- Home

- »

- Sensors & Controls

- »

-

Motion Control Market Size, Share And Growth Report, 2030GVR Report cover

![Motion Control Market Size, Share & Trends Report]()

Motion Control Market (2024 - 2030) Size, Share & Trends Analysis Report By System (Open-loop System, Closed-loop System), By Offerings, By Application, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-188-0

- Number of Report Pages: 124

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Motion Control Market Summary

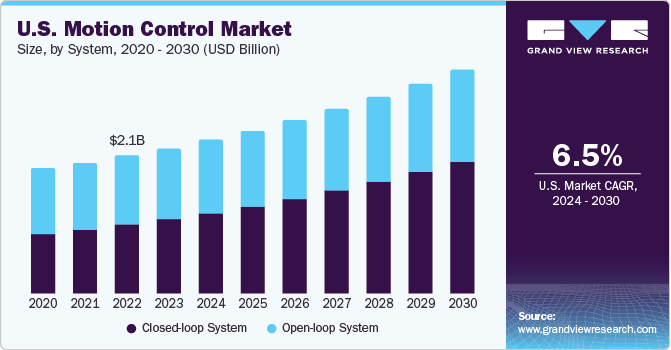

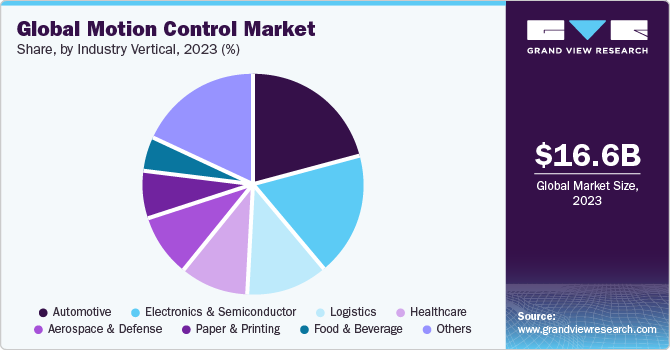

The global motion control market size was estimated at USD 16,630.2 million in 2023 and is projected to reach USD 24,659.7 million by 2030, growing at a CAGR of 5.8% from 2024 to 2030. Factors such as the increasing demand for automation in various industries and the rising adoption of robotics & industry 4.0 are driving market growth.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Spain is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, closed-loop system accounted for a revenue of USD 8,554.2 million in 2023.

- Closed-loop System is the most lucrative system segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 16,630.2 Million

- 2030 Projected Market Size: USD 24,659.7 Million

- CAGR (2024-2030): 5.8%

- Asia Pacific: Largest market in 2023

Moreover, incorporating AI/ML and advanced control algorithms in motion control systems presents significant growth opportunities for the market. The use of motion control technology in various industries, including manufacturing, automotive, and aerospace, enables precise control over machinery, leading to optimized resource utilization and reduced waste. It also helps minimize operational costs, leading to fewer errors and lower production downtime, contributing to cost savings. In addition, motion control technology allows for handling hazardous tasks or repetitive activities, ensuring improved safety for workers and reducing issues associated with specific manual tasks.

Motion control systems are becoming more connected to the Industrial Internet of Things (IIoT), which allows for remote monitoring, predictive maintenance, and real-time data analysis. It results in better decision-making for businesses as they can bridge the gap between the physical and virtual worlds of manufacturing. By utilizing these new technologies, manufacturing businesses are moving towards creating self-organizing, autonomous decision-making, and acting smart factories. The digital enterprise is considered to be the future of manufacturing. According to the Global Innovation Index 2023, the number of industrial robots in operation increased by 14.6% between 2020 and 2021, reaching a total of 3.4 million robots.

The COVID-19 pandemic had a negative impact on the market. During the pandemic, the market experienced disruptions due to supply chain constraints, leading to a manufacturing halt and decreased demand for robotics & motion control systems across various industries. According to the World Robotics Report 2023 by the International Federation of Robotics, during the pandemic, robot installations decreased to 391,000 in 2019 and 394,000 in 2020 from 423,000 in 2018.

Market Concentration & Characteristics

The market is significantly fragmented in nature, and the pace of the market growth is accelerating. Rapid technological advancements characterize The motion control industry with a high degree of innovation. Integrating robotics and Industry 4.0 technologies has significantly influenced the market, attracting advancements in automation and precision across various industries. Robotics with advanced speed and material handling are expected to perform with extraordinary efficiency.

The market is characterized by a medium level of leading players' merger and acquisition (M&A) activity. The mergers and acquisition activities were majorly carried out for growth and expansion by the businesses. For instance, in May 2023, ABB announced the acquisition of Siemens' low-voltage NEMA motor business, which had around 600 employees. This acquisition is a part of the motion business area's strategy to achieve profitable growth. It reinforces ABB's position as a top-tier industrial NEMA motor manufacturer and provides a more substantial base from which ABB can serve its customers worldwide more effectively.

The market for motion control is also subject to increasing regulatory scrutiny. Regulations related to motion control cover various aspects like safety, accuracy, and industry-specific needs. These regulations exist to guarantee the reliability of motion control systems used for different applications.

Limited direct product substitutes exist for motion control, such as manual controls, as well as traditional automation technologies, such as programmable logic controllers (PLCs). These substitutes cater to specific applications where motion control might not be the most suitable.

System Insights

The closed-loop system dominated the market and accounted for a share of 51.4% in 2023. Industries that need high precision and accuracy in operations choose to use close-loop systems. These systems provide precise positioning and movement, essential in all applications demanding high accuracy. Industries requiring advanced functionalities such as predictive maintenance, adaptive control, and complex motion profiles use close-loop systems. These systems provide the necessary feedback for sophisticated control and adjustments.

The open-loop system is projected to grow at a significant CAGR over the forecast period. Open-loop motion control systems are generally more cost-effective than other systems. They require fewer components and less complex control mechanisms, which makes them an economical choice for industries seeking cost-effective automotive solutions. Open-loop motion control systems offer fast and efficient performance in applications where specific feedback control is not essential, such as certain types of material handling, simple positioning tasks, or high-speed operations. Industries that prioritize speed and operational efficiency choose to use open-loop systems.

Offerings Insights

Motors dominated the offerings segment in 2023. The increasing adoption of automation in manufacturing and various industries leads to increased demand for motors, a fundamental component of automation systems, which improve efficiency, productivity, and control, enabling systems. In addition, ongoing advancements in motor technology, such as the development of more efficient and precise servo motors, stepper motors, and DC motors, are driving the adoption. These advancements result in motors with improved performance and better control, meeting the evolving needs of industries for more accuracy and reliability in motion control.

The motion controllers segment is projected to grow at the fastest CAGR over the forecast period. Motion controllers have undergone significant advancements, offering more efficient features, faster processing capabilities, and improved integration with other automation components. These improvements enable complex motion control tasks, adaptive control algorithms, and synchronization of multiple axes, making them a prevalent choice for industries that require high-performance automation solutions. Industries that use motion controllers have been focusing on implementing more advanced controllers with better connectivity. It helps to address the transfer of data between devices in the field and supervisory control and data acquisition (SCADA) or other networks. The adoption of advanced motion controllers has increased because of the growing need for communication between control elements and automation software.

Application Insights

Metal cutting applications dominated the market in 2023. Laser technology has advanced significantly, especially in manufacturing and materials processing. It is due to ultra-short pulse laser technologies, motion control, and industrial automation improvements. Directing the laser beam to its intended destination or moving the sample toward the beam can greatly enhance precision and speed. High-end solutions often employ a combination of both methods for even better results. Automation in manufacturing industries, including metalwork, drives the adoption of motion control systems. Automated metal cutting processes powered by motion control enable consistent and efficient operations, reducing errors and increasing output.

The robotics segment is projected to grow at the highest CAGR over the forecast period. Industries are increasingly incorporating automation to improve productivity and efficiency. When combined with advanced motion control systems, robots provide accuracy, flexibility, and speed in performing various tasks across various sectors, including manufacturing, logistics, healthcare, and more. The decreasing costs of robotics and motion control technologies have made them much more accessible to multiple industries. Robotics and motion control systems support this vision by enabling predictive maintenance, improved safety, and increased operational efficiency. According to the United Nations report on Industry 4.0 for inclusive development, published in January 2022, Brazil's Basket 4.0 initiative emphasizes bolstering the industrial and technological sectors associated with Industry 4.0 through targeted investments and promotional activities.

Industry Vertical Insights

The automotive dominated industry vertical segment of the market in 2023. Automotive manufacturing heavily depends on automation to increase production efficiency and precision. Advanced manufacturing technologies are necessary for the automotive industry due to the rise of electric, autonomous, and connected vehicles. The automotive sector has stringent safety standards that ensure precise control of manufacturing processes. It leads to higher-quality components that meet safety requirements.

As the global demand for vehicles rises, efficient and technologically advanced manufacturing processes become essential. Motion control systems enable automotive manufacturers to meet this demand by providing precision, speed, and adaptability in production. An Economic and Market Report published in January 2023 by the European Automobile Manufacturers Association stated that in 2022, North America witnessed a 10.3% increase in car production, reaching 10.4 million units. This boost was primarily due to high demand in the U.S. Car production in China also saw a rise of 11.7% in 2022, producing 23.2 million vehicles.

The electronics & semiconductor industry vertical segment is projected to grow at the fastest CAGR over the forecast period. Motion control systems enable handling small components in manufacturing microchips, circuit boards, and other semiconductor devices. They reduce human error and increase productivity by automating various stages of the manufacturing process. Integrated with advanced technologies, motion control systems ensure precision, speed, and quality control in producing components for emerging technologies such as 5G, IoT, AI, and autonomous vehicles. Motion control systems offer a pathway to innovation by enabling faster production cycles and improved product quality in the rising demand for electronic devices.

According to the Semiconductor Industry Association, global semiconductor sales have increased from USD 139.0 billion in 2001 to USD 574.0 billion in 2022. The World Semiconductor Trade Statistics (WSTS) Fall 2022 Semiconductor Industry Forecast estimated that global semiconductor industry sales would decline to USD 556 billion in 2023 and is expected to rise to USD 602 billion by 2024.

Regional Insights

Asia Pacific dominated the market and accounted for a 44.6% share in 2023. The Asia Pacific market is experiencing growth driven by factors such as the increasing adoption of robots in the manufacturing sector, government initiatives to promote industrial automation, and rising investments in transforming conventional production facilities. The Asia Pacific region's manufacturing sector has also witnessed an increase in demand for Industrial Internet of Things (IIoT), which enables significant growth opportunities for SMEs and other participants in the market. According to the International Federation of Robotics (IFR), Asia is the most significant global market for industrial robots, accounting for 73% of all newly deployed robots in 2021. The number of robots shipped amounted to 354,500 units, a significant increase of 33% compared to 2020.

North America is anticipated to witness the highest CAGR growth over the forecast period. The market experienced significant growth due to the high demand for industrial robots in manufacturing processes. Automation systems also play a crucial role in supporting this growth. The increasing industrialization has driven the demand for industrial robots in manufacturing. Industrial robots are critical in functional automation and modernization. According to the IFR, North America experienced significant growth in the use of industrial robots. In 2022, the number of robot installations in manufacturing increased by 12%, reaching 41,624 units. The automotive industry was the leading user of industrial robots in North America, with companies in the U.S., Canada, and Mexico installing 20,391 units, an increase of 30% compared to 2021.

Key Motion Control Company Insights

Some of the key players operating in the market include ABB, Siemens, and Robert Bosch GmbH.

-

ABB provides a range of high-performance motion control products for various industries. Their offerings include servo drives, motors, controllers, and software solutions. These components enable precise and efficient control of motion in industrial automation, robotics, and machine applications.

-

Siemens offers an inclusive set of motion control solutions for diverse industrial needs. Simotion Control System is well-known for its integrated approach to handling complex motion tasks across industries. Siemens provides Sinamics Drives, known for their precision and adaptability, offering efficient motion control capabilities.

-

Robert Bosch GmbH produces various motion control products and solutions, including servo drives, motors, controllers, and sensors. Their offerings cater to industrial automation, robotics, and automotive applications, emphasizing precision and reliability in motion control systems.

Rockwell Automation and YASKAWA ELECTRIC CORPORATION are some of the emerging market participants in the market.

-

Allen-Bradley offers industrial automation components, information solutions, and integrated control under Rockwell Automation and delivers industry-leading control and automation solutions, specializing in innovative products and systems for enhanced industrial efficiency and productivity. Rockwell Automation specializes in motion control solutions, offering a wide range of products such as servo drives, motors, motion controllers, and software.

-

YASKAWA ELECTRIC CORPORATION produces a wide range of precision motion control systems, including servo motors, drives, controllers, and robotics solutions. These technologies are utilized in industrial automation, robotics, CNC machines, and other high-precision applications. Yaskawa's offerings cater to diverse needs, providing reliable, high-performance motion control solutions to enhance manufacturing efficiency and productivity globally.

Key Motion Control Companies:

The following are the leading companies in the motion control market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these motion control companies are analyzed to map the supply network.

- ABB

- Siemens

- Schneider Electric

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- YASKAWA ELECTRIC CORPORATION

- Robert Bosch GmbH

- OMRON Corporation

- Fuji Electric Co., Ltd.

- PARKER HANNIFIN CORP

- FANUC CORPORATION

- Celera Motion, a Novanta Company

Recent Developments

-

In August 2023, Siemens introduced the latest servo offering to the manufacturing industry in North America. The SINAMICS servosystem includes a SINAMICS drive and SIMOTICS S-1FL2 motor and is available with flexible or standard cable options. This new product expands the SINAMICS drive offering for different applications to the servo product line. The pulse train variant enables various installed machines to incorporate supplementary positioning axes using the onboard positioner.

-

In May 2023, Japan-based Mitsubishi Electric and Korea-based MOVENSYS Inc. announced a partnership to collaborate in their motion control and AC servo businesses. This new partnership aims for Mitsubishi Electric to expand its AC servo enterprise, targeting semiconductor manufacturing equipment and other applications by including Movensys' technologies and product manufacturing capabilities.

-

In March 2023, Celera Motion, a business unit of Novanta Inc. launched the Field Calibration IncOder. It is an innovative absolute inductive encoder solution that provides highly accurate angle measurement for motion control applications as well as position feedback in robotics. This encoder is designed to work in harsh environments that are not ideal for optical encoders, such as dirty, dusty, and wet conditions. It can also withstand high shocks and vibrations.

Motion Control Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.48 billion

Revenue forecast in 2030

USD 24.66 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System, offerings, application, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Netherlands; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

ABB; Siemens; Schneider Electric; Mitsubishi Electric Corporation; Rockwell Automation, Inc.; YASKAWA ELECTRIC CORPORATION; Robert Bosch GmbH; OMRON Corporation; Fuji Electric Co., Ltd.; PARKER HANNIFIN CORP; FANUC CORPORATION; Celera Motion, a Novanta Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Motion Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global motion control market report based on system, offerings, application, industry vertical, and region:

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Open-loop System

-

Closed-loop System

-

-

Offerings Outlook (Revenue, USD Million, 2018 - 2030)

-

Actuators & Mechanical Systems

-

Drives

-

Motors

-

Motion Controllers

-

Sensors & Feedback Devices

-

Software & Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Cutting

-

Metal Forming

-

Material Handling

-

Packaging

-

Robotics

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronics & Semiconductor

-

Logistics

-

Automotive

-

Healthcare

-

Food & Beverage

-

Paper & Printing

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global motion control market size was estimated at USD 16.63 billion in 2023 and is expected to reach USD 17.48 billion in 2024

b. The global motion control market is expected to grow at a compound annual growth rate of 5.9% from 2022 to 2030 to reach USD 24.66 billion by 2030

b. Asia Pacific dominated the motion control market with a market share of 44.6% in 2022. The Asia Pacific motion control market is experiencing growth driven by factors such as the increasing adoption of robots in the manufacturing sector, government initiatives to promote industrial automation, and rising investments in transforming conventional production facilities.

b. Some key players operating in the motion control market include ABB; Siemens; Schneider Electric; Mitsubishi Electric Corporation; Rockwell Automation, Inc.; YASKAWA ELECTRIC CORPORATION; Robert Bosch GmbH; OMRON Corporation; Fuji Electric Co., Ltd.; PARKER HANNIFIN CORP; FANUC CORPORATION; Celera Motion, a Novanta Company

b. Factors such as the increasing demand of automation in various industries and the rising adoption of robotics & industry 4.0 are driving market growth. Moreover, incorporation of AI/ML and advanced control algorithms in motion control systems present significant growth opportunities for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.