- Home

- »

- Plastics, Polymers & Resins

- »

-

Monomaterial Packaging Market Size, Industry Report, 2030GVR Report cover

![Monomaterial Packaging Market Size, Share & Trends Report]()

Monomaterial Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polylactic Acid (PLA), Polyvinyl Chloride (PVC)), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-540-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Monomaterial Packaging Market Summary

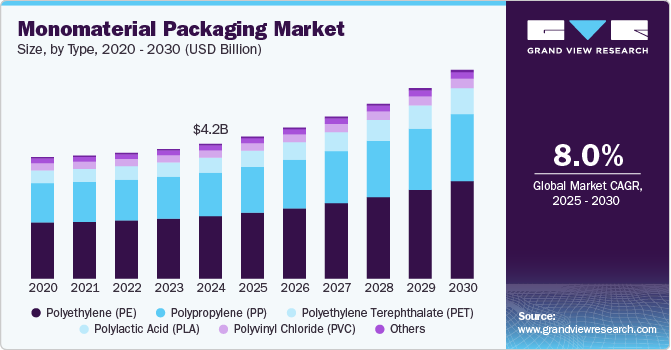

The global monomaterial packaging market size was valued at USD 4.19 billion in 2024 and is expected to reach USD 6.50 billion by 2030, growing at a CAGR of 8.01% from 2025 to 2030. The monomaterial packaging sector is projected to expand as sustainability issues, regulatory demands, and technological innovations promote its acceptance.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 42.25% in 2024.

- By type, the polyethylene (PE) segment recorded the largest market revenue share of over 46.0% in 2024.

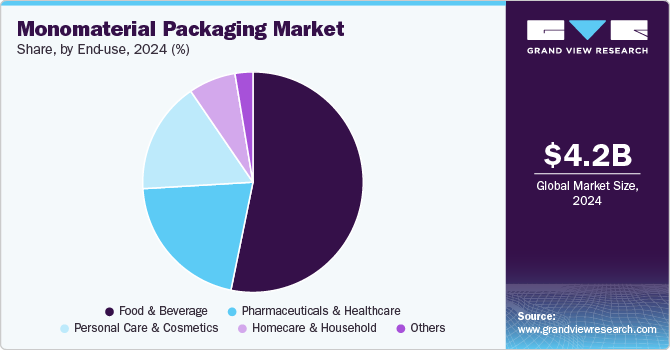

- By end-use, the Food & Beverage segment recorded the largest market share of 53.60% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.19 Billion

- 2030 Projected Market Size: USD 6.50 Billion

- CAGR (2025-2030): 8.01%

- Asia Pacific: Largest market in 2024

Rising consumer interest in recyclable packaging, coupled with more stringent Extended Producer Responsibility (EPR) regulations and restrictions on single-use plastics, is likely to encourage brands to pursue sustainable options.The growing popularity of e-commerce is anticipated to boost the demand for adaptable, recyclable packaging options. Furthermore, prominent brands and retailers, including Unilever, Nestlé, and P&G, are likely to keep investing in monomaterial packaging to fulfill their sustainability goals. Savings from optimized recycling methods and increased sourcing of local materials are also projected to promote adoption. As advancements in coating and processing technology progress, monomaterial packaging is expected to be instrumental in influencing the future of circular economy initiatives and environmentally friendly packaging.

Governments around the globe are implementing more stringent regulations on packaging waste and recyclability, including the EU’s Packaging and Packaging Waste Regulation (PPWR) and the U.S. Plastics Pact, prompting businesses to embrace monomaterial solutions. The increasing emphasis on a circular economy and the urgency to minimize plastic waste in landfills will further hasten this shift.

Advancements in mechanical and chemical recycling methods, which will improve the effectiveness of reprocessing mono-material plastics, are anticipated to benefit the market. Furthermore, reductions in the costs of recyclable resins and a rise in investments in closed-loop recycling systems are predicted to establish mono-material packaging as a sustainable long-term option across various sectors.

Type Insights

The polyethylene (PE) segment recorded the largest market revenue share of over 46.0% in 2024 and is projected to grow at CAGR of 8.1% during the forecast period. The market for polyethylene (PE)-based monomaterial packaging is anticipated to expand as the demand for sustainable and recyclable packaging solutions rises in sectors like food and beverage, pharmaceuticals, and personal care. More stringent EPR regulations and government initiatives aimed at reducing plastic waste are encouraging manufacturers to embrace PE-based monomaterial designs, which are more straightforward to recycle than multi-material options.

Moreover, the market for packaging made from polyethylene terephthalate (PET) nanomaterials is projected to expand due to the rising need for recyclable and high-performance packaging options in sectors like food & beverage, pharmaceuticals, and personal care. The growth of the beverage sector, particularly in bottled water and soft drinks, is anticipated to boost the demand for entirely recyclable PET bottles and containers. Furthermore, increasing investments in chemical recycling technology will improve the circularity of PET, making it possible to produce food-grade recycled PET (rPET). Heightened consumer awareness regarding sustainable packaging, along with brand efforts to reduce plastic waste, is additionally driving the trend toward adoption.

End-use Insights

The Food & Beverage segment recorded the largest market share of 53.60% in 2024 and is projected to grow at a significant CAGR during the forecast period. The demand for sustainable, recyclable, and food-safe packaging solutions is anticipated to drive growth in the monomaterial packaging sector within the food and beverage industry. Tighter government regulations, such as Extended Producer Responsibility (EPR) policies and mandates for reducing packaging waste, are encouraging food brands to implement monomaterial designs that facilitate recycling and support circular economy objectives. Advancements in barrier coatings and high-performance monomaterial films, especially those made from polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), are enhancing the moisture, oxygen, and light barrier capabilities needed to preserve food freshness and lengthen shelf life.

The market for monomaterial packaging within the personal care and cosmetics sector is anticipated to expand due to the rising need for sustainable and recyclable packaging options. Stricter regulations imposed by governments aimed at reducing plastic waste and Extended Producer Responsibility (EPR) initiatives are encouraging beauty brands to transition to mono-material packaging that simplifies recycling. As consumers grow more environmentally conscious, there is an increased demand for refillable, recyclable, and biodegradable packaging in skincare, haircare, and cosmetic goods.

The increasing popularity of refillable beauty items and simple packaging designs is promoting the use of monomaterial solutions, as they contribute to reducing waste and supporting circular economy efforts. Additionally, improvements in chemical and mechanical recycling technologies will enhance the recyclability of mono-material personal care packaging, ensuring adherence to changing environmental regulations and consumer demands.

Region Insights

North America is anticipated to grow at a significant CAGR of 7.0% over the forecast period. The monomaterial packaging sector in North America is anticipated to expand due to strict sustainability regulations, a growing consumer preference for recyclable packaging, and innovations in material science. Initiatives like the U.S. Plastics Pact, Canada’s Zero Plastic Waste Initiative, and Extended Producer Responsibility (EPR) programs are motivating brands to shift towards entirely recyclable monomaterial packaging. Increasing awareness of plastic pollution and efforts to promote a circular economy are contributing to the demand for monomaterial solutions made from polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) across industries such as food and beverage, personal care, and pharmaceuticals.

U.S. Monomaterial Packaging Market Trends

The monomaterial packaging market in U.S. growth is majorly driven by the rising sustainability regulations, an increase in consumer preference for recyclable packaging, and improvements in recycling technologies. Government efforts like the U.S. Plastics Pact and state-level Extended Producer Responsibility (EPR) laws are prompting brands to move toward completely recyclable monomaterial packaging. Major corporations such as PepsiCo, Coca-Cola, Unilever, and Procter & Gamble are putting money into innovations in monomaterial packaging, including high-barrier films, recyclable pouches, and monomaterial PET bottles, to improve recyclability and lessen plastic waste.

Asia Pacific Monomaterial Packaging Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 42.25% in 2024. The market for monomaterial packaging in the Asia-Pacific area is anticipated to expand because of heightened government regulations aimed at reducing plastic waste, growing environmental consciousness, and swift urban development. Nations such as China, Japan, India, and South Korea are implementing Extended Producer Responsibility (EPR) policies as well as bans on single-use plastics, compelling manufacturers to adopt recyclable and sustainable packaging alternatives.

The China Monomaterial Packaging Market is experiencing robust growth largely driven by stringent government regulations regarding plastic waste, escalating sustainability objectives, and a growing consumer preference for environmentally friendly packaging. The Chinese government's policies on plastic waste management, which include prohibitions on non-recyclable plastic packaging and the encouragement of Extended Producer Responsibility (EPR) initiatives, are facilitating the uptake of monomaterial packaging options.

Europe Monomaterial Packaging Market

The market for monomaterial packaging in Europe is projected to expand significantly due to rigorous sustainability regulations, ambitious goals for a circular economy, and a rising consumer preference for recyclable packaging. Furthermore, the implementation of plastic taxes and deposit return schemes (DRS) is prompting businesses to move away from multi-material and non-recyclable packaging. As consumers in Europe increasingly emphasize eco-friendly packaging, the demand for monomaterial solutions in both flexible and rigid packaging formats is anticipated to grow swiftly in the region.

The Monomaterial Packaging Market in Central & South America is primarily driven by stricter environmental regulations, heightened consumer awareness regarding sustainability, and the growth of the food and beverage as well as personal care industries. The surge in food delivery, e-commerce, and retail sectors is driving the demand for lightweight and flexible packaging that is both economical and easier to recycle. Furthermore, innovations in high barrier monomaterial films and coatings are improving the shelf life and resilience of packaged products, positioning them as a feasible substitute for conventional multi-material structures. The increasing investment in mechanical and chemical recycling facilities, especially in countries such as Brazil and Mexico, is anticipated to bolster the acceptance of monomaterial packaging.

Key Monomaterial Packaging Company Insights

The competitive environment of the market is characterized by the presence of established players and emerging innovators focusing on advanced packaging technologies. Strategic collaborations, mergers, and acquisitions are common, as companies aim to strengthen their portfolios and expand their global footprint. The increasing emphasis on sustainable packaging solutions is driving heightened competition and innovation in this rapidly evolving market.

-

In January 2025, SGT Group, a prominent producer of PET preforms and food-grade rPET located in Rezé, Loire-Atlantique, announced a major achievement in its expansion: the purchase of Axium Packaging, an important participant in the plastic packaging sector. This strategic acquisition enhances SGT’s standing in the European market and paves the way for new opportunities in growth and innovation.

-

In January 2024, Mars China launched a Snickers bar that includes dark chocolate cereal and comes in mono-material flexible packaging. This innovative product provides a low-sugar and low-glycemic index (GI) alternative, along with individually wrapped portions created from a mono PP material, following the 'Designed For Recycling' principle for easy recycling in appropriate channels. Flexible packaging, celebrated for its lightweight nature, versatility, and resistance to moisture and humidity, is extensively utilized in the food sector for items like instant noodles, biscuits, and snack packaging supplies.

Key Monomaterial Packaging Companies:

The following are the leading companies in the monomaterial packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor Plc

- Berry Global Group

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- Constantia Flexibles

- ProAmpac

- Borouge

- Smurfit Kappa Group

- TOPPAN Inc.

Global Monomaterial Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.42 billion

Revenue forecast in 2030

USD 6.50 billion

Growth rate

CAGR of 8.01% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

States scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Amcor Plc; Berry Global Group; Mondi Group; Sealed Air Corporation; Sonoco Products Company; Constantia Flexibles; ProAmpac; Borouge; Smurfit Kappa Group; TOPPAN Inc.

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Monomaterial Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global monomaterial packaging market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Proton Exchange Membranes (PEM)

-

Anion Exchange Membranes (AEM)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Energy & Utilities

-

Industrial

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global monomaterial packaging market was estimated at around USD 4.19 billion in the year 2024 and is expected to reach around USD 4.42 billion in 2025.

b. The global monomaterial packaging market is expected to grow at a compound annual growth rate of 8.01% from 2025 to 2030 to reach around USD 6.50 billion by 2030.

b. The Polyethylene (PE) segment recorded the largest market revenue share of over 46.0% in 2024. The market for polyethylene (PE)-based monomaterial packaging is anticipated to expand as the demand for sustainable and recyclable packaging solutions rises in sectors like food and beverage, pharmaceuticals, and personal care.

b. The key players in the monomaterial packaging market include Amcor Plc; Berry Global Group; Mondi Group; Sealed Air Corporation; Sonoco Products Company; Constantia Flexibles; ProAmpac; Borouge; Smurfit Kappa Group; and TOPPAN Inc.

b. Rising consumer interest in recyclable packaging, coupled with more stringent Extended Producer Responsibility (EPR) regulations and restrictions on single-use plastics, is likely to encourage brands to pursue sustainable options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.