Mold Release Agent Market Size, Share & Trends Analysis Report By Type (Water-based, Solvent-based), By Application (Die Casting, PU Molding), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-337-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Mold Release Agent Market Size & Trends

The global mold release agent market size was estimated at USD 2.07 billion in 2023 and is projected to grow at a CAGR of 6.2% in terms of revenue from 2024 to 2030. The market has great potential due to the growth of the construction industries, transportation, and manufacturing in emerging economies. The demand for mold release agents is expected to increase as these emerging countries experience rapid growth and modernization.

A mold release agent is a specialized lubricant designed to provide a protective coating on the surface of a mold cavity. The primary purpose of this protective layer is to ensure that the molded part can be easily and efficiently removed from the mold without sticking to it. This facilitates a smooth demolding process and significantly reduces the risk of damaging the mold or the finished product. These products are essential in the manufacturing process. They are meticulously applied to the mold surface before the casting of the substrate, ensuring a seamless and efficient production cycle.

Drivers, Opportunities & Restraints

The mold release agent market is driven by the growth and expansion of personal care and cosmetics, paints and coatings and other industries. Technological advancements also help improve the efficiency and effectiveness of product market, increasing demand from end-use industries such as automotive, construction, and manufacturing for high-quality finished products, and stringent environmental regulations that push for the development and use of eco-friendly, non-toxic release agents.

Rising concerns over the environmental impact and health hazards associated with specific chemical-based release agents, leading to strict regulatory constraints and the need for compliance. The product also uses fluorocarbons as one the type, has been banned in many countries due to its threat for the environment. Technological limitations in developing countries, cost constraints for small and medium-sized enterprises in adopting advanced agents, and the availability of substitutes that might reduce dependency on traditional product market also act as market restraints.

The rising emphasis on sustainable and green manufacturing processes opens avenues for developing and adopting bio-based and environmentally friendly product market release agents. Innovations leading to the production of more efficient, cost-effective, and versatile release agents can tap into new application sectors. Additionally, expanding end-user industries in rapidly growing economies presents significant market opportunities for product market increased use and demand.

Type Insights & Trends

“Water-based emerged as the fastest growing application with a CAGR of 6.5%”

Water-based application segment dominated the market and accounted for a revenue share of 52.8% in 2023. A water-based product is a lubricating solution used in molding to ensure easy removal of the molded part from its mold without causing any damage. Unlike oil-based counterparts, this agent relies on water as the primary solvent, making it more environmentally friendly and safer for use in various industries, including food packaging, medical supplies, and automotive parts. It effectively prevents the adhesion of the molding material to the mold surface, enhancing the quality of the final product and prolonging the lifespan of the mold by reducing wear and tear. Moreover, cleaning off the finished product and mold is generally easier, supporting faster production cycles and reducing the need for harsh cleaning type.

A solvent-based product is a chemical used in manufacturing and molding industries to prevent materials from sticking to molds during fabrication. It creates a thin barrier between the surface and the material being molded, thus facilitating the easy removal of the finished product without causing damage or deformation. Solvent-based agents typically dry quickly due to the rapid evaporation of the solvent, offering a significant advantage in fast-paced production environments. However, their use requires proper ventilation due to potential health and safety risks associated with solvent vapors. These release agents are crucial for achieving high-quality finishes and extending the lifespan of molds in various industrial applications.

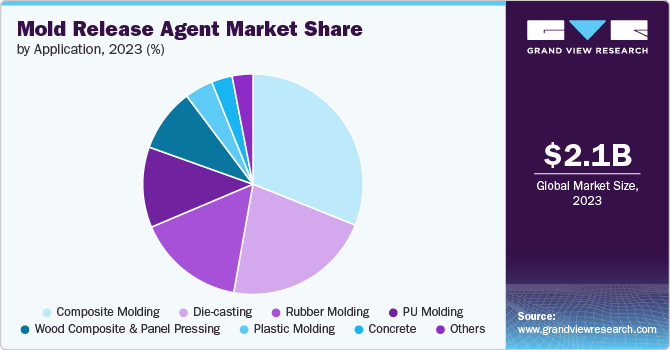

Application Insights & Trends

“Die-casting emerged as the fastest growing application with a CAGR of 6.6%”

Composite-molding application segment dominated the market and accounted for a revenue share of 31.07% in 2023. In composite molding, the product market is essential for efficiently separating the finished product from the mold. These agents are a barrier to prevent the composite material from sticking to the mold, ensuring a smooth demolding process. Manufacturers can preserve the integrity and surface finish of the molded part, reducing the risk of defects. Also, mold release agents help prolong the mold's lifespan by minimizing wear and tear. Various mold release agents are available, including water- and solvent-based formulations, each suited to different molding processes and materials.

The product market is crucial in die casting for ensuring the smooth separation of the casting from the mold. This agent acts as a lubricant to prevent the molten metal from sticking to the walls of the mold, which could otherwise damage both the cast product and the mold itself. Its application is carefully controlled to ensure uniform coating, improve surface finish, and prolong the life of the mold. Different formulations are available, tailored to various casting metals and processes, enhancing efficiency and product quality in the die-casting industry.

Regional Insights

The market in North America is expected to be driven by increasing manufacturing production in the region. Rising automotive, aerospace and defense sectors, and construction fuels the market. The growth in the manufacturing industry has resulted in growing demand for the product market in the region.

Asia Pacific Mold Release Agent Market Trends

“India emerged as the fastest growing market in Asia-Pacific with a CAGR of 6.6% from 2024-2030”

Asia Pacific dominated the market and accounted for a 46.72% share in 2023. The region's leading position is attributed to the rising automotive sector in Asia-pacific and due to the rising manufacturing plants in the region which are expected to drive the market. Additionally, the availability of land, low raw material, and labor costs, along with a favorable government outlook, are key factors associated with high production volumes of mold release agent in countries such as China, India.

China is a key player in the global market, with a significant influence on market dynamics. The country's dominance is attributed to its high production capacity, low labor costs, and availability of raw materials, driving the market's competitive pricing and high production volumes. The demand in China is mainly driven by rising manufacturing plants, and automotive in the country. Moreover, the low labor cost has also resulted in the rising of manufacturing plants in the country.

Europe Mold Release Agent Market Trends

Europe plays a significant role in the market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the demand from the automotive industry, industrial automation, and aerospace & defense sector. Additionally, Europe is also seeing a rise in manufacturing projects leading to rise in demand for mold release agent.

Key Mold Release Agent Company Insights

Some of the key players operating in the market include

-

Dow is a manufacturing company operational in more than 31 countries through its 104 manufacturing sites. The company has a wide product portfolio comprising of industrial solutions, plastics, coatings & silicones businesses delivering to vast end-user industries like infrastructure, packaging, consumer goods, and automotive, among others.

-

Daikin Industries, Ltd. offers mold release agent, air-conditioning systems, room heating and heat pump hot water supply systems, room air conditioning systems, packaged air-conditioning systems, and air conditioning systems for plants, facilities, and office buildings. It also provides low and medium air conditioning systems, water chillers, air purifiers, humidity-adjusting air processing units, marine-type container refrigeration systems, and air handling units. The company’s chemical products include fluoroplastics, fluorocarbons, fluorinated oils, mold release agents, water and oil-repellent products, dry air suppliers, and semiconductor etching products.

Huntsman Corporation and Dow are some of the emerging market participants in the global market.

-

LANXESS AG is a German specialty chemicals company, via the spin-off of the chemicals division and parts of the polymers business from Bayer AG. The company has a presence in 32 countries. The company operates through three segments namely, Advanced Industrial Intermediates, Specialty Additives and Consumer Protection.

-

Henkel AG & Co. KGaA is a multinational company that operates in various industries including mold release agents, adhesives, sealants, surface treatments, and other industrial chemicals. The company is known for its well-known brands such as Loctite, Bonderite, Teroson, Technomelt, Aquence, and Schwarzkopf. The company holds leading positions in both industrial and consumer businesses, offering a diverse portfolio that includes hair care products, laundry detergents, fabric softeners, adhesives, sealants and functional coatings.

Key Mold Release Agent Companies:

The following are the leading companies in the mold release agent market. These companies collectively hold the largest market share and dictate industry trends.

- Daikin Industries Ltd.

- Dow

- Henkel AG

- Lanxess AG

- Freudenberg SE

- Shin-Etsu Chemical Co., Ltd.

- Michelman Inc.

- Marbocote Ltd.

- McGee Industries Ltd.

- Miller-Stephenson Inc.

Recent Developments

-

In February 2024, Lanxess India announced the completion of the expansion of the Rhenodiv production plant at the Jhagadia site. The company’s Rhein Chemie business unit has increased production to meet the growing demand in the Asian and Indian Subcontinent tire and rubber goods markets. Rhenodiv release agents are solvent-free, water-based, and free of volatile organic compounds (VOCs), making them environmentally friendly.

-

In November 2023, Chem-Trend announced the launch of a new brand of mold release aimed at global manufacturers. This latest addition to their brand comes from acquiring the Mavcoat brand of mold release products from Maverix Solutions, Inc., facilitated by Global Capital Markets, Inc. These products are mainly developed and distributed in the U.S. They are renowned for their strong performance in challenging molding applications in rubber, polyurethane, advanced composites, rotational molding, and thermoplastics processing industries.

Mold Release Agent Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.20 billion |

|

Revenue forecast in 2030 |

USD 3.15 billion |

|

Growth Rate |

CAGR of 6.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa. |

|

Key companies profiled |

Daikin Industries Ltd.; Dow; Henkel AG; Lanxess AG; Freudenberg SE; Shin-Etsu Chemical Co., Ltd.; Michelman Inc.; Marbocote Ltd.; McGee Industries Ltd.; Miller-Stephenson Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Mold Release Agent Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mold release agent market report based on type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-based

-

Solvent-based

-

Other Types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Die Casting

-

PU Molding

-

Rubber Molding

-

Composite Molding

-

Plastic Molding

-

Wood Composite & Panel Pressing

-

Concrete

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mold release agent market size was estimated at USD 2.07 billion in 2023 and is expected to reach USD 2.20 billion in 2030.

b. The global mold release agent market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 3.15 billion by 2030.

b. Asia Pacific dominated the mold release agent market with a share of 46.7% in 2023. This is attributable to rise in automotive industry and manufacturing plants in the emerging economies like China, India, Japan.

b. Some key players operating in mold release agent market include Daikin Industries Ltd; Dow; Henkel AG; Lanxess AG; Freudenberg SE; Shin-Etsu Chemical Co., Ltd.; Michelman Inc.; Marbocote Ltd.; McGee Industries Ltd.; and Miller-Stephenson Inc.

b. Key factors that are driving the market growth include increase in manufacturing plants, automotive industry, and aerospace & defense sector across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."