Molded Interconnect Device Market Size, Share & Trends Analysis Report By Process (Laser Direct Structuring (LDS), Two-shot Molding, Others), By Product (Sensor Housings, Antennas, Connectors & Switches, Lighting), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-381-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Molded Interconnect Device Market Trends

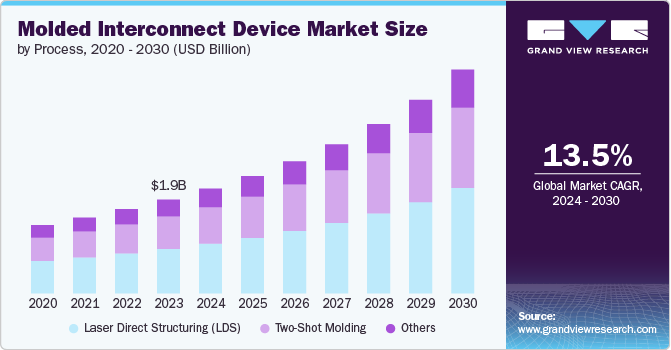

The global molded interconnect device market size was estimated at USD 1.91 billion in 2023 and is projected to grow at a CAGR of 13.5% from 2024 to 2030. Factors such as the trend towards miniaturization of electronic devices and the increasing demand for high-performance and lightweight components are driving the global market growth. A Molded Interconnect Device (MID) is an innovative electronic component that integrates mechanical and electronic functions into a single, three-dimensional (3D) structure. This is achieved by creating circuit traces directly onto the surface of a molded plastic part.

The key advantages of MIDs include space-saving, weight reduction, and a decrease in the number of components. Unlike conventional PCBs, MIDs provide electrical connectivity on the surfaces of 3D structures. Consequently, MIDs are particularly beneficial in situations where traditional wiring is impractical due to space constraints. Moreover, by combining multiple functions into a single part, MIDs can reduce the number of components and assembly steps, potentially lowering manufacturing costs. The ability to create complex 3D shapes and integrate multiple functions into a single component provides greater design flexibility.

The trend towards smaller, more compact electronic devices necessitates advanced interconnect solutions that MID technology can provide. MIDs allow for more efficient use of space and integration of electronic components. Industries such as automotive, consumer electronics, and medical devices require high-performance yet lightweight components. MIDs, made from lightweight materials, meet these needs while maintaining performance standards.

The demand for customized electronic components is growing, and MIDs offer the flexibility to create bespoke designs that meet specific application requirements. MIDs are becoming more accessible for prototyping and low-volume production, allowing companies to experiment with innovative designs without significant upfront investment.

Government initiatives can have a significant positive impact on the molded interconnect device market. For instance, in February 2024, the Indian government launched the "Digital India FutureLABS" at the Digital India FutureLABS Summit 2024, emphasizing India's progress from a technology consumer to a leader in developing next-generation electronics. The summit featured the announcement of 22 Memorandums of Understanding (MoUs) with companies like NXP Semiconductors and Qualcomm Technologies, Inc., aiming to strengthen India's Electronics System Design and Manufacturing (ESDM) sector through innovation and collaboration in key areas such as Artificial Intelligence (AI), the Internet of Things (IoT), and quantum computing. Such initiatives can accelerate technological advancements and reduce the cost barriers associated with developing innovative MID solutions.

Process Insights

In terms of process, the market is classified into Laser Direct Structuring (LDS), two-shot molding, and others. The Laser Direct Structuring (LDS) segment dominated the target market in 2023 and accounted for more than 47.0% share of global revenue. The segment’s growth is attributed to advancements in technology and the design flexibility of LDS. Recent technological advancements in LDS, such as improved laser technology and more precise structuring techniques, are enhancing the capabilities and applications of LDS. These improvements increase the efficiency and quality of the manufacturing process. Moreover, LDS offers design flexibility, supporting the development of innovative and customized solutions and appealing to industries seeking unique and efficient designs.

The two-shot molding segment is projected to grow at the fastest CAGR of 14.0% from 2024 to 2030. The generally fast manufacturing speed through two-shot molding drives the segment’s growth. The two-shot injection molding process offers a notable advantage with its short processing times, making it a more cost-effective choice for projects involving large quantities. Additionally, it provides greater flexibility in 3D design, allowing for conductor paths to be integrated into areas that a laser might not be able to reach. Moreover, two-shot molding is particularly valuable for creating components that require multiple materials or colors in a single part. This capability is crucial in industries like automotive and consumer electronics, where complex, multi-functional components are increasingly demanded.

Product Insights

In terms of product, the market is classified into sensor housings, antennas, connectors & switches, lighting, and others. The sensor housings segment dominated the market in 2023 and accounted for more than 27.0% share of global revenue. The segment’s growth is attributed to the increasing demand for advanced sensors. The proliferation of advanced sensors across various industries, such as automotive, consumer electronics, and industrial automation, is fueling demand for sensor housings. These sensors are essential for applications like autonomous driving, smart devices, and predictive maintenance. Moreover, advances in molding technology allow for complex and customized sensor housing designs. This flexibility supports the development of innovative sensor solutions tailored to specific applications, which is driving growth in the sensor housings segment.

The antennas segment is projected to grow at the fastest CAGR of 14.2% from 2024 to 2030. The growing demand for wireless communication across various devices, including smartphones, IoT devices, and automotive systems, is driving the need for integrated antennas. MIDs enable the creation of compact, efficient antennas embedded within electronic devices. Moreover, the rollout of 5G technology and the development of future wireless standards require advanced antenna solutions. MIDs offer the capability to integrate antennas directly into the device housing, supporting the complex requirements of next-generation communication systems.

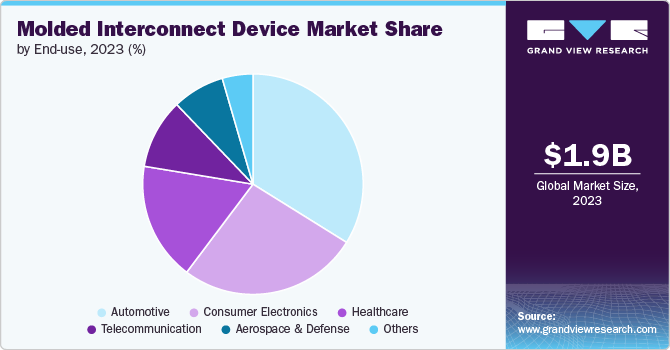

End-use Insights

In terms of end-use, the market is classified into healthcare, automotive, consumer electronics, telecommunication, aerospace and defense, and others. The automotive segment dominated the market in 2023 and account for more than 33.0% share of global revenue. The automotive segment’s growth is driven by the growing usage of electronics in vehicles. The growing adoption of Advanced Driver Assistance Systems (ADAS) in vehicles requires sophisticated electronic systems. MIDs are used to integrate various sensors, connectors, and circuitries into automotive components, supporting features like lane-keeping assistance, adaptive cruise control, and collision avoidance. Moreover, the automotive industry is moving towards greater vehicle connectivity with features such as vehicle-to-everything (V2X) communication and over-the-air updates. MIDs support the integration of communication modules and antennas, enhancing the connectivity capabilities of modern vehicles.

The consumer electronics segment is projected to grow at the fastest CAGR of 14.3% from 2024 to 2030. The growth of the consumer electronics segment in the global molded interconnect device market is driven by trends towards miniaturization, advanced functionality, cost efficiency, and increased demand for wearable technology and connected devices. Technological advancements and design flexibility further support the expansion of this segment, meeting the evolving needs of the consumer electronics industry. Consumer electronics, including smartphones, wearables, and smart home devices, are becoming increasingly compact. MIDs offer a solution for integrating multiple electronic functions into a single, compact component, allowing for smaller and lighter devices. Hence, the growing penetration of consumer electronic devices is likely to offer significant growth opportunities for the market.

Regional Insights

The molded interconnect device market in North America is expected to grow at a CAGR of 13.1% from 2024 to 2030. The market's growth in the region is attributed to the high technological innovation in the region. The demand for cutting-edge electronic devices, such as smartphones, wearables, and advanced automotive systems, is driving the need for sophisticated MID solutions. Moreover, government policies and incentives supporting technological innovation and manufacturing advancements contribute to the growth of the market. In March 2024, the U.S. government teamed up with the Government of Mexico through the International Technology Security and Innovation (ITSI) Fund to expand and diversify the global semiconductor ecosystem. This partnership focuses on evaluating Mexico's semiconductor industry and regulatory environment to identify opportunities for future initiatives that will bolster the semiconductor supply chain and enhance regional competitiveness.

U.S. Molded Interconnect Device Market Trends

The molded interconnect device market in the U.S. is expected to grow at a CAGR of 13.0% from 2024 to 2030. The deployment of 5G technology is accelerating this growth by driving the need for advanced antennas, improved connectivity components, support for IoT and smart devices, enhanced device performance and design, and advanced manufacturing processes. Moreover, significant investment in research and development in the U.S. leads to advancements in molding technology and materials, enhancing the performance and capabilities of MIDs.

Asia Pacific Molded Interconnect Device Market Trends

Asia Pacific dominated the global molded interconnect device market and accounted for a revenue share of over 34.0% in 2023. The growing demand for consumer electronics in the region is driving the market’s growth. Asia Pacific is a major hub for consumer electronics manufacturing and consumption, including smartphones, wearables, and smart home devices. MIDs are essential for integrating complex functionalities into these compact devices. Moreover, the roll-out of 5G networks across the Asia Pacific creates a high demand for advanced antennas and connectivity solutions. MIDs play a crucial role in integrating these components into compact and efficient designs.

Europe Molded Interconnect Device Market Trends

The molded interconnect device market in Europe is expected to grow at a significant CAGR of 13.6% from 2024 to 2030. The expansion of the European automotive industry drives the market’s growth. The European automotive industry is at the forefront of adopting Electric Vehicles (EVs) and Advanced Driver Assistance Systems (ADAS). MIDs are crucial for integrating the complex electronics required for these technologies. Moreover, Europe’s well-established manufacturing infrastructure supports the production and distribution of high-quality MIDs.

Key Molded Interconnect Device Company Insights

Some of the key companies operating in the market include TE Connectivity, KYOCERA AVX Components Corporation, Molex, and Amphenol Corporation.

-

TE Connectivity is a Switzerland-based company that designs and manufactures connectivity and sensor solutions essential in today's increasingly connected world. The company provides a wide range of products and solutions that connect and protect the flow of power and data in virtually every industry, including automotive, aerospace, defense, medical, industrial, and consumer electronics. Its product portfolio includes connectors and sensors, and it also provides custom antenna solutions using MID technology.

MID Solutions GmbH and TEPROSA are some of the emerging companies in the target market.

-

MID Solutions GmbH, a Germany-based company, specializes in the design, development, and production of Molded Interconnect Devices (MIDs). The company focuses on providing innovative and customized MID solutions that integrate mechanical and electronic functions within a single molded component. Their expertise lies in creating complex 3D circuit designs that offer high levels of functionality and reliability for various applications.

Key Molded Interconnect Device Companies:

The following are the leading companies in the molded interconnect device market. These companies collectively hold the largest market share and dictate industry trends.

- TE Connectivity

- KYOCERA AVX Components Corporation

- LPKF

- Molex

- Amphenol Corporation

- Taoglas

- HARTING Technology Group

- Sumitomo Electric Industries, Ltd.

- MID Solutions GmbH

- TEPROSA

Recent Developments

-

In November 2023, Molex expanded its manufacturing footprint by opening a new campus in Katowice, Poland. It features an initial 23,000 square-meter space dedicated to producing advanced medical devices and electric vehicle solutions. With plans to expand it up to 85,000 square meters, this facility will support Molex's growth in Europe. The facility will feature cutting-edge capabilities, such as advanced medical device assembly, drug handling, packaging, and injection molding.

-

In July 2022, TE Connectivity inaugurated a new, larger production facility in Hermosillo, Mexico, to enhance its Data and Devices business unit. This 230,000-square-foot site, replacing a smaller facility from 1996, will support the company's IoT product portfolio, including high-speed communications connectors and cables. It will employ over 1,750 people and benefit from its proximity to TE Connectivity's global logistics center and four other Hermosillo facilities.

Molded Interconnect Device Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.14 billion |

|

Revenue forecast in 2030 |

USD 4.56 billion |

|

Growth rate |

CAGR of 13.5% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Process, product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

TE Connectivity; KYOCERA AVX Components Corporation; LPKF; Molex; Amphenol Corporation; Taoglas; HARTING Technology Group; Sumitomo Electric Industries, Ltd.; MID Solutions GmbH; TEPROSA |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Molded Interconnect Device Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global molded interconnect device market report based on process, product, end-use, and region:

-

Process Outlook (Revenue, USD Million, 2017 - 2030)

-

Laser Direct Structuring (LDS)

-

Two-Shot Molding

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Sensor Housings

-

Antennas

-

Connectors & Switches

-

Lighting

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Automotive

-

Consumer Electronics

-

Telecommunication

-

Aerospace and Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global molded interconnect device market size was estimated at USD 1.91 billion in 2023 and is expected to reach USD 2.14 billion in 2024.

b. The global molded interconnect device market is expected to grow at a compound annual growth rate of 13.5% from 2024 to 2030 to reach USD 4.56 billion by 2030.

b. Asia Pacific dominated the molded interconnect device market with a share of over 34.0% in 2023. This is attributable to the developing technological infrastructure and the growing demand for consumer electronic devices.

b. Some key players operating in the molded interconnect device market include TE Connectivity, KYOCERA AVX Components Corporation, LPKF, Molex, Amphenol Corporation, Taoglas, HARTING Technology Group, Sumitomo Electric Industries, Ltd., MID Solutions GmbH, and TEPROSA.

b. Key factors driving market growth include the trend towards miniaturization of electronic devices and the growing use of electronics in the automotive sector.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."