Molded Fiber Packaging Market Size, Share & Trends Analysis Report By Source (Wood Pulp, Non-Wood Pulp), By Molded Type (Thermoformed, Transfer), By Product, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-457-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Molded Fiber Packaging Market Trends

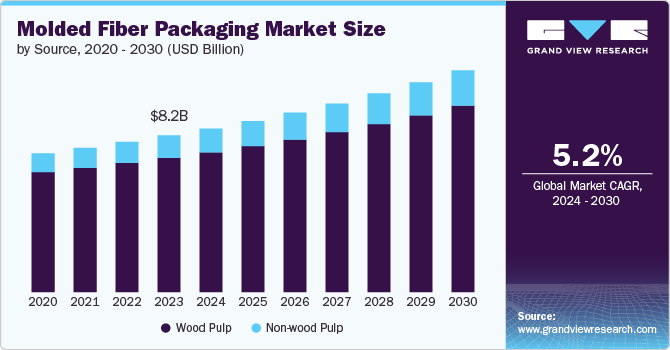

The global molded fiber packaging market size was estimated at USD 8.23 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. Growing consumer-driven demand for sustainable and environmentally- friendly packaging solutions is expected to drive the market growth over the forecast period. Manufacturers are striving to maintain a healthy competitive environment across market space by implementing various strategies.

For instance, in January 2023, Sabert Corporation, a sustainable food packaging manufacturer, announced its commitment to making its product portfolio free from per- and poly-fluoroalkyl substances (PFAS) by the end of 2023. This initiative is in line with the company’s plans to offer such products as packaging options in the event of legislation being planned to prohibit PFAS in food packaging.

Eggs are packaged in molded fiber trays and clamshells, which are then sold to restaurants, food service operators, and individual buyers. In addition, per capita egg consumption is increasing worldwide yearly. Thus, the rising consumption of eggs, owing to the expanding population, associated health benefits, and increasing demand for higher protein intake, is anticipated to drive the demand for molded fiber packaging products, thereby propelling market growth.

The rising consumption of eggs has increased egg production. The graph below represents the total production of eggs in the world in 2020. Eggs are packed in plastic, molded fiber trays, and clamshells, which are then sold to retail chains and food service operators. The U.S., Netherlands, and Turkey are among the top exporters of eggs in the world. Molded fiber packaging can also be used for the storage and transportation of eggs, which is expected to drive the market over the forecast period.

Apart from eggs, fruits such as apples, avocados, guavas, and oranges are packaged in molded fiber packaging products such as trays. Factors such as the growing population, rising disposable income, and the growing trend of a healthy lifestyle are expected to drive the demand for fresh fruits in the coming years, augmenting the demand for molded fiber packaging over the forecast period.

Source Insights

Based on source, the wood pulp segment led the market with the largest revenue share of 85.71% in 2023. Molded fiber packaging manufacturers majorly use waste newspapers for manufacturing fiber. The wide availability of wastepaper and virgin wood can be attributed to the highest share of the segment in 2023.

The non-wood pulp segment is anticipated to grow at the fastest CAGR of 6.9% over the forecast period. Non-wood pulp sources eliminate the need for virgin wood and hence provide complete sustainability, contributing to their growing market penetration rate.

Molded Type Insights

Based on molded type, the transfer molded fiber type segment led the market with the largest revenue share of 57.06% in 2023. The wide-scale adoption of transfer molded fiber products, such as trays and clamshells for eggs and fruit packaging, can be attributed to highest revenue share of the segment in the global market.

The thermoformed molded segment is expected to grow at the fastest CAGR of 6.4% over the forecast period. The segment has been driven by its higher aesthetic appeal, which has been driving considerable traction for the past several years.

Product Insights

The trays segment led the market with the largest revenue share of 41.48% in 2023. Low cost, wide availability, and good shock absorption characteristics for the packaging of fragile products such as eggs and glass beverage bottles contributed to the highest share of the segment.

The clamshells segment is anticipated to grow at the fastest CAGR of 6.2% over the forecast period. The demand for molded fiber clamshells is rapidly increasing due to the high demand for retail egg packaging.

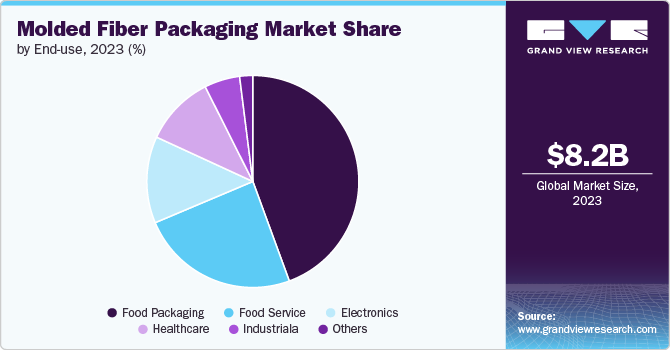

End Use Insights

Based on end use, the food packaging segment led the market with the largest revenue share of 44.41% in 2023. Molded fiber packaging products, such as trays and clamshells used in the food industry, offer cushioning for fragile food items such as fruits and eggs. The molded fiber trays are used for fruit stacking in cardboard boxes. The growing import and export of fruits globally is expected to drive the demand for molded fiber packaging in the food packaging end use industry.

The electronics segment is estimated to grow at the fastest CAGR of 6.5% from 2024 to 2030. The increasing consumption of molded fiber products for the packaging of various electronic products, including mobile phones and their accessories, computers, printers, modems, trimmers, and projectors, due to their convenience, sustainability, and low cost, is contributing to the growth of this segment.

Regional Insights

The molded fiber packaging market in North America is anticipated to grow at the fastest CAGR during the forecast period. Increasing digitization and a focus on reducing the use of plastics, especially in packaged food and the food service industry, are expected to augment the demand for molded fiber packaging. Regulations pertaining to environmental safety and the rising need for easy disposal are expected to drive the demand for bio-based materials in packaging applications, boosting the overall market growth in the coming years.

U.S. Molded Fiber Packaging Market Trends

The molded fiber packaging market in U.S. is expected to grow at a significant CAGR during the forecast period. In November 2021, ProAmpac Intermediate, Inc., the U.S.-based leader in flexible packaging, acquired Irish Flexible Packaging and Fispak from their parent company, IFP Investments Limited. With these acquisitions, ProAmpac advances its strategy to expand in Europe and the United Kingdom by further enhancing its existing product offering with a strong portfolio of sustainability-focused flexible packaging capabilities. Such collaborations and partnerships are expected to drive the demand for molded fiber packaging over the forecast period.

Asia Pacific Molded Fiber Packaging Market Trends

Asia Pacific dominated the molded fiber packaging market with the largest revenue share of 41.70% in 2023. The region is segmented into China, Japan, and India. China accounted for largest market share in 2023 in Asia Pacific region. This is attributed to the large food & beverage industry followed by the electronics market owing to the high population and increasing disposable income of consumers in the country. Moreover, the country is home to several electronic companies such as Huawei Technologies Co., Ltd, Lenovo, Xiaomi, and others which gives rise to demand for molded fiber packaging to store and transport delicate electronic goods.

The molded fiber packaging market in China is the largest food & beverage market in Asia Pacific, with a high consumer spending on eating out. Out of this food service, full-service restaurants accounted for the highest share (around 70%) of sales. The emergence of problems related to the environment and pollution in the country has forced governmental agencies and organizations to strictly adhere to sustainability strategies. This essentially meant to adoption of biodegradable packaging solutions and ban the use of single-use plastic.

Europe Molded Fiber Packaging Market Trends

The molded fiber packaging market in Europe can be attributed to the wide application scope for molded fiber packaging in the food service & packaging industry in Europe. EU had close to one million restaurants and mobile food services in 2022, and the number is expected to increase during the forecast period. With an increasing number of restaurants and other food outlets, the demand for sustainable packaging solutions is also expected to grow. The member countries of the EU maintain stringent regulatory regimes to keep a check on environmental impacts caused by disposal of wastes, mainly plastics.

Europe is a major producer of fiber-based products. According to the Confederation of European Paper Industries (CEPI), 90.58 million tons of paper and board were produced in the region in 2021. This shows the rising demand for fiber-based products in Europe, thereby creating significant market growth.

Key Molded Fiber Packaging Company Insights

The market is highly competitive, with both global and regional companies present. Companies operating in the market offer a wide range of products in a variety of shapes, sizes, and colors. Moreover, they offer custom packaging products to suit customer-specific requirements. Over the last few years, the market has also witnessed several new product launches, divestments, and mergers and acquisitions.

Key Molded Fiber Packaging Companies:

The following are the leading companies in the molded fiber packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Brodrene Hartmann A/S

- Huhtamako Oyj

- CKF Inc

- Thermoform Engineered Quality LLC

- Genpak, LLC

- Eco-Products, Inc.

- Pro-Pac Packaging Limited

- Fabri-Kal

- Hentry Molded Products, Inc.

- Sabert Corporation

Recent Developments

-

On July 03, 2024, Hartmann’s developed new product Plus View, which is used to show coloured and hard-boiled eggs - an egg specialty found mainly in Germany, Austria and Switzerland. Plus View is the only moulded fibre-based egg carton in the world where your eggs are visible from the top and front

-

Om May 05, 2024, Huhtamaki has decided to consolidate its three Flexible Packaging manufacturing sites in the United Arab Emirates, keeping one factory in Jebel Ali and expanding the one in Ras Al Khaimah. The change is part of Huhtamaki’s program to accelerate strategy implementation and is expected to lead to savings of approximately EUR 100 million over the next three years

Molded Fiber Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.60 billion |

|

Revenue forecast in 2030 |

USD 11.66 billion |

|

Growth rate |

CAGR of 5.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in Kilotons; Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Volume Forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, molded type, product, end use, region |

|

Regional Scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Brodrene Hartmann A/S; Huhtamako Oyj; CKF Inc.; Thermoform Engineered Quality LLC; Genpak, LLC; Eco-Products, Inc; Pro-Pac Packaging Limited; Fabri-Kal; Hentry Molded Products, Inc; Sabert Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Global Molded Fiber Packaging Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis on latest industry trends and opportunities in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global molded fiber packaging market report based on source, molded type, product, end use, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wood Pulp

-

Non-wood Pulp

-

-

Molded Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thick Wall

-

Transfer

-

Thermoformed

-

Processed

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Trays

-

End Caps

-

Bowls & Cups

-

Clamshells

-

Plates

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global molded fiber packaging market was estimated at USD 8.23 billion in 2023 and is expected to reach USD 8.60 billion in 2024.

b. The global molded fiber packaging market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030, reaching around USD 11.66 billion by 2030.

b. Asia Pacific accounted for over 41% of the total market share in 2023. This growth in market share can be ascribed to the rising importance of using disposable packaging solutions due to rising instances of environment-related problems faced by economies such as China and India in recent years.

b. Some key players in the molded fiber packaging market include Brodrene Hartmann A/S, Huhtamako Oyj, CKF Inc., Inc., Thermoform Engineered Quality LLC, Genpak, LLC, Eco-Products, Inc., Pro-Pac Packaging Limited, Fabri-Kal, Hentry Molded Products, Inc., and Sabert Corporation.

b. Growing consumer demand for sustainable and environmentally friendly packaging solutions is expected to drive market growth over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."