- Home

- »

- Automotive & Transportation

- »

-

Mobility As A Service Market Size, Industry Report, 2033GVR Report cover

![Mobility As A Service Market Size, Share & Trends Report]()

Mobility As A Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution, By Service, By Transportation Type, By Propulsion Type, By Payment Type, By Operating System, By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-114-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobility As A Service Market Summary

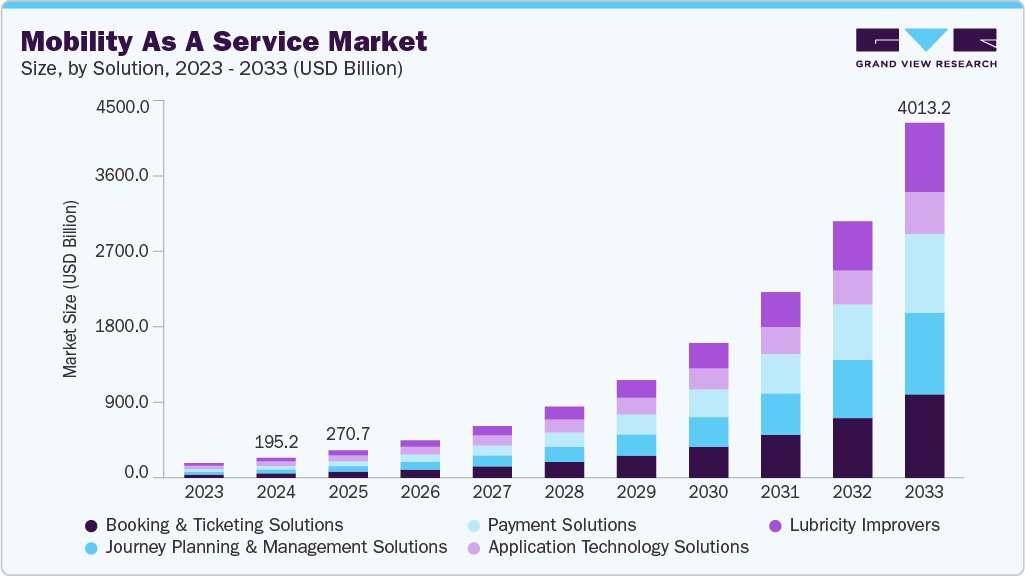

The global mobility as a service market size was estimated at USD 195.2 billion in 2024, and is projected to reach USD 4,013.2 billion by 2033, growing at a CAGR of 40.1% from 2025 to 2033. The vehicle subscription model expedites the adoption of mobility as a service by providing a flexible and comprehensive transportation solution.

Key Market Trends & Insights

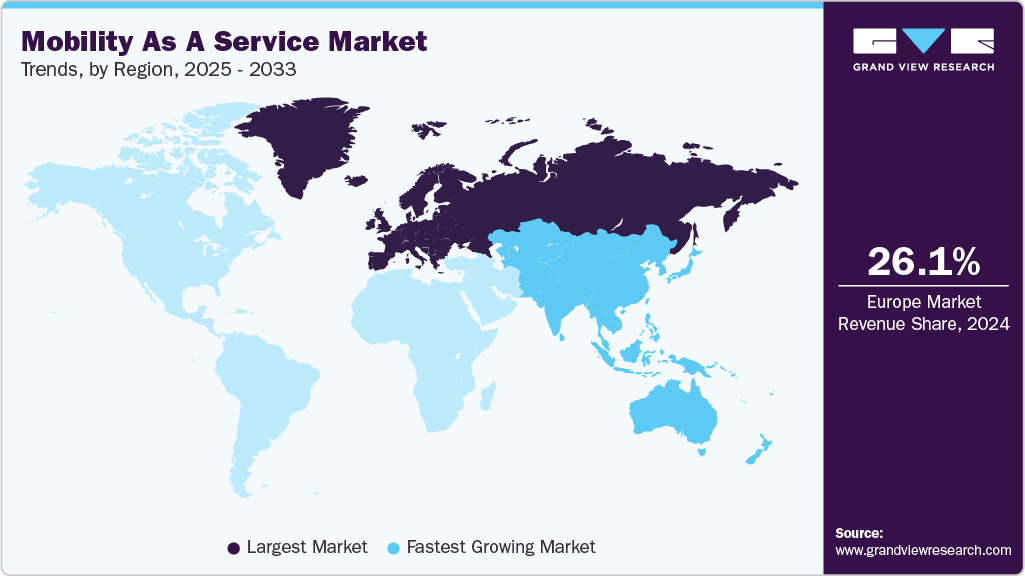

- Europe mobility as a service market accounted for a 26.1% share of the overall market in 2024.

- Germany's MaaS market is driven by urban congestion, government-backed multimodal transport, and rising demand for sustainable app-based mobility.

- By transportation type, the public transportation segment accounted for the largest share of 57.3% in 2024.

- By solutions, the application technology solutions segment dominated the market in 2024 and accounted for more than 23.2%.

- By services, the ride-hailing services segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 195.2 Billion

- 2033 Projected Market Size: USD 4,013.2 Billion

- CAGR (2025-2033): 40.1%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Subscribers have on-demand access to book private vehicles, such as cars and bikes, and even public modes of transport, like buses and trains. Moreover, a cost-effective and convenient transit approach prompts users to embrace mobility as a service platform for transportation services. Through subscription services, mobility as a service platform streamlines vehicle access, thus driving the transition to more integrated and eco-friendly urban mobility solutions. Due to increasing migration to urban areas, the demand for upgraded transportation infrastructure plays a vital role in driving the adoption of mobility as a service. Digital applications that provide travel planning, booking, and payment features facilitate mobility as a service.

Furthermore, the ability of mobility as a service platform to furnish real-time updates on routes, timetables, delays, and the availability of diverse transportation options contributes significantly to user convenience. In addition, mobility as a service incorporates advanced payment and ticketing systems, allowing users to conveniently pay for various modes of transportation within a unified platform. Modernized infrastructure supports contactless payment methods, Quick Response (QR) codes, and digital tickets, ensuring users a seamless payment experience.

Technological advancements are pivotal in propelling the adoption of mobility as a service for entities like travel agencies and municipalities. Integrating mobility as a service into their services allows travel agencies to enhance operational efficiency and provide customers with multimodal options, ultimately bolstering customer satisfaction and loyalty. Meanwhile, municipalities can leverage data-driven insights from mobility as a service platform, optimizing transportation infrastructure and reducing traffic congestion. Data insights also help municipalities improve resource allocation by enabling a better understanding of peak travel times and frequently used routes, leading to more effective management of public transportation and traffic signals during periods of high demand.

Moreover, the increasing adoption of mobility as a service within smart urban environments is anticipated to fuel market expansion. Smart cities utilize mobile applications and internet-connected devices to establish a connected transportation ecosystem. By embracing digital technology solutions such as mobility as a service, smart cities have the potential to create a more streamlined and readily accessible transportation network. For example, real-time data analysis can be harnessed to provide tailored travel recommendations and route planning functionalities, aiding users in pinpointing the most efficient and economical paths to their intended destinations.

Implementing mobility as a service is complex and is anticipated to challenge market growth over the forecast period. Mobility as a service often involves coordination among multiple service providers and regulatory authorities, leading to complexities in ensuring compliance with various rules and regulations. Moreover, collecting and sharing user data for mobility as a service raises concerns about privacy and security. Striking a balance between providing personalized services and safeguarding user information is critical; however, rising collaborations between government transportation providers and mobility as a service companies will gradually instill consumer confidence.

Solution Insights

The application technology solutions segment dominated the market in 2024 and accounted for more than 23.2% of the global revenue share. This growth is primarily due to mobility as a service application encompassing a range of technology solutions designed to facilitate seamless integration of transportation modes and services. For instance, Application Programming Interfaces (APIs) foster connections among diverse transportation providers, facilitating data sharing and seamless integration of services within the mobility as a service framework. In addition, cloud-based platforms effectively manage the substantial data generated by mobility as a service applications, ensuring scalability and robust data security measures.

The payment solutions segment is anticipated to grow significantly over the forecast period. Users can make payments directly within the mobility as a service application, removing the necessity to switch between diverse platforms for different transportation services. Mobility as a service payment solution is designed to include multi-currency support, ensuring compatibility with tourists and travelers from various regions. Moreover, MaaSpayment solutions are bundling transportation services into packages, offering users more value by combining different modes of travel at a discounted rate, which is expected to bode well for the segment’s growth.

Service Insights

The ride-hailing services segment accounted for the largest share in 2024. Ride-hailing services help cater to the rising demand for transportation services, providing users with an option for last-mile connectivity. Ride-hailing services provide users the freedom to determine their travel time, route, and the type of vehicle they prefer. By integrating ride-hailing services, mobility as a service platform offers users a complete range of transportation options, ensuring they can choose the most suitable mode for their needs within a single application.

The ride-sharing services segment is anticipated to grow significantly over the forecast period. By optimizing vehicle occupancy, ride-sharing services reduce the number of single-occupancy vehicles on the road, contributing to reduced carbon emissions. Established ride-sharing companies like UBER TECHNOLOGIES, INC. and Lyft, Inc. have strong brand recognition, making it easier for them to introduce and gain trust for such shared services. Moreover, ride-sharing is cost-effective for users, a factor further expected to drive the segment’s growth over the forecast period.

Transportation Type Insights

The public transportation segment accounted for the largest share in 2024. Mobility as a service presents substantial advantages for public transportation. Mobility as a service solution enhances operational efficiency by offering data-driven insights into data regarding user preferences, travel patterns, and demand, allowing for better resource allocation and route optimization. Mobility as a service can boost ridership by simplifying the user experience, offering seamless multi-modal options, and increasing the appeal of public transportation.

The private transportation segment is anticipated to grow significantly over the forecast period. Private vehicle booking through mobility as a service allows users to access on-demand transportation while maintaining the convenience and familiarity of their vehicles. Mobility as a service users can opt for private vehicle bookings to address specific travel needs, such as reaching destinations not well-served by public transit. Moreover, the youth may prefer private transportation, further driving the segment’s growth.

Propulsion Type Insights

The Internal Combustion Engine (ICE) vehicle segment accounted for the largest share in 2024. With varying demand for transportation services, ICE vehicles might be used to meet fluctuations in demand when electric vehicles are limited. This occurrence is predominantly true for developing economies with large populations earning below median wages. Mobility, as a service provider with mixed fleets, could include ICE vehicles as an option until the use of electric vehicles becomes full-fledged.

The electric vehicle (EV) segment is anticipated to grow significantly during the forecast period. The segment’s growth can be attributed to the growing need for sustainable and eco-friendly transportation. Mobility, as a service provider that adds EVs as mobility options to its offerings, augments well with environmentally conscious consumers and comes across as a responsible entity. Moreover, EVs have lower fuel and maintenance costs than traditional internal combustion engine vehicles, making them cost-effective for transportation services.

Payment Type Insights

The on-demand segment accounted for the largest share in 2024. The increasing adoption of on-demand mobility as a service is driven by its capacity to meet city residents' convenience, flexibility, and immediate transportation access needs. On-demand mobility as a service seamlessly combines ride-hailing, bike-sharing, scooter-sharing, and similar services, offering users transportation alternatives at their fingertips. Furthermore, the surge of smartphone applications further amplifies the popularity of on-demand mobility as a service, transforming urban mobility and reshaping urban transportation patterns.

The subscription-based segment is anticipated to register significant growth over the forecast period. Subscription-based mobility as a service allows users to consolidate diverse transportation modes such as public transit, ride-sharing, and car rentals into a monthly payment. The subscription model is attractive to commuters who value predictable expenses, minimized administrative tasks, and the versatility to utilize various modes without needing separate transactions. Through subscription-based mobility as a service, users gain an integrated travel journey, the ability to access various modes at a predetermined rate, and the opportunity for cost efficiencies compared to individualized payments.

Operating System Insights

The Android segment accounted for the largest share in 2024. Android users’ rising adoption of mobility as a service is propelled by its ease of use and smooth integration with the Android platform. Mobility as a service application customized for Android devices delivers a user-friendly experience, leveraging the extensive popularity of Android smartphones. Furthermore, the growing user base in emerging markets contributes to segment growth.

The iOS segment is anticipated to register significant growth over the forecast period. Mobility as a service application for iOS devices provides users with an intuitive and user-friendly experience, capitalizing on the widespread adoption of iOS devices such as iPhones and iPads. This trend also reflects the preference of iOS users for streamlined travel planning, booking, and payment functionalities, contributing to the growing popularity of mobility as a service solution within the iOS ecosystem. As mobility as a service applications continue to evolve on the iOS platform, they play a significant role in shaping the future of urban mobility, enhancing convenience, and redefining transportation services.

Application Insights

The Business-to-Consumer (B2C) segment accounted for the largest share in 2024. Business-to-consumer (B2C) mobility as a service refers to providing comprehensive transportation solutions directly to individual consumers by service providers. The segment’s growth can be attributed to the ease and convenience of mobility services over self-driving. Moreover, in densely populated cities, mobility services provide a solution to limited parking spaces, making it easier for users to access transportation without worrying about limited parking.

The Business-to-Business (B2B) segment is projected to experience notable expansion throughout the forecast period. The requirement for streamlined and effective transportation alternatives for corporations and institutions propels the surge in demand for B2B mobility solutions. Enterprises are pursuing efficient travel options that optimize workforce productivity during business trips. Mobility as a service delivers a streamlined gateway to diverse transportation modes, enabling travelers to utilize their time fully.

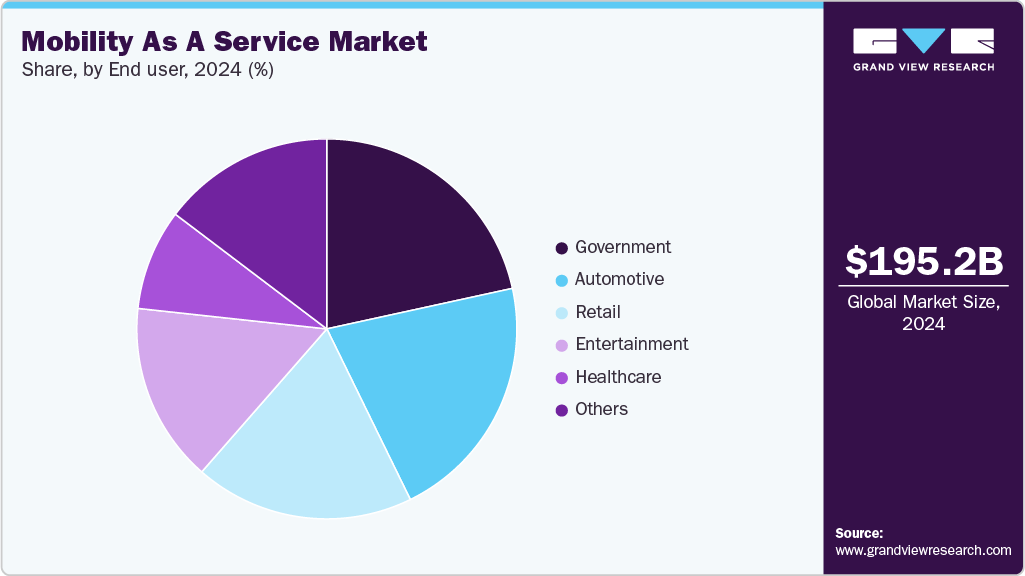

End User Insights

The automotive segment accounted for the largest share in 2024. Automakers are recognizing the evolving preferences of consumers who value access over ownership and seek integrated transportation experiences. Mobility as a service offering in the automotive sector provides users with various services, from ride-sharing and one-day rentals to public transit and micro-mobility options. Through mobility as a service, automotive companies can position themselves as providers of holistic mobility solutions.

The government segment is anticipated to register significant growth over the forecast period. Governments utilize mobility as a service as a strategic tool to enhance urban mobility, address transportation challenges, and improve citizens' overall quality of life. Governments partner with mobility as a service providers to integrate various transport modes and offer citizens a comprehensive travel experience. Moreover, mobility as a service solution can be tailored to cater to the needs of citizens with disabilities, ensuring proper access to optimal transport.

Regional Insights

The Europe mobility as a service market accounted for 26.1% of the global share in 2024. Europe's strong emphasis on sustainability is a major factor contributing to growth. Integrating electric vehicles, bike-sharing, and public transit options on mobility as a service platform aligns with the commitment to reducing emissions and promoting eco-friendly transportation. Moreover, the regulatory framework is well-defined and supportive of emerging technologies. Regulations encourage open data sharing, fair competition, and public transportation integration, which drives European market strength.

Germany Mobility As A Service Market Trends

The mobility-as-a-service (MaaS) market in Germany is being shaped by increasing urban congestion, strong government support for multimodal transport integration, and growing consumer demand for sustainable, app-based mobility solutions. Public transport authorities collaborate with private MaaS providers to digitize ticketing and unify access to buses, trains, bike-sharing, and e-scooters under a single platform. This trend is further supported by investments in smart mobility infrastructure and EU-backed initiatives promoting carbon-neutral transportation across major German cities.

The UK mobility as a service market is witnessing steady growth, driven by the rise of local government-led smart city programs, increased integration of contactless payment systems, and a growing shift toward subscription-based urban mobility. Transport for London (TfL) and regional authorities are piloting digital mobility hubs that consolidate public and private transport modes into unified platforms. The rise of mobility credit schemes to replace personal vehicle ownership also promotes MaaS adoption in suburban and semi-urban areas.

Asia Pacific Mobility As A Service Market Industry Trends

The mobility as a service market in Asia Pacific is anticipated to emerge as the fastest-growing regional market from 2025 to 2033. Asia Pacific has a tech-savvy population that readily adopts new digital solutions. Asia Pacific countries like China and India have already embraced successful shared mobility services like ride-hailing and bike-sharing. Mobility as a service extends this trend by integrating these services into a comprehensive transportation ecosystem. The high population density in cities makes efficient transportation crucial. Mobility as a service platform can integrate various modes of transport, helping people navigate densely populated areas seamlessly.

China mobility as a service market held a substantial market share in 2024, driven by widespread smartphone and super-app adoption, robust integration of digital payments, national smart transportation initiatives, and expanding demand from tier-2 and tier-3 urban centers. Through a unified interface, platforms including WeChat and Amap enable seamless multimodal trip planning, booking, and payment for metro, bus, bike-sharing, and ride-hailing services. For instance, cities such as Guangzhou, Xiamen, and Zhengzhou have deployed MaaS systems via WeChat mini-programs, offering real-time transit data, fare integration, and one-click ticketing. This trend underscores China’s strategic push to build centralized, app-based transport ecosystems that optimize public mobility and reduce urban congestion.

The mobility as a service market in Japan held a significant share in 2024, influenced by the progressive digitization of public transportation systems, a shrinking driver population, strong government support for smart mobility infrastructure, and growing consumer demand for app-based transport solutions. Regional governments and private operators collaborate to create unified platforms integrating rail, bus, micromobility, and ride-hailing services. For instance, in April 2023, JR East launched its “Regional and Tourism-Oriented MaaS” initiative in areas like Nagano and the Tohoku region, integrating buses, on-demand transport, and bike-sharing into a single platform using its Mobility Linkage Platform (MLP). This reflects Japan’s national strategy to promote multimodal transport systems while addressing demographic and regional accessibility challenges.

North America Mobility As A Service Market Industry Trends

The mobility as a service market in North America was identified as a lucrative region in 2024. The market is driven by rapid urbanization, strong public-private collaboration for smart city development, increasing electric vehicle integration into shared mobility fleets, and advancements in real-time data and multimodal transport platforms. Cities across the U.S. and Canada are leveraging connected infrastructure and policy incentives to scale MaaS solutions to reduce congestion and improve transit efficiency.

Canada mobility as a service market is gaining traction through federal investments in sustainable transport infrastructure and smart mobility pilots. Municipalities, including Toronto and Montreal, have launched MaaS trials integrating buses, subways, ride-hailing, and bike-sharing services through app-based platforms. These developments are accelerated by Canada's national Net-Zero strategy and the push for low-emission transportation alternatives.

The mobility as a service market in Mexico is shaped by growing smartphone adoption, demand for urban mobility in densely populated cities, and emerging private sector innovation.

The U.S. mobility as a service market held a dominant position in 2024. The market is driven by increased federal support for first/last-mile transit programs, widespread implementation of real-time multimodal trip planning, expansion of EV‑based microtransit fleets, and stronger collaboration between public agencies and private mobility providers. Centralized platforms now integrate scheduling, booking, and payments across buses, subways, bikesharing, ride‑hailing, and microtransit services, enhancing user experience and network efficiency. For instance, in December 2022, the FTA published its evaluation of the Mobility on Demand Sandbox demonstrations in Los Angeles and Puget Sound, highlighting multimodal service pilots that combined demand‑responsive shuttles, bike/car‑sharing, and public transit, demonstrating scalable U.S. MaaS implementation.

Key Mobility As A Service Company Insights

Some key players operating in the market include Lyft, Inc., INTEL CORPORATION (Moovit, Inc.), UBER TECHNOLOGIES, INC., Free Now, and BlaBlaCar.

-

Founded in 2012 and headquartered in San Francisco, California, Lyft, Inc. is a prominent player in the Mobility-as-a-Service market. The company provides multimodal transportation services through its platform, including ride-hailing, bike-sharing, car rentals, and public transit integration. Lyft is expanding its footprint through advertising, autonomous mobility trials, and sustainable transportation initiatives. It leverages real-time data, in-app personalization, and strategic partnerships to enhance urban mobility across North America.

-

Founded in 1968 and headquartered in Santa Clara, California, INTEL CORPORATION operates in the Mobility-as-a-Service market through its subsidiary Moovit, Inc., acquired in 2020. Moovit specializes in urban mobility solutions, offering real-time transit data, journey planning, and MaaS analytics through its app and mobility platform. Integrated within Intel’s Mobileye division, Moovit powers smart city initiatives and autonomous mobility deployments across over 3,500 cities in more than 110 countries, leveraging AI and edge computing technologies to optimize public transport access.

Key Mobility As A Service Companies:

The following are the leading companies in the mobility as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Lyft, Inc.

- INTEL CORPORATION (Moovit, Inc.)

- UBER TECHNOLOGIES, INC.

- BlaBlaCar

- GRAB HOLDINGS LIMITED

- Free Now

- SkedGo

- Moovel North America, LLC.

- Fluidtime

- Cubic Transportation Systems, Inc.

Recent Developments

-

In June 2025, Dutch startup umob raised €3.5 million to expand its unified mobility app across Europe. Following its earlier acquisition of MaaS Global and the ‘Whim’ app, the company aims to scale sustainable transport options by integrating ride-sharing, micromobility, and public transit into a seamless, all-in-one user experience.

-

In September 2024, myTVS launched a pan-India Mobility-as-a-Service platform tailored for EV fleet operators. The platform integrates leasing, fleet management, charging, telematics, and insurance under one digital ecosystem. In partnership with MoEVing, this launch supports India's push toward EV adoption and quick commerce electrification.

-

In May 2024, HCLTech and Cisco launched Pervasive Wireless Mobility-as-a-Service, delivering secure, low-latency wireless backhaul solutions for enterprise and industrial applications. The service enables vehicle, fleet, and mobile worker connectivity across automotive, mining, retail, and healthcare sectors, supporting digital MaaS infrastructure expansion.

-

In July 2023, UBER TECHNOLOGIES, INC. partnered with RideCo Inc., an on-demand solutions provider. The partnership will help transit agencies manage cost strategies and scale operations up or down according to demand. The two companies' shared technological expertise will benefit customers through personalized services and reduced waiting time.

Mobility As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 270.7 billion

Revenue forecast in 2033

USD 4,013.2 billion

Growth rate

CAGR of 40.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2020 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Solutions, services, transportation type, propulsion type, payment type, operating system, application, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Lyft, Inc.; INTEL CORPORATION (Moovit, Inc.); UBER TECHNOLOGIES, INC.; BlaBlaCar; GRAB HOLDINGS LIMITED; Free Now; SkedGo; moovel North America, LLC.; Fluidtime; Cubic Transportation Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobility As A Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mobility as a service market report based on solutions, services, transportation type, propulsion type, payment type, operating system, application, end user, and region:

-

Solutions Outlook (Revenue, USD Billion, 2021 - 2033)

-

Journey Planning & Management Solutions

-

Payment Solutions

-

Booking & Ticketing Solutions

-

Application Technology Solutions

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2021 - 2033)

-

Ride-hailing Services

-

Ride-sharing Services

-

Micromobility Services

-

Public Transport Services

-

Others

-

-

Transportation Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public Transportation

-

Private Transportation

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Internal Combustion Engine (ICE) Vehicle

-

Electric Vehicle (EV)

-

Compressed Natural Gas (CNG)/Liquefied Petroleum Gas (LPG) Vehicle

-

-

Payment Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-demand

-

Subscription-based

-

-

Operating System Outlook (Revenue, USD Billion, 2021 - 2033)

-

Android

-

iOS

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Business-to-Business (B2B)

-

Business-to-Consumer (B2C)

-

Peer-to-Peer (P2P)

-

-

End User Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

Government

-

Healthcare

-

Retail

-

Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobility as a service market size was estimated at USD 195.2 billion in 2024 and is expected to reach USD 270.7 billion in 2025.

b. The global mobility as a service market is expected to grow at a compound annual growth rate of 40.1% from 2025 to 2033 to reach USD 4,013.2 billion by 2033.

b. Europe dominated the mobility as a service market with a share of 26.1% in 2024. Europe's strong emphasis on sustainability is a major factor contributing to growth.

b. Some key players operating in the mobility as a service market include Lyft, Inc.; INTEL CORPORATION (Moovit, Inc.); UBER TECHNOLOGIES, INC.; BlaBlaCar; GRAB HOLDINGS LIMITED; MaaS Global; SkedGo; moovel North America, LLC.; Fluidtime; Cubic Transportation Systems, Inc.

b. Key factors that are driving the market growth include smart cities and government initiatives and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.