- Home

- »

- Consumer F&B

- »

-

Mortadella Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Mortadella Market Size, Share & Trends Report]()

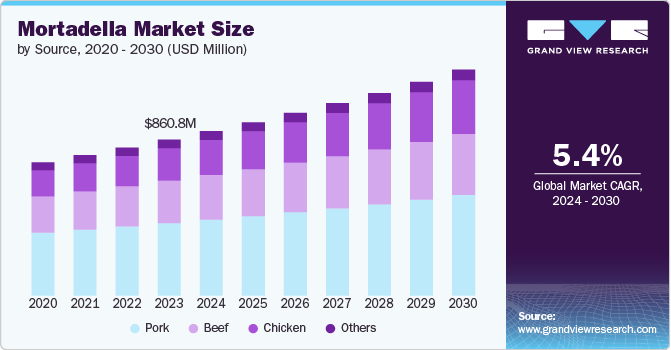

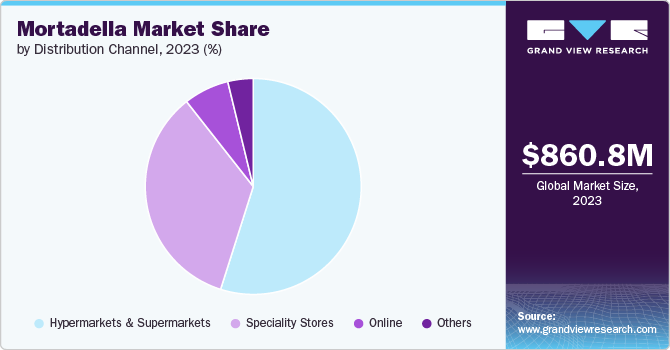

Mortadella Market Size, Share & Trends Analysis Report By Source (Pork, Beef, Chicken, Others), By Distribution Channel (Supermarkets And Hypermarkets, Specialty Stores, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-401-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Mortadella Market Size & Trends

The global mortadella market size was estimated at USD 860.8 million in 2023 and is expected to grow at a CAGR of 5.4% from 2024 to 2030. The market has experienced significant growth over the past few years, driven by its rich history and cultural significance, particularly in Italian cuisine. The distinctive flavor, smooth texture, and cultural heritage associated with mortadella make it a preferred choice among consumers seeking authentic culinary experiences. This trend is particularly noticeable in urban areas where food tourism and the popularity of international cuisines are on the rise, further boosting the demand for mortadella across various distribution channels, including supermarkets, hypermarkets, specialty stores, and online platforms.

Mortadella, a traditional Italian sausage meat made from finely hashed or ground, heat-cured pork, gained popularity globally due to its distinctive flavor and versatility in culinary applications. The current market for mortadella encompasses a wide range of product sources ranging from chicken, beef, turkey among others, from traditional pork to innovative variations that cater to contemporary tastes across the globe.

For almost 30 years (from 1967 to 2000), traditional mortadella (pork based) was banned in the U.S., this came after the spread of swine fever in Italy in 1967. The ban was lifted in 2000 after an agreement was reached that allowed disease-free regions to export to the U.S. and accepted animal and food tests done abroad as equivalent to tests done in the U.S. The ban was further relaxed in 2013, allowing the importation of some cured pork products from producers that pay a certification fee.

One of the prominent drivers is the rising consumer inclination towards high-quality, premium meat products. As the global population becomes more affluent and adventurous in their culinary choices, there is an increasing demand for gourmet food items, including traditional and artisanal sausages like mortadella.

Another significant driver is the innovation in product offerings and the expansion of distribution networks. Manufacturers are continuously developing new varieties of mortadella to cater to diverse consumer preferences and dietary requirements. This includes the introduction of low-fat, organic, and halal-certified options, which have broadened the consumer base and facilitated market penetration into new regions.

Enhanced packaging solutions that extend shelf life and preserve product quality have also contributed to increased availability and consumer appeal. Additionally, the expansion of distribution networks, particularly the growth of online sales channels, has made it easier for consumers to access a wide range of mortadella products. Online platforms have gained popularity due to their convenience and the ability to offer a vast selection of products, including specialty and gourmet options.

Source Insights

Pork based market accounted for a share of 46.4% in 2023. This high market share can be attributed to the traditional and authentic appeal of pork mortadella, which is a staple in Italian cuisine and enjoys widespread consumer preference globally. The rich flavor profile and smooth texture of pork mortadella have made it a favored choice among consumers seeking high-quality, gourmet meat products.

Additionally, the established reputation and cultural significance of pork mortadella contribute to its strong market presence. The continued innovation in product offerings, such as the introduction of organic and low-fat options, has also played a role in maintaining its popularity. Despite facing competition from other meat sources and navigating regulatory challenges, pork-based mortadella continues to hold a leading position in the market, driven by its heritage and enduring consumer demand.

Chicken based market is expected to grow at a CAGR of 7.3% from 2024 to 2030. This robust growth can be attributed to several factors, including the increasing consumer demand for healthier and leaner meat options. Chicken-based mortadella offers a lower fat content compared to its pork counterpart, making it an attractive choice for health-conscious consumers and those with dietary restrictions. Additionally, the rising awareness of poultry as a sustainable and environmentally friendly protein source further drives the market.

The expansion of the chicken-based market is also fueled by product innovation and diversification. Manufacturers are introducing new flavors and formulations, such as organic and halal-certified options, to cater to diverse consumer preferences and expand their market reach. The growing popularity of convenience foods and ready-to-eat meat products has also contributed to the market's expansion, with chicken-based mortadella becoming a preferred choice for quick and nutritious meals.

Distribution Channel Insights

Sales of mortadella through hypermarkets & supermarkets accounted for a revenue share of 54.9% in 2023. This prevalence can be attributed to the widespread accessibility and convenience these large retail formats offer to consumers. Hypermarkets and supermarkets provide a one-stop shopping experience, where customers can easily find a diverse range of mortadella products, from traditional pork-based varieties to innovative chicken and beef options. These retail outlets also benefit from extensive distribution networks and established relationships with manufacturers, ensuring a consistent supply of fresh and high-quality mortadella.

The prominence of hypermarkets and supermarkets in mortadella sales is also driven by their ability to offer competitive pricing and attractive promotions, making mortadella more affordable and appealing to a broad consumer base. Additionally, the visibility and shelf space allocated to mortadella in these stores enhance brand recognition and consumer awareness, further boosting sales. The convenience of purchasing mortadella during routine grocery shopping trips, coupled with the assurance of quality and variety, underscores the continued dominance of hypermarkets and supermarkets as the preferred channels for mortadella sales.

The sales of mortadella through online sales channels are projected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030. This anticipated growth reflects the increasing shift towards digital and e-commerce platforms, driven by changing consumer behaviors and the growing preference for convenience. Online sales channels offer several advantages that contribute to this upward trend, including the ability to shop from the comfort of one’s home, access to a broader selection of products, and the convenience of home delivery.

The rise in online sales of mortadella is also fueled by the expansion of online grocery platforms and the entry of traditional retailers into the e-commerce space. These platforms often provide detailed product descriptions, customer reviews, and competitive pricing, which enhance the shopping experience and build consumer trust. Additionally, the growing popularity of subscription services and meal kit deliveries that include specialty meats like mortadella further boosts online sales.

Regional Insights

The mortadella market in North America captured a revenue share of over 22.0% in the market. The strong market presence in North America can be attributed to several factors, including the growing popularity of international cuisines and the increasing consumer inclination towards gourmet and artisanal food products. Mortadella's unique flavor profile and versatility in culinary applications make it a favored choice among North American consumers who appreciate high-quality, specialty meats.

The market's growth in North America is also supported by the well-established foodservice industry, which includes a wide array of restaurants, delicatessens, and gourmet food stores that offer premium mortadella products. Additionally, the expansion of retail channels, such as supermarkets, hypermarkets, and online platforms, has made mortadella more accessible to a broader consumer base. These retail outlets often feature a diverse range of mortadella varieties, catering to different taste preferences and dietary requirements.

U.S. Mortadella Market Trends

The U.S. mortadella market is a dynamic and evolving segment within the broader processed meat industry, characterized by a blend of traditional culinary heritage and modern consumer trends. Mortadella, a staple of Italian cuisine, has found a substantial and growing audience in the U.S., where consumers are increasingly seeking out high-quality, gourmet food products. The market in the U.S. is driven by several key factors, including the rising popularity of international and ethnic foods, the expansion of the foodservice sector, and the growth of diverse distribution channels.

One of the primary drivers of the U.S. market is the increasing consumer interest in gourmet and artisanal food products. American consumers are becoming more adventurous in their culinary preferences, seeking out unique and authentic flavors that mortadella offers. This trend is particularly pronounced in urban areas where food tourism and the appreciation for international cuisines are growing. The distinctive taste and texture of mortadella, combined with its versatility in sandwiches, antipasti platters, and various recipes, make it a favored choice among food enthusiasts and chefs alike.

Europe Mortadella Market Trends

The mortadella market in Europe holds a prominent position, deeply rooted in the region's rich culinary traditions and heritage. Europe, particularly Italy, is the birthplace of mortadella, and the sausage enjoys a revered status among European consumers. The market is characterized by a blend of tradition and innovation, with a strong emphasis on quality, authenticity, and diverse product offerings. The European market continues to thrive, driven by cultural significance, consumer preferences, and a robust food industry infrastructure.

European manufacturers are known for their commitment to quality and craftsmanship, constantly refining their recipes and production techniques. This includes the introduction of new varieties such as organic, low-fat, and halal-certified mortadella, catering to the evolving dietary preferences and health consciousness of modern consumers. These innovative products not only expand the consumer base but also enhance the market's appeal to a broader audience.

Asia Pacific Mortadella Market Trends

Asia Pacific mortadella market is expected to witness a CAGR of 6.3% from 2024 to 2030. This growth trajectory is indicative of the region's increasing acceptance and demand for international and gourmet food products. As consumer preferences evolve and the food industry continues to expand, the Asia Pacific market presents numerous opportunities for mortadella manufacturers and distributors.

A key driver of the market in Asia Pacific is the rising middle class and increasing disposable income. As more consumers in the region achieve higher income levels, there is a greater propensity to explore and invest in premium and gourmet food products. Mortadella, with its rich flavor and artisanal appeal, fits well within this trend, attracting consumers who are keen to experience diverse and high-quality culinary options.

Innovation in product offerings tailored to local tastes and dietary preferences is another important driver. Manufacturers are increasingly developing new varieties of mortadella that cater to the unique preferences of Asian consumers, such as incorporating local spices or offering halal-certified options. These adaptations not only broaden the market appeal but also help in penetrating diverse consumer segments across the region.

Key Mortadella Company Insights

The competitive landscape of the market is characterized by a diverse range of players, including large multinational corporations, regional producers, and artisanal manufacturers. This dynamic environment is shaped by factors such as product innovation, quality differentiation, distribution strategies, and consumer preferences.

Major global food companies are significant players in the mortadella market, leveraging their extensive distribution networks, brand recognition, and production capabilities. Companies like Hormel Foods, and Campofrío Food Group are notable for their large-scale operations and wide product range. These players often focus on maintaining high standards of quality and expanding their product offerings to cater to diverse consumer needs.

Regional and local producers also hold a substantial share of the market, particularly in areas with strong traditional culinary ties to mortadella. In Italy, for example, companies like Felsineo and Montorsi are prominent players, known for their authentic and high-quality products. These producers often emphasize traditional production methods and regional specialties, appealing to consumers who value authenticity and heritage.

The market also features a range of artisanal and specialty manufacturers that focus on niche markets and premium products. These companies often differentiate themselves through unique recipes, high-quality ingredients, and artisanal production techniques. Brands such as Gourmet Food Store and various boutique producers cater to consumers seeking gourmet and handcrafted options.

Key Mortadella Companies:

The following are the leading companies in the mortadella market. These companies collectively hold the largest market share and dictate industry trends.

- Hormel Foods

- Campofrío Food Group

- Columbus Manufacturing, Inc.

- Fairfield Cheese Company

- Felsineo

- Montorsi

- Gourmet Food Store

- F.lli Veroni fu Angelo SpA

- Stiglmeier Sausage Co. Inc.

- VitaVolpi Foods

Recent Developments

-

In June 2024, Billie Green launched a range of plant-based mortadellas. The classic variety is mildly spicy; the garden herb as mild and herby; and the cherry pepper variety is described as a fruity, flavourful mortadella.

-

In October 2023, award-winning Italian restaurant and fast-casual food brand Indegno in the UK launched signature dishes include the Indegna, a classic crescentina filled with artisanal mortadella sausage made in Bologna with handmade parmesan cream.

Mortadella Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 907.3 million

Revenue forecast in 2030

USD 1.25 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; UK; Italy; Spain; China; Japan; South Korea; Australia & New Zealand; Brazil; and South Africa

Key companies profiled

Hormel Foods; Campofrío Food Group; Columbus Manufacturing, Inc.; Fairfield Cheese Company; Felsineo; Montorsi; Gourmet Food Store; F.lli Veroni fu Angelo SpA;Stiglmeier Sausage Co. Inc.; and Volpi Foods

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Mortadella Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mortadella market report based on source, distribution channel, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Pork

-

Beef

-

Chicken

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets And Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mortadella market size was estimated at USD 860.8 million in 2023 and is expected to reach USD 907.3 million in 2024.

b. The global mortadella market is expected to grow at a compounded growth rate of 5.4% from 2024 to 2030, reaching USD 1.25 billion by 2030.

b. The mortadella market in Asia Pacific captured a revenue share of over 32.8% in the market. This growth trajectory is indicative of the region's increasing acceptance and demand for international and gourmet food products. As consumer preferences evolve and the food industry continues to expand, the Asia Pacific market presents numerous opportunities for mortadella manufacturers and distributors.

b. Some key players operating in the market include Hormel Foods, Campofrío Food Group, Columbus Manufacturing, Inc., Fairfield Cheese Company, Felsineo, Montorsi, Gourmet Food Store, F.lli Veroni fu Angelo SpA, Stiglmeier Sausage Co. Inc., and Volpi Foods

b. A prominent driver is the rising consumer inclination towards high-quality, premium meat products. As the global population becomes more affluent and adventurous in their culinary choices, there is an increasing demand for gourmet food items, including traditional and artisanal sausages like mortadella.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."