- Home

- »

- Pharmaceuticals

- »

-

Montelukast Sodium Market Size And Share Report, 2030GVR Report cover

![Montelukast Sodium Market Size, Share & Trends Report]()

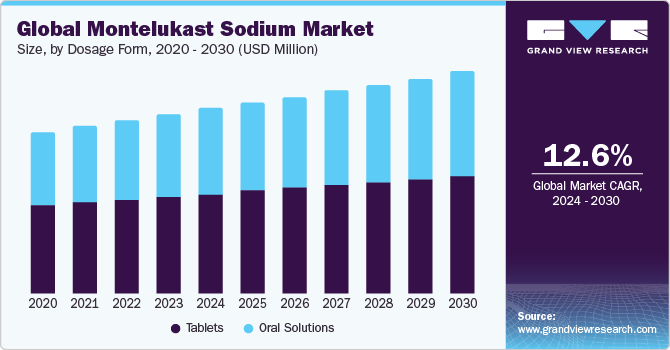

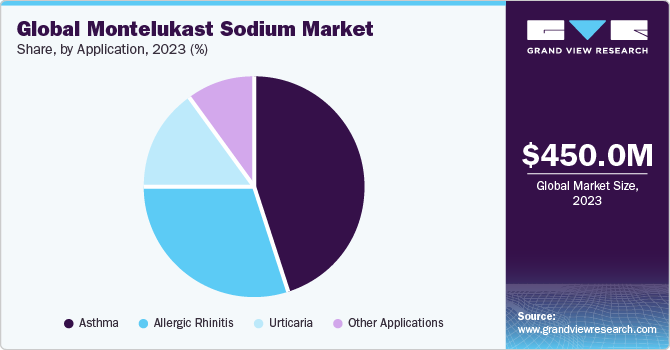

Montelukast Sodium Market Size, Share & Trends Analysis Report By Dosage Form (Tablets, Oral Solutions), By Application (Asthma, Allergic Rhinitis, Urticaria, Other Applications), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-201-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Montelukast Sodium Market Size & Trends

The global montelukast sodium market size was valued at USD 450.0 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 15.6% from 2024 to 2030. The growing prevalence of allergies and rising geriatric population are some of the key drivers for this market. Montelukast sodium is an oral drug that is available as a coated tablet. The medicine is used to treat chronic asthma and prevent exercise-induced bronchoconstriction.

Moreover, the increasing prevalence of asthma globally is elevating the market growth in the current scenario. For instance, according to the World Health Organization, in 2023, asthma is one of the major noncommunicable diseases (NCD) globally, and it is one of the most common chronic diseases among children. The rising number of asthma-related incidences has increased demand for the montelukast sodium market.

The COVID-19 pandemic significantly impacted the montelukast sodium market. The pandemic initially disrupted global supply chains to some extent, affecting montelukast sodium distribution of products in hospital and retail pharmacies, leading to market shortages. However, the pandemic enhanced the market revenue due to the rising number of respiratory diseases and COVID-19 globally. For instance, in 2022, the Indian Institute of Science stated in a study that montelukast drug has the potential to stop a few variants of COVID-19 from replicating within an individual's body. The growing importance of montelukast sodium has contributed to increased demand for products during the pandemic and post-pandemic.

Dosage Form

The montelukast sodium market is segmented based on dosage form into tablets and oral solutions. Tablets held the largest market share in 2023. This segment is majorly driven by the easy availability of tablets and an increasing number of applications that require montelukast tablets for treatment. Moreover, tablets have a higher shelf life and are mostly prescribed by doctors for asthma, thus elevating the segment's growth.

Application Insights

Based on application, the market is segmented into asthma, allergic rhinitis, urticaria, and other applications. Asthma dominated the application segment in 2023. The growing prevalence of asthma globally fuels market growth. For instance, in 2022, according to the Centers for Disease Control and Prevalence, around 8.7% of adults aged 18 and above had asthma; similarly, around 6.2% of children aged 18 and under had asthma. The number of patients visiting the emergency department with asthma is around 939,000. Thus, the segment is expected to witness growth.

Montelukast is significantly effective in treating exercise-induced asthma and asthma associated with allergic rhinitis. Additionally, it has been proven effective in treating asthma, which occurs in obese patients, smokers, those with aspirin-induced asthma, and those experiencing viral-induced wheezing episodes. Montelukast is often used as monotherapy or in conjunction with other drugs, such as inhaled corticosteroids (ICS), and has been compared to various other drugs to determine its efficacy in treating different levels of asthma.

Regional Insights

North America dominated the market in 2023, which can be attributed to the growing prevalence of asthma and respiratory diseases and well-established healthcare facilities' demand for montelukast sodium across the region. For instance, in April 2022, as per the Asthma and Allergy Foundation of America, around 27 million individuals in the U.S. have asthma, around 1 in 12 individuals. Asthma is one of the leading chronic diseases in children, and there are around 4.5 million children under the age of 18 who have asthma. This factor has elevated the need for various asthma treatments. Some other factors contributing to the market growth are growing awareness of treatment, the presence of well-established market players, and the rising number of approvals for montelukast sodium.

Competitive Insights

Some of the key players operating in the market are Teva Pharmaceuticals USA Inc., Merck & Co. Inc., Cipla Limited, Morepen Laboratories, Sanofi Aventis SA, SUN PHARMA, Intas Pharmaceuticals Ltd, Delmar Chemicals Inc., SK Capital (Apotex Inc), and Sanyo Chemical Industries Ltd. The key players in the market undertake various strategic initiatives, such as new FDA approval, product launches, partnerships, and mergers & acquisitions, to gain more market share. In December 2021, Morepen Laboratories stated that it had received the U.S. health regulators’ approval to make its generic anti-allergic drug.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."