs of motor graders could further pressure the construction budget. This further hinders the motor grader industry's growth. Additionally, the volatile demand and economic conditions in the construction and mining sector directly impact the demand for motor graders and hamper the motor grader industry's growth.

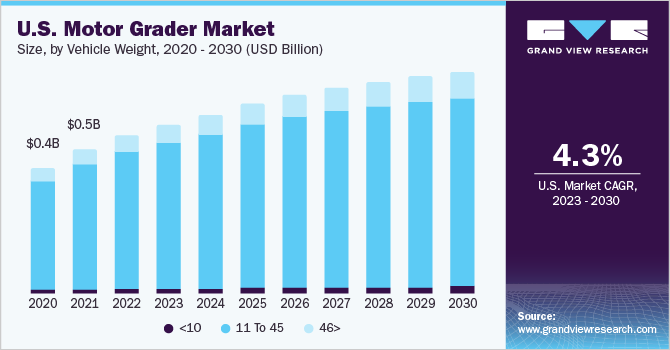

Vehicle Weight Insights

The 11 to 45 segment accounted for the largest market share of over 87% in 2022 and is expected to witness significant market growth within the forecast period. The motor grader in the 11 to 45 weight category can do small to medium grading work. Medium-capacity motor graders offer efficiency and power for medium to large-scale commercial construction projects. Medium-duty motor graders are useful for leveling grounds and laying smooth foundations. These medium-duty motor graders are mostly used in large construction sites, highways, and roads. These motor graders are also suitable for leveling in confined spaces. Companies such as Caterpillar are concentrating on building low-cost operating motor graders, which can be specifically built for road maintenance, government projects, and finish grading of the ground. The company equips its medium-duty motor grader with an engine providing improved torque and all-wheel options. The growing traction towards multi-functional medium motor graders and refurbishment or new projects for agriculture, mining, and road construction is poised to instigate the demand for 11 to 45-vehicle-weight motor graders.

Engine Capacity Insights

The Up to 250 HP segment has accumulated the highest market share of over 62% in 2022 and is expected to witness significant market growth within the forecast period. The residential and commercial construction projects are key factors encouraging segmental growth. Motor graders with up to 250 HP engine capacities are widely used in large-scale port construction, highway construction, and mining operations. Additionally, the segment's growth is being stimulated by the increased use of automated motor graders. These motor graders help lower labor expenses and enable remote operation tracking. Various product enhancements, such as using motor grader power from electric motors powered by fuel cells, are among other growth-promoting factors. Because fuel cells are smaller and more efficient than diesel engines, the operator's cabin is larger, and the machine's overall output increases.

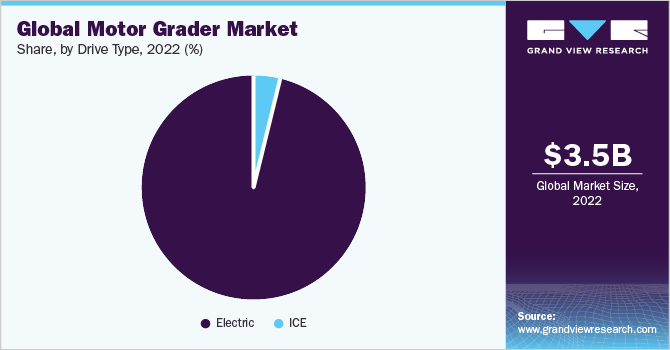

Drive Type Insights

The ICE segment accumulated the highest market share of over 96% in 2022. Government initiatives and road projects worldwide are expected to increase demand for motor graders. Urbanization and industrialization trends are causing an uptake in construction activity, which is driving up demand for motor graders. The manufacturers of motor graders are developing and launching a motor grader with low carbon introducing engines equipped with emission control technology. Additionally, as nations worldwide implement the required measures to achieve net-zero emissions, manufacturers are developing electric motor graders. The companies are actively showcasing prototypes of motor graders while trying to develop technology that can help introduce commercial electric motor graders.

The electric motor grader segment is expected to witness significant market growth over the forecast period. Electric motor grade rare still at a nascent stage of development. But, as more countries across the globe take the necessary steps to reach net-zero emissions, the demand for electric automobiles in the construction sector is growing. Similarly, rental companies understood that the electrification of the engines is an essential technology to lower emissions from construction equipment, supporting market expansion. The trend toward stricter pollution regulations has increased the need for battery-powered devices, which will propel the demand for the electric motor grader industry.

Regional Insights

Asia Pacific region accumulated revenue of over 50% in 2022 and is expected to witness significant market growth over the forecast period, showcasing dominance in the motor grader market. Improvements in economy and infrastructure growth in emerging countries like India, South Korea, and China support the construction industry due to the established foothold of large manufacturers and their ongoing efforts to create new manufacturing facilities. The need for greater infrastructure, including homes, schools, hospitals, stadiums, office buildings, and airports, is developing in Asian nations like China, India, and other emerging economies.

For instance, the Government of India announced in 2019 that it would invest USD 1.4 trillion in infrastructure projects between 2019 and 2023; this indicates the country's anticipated need for construction equipment throughout the projection period. The Indian government has also introduced several initiatives for the development of infrastructure, such as the Bharatmala Pariyojana, which incorporates provisions for enhancing the nation's road systems. In addition, infrastructure projects contributed 13% of India's USD 81.72 billion in overall FDI inflows in 2021. The development of such projects requires motor graders, which is expected to propel the demand for the motor grader industry.

Key Companies & Market Share Insights

The motor grader market is highly competitive. Hitachi, Komatsu, John Deere, and Liebherr Industry rivals Kobelco, and Caterpillar are major competitors operating in the market. Motor grader manufacturers are increasing the number of products they offer by adopting strategies such as rentals, partnerships with component suppliers, and R&D spending. For instance, a 120 GC motor grader was launched by Caterpillar Inc. Incorporating its most modern Cat Connect Technology into the design of these motor grader has improved decreased operational costs, productivity, economy, and fuel consumption, according to a recent announcement from Caterpillar. Some prominent players in the global motor grader industry include:

-

Caterpillar Inc.

-

Doosan

-

Komatsu Ltd.

-

Sumitomo Heavy Industries Ltd

-

Volvo Construction Equipment AB

-

CNH Global NV

-

Escorts Group

-

Hitachi Construction Machinery

-

Hyundai Heavy Industries Ltd

-

JC Bamford Motor Grader s Ltd.

-

John Deere

-

Kobelco

-

Liebherr-International AG

-

Mitsubishi

-

Sany Heavy Industries Co Ltd.

Motor Grader Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 3.83 billion |

|

Revenue forecast in 2030 |

USD 5.53 billion |

|

Growth rate |

CAGR of 5.4% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million, volume units, CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking/share, competitive landscape, growth factors, trends |

|

Segments covered |

Vehicle Weight, engine capacity, drive type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Caterpillar Inc.; CNH Global NV; Doosan; Escorts Group; Hitachi Construction Machinery; Hyundai Heavy Industries Ltd; JC Bamford Motor grader s Ltd.; John Deere; Kobelco; Komatsu Ltd.; Liebherr-International AG; Manitou Group; Mitsubishi; Sany Heavy Industries Co Ltd.; Sumitomo Heavy Industries Ltd; Volvo Construction Equipment AB |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Motor Grader Market Report Segmentation

The report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global motor grader market report based on vehicle weight, engine capacity, type, drive type, and region:

-

Vehicle Weight Outlook (Volume, Units; Revenue, USD, 2018 - 2030)

-

<10

-

11 to 45

-

46>

-

-

Engine Capacity Outlook (Volume, Units; Revenue, USD, 2018 - 2030)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Drive Type Outlook (Volume, Units; Revenue, USD, 2018 - 2030)

-

Electric

-

ICE

-

-

Regional Outlook (Volume, Units; Revenue, USD, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global motor grader market size was estimated at USD 3.55 billion in 2022 and is expected to reach USD 3.83 billion in 2023.

b. The global motor grader market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 5.53 billion by 2030.

b. The ICE segment accounted for the largest motor grader market share of over 96% in 2022. Government initiatives and road projects worldwide are expected to increase demand for motor graders.

b. Some key players operating in the motor grader market include Caterpillar Inc., CNH Global NV, Doosan, Escorts Group, Hitachi Construction Machinery, Hyundai Heavy Industries Ltd, JC Bamford Motor grader s Ltd., John Deere, Kobelco, Komatsu Ltd., Liebherr-International AG, Manitou Group, Mitsubishi, Sany Heavy Industries Co Ltd.,Sumitomo Heavy Industries Ltd, Volvo Construction Equipment AB

b. An increasing number of commercial, public, and residential construction projects and mining activities worldwide contribute to the uptick in motor grader demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."