Morocco Cosmetics Market Size & Trends

The Morocco cosmetics market size was valued at USD 1.82 billion in 2024 and is expected to grow at a CAGR of 7.5% from 2025 to 2030.The increasing consumption of body sunscreen, lotions, and anti-aging creams among consumers is a significant driver. The rising popularity of e-commerce websites has made it easier for consumers to access and purchase cosmetic products, contributing to market growth. Additionally, there is a growing trend towards natural and organic products, with consumers seeking ingredients such as argan oil, which is native to Morocco. Changing lifestyles and rising disposable incomes have also played a role in boosting market demand. The influence of Western beauty standards and the increasing focus on personal grooming and self-care among men and women further drive the market expansion.

The increasing influence of social media and beauty influencers has significantly boosted consumer awareness and interest in various cosmetic products. The growing number of beauty salons and spas in Morocco has also contributed to the rising demand for cosmetics. Furthermore, the tourism industry plays a crucial role, as visitors seek authentic Moroccan beauty products, particularly those containing traditional ingredients such as argan oil and rosewater. The emphasis on natural and organic formulations drives innovation and product development in the market. Moreover, expanding distribution channels, including specialty stores and online platforms, has made these products more accessible to a broader audience.

Product Insights

Skin & sun care products dominated the market with the largest revenue share of 40.6% in 2024. The growing awareness of the importance of skin protection and maintenance has led to a high demand for skin care products, including moisturizers, serums, and anti-aging creams. The climate in Morocco, with sun exposure, has also fueled the demand for effective sun care products, such as sunscreens and after-sun lotions. Additionally, the rising trend towards natural and organic ingredients in beauty products has boosted the popularity of skin and sun care items that incorporate traditional Moroccan ingredients like argan oil and rosewater.

Makeup & color cosmetic products are expected to grow at a significant CAGR of 7.4% over the forecast period. The increasing emphasis on personal grooming and appearance among consumers is driving the demand for makeup products. Social media platforms and beauty influencers play a crucial role in popularizing makeup trends and products, thereby boosting market growth. Additionally, the growing acceptance of makeup as a form of self-expression and creativity has led to higher spending on a variety of color cosmetics, including lipsticks, eyeliners, and blushes. The trend towards natural and organic makeup products, featuring traditional Moroccan ingredients such as argan oil, is also contributing to market expansion.

Gender Insights

Females dominated the market with the largest revenue share in 2024 due to social media's growing influence, and beauty influencers have heightened awareness and interest in cosmetic products. The rising disposable income and willingness to spend on premium and high-quality beauty products have also contributed to this dominance. The market has also seen an expansion in product offerings specifically tailored to women's needs, including skincare, makeup, and anti-aging products.

The male segment is expected to grow significantly over the forecast period. Increasing awareness about personal grooming and the importance of skincare among men is driving demand for male-specific cosmetic products. The influence of social media and male grooming influencers has also played a crucial role in encouraging men to adopt beauty and skincare routines. Additionally, expanding product lines that cater specifically to men's skin types and concerns, such as beard care, anti-aging, and sun protection, further boosts the market. The rising disposable incomes and changing societal norms regarding male grooming and self-care are also contributing to this growth.

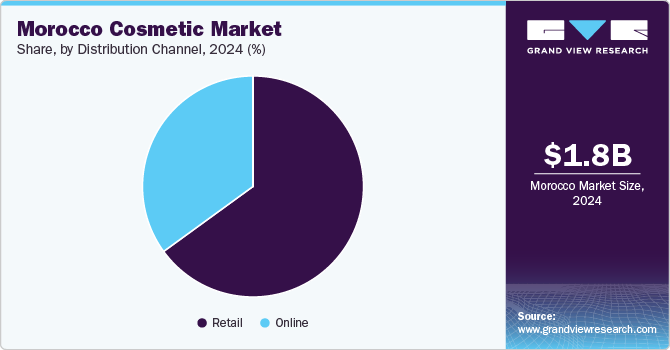

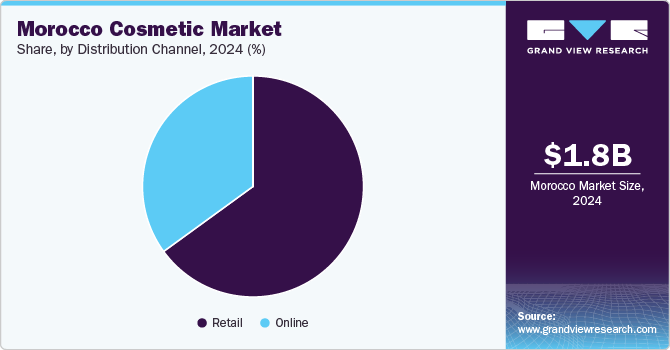

Distribution Channel Insights

The retail channel dominated the market with the largest revenue share in 2024. Physical retail stores, such as department stores, specialty beauty shops, and pharmacies, provide consumers with the opportunity to try products before purchasing, which is especially important for cosmetics. Personalized customer service and professional advice from beauty consultants enhance the shopping experience, encouraging consumer spending. Additionally, cosmetic products' widespread availability and visibility in retail outlets contribute to their popularity. Promotions, discounts, and exclusive in-store events further drive consumer footfall and sales.

The online channel is expected to grow at the fastest CAGR over the forecast period. The convenience of shopping online, with the ability to browse and purchase products from the comfort of home, appeals to a broad range of consumers. The rise of e-commerce platforms and beauty-focused websites has provided greater access to various cosmetic products. Additionally, the influence of social media, beauty influencers, and targeted digital marketing campaigns has significantly boosted online sales. These platforms often offer detailed product reviews, tutorials, and recommendations, which help consumers make informed purchasing decisions. The availability of exclusive online deals and promotions also attracts consumers to shop via online channels. Furthermore, advancements in logistics and delivery services have improved the speed and reliability of receiving online orders, enhancing the overall shopping experience.

Key Morocco Cosmetics Company Insights

Some key companies in the Morocco cosmetics market includeDabur International, Botanica Natural Products, Groupe Clarins, Unilever, Oriflame Cosmetics Global SA, and others. Manufacturers are focusing on reducing their production lead time and material handling costs and establishing adequate quality control and productivity maximization measures.

-

Unilever is a global leader in the cosmetics market, offering a wide range of products that cater to various beauty and personal care needs. Unilever provides a variety of sunscreens, moisturizers, and anti-aging creams designed to protect and nourish the skin. Furthermore, the company offers shampoos, conditioners, and hair treatments that cater to different hair types and concerns. Unilever's commitment to sustainability and natural ingredients aligns with the growing consumer preference for eco-friendly and organic products in the Morocco cosmetics industry.

Key Morocco Cosmetics Companies:

- Dabur International

- Botanica Natural Products

- Groupe Clarins

- Unilever

- Oriflame Cosmetics Global SA

- Kao Corporation

- Shiseido Company, Limited

- L’Oréal S.A.

- The Avon Company

- Procter & Gamble

Recent Developments

-

In September 2024, SoPharma successfully launched Erborian beauty product line in Morocco, merging traditional Korean beauty practices with contemporary consumer needs. The product line features key Korean ingredients like Centella Asiatica and Ginseng, available in pharmacies and approved retailers across Morocco.

Morocco Cosmetics Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.94 billion

|

|

Revenue forecast in 2030

|

USD 2.79 billion

|

|

Growth Rate

|

CAGR of 7.5% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, gender, distribution channel

|

|

Country scope

|

Morocco

|

|

Key companies profiled

|

Dabur International; Botanica Natural Products; Groupe Clarins; Unilever; Oriflame Cosmetics Global SA; Kao Corporation; Shiseido Company, Limited; L’Oréal S.A.;The Avon Company; Procter & Gamble

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Morocco Cosmetics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Morocco cosmetics market report based on product, gender, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)