- Home

- »

- Digital Media

- »

-

Mobile Wallet Market Size, Share And Growth Report, 2030GVR Report cover

![Mobile Wallet Market Size, Share & Trends Report]()

Mobile Wallet Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Remote, Proximity), By Application (Retail & E-commerce, Banking, Hospitality & Transportation), By Region, And Segment Forecasts

- Report ID: 978-1-68038-092-7

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Wallet Market Summary

The global mobile wallet market size was estimated at USD 7.42 billion in 2022 and is projected to reach USD 51.53 billion by 2030, growing at a CAGR of 8.5% from 2023 to 2030. Increasing penetration of smartphones and the internet and the growing e-commerce sector are major market drivers.

Key Market Trends & Insights

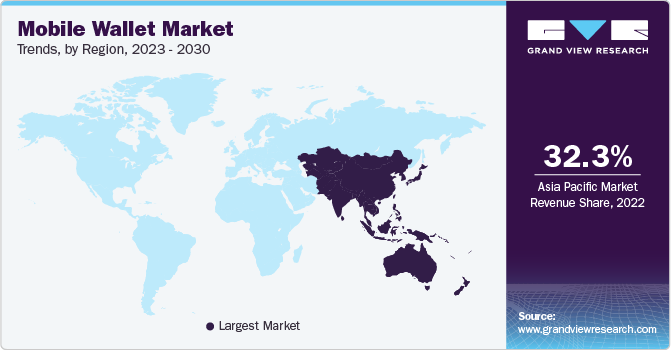

- Asia Pacific dominated the mobile wallet market in 2022 with a share of 32.3% and is expected to grow at the fastest CAGR of 28.9% during the forecast period.

- Latin America is expected to register at a significant CAGR of 28.6% over the forecast period.

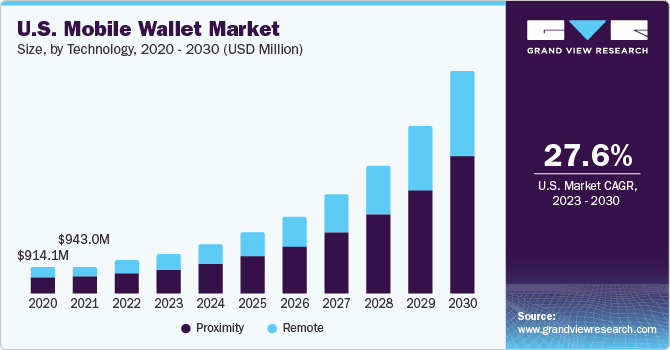

- By technology, the proximity segment accounted for the largest revenue share of 62.6% in 2022.

- By technology, the remote technology segment is expected to grow at the fastest CAGR of 28.6% during the forecast period.

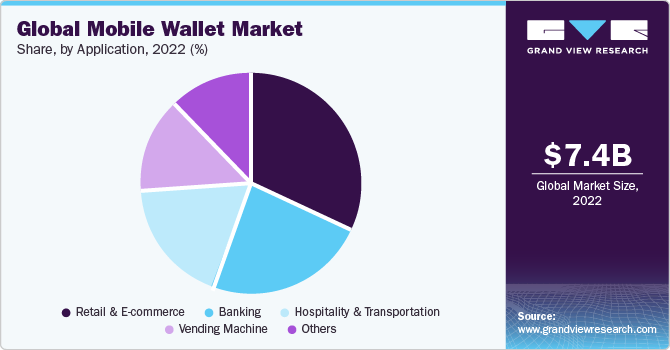

- By application, The retail and e-commerce segment accounted for the largest revenue share of 32.0% in 2022 and is expected to maintain its position over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 7.42 Billion

- 2030 Projected Market Size: USD 51.53 Billion

- CAGR (2023-2030): 8.5%

- North America: Largest market in 2022

A mobile wallet is an e-wallet that uses a credit/debit card or bank account to make payments easily while securing the users’ data. Users can use a mobile wallet to make mobile recharges, bill payments, movie/travel bookings, and money transfers from one bank account to another.

The COVID-19 pandemic had a positive impact on the market. Industry players had to temporarily close most of their offices due to government regulations and travel restrictions, forcing them to change their mode of operations. For instance, NICE adopted work-from-home and hybrid working models and restricted employee travel. Although most industry players reported that the pandemic posed a risk to their business and was uncertain of its effects, most prominent market players witnessed revenue growth throughout the pandemic.

The pandemic pushed digital transactions and mobile payments across the world. It has accelerated the growth of the e-commerce industry toward new customers, firms, and types of products. For instance, according to the Census Bureau’s Annual Retail Trade Survey (ARTS), in the U.S., sales in the e-commerce sector surged by 43% or USD 244.2 billion in 2020, the first year of the pandemic, increasing to USD 815.4 billion in 2020 from USD 571.2 billion in 2019.

Technology Insights

The market has been segmented into remote and proximity in the context of technology. The proximity segment accounted for the largest revenue share of 62.6% in 2022. Using proximity technology, users can pay for goods and services with their mobile phones or any smart device at a physical point-of-sale (POS) terminal.

The remote technology segment is expected to grow at the fastest CAGR of 28.6% during the forecast period due to the growing penetration of cashless payments through communication networks. By using a remote technology-based mobile wallet, users can purchase goods via a mobile website or SMS text message with their mobile devices.

Application Insights

The retail and e-commerce segment accounted for the largest revenue share of 32.0% in 2022 and is expected to maintain its position over the forecast period. The potential advantages of accepting mobile wallet payments are becoming increasingly apparent to retailers and online retailers. Retailers integrating cashless or contactless payment technology with digital marketing are intended to gain consumer data opportunities and loyalty. Furthermore, NFC technology is anticipated to increase operational efficiency through low processing costs and quicker checkout. The technology aids e-commerce companies and retailers in providing exceptional promotions and tracking loyalty rewards for enhancing relations with mobile consumers.

The banking segment is expected to grow at the fastest CAGR of 29.6%. Also, several vending businesses are adopting mobile payment solutions to offer convenient, quick transactions at vending machines. Vending businesses can provide customers with mobile payments from QR code systems, wallet apps, or vouchers.

Regional Insights

Asia Pacific dominated the mobile wallet market in 2022 with a share of 32.3% and is expected to grow at the fastest CAGR of 28.9% during the forecast period. Factors such as increasing population, rising adoption of smartphones, rising number of internet subscribers, and rapid growth in the retail and e-commerce sector across countries such as India and China are driving the market. In addition, increasing government initiatives such as Digital India and Make in India are expected to improve the penetration of smartphones and other smart devices, resulting in the increasing demand for mobile wallets.

Latin America is expected to register at a significant CAGR of 28.6% over the forecast period. The growth is attributed to the increasing penetration of smartphones, the rise of e-commerce, and the increasing demand for convenience. Governments and financial institutions in Latin America support mobile wallets' growth by providing regulatory frameworks and infrastructure. For instance, in November 2020, the Brazilian government launched a national mobile wallet platform, Pix, to promote mobile wallets among its citizens.

Key Companies & Market Share Insights

Leading industry players are undertaking strategies such as partnerships, collaborations, acquisitions & mergers, and agreements to survive the highly competitive environment and expand their business footprints. Furthermore, major industry players collaborate with payment service providers, technology vendors, and banks to develop the required infrastructure to improve the consumer experience. For instance, in July 2022, Damen ePayment launched its mobile wallet app in collaboration with BKN301. BKN301 is a financial technology company that develops Cashflo, banking-as-a-service functionalities, and payment services. Additionally, in September 2021, PayPal Holdings, Inc. announced that it had settled to acquire Paidy for USD 2.7 billion, principally in cash. The acquisition is expected to increase PayPal's capabilities, relevance, and distribution in the domestic payments market in Japan. Paidy would continue to operate its present business, maintain its support, and brand various consumer wallets and marketplaces.

Key Mobile Wallet Companies:

- Amazon Web Services, Inc.

- Visa Inc.

- American Express

- PayPal Holdings Inc.

- Apple Inc.

- Google Inc.

- Airtel

- Mastercard

- Alipay

- Samsung

- AT&T

Recent Developments

-

In June 2023, Google announced the expansion of Google Wallet in five more countries: Albania, Argentina, Bosnia and Herzegovina, North Macedonia, and Montenegro. A company representative revealed the launch in a forum post, noting that the app expanded to 12 countries throughout Asia, Europe, and North America in November last year.

-

In June 2023, Alipay, a Chinese mobile payment platform, and Mastercard, a payments network, partnered to provide international tourists with another easy means to make cashless payments in China. International tourists can attach any Mastercard card to their Alipay digital wallet, making e-payments in China easier through collaboration.

-

In January 2023, Samsung Electronics announced the expansion of its digital wallet, Samsung Wallet, in eight new countries: Canada, Australia, Brazil, Hong Kong, Malaysia, India, Taiwan, and Singapore. The wallet is a secure, go-everywhere app to use and helps in organizing daily essentials.

-

In October 2022,Visa introduced a crypto wallet for Bitcoin, Ethereum, and Ripple (XRP).The applications cover a wide range of services related to cryptocurrency, including the issuance of cryptocurrency cards, the provision of cryptocurrency wallets, and the facilitation of cryptocurrency payments.

Mobile Wallet Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.01 billion

Revenue forecast in 2030

USD 51.53 billion

Growth Rate

CAGR of 28.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Amazon Web Services, Inc.; Visa Inc.; American Express; PayPal Holdings Inc.; Apple Inc.; Google Inc.; Airtel; Mastercard; Alipay; Samsung; AT&T

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Wallet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mobile wallet market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Remote

-

Proximity

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & E-commerce

-

Hospitality & Transportation

-

Banking

-

Vending Machine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mobile wallet market size was estimated at USD 7.42 billion in 2022 and is expected to reach USD 9.01 billion in 2023.

b. The global mobile wallet market is expected to grow at a compound annual growth rate of 28.3% from 2023 to 2030 to reach USD 51.53 billion by 2030.

b. The Asia Pacific dominated the mobile wallet market with a market share of 32.3% in 2022. This is attributed to the increasing penetration of mobile devices and mobile payment technologies.

b. Some key players operating in the mobile wallet market include Amazon Web Services Inc, Visa Inc, American Express, PayPal Holdings Inc, Apple Inc, Google Inc, Airtel, Mastercard, Alipay, Samsung, and AT&T.

b. Key factors driving the market growth include government initiatives to modernize the transportation sector and the rising number of internet users.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.