- Home

- »

- Biotechnology

- »

-

Molecular Methods For Food Safety Testing Market Report, 2030GVR Report cover

![Molecular Methods For Food Safety Testing Market Size, Share & Trends Report]()

Molecular Methods For Food Safety Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Polymerase Chain Reaction (PCR), Immunoassay), By Product (Instrument, Reagents & Consumables), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-782-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

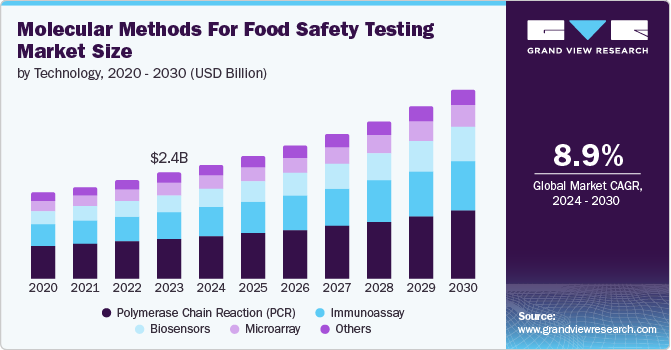

The global molecular methods for food safety testing market size was valued at USD 2.41 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. The driving factors of the growth are attributed to the rising prevalence of food contamination, the increase in foodborne diseases, and the demand for rapid food pathogen testing. The rising prevalence of food contamination is the driving factor for the molecular methods for food safety testing market growth. According to the World Health Organization (WHO) report published in May 2022, the organization estimated 600 million people fell ill due to the consumption of contaminated food, claiming 420,000 lives annually. Such rising incidences are driving market growth.

The rising number of food contamination cases is giving rise to foodborne diseases. The World Health Organization (WHO) recognized about 200 diseases caused by consuming food contaminated with bacteria, viruses or parasites. Foodborne diseases give rise to a wide range of illnesses, such as diarrhea, and may even lead to cancers. According to the World Health Organization (WHO), foodborne diseases claim 125,000 lives every year, with children under five years of age carrying 40% of the foodborne disease burden. Such rising incidences are expected to drive demand for advanced methods for testing food safety including molecular methods.

The U.S. Food and Drug Administration (FDA) established the Food Analysis Laboratory Accreditation (LAAF) program in May 2024. Under this program, the FDA aims to recognize the accreditation bodies proposed to accredit LAAF-accreditation to the laboratories for conducting food testing. The testing laboratories will be required to use an LAAF-accredited facility for food safety testing.

Technology Insights

Polymerase chain reaction (PCR) dominated the market and accounted for a share of 37.4% in 2023 owing to the increased prevalence of food contamination and growing foodborne diseases. Food with bacteria such as salmonella may cause salmonellosis, which can lead to diarrheal diseases. According to the World Health Organization (WHO), salmonella is one of the critical causes of global diarrheal diseases. The polymerase chain reaction technology is widely used to detect the presence of pathogenic bacteria and viruses as it detects a single pathogenic bacterium by targeting specific DNA sequences. The PCR technology is used in food analysis in various industries such as dairy, meat and poultry, seafood, processed foods, and beverages for pathogen detection. Such a wide range of applications drives the segment growth.

The biosensors segment is expected to register the fastest CAGR over the forecast period. The rising food contamination and growth in deaths caused by contaminated food encourage the demand for rapid technology in food testing. Biosensing technology is used to analyze nutrients, detect toxins, and deliver quick food safety detection. Biosensors offer high efficacy over traditional analysis methods and rapidly detect pathogens, food additives, and residue of antibiotics and pesticides. According to the ScienceDirect data published in April 2022, the biosensors are affordable, offer rapid response, are highly sensitive, and are non-destructive. Their advantages over the traditional molecular methods are expected to drive the segment growth.

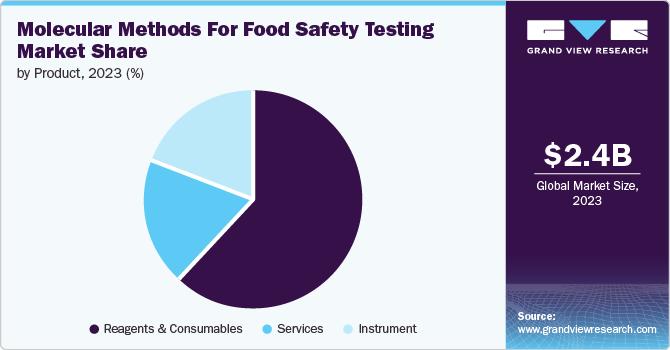

Product Insights

Reagents & consumables dominated the market and accounted for a share of 62.1% in 2023. Determining food safety and its quality depends on verifying the nutritional quality of the food and conducting tests for identifying contaminants such as pathogens, and residual pesticides. Reagents and consumables are used to detect nutritional values in numerous foods and beverages. Various reagents are used to detect nutrients, such as iodine, to detect the starch presence; reagent biuret is used to identify protein presence and ethanol reagent is used to detect fat.

The services segment is expected to register the fastest CAGR during the forecast period. The rising consumption of contaminated food, which has led to increased foodborne cases, encourages various food laboratories to provide food testing services. Various companies and laboratories such as ALS, Bureau Veritas, Intertek Group plc, and Food Safety Net Services (FSNS) are offering food and beverage testing services to ensure safety. Food Safety and Standards Authority of India (FSSAI) has created 232 laboratories comprising of 142 accredited food testing laboratories, including government and private owned-labs, 72 state food testing laboratories and 18 referral labs where two of them are under the FSSAI control. Such progressive steps taken by the government towards food safety are expected to drive segment growth.

Regional Insights

North America molecular methods for food safety testing market dominated the market in 2023. The rising prevalence of food contamination leading to increased food poisoning cases is a major factor driving growth in the region. According to the government of Canada data published in February 2023, 11 million food poisoning cases were recorded annually. The Canadian Food Inspection Agency (CFIA) built a network of 13 diagnostic testing and research laboratories nationwide, which is expected to help in improving food testing in the country and drive market growth.

U.S. Molecular Methods For Food Safety Testing Market Trends

The U.S. molecular methods for food safety testing accounted for a 32.5% share of the global market in 2023. The rising incidences of food poisoning and foodborne diseases are driving market growth. For instance, the U.S. Food and Drug Administration (FDA) reported around 48 million of foodborne disease cases, accounting for one in six Americans falling ill because of contaminated food consumption.

Europe Molecular Methods For Food Safety Testing Market Trends

Europe accounted for a significant market share in 2023 in the molecular methods for food safety testing. Foodborne outbreak illnesses are driving market growth in the region. For instance, the European Food Safety Authority (EFSA) reported a 44% rise in foodborne cases in 2022 compared with last year. The EU has established strict standards in agriculture, animal husbandry, and food production sector to ensure safe food consumption among the citizens. Such rising instances are expected to drive market growth in the region.

The UK Research and Innovation (UKRI) report published in June 2022 recorded 2.4 million cases of foodborne illnesses in the country. Listerias caused by contaminated food recorded a 13% mortality rate nationwide. The Biotechnology and Biological Sciences Research Council (BBSRC) and Food Standards Agency (FSA) invested approximately USD 2.067 million in the food safety network held by Quadram Institute in July 2022, which is expected to help ensure food safety in the country. Such initiatives are expected to drive market growth.

Asia Pacific Molecular Methods For Food Safety Testing Market Trends

Asia Pacific molecular methods for food safety testing market is estimated to register the fastest CAGR over the forecast period. The World Health Organization (WHO) reported that Southeast Asia bears the second highest foodborne disease burden after the African region, recording around 150 million cases annually. The institutions are working in collaboration to overcome this health issue and help reduce the number of patients suffering from these illnesses. For instance, the Food Safety Asia (FSA) network consolidates food safety institutions in Asia, the Pacific, and the Middle East. Such initiatives are expected to drive market growth.

The rising food contamination cases and increased foodborne diseases in India primarily drive market growth. Several cases of food poisoning were reported in various states of the country. The government is also taking initiatives to help improve food safety in the country. For instance, the government announced advanced projects in food safety and infrastructure facilities in multiple states across the nation in February 2024 which are aimed at ensuring the quality of food consumed by millions of the citizens. Such initiatives by the government to curb the rising number of food poisoning cases are expected to drive market growth.

Key Molecular Methods For Food Safety Testing Company Insights

Some companies in the molecular methods for food safety testing market include QIAGEN, 3M, Veredus Laboratories Pte Ltd., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., and Eurofins Scientific. Key companies are involved in strategic initiatives such as innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Eurofins Scientific is a life science company providing a wide range of services in various domains, such as food, environment, pharmaceutical, forensics, cosmetic product testing and agriscience contract research services. The company has established laboratories to offer various testing services, such as food and feed testing, agro testing, environment testing, and materials testing and analysis.

-

Bio-Rad Laboratories, Inc. is a biotechnology research company that develops, manufactures, and markets a range of innovative products to offer in life science and clinical diagnostic markets. The company offers molecular testing, food and beverage testing, and immunoassay solutions.

Key Molecular Methods For Food Safety Testing Companies:

The following are the leading companies in the molecular methods for food safety testing market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- 3M

- Veredus Laboratories Pte Ltd.

- NEOGEN CORPORATION

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- ArcherDX, Inc.

- HiMedia Laboratories.

- Eurofins Scientific

Recent Developments

-

Intertek Group plc acquired Brasil Laboratório de Análises de Alimentos S.A. to expand into the food safety testing service portfolio in July 2021.

-

Eurofins Scientific acquired Alliance Technical Laboratories in May 2021 to enhance food, water, and feed testing.

Molecular Methods For Food Safety Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.59 billion

Revenue forecast in 2030

USD 4.31 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden ; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

QIAGEN; 3M; Veredus Laboratories Pte Ltd.; NEOGEN CORPORATION; Bio-Rad Laboratories; Inc.; Thermo Fisher Scientific Inc.; BIOMÉRIEUX; ArcherDX; Inc.; HiMedia Laboratories.; Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molecular Methods For Food Safety Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global molecular methods for food safety testing market report based on technology, product, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase Chain Reaction (PCR)

-

Immunoassay

-

Biosensors

-

Microarray

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instrument

-

Reagents & Consumables

-

Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.