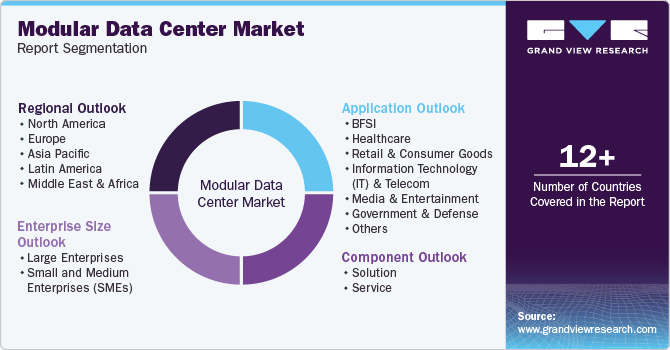

Modular Data Center Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Enterprise Size (Large Enterprises, Small And Medium Enterprises), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-004-7

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Modular Data Center Market Size & Trends

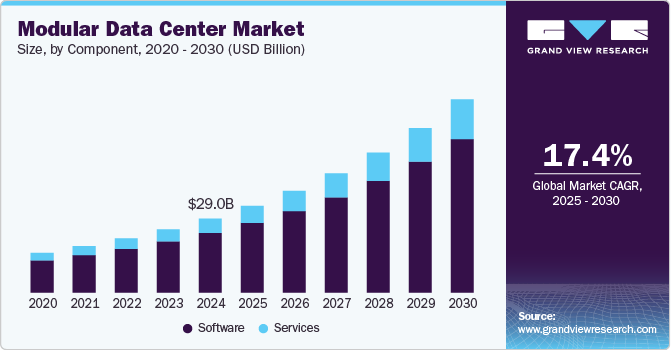

The global modular data center market size was valued at USD 29.04 billion in 2024 and is anticipated to grow at a CAGR of 17.4% from 2025 to 2030. The industry is primarily driven by the increasing demand for scalable and energy-efficient data center solutions to address the rapid growth in data generation and processing requirements. Organizations are seeking flexible and cost-effective alternatives to traditional data centers, and modular data centers provide a compelling solution through their prefabricated, pre-engineered components that enable quick deployment and reduced construction time. The rising adoption of cloud computing, edge computing, and IoT technologies further fuels the demand, as these applications require decentralized and easily expandable infrastructure.

Additionally, the growing focus on sustainability and reducing carbon footprints has highlighted the energy efficiency and reduced operational costs associated with modular designs. Enhanced reliability, ease of maintenance, and the ability to operate in challenging environments also make modular data centers an attractive choice for industries such as telecommunications, IT, healthcare, and government.

Energy efficiency is another critical factor propelling the adoption of modular data centers. Organizations are under increasing pressure to reduce operational costs and adhere to stringent environmental regulations. Modular data centers are designed with advanced cooling technologies, optimized airflow management, and energy-efficient components, which collectively contribute to lower power consumption and a reduced carbon footprint compared to traditional facilities.

The rapid deployment capabilities of modular data centers further enhance their appeal. Traditional data center construction can take several months or even years, while modular units can be deployed in a matter of weeks. This speed is particularly advantageous for businesses seeking to meet urgent infrastructure needs, as well as for disaster recovery and remote site applications where time-sensitive deployment is critical.

The growing prevalence of cloud computing, edge computing, and the Internet of Things (IoT) has also fueled the demand for modular data centers. These technologies often require decentralized infrastructure to process and store data closer to the source. Modular data centers, with their compact and versatile designs, are well-suited to support edge computing and other applications that prioritize low latency and localized processing.

Sustainability concerns are driving organizations to adopt greener practices, further bolstering the modular data center market. By reducing energy consumption and leveraging renewable energy sources, modular data centers align with corporate social responsibility goals and environmental commitments. Additionally, the reduced construction waste and smaller physical footprint of modular data centers contribute to their eco-friendly profile.

Industry-specific demands play a pivotal role in the market's growth. Sectors such as telecommunications, healthcare, government, and IT services require reliable and easily maintainable infrastructure in diverse and often challenging environments. Modular data centers are designed to meet these needs with high reliability, standardized components, and the ability to withstand harsh conditions, making them an attractive solution for a wide range of applications.

Component Insights

The solution segment accounted for the largest market share of over 80% in 2024 due to its comprehensive and ready-to-deploy offerings, including prefabricated modules with integrated power, cooling, and IT infrastructure. These solutions provide businesses with a one-stop approach to quickly addressing their data center needs, eliminating the complexities of designing and assembling components from multiple vendors. Customizing modular data center solutions to meet specific operational and environmental requirements further enhances their appeal. Additionally, the increasing adoption of turnkey modular solutions by enterprises seeking reliability, scalability, and operational efficiency reinforces the dominance of the solution segment in the market.

The service segment is expected to grow at the fastest CAGR during the forecast period as organizations increasingly rely on professional expertise to support the deployment, operation, and maintenance of modular data centers. Services such as consulting, system integration, installation, and ongoing maintenance are critical to ensuring that modular data centers function optimally and align with business objectives. The growing complexity of IT environments, coupled with advancements in modular technology, has heightened the need for specialized knowledge and tailored service offerings. Moreover, as businesses prioritize scalability and operational continuity, the demand for managed and support services is surging, driving the rapid growth of the services segment in the modular data center market.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share in 2024. The large enterprise segment dominates the modular data center market because these organizations have significant data processing needs, larger IT budgets, and the capacity to invest in advanced infrastructure. Large enterprises often deal with complex operations, high volumes of data, and a need for reliable and scalable solutions to support global operations. Modular data centers offer them the ability to enhance their existing infrastructure efficiently, meet sustainability goals, and rapidly deploy additional capacity in response to growing business demands. Moreover, the criticality of minimizing downtime and ensuring operational continuity makes modular data centers an attractive choice for large enterprises that prioritize performance and reliability.

The small & medium enterprise (SME) segment is expected to grow at the fastest rate during the forecast period owing to the increasing affordability and accessibility of modular solutions. SMEs recognize modular data centers' value as cost-effective, scalable options that eliminate the need for large upfront capital investments. With the growth of cloud computing, IoT, and edge computing, SMEs are adopting modular data centers to handle localized data processing and storage while maintaining flexibility for future expansion. Additionally, modular data centers enable SMEs to compete with larger organizations by providing access to high-performance infrastructure that can be deployed quickly and tailored to their business needs. This combination of affordability, flexibility, and scalability drives rapid adoption among SMEs.

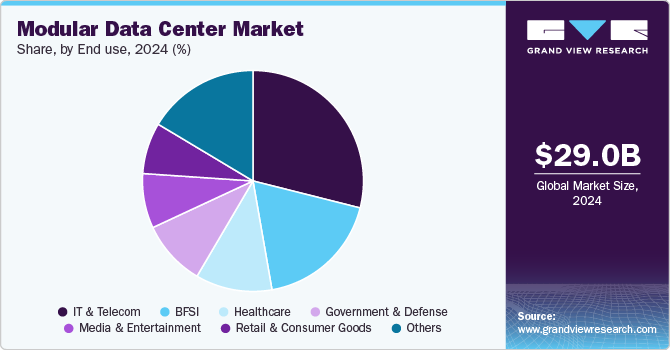

End Use Insights

The IT & telecom end use segment accounted for the largest market share in 2024 due to its reliance on robust, scalable, and reliable infrastructure to support massive data processing and storage requirements. IT and telecom companies are at the forefront of digital transformation, managing vast networks, cloud services, and extensive data traffic. Modular data centers offer these organizations the flexibility to expand rapidly, deploy in diverse geographic locations, and maintain high operational efficiency. Additionally, with the proliferation of 5G networks and the rising demand for edge computing, IT and telecom companies increasingly turn to modular solutions to ensure low latency, seamless connectivity, and superior performance.

The healthcare segment is expected to grow at a significant rate during the forecast period, driven by the rapid digitization of healthcare services and the adoption of technologies such as electronic health records (EHRs), telemedicine, and artificial intelligence. These advancements require secure, scalable, and efficient data processing and storage solutions to handle sensitive patient information and real-time analytics. Modular data centers provide healthcare organizations with the flexibility to deploy infrastructure quickly, even in remote or disaster-prone areas, ensuring uninterrupted access to critical systems. Furthermore, the growing emphasis on data privacy and regulatory compliance in the healthcare sector underscores the need for advanced modular solutions, contributing to the segment's accelerated growth.

Regional Insights

North America modular data center industry held the major share of 41.0% in 2024. The modular data center industry in North America is driven by the increasing adoption of edge computing and 5G technology and a strong focus on energy-efficient infrastructure. The need for scalable solutions to support cloud services and IoT growth has further accelerated the market. Additionally, stringent data security and environmental sustainability regulations influence investments in modular solutions.

U.S. Modular Data Center Market Trends

The modular data center industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. leads the modular data center market due to the presence of major cloud service providers, hyperscale data center operators, and a robust IT infrastructure. Demand for quick deployment of data centers to support AI, machine learning, and digital transformation initiatives is a prominent trend. Rising concerns about energy efficiency and carbon emissions are also shaping the market.

Europe Modular Data Center Market Trends

The modular data center industry in Europe is expected to grow significantly at a CAGR of over 16% from 2025 to 2030. Europe's modular data center industry is experiencing steady growth, driven by the region's emphasis on sustainability, data sovereignty, and digital transformation. The European Union's stringent energy efficiency and carbon emissions regulations have accelerated the adoption of energy-efficient modular solutions. Additionally, the growing use of hybrid cloud environments and the need for edge computing to support IoT and 5G deployments are key regional trends.

The U.K. modular data center industry is expected to grow rapidly in the coming years. In the U.K., the modular data center industry benefits from increasing adoption in government and financial sectors, driven by data sovereignty regulations such as GDPR. The growth of hybrid cloud environments and the emphasis on quick deployment in urban areas contribute to market expansion. Sustainability and green energy integration remain key trends.

The modular data center industry in Germany held a substantial market share in 2024. Germany's modular data center market is fueled by its position as a central hub for European data traffic and cloud services. Demand for energy-efficient and scalable solutions is high, driven by stringent environmental regulations and the adoption of Industry 4.0 technologies. The industrial and automotive sectors also increasingly rely on modular data centers.

Asia Pacific Modular Data Center Market Trends

The modular data center industry in Asia Pacific is expected to grow significantly at a CAGR of over 18% from 2025 to 2030. The Asia Pacific region is experiencing significant growth due to rapid digitalization, cloud adoption, and the rise of smart cities. Modular data centers are gaining traction in emerging economies to meet the demands of growing IT and telecom sectors. Scalability and low-cost deployment options make them particularly attractive for regional businesses.

China modular data center industry held a substantial share in 2024. China's modular data center market is driven by extensive investments in digital infrastructure, fueled by government initiatives like the New Infrastructure Plan. The rapid expansion of 5G networks, cloud computing, and e-commerce creates a high demand for scalable and efficient data center solutions.

The modular data center industry in Japan held a substantial share in 2024. Japan's market is shaped by the adoption of advanced technologies such as IoT, AI, and 5G, which drive demand for localized data processing. The emphasis on disaster-resilient infrastructure and energy-efficient solutions also contributes to the country's adoption of modular data centers.

India modular data center industry is expanding rapidly due to increasing data consumption, cloud adoption, and favorable government policies like the Digital India initiative. Modular solutions are preferred for their cost-effectiveness, ease of deployment, and ability to address the growing demand for edge computing in rural and urban areas.

Key Modular Data Center Company Insights

Key players operating in the modular data center market include Cannon Technologies Ltd., Dell Inc., Eaton, Hewlett Packard Enterprise Development LP., Huawei Technologies Co., Ltd., IE Corp., PCX Holding LLC, Rittal GmbH & Co. KG, Schneider Electric, and Vertiv Group Corp. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

With the growing demand for AI-ready data center capacity surpassing supply, developers and operators are prioritizing the swift deployment of new infrastructure. In response to this need, Vertiv, a global company in critical digital infrastructure and continuity solutions, has introduced the Vertiv MegaMod CoolChip, a prefabricated modular (PFM) data center solution equipped with liquid cooling technology. This innovative solution is designed to support the platforms of leading AI computing providers and can be scaled to meet specific customer requirements. By combining the precision and efficiency of offsite fabrication with advanced AI-ready technologies, the MegaMod CoolChip significantly accelerates deployment timelines, reducing the time required to establish AI-critical digital infrastructure by up to 50%.

-

In March 2024, Eaton announced the North American launch of its innovative SmartRack modular data center solution. This new offering is designed to help organizations rapidly address the increasing demands of machine learning, edge computing, and artificial intelligence (AI). The SmartRack modular data centers are engineered for swift deployment, with installation possible within days, making them ideal for manufacturing facilities, enterprise and colocation data centers, and warehouses. The SmartRack solution integrates IT racks, cooling systems, and service enclosures to create a performance-optimized modular data center capable of supporting critical IT equipment with loads of up to 150 kW. Featuring durable and easily transportable modular enclosures, these data centers can be quickly sized, configured, commissioned, and deployed to meet various operational requirements.

Key Modular Data Center Companies:

The following are the leading companies in the modular data center market. These companies collectively hold the largest market share and dictate industry trends.

- Cannon Technologies Ltd.

- Dell Inc.

- Eaton

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IE Corp.

- PCX Holding LLC

- Rittal GmbH & Co. KG

- Schneider Electric

- Vertiv Group Corp.

Modular Data Center Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 34.00 billion |

|

Revenue forecast in 2030 |

USD 75.77 billion |

|

Growth rate |

CAGR of 17.4% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, enterprise size, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa |

|

Key companies profiled |

Cannon Technologies Ltd., Dell Inc., Eaton, Hewlett Packard Enterprise Development LP., Huawei Technologies Co., Ltd., IE Corp., PCX Holding LLC, Rittal GmbH & Co. KG, Schneider Electric, and Vertiv Group Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Modular Data Center Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global modular data center market report based on component, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

All-in-One Modules

-

Individual Modules

-

IT

-

Power

-

Cooling

-

-

-

Service

-

Design & Consulting

-

Integration & Deployment

-

Maintenance & Support

-

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail & Consumer Goods

-

Information Technology (IT) & Telecom

-

Media & Entertainment

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global modular data center market size was estimated at USD 29.04 billion in 2024 and is expected to reach USD 34.00 billion in 2025

b. The global modular data center market is expected to grow at a compound annual growth rate of 17.4% from 2025 to 2030 to reach USD 75.77 billion by 2030

b. The North America dominated the modular data center market with a share of 41% in 2024. The modular data center industry in North America is driven by the increasing adoption of edge computing and 5G technology and a strong focus on energy-efficient infrastructure. The need for scalable solutions to support cloud services and IoT growth has further accelerated the market. Additionally, stringent data security and environmental sustainability regulations influence investments in modular solutions.

b. Some key players operating in the modular data center market include Cannon Technologies Ltd., Dell Inc., Eaton, Hewlett Packard Enterprise Development LP., Huawei Technologies Co., Ltd., IE Corp., PCX Holding LLC, Rittal GmbH & Co. KG, Schneider Electric, and Vertiv Group Corp.

b. The modular data center market is primarily driven by the increasing demand for scalable and energy-efficient data center solutions to address the rapid growth in data generation and processing requirements. Organizations are seeking flexible and cost-effective alternatives to traditional data centers, and modular data centers provide a compelling solution through their prefabricated, pre-engineered components that enable quick deployment and reduced construction time.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."