- Home

- »

- Medical Devices

- »

-

Molecular Imaging Market Size, Industry Report, 2030GVR Report cover

![Molecular Imaging Market Size, Share, & Trends Report]()

Molecular Imaging Market (2025 - 2030) Size, Share, & Trends Analysis Report By Modality (Molecular Ultrasound Imaging, Positron Emission Tomography), By Application (Cardiovascular, Neurology), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-374-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Molecular Imaging Market Summary

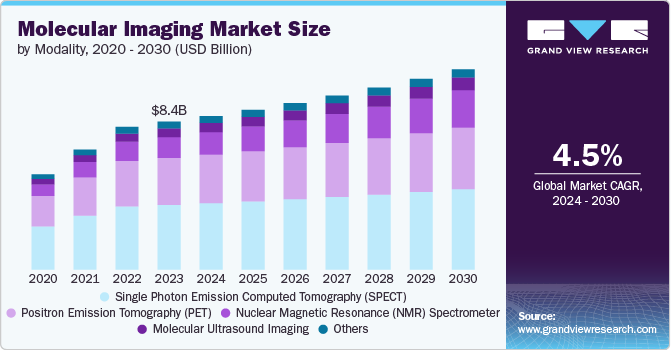

The global molecular imaging market size was valued at USD 8.8 billion in 2024 and is projected to reach USD 11.4 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. Major factors contributing to the market growth include the increasing prevalence of chronic diseases such as cancer, cardiovascular diseases (CVDs), and neurological disorders; technological advancements; and rising investment in Research and Development (R&D).

Key Market Trends & Insights

- North America dominated the global molecular imaging market with the share of 41.4% in 2024.

- The U.S. molecular imaging market accounted for the largest share of the North America in 2024.

- Based on modality, the Single Photon Emission Computed Tomography (SPECT) segment dominated the market with a share of 43.3% in 2024.

- Based on application, the oncology segment dominated the market in 2024.

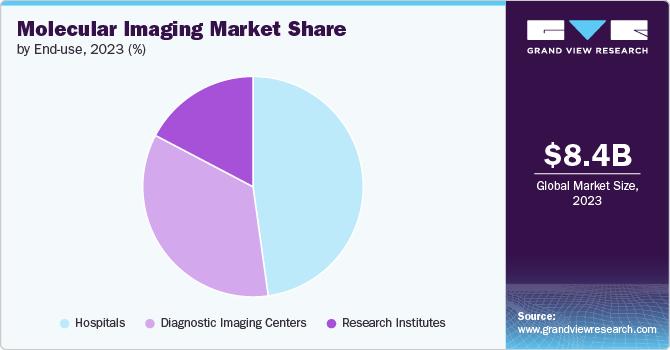

- Based on end-use, the hospitals segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.8 Billion

- 2030 Projected Market Size: USD 11.4 Billion

- CAGR (2025-2030): 4.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to the America College of Radiology, The president's 2024 budget proposed a significant increase in discretionary funds for the National Cancer Institute (NCI), aiming for USD 716 million, which is USD 500 million more than the FY 2023 allocation. These funds are intended to support research, prevention, diagnosis, and treatment efforts, all of which depend heavily on radiology and imaging tools.

Moreover, the Cancer Moonshot initiative has been allocated USD 1.5 billion in mandatory funding. This funding will be distributed across the NCI, the U.S. FDA, the Centers for Disease Control and Prevention, and ARPA-H. Technological advancements in imaging modalities are expected to drive market growth significantly. Innovations in Positron Emission Tomography (PET) and Single Photon Emission Computed Tomography (SPECT) have significantly enhanced their diagnostic capabilities. PET scans, which provide high-resolution images of metabolic activity within the body, are now more sensitive and specific, enabling earlier detection of diseases such as cancer.

In addition, the development of hybrid imaging systems, particularly PET/CT and SPECT/CT, combines the functional imaging capabilities of PET or SPECT with the anatomical imaging capabilities of Computed Tomography (CT), providing detailed diagnostic information. The integration of Artificial Intelligence (AI) into these imaging modalities represents another significant technological advancement. These innovations are leading to increased adoption of molecular imaging modalities among end users. For instance, in January 2024, the Molecular Imaging Laboratory at the Beckman Institute for Advanced Science and Technology, supported by the Roy J. Carver Charitable Trust, added a new ultra-high-performance PET and X-ray CT scanner opening new opportunities for research.

The increasing prevalence of chronic disorders is a significant factor driving the expansion of the molecular imaging industry. Chronic diseases such as cancer, CVDs, diabetes, and neurological disorders are becoming more common, fueled by an aging population, lifestyle changes, and environmental factors. Molecular imaging techniques, including PET, SPECT, and others, provide detailed insights into the molecular and cellular processes underlying these conditions. For instance, PET imaging is essential in oncology for detecting tumors, staging cancer, and monitoring response to therapy.

Modality Insights

The Single Photon Emission Computed Tomography (SPECT) segment dominated the market with the largest revenue share of 43.3% in 2024, attributed to its advantages in diagnostic imaging, particularly in the fields of cardiology and neurology, where it provides detailed 3D images of internal organs and tissues. Its ability to assess myocardial perfusion and detect neurological disorders such as Alzheimer's makes it indispensable in clinical settings. Furthermore, advancements in SPECT technology, including improved image resolution, faster scan times, and enhanced quantification techniques, have contributed to its widespread adoption among healthcare providers.

The Nuclear Magnetic Resonance (NMR) spectrometer segment is anticipated to be the fastest-growing segment, with a CAGR of 8.8% from 2025 to 2030. Advancements in NMR technology, including improvements in sensitivity, resolution, and data acquisition speed, have expanded its applications beyond traditional research settings into clinical diagnostics. The ability of NMR spectroscopy to provide comprehensive, multidimensional data sets further enhances its utility in precision medicine and personalized healthcare. In December 2023, Bruker Corporation announced the installation of a 1.2 Gigahertz (GHz) NMR system at Ohio State University's National Gateway Ultrahigh Field NMR Center. This GHz-class NMR system represents a major advancement in NMR spectroscopy and is expected to significantly impact life science and materials research.

Application Insights

Oncology segment accounted for the largest market share in 2024 due to the rising global cancer burden and the growing demand for advanced diagnostic solutions. Molecular imaging technologies provide critical insights into tumor biology, enabling early detection, accurate staging, and effective monitoring of treatment responses. Tools such as PET/CT and SPECT/CT allow for detailed tumor metabolism and structure visualization, improving clinical decision-making. The increasing adoption of these advanced imaging modalities for cancer diagnosis and management has significantly contributed to the market dominance of the segment.

Moreover, end users are increasingly adopting these advanced imaging devices to diagnose a growing number of cancer patients. For instance, in March 2024, Spectrum Dynamics Medical announced that its VERITON-CT 400, a new generation digital SPECT/CT, was installed and patient scanning commenced at Gustave Roussy in Grand Paris, France. It is one of Europe's leading cancer centers and is ranked the world's fourth-best oncology hospital by Newsweek magazine. The institute treats patients of all ages with all types of cancer and specializes in the treatment of rare and complex tumors.

The cardiovascular segment is anticipated to be the fastest-growing segment from 2025 to 2030, fueled by the increasing prevalence of CVDs worldwide, necessitating more effective and precise diagnostic tools. According to the WHO, CVDs are the leading cause of death globally, accounting for an estimated 17.9 million deaths each year. Advances in imaging technologies have significantly enhanced the ability to detect and monitor heart conditions at an early stage, leading to better patient outcomes. In addition, there is a rising demand for noninvasive imaging techniques that provide detailed insights into the heart's structure and function, further propelling the adoption of molecular imaging devices in the cardiovascular segment.

End Use Insights

Hospitals segment held the largest market share in 2024 due to the increasing adoption of advanced imaging technologies in clinical settings. Hospitals are primary centers for cancer diagnosis, treatment, and patient care, where molecular imaging plays a vital role in the early detection, staging, and monitoring of various diseases. The need for precise, non-invasive imaging tools for personalized treatment plans has driven hospitals to invest in state-of-the-art devices, including PET/CT and SPECT/CT. The increasing demand for precise diagnostic capabilities has greatly strengthened the segment's leading position in the market.

The diagnostic imaging centers segment is projected to be the fastest-growing segment over the forecast period, driven by the ability to offer high-quality, specialized imaging procedures with efficient turnaround times compared to larger hospitals. These centers are equipped with advanced imaging technologies and specialized expertise to ensure accurate diagnostic outcomes. Their accessibility and convenience are thus beneficial for diagnosing patients and healthcare providers aiming for efficient patient management. Furthermore, the increasing global incidence of chronic diseases drives the demand for accurate and timely diagnostic imaging, further propelling the growth of the molecular imaging industry.

Regional Insights

North America molecular imaging market dominated the global market, with the largest revenue share of 41.4%, in 2024. This is attributable to well-established healthcare infrastructure and favorable reimbursement policies. The region’s advanced healthcare facilities are increasingly adopting cutting-edge molecular imaging technologies, such as PET/CT and SPECT/CT, to improve diagnostic accuracy and patient care. In addition, favorable reimbursement policies in the U.S. and Canada encourage healthcare providers to invest in these sophisticated tools. These supportive policies, coupled with the strong healthcare infrastructure, are significantly expanding the market and enhancing the accessibility of advanced imaging solutions.

U.S. Molecular Imaging Market Trends

TheU.S. molecular imaging market accounted for the largest share in 2024. Continuous innovations in molecular imaging modalities, such as PET/CT, SPECT/CT, and MRI, are projected to fuel the molecular imaging industry across the U.S. These technological advancements enhance diagnostic precision, enabling early detection and accurate staging of diseases. The shift toward personalized medicine, where treatment plans are tailored based on individual patient profiles and molecular imaging data, further fuels market expansion. The adoption of more targeted approaches to patient care by healthcare providers is driving the demand for advanced imaging solutions, fueling market expansion.

Europe Molecular Imaging Market Trends

Europe molecular imaging market is anticipated to witness growth over the forecast period, owing tothe aging population and the rising prevalence of chronic diseases. Older adults are more susceptible to conditions such as cancer, CVDs, and neurological disorders, increasing the demand for advanced diagnostic tools. Molecular imaging technologies, especially PET/CT and SPECT/CT, play a critical role in the early detection and precise monitoring of these diseases. The growing need for effective diagnostics and personalized treatment plans is set to propel regional market share.

Asia Pacific Molecular Imaging Market Trends

Asia Pacific molecular imaging market is set to experience the fastest growth at a CAGR of 5.6% from 2025 to 2030. Significant regional healthcare infrastructure developments are set to enhance access to advanced diagnostic technologies, including molecular imaging. Countries including China, India, and Southeast Asia are investing heavily in upgrading healthcare facilities, driving the demand for state-of-the-art medical equipment. In addition, product launches and collaborations by major players fuel market expansion. These advancements improve disease detection capabilities and are expected to significantly impel the molecular imaging industry in the region.

Japan Molecular Imaging Market Trends

Japan molecular imaging market is projected to grow with the fastest CAGR during the forecast period due to the focus on neurology and cardiology. The increasing prevalence of neurological disorders and CVDs impels the adoption of advanced imaging techniques for early diagnosis and treatment monitoring. Moreover, the integration of AI and Machine Learning (ML) into molecular imaging systems enhances image analysis, enabling faster and more accurate diagnoses. These technological advancements, coupled with the growing demand for precise diagnostics, are expected to fuel the market expansion.

Key Molecular Imaging Company Insights

Some of the key companies in the molecular imaging industry includeGE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; Canon Medical Systems Corporation; Shimadzu Corporation; and Positron.

-

GE HealthCare provides advanced medical imaging, diagnostics, monitoring, and digital solutions. Its products include imaging systems, ultrasound, patient monitoring, and AI-powered technologies, aiming to improve patient care and optimize healthcare operations worldwide.

-

Siemens Healthineers AG offers innovative healthcare solutions, including medical imaging, laboratory diagnostics, point-of-care testing, and digital health services. It aims to improve patient outcomes, enhance efficiency, and advance precision medicine worldwide.

Key Molecular Imaging Companies:

The following are the leading companies in the molecular imaging market. These companies collectively hold the largest market share and dictate industry trends.

- Bruker

- GE HealthCare

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- Canon Medical Systems Corporation

- Mediso Ltd.

- Cubresa Inc.

- Shimadzu Corporation

- United Imaging Healthcare Co., Ltd.

- Positron

Recent Developments

-

In June 2024, Siemens Healthineers obtained FDA clearance for the Biograph Trinion, a state-of-the-art, energy-efficient PET/CT scanner that provides a wide range of clinical applications while maintaining low lifetime operational costs for enhanced healthcare efficiency.

-

In June 2024, Positron Corporation announced the sale of Attrius PET System. Positron will install the Attrius in Q4 2024, aligning with the facility's timeline. Positron is the industry's only provider of a dedicated PET scanner. Attrius is a 2D quantitative PET scanner specifically designed for nuclear cardiology, offering high-resolution images.

-

In October 2022, Spectrum Dynamics announced an advancement in digital nuclear medicine imaging: the ability to image high-energy isotopes using solid-state detector technology in a 360° CZT-based, wide-bore SPECT/CT configuration. This feature is available in the new VERITON-CT 400 Series Digital SPECT/CT scanners and supports total body, brain, heart, and other imaging applications.

Molecular Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.1 billion

Revenue forecast in 2030

USD 11.4 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Bruker; GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; Canon Medical Systems Corporation; Mediso, Ltd.; Cubresa, Inc.; Shimadzu Corporation; United Imaging Healthcare Co., Ltd.; and Positron.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molecular Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global molecular imaging market report on the basis of modality, application, end use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Ultrasound Imaging

-

Positron Emission Tomography (PET)

-

Single Photon Emission Computed Tomography (SPECT)

-

Nuclear Magnetic Resonance (NMR) Spectrometer

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Neurology

-

Oncology

-

Respiratory

-

Gastrointestinal

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.