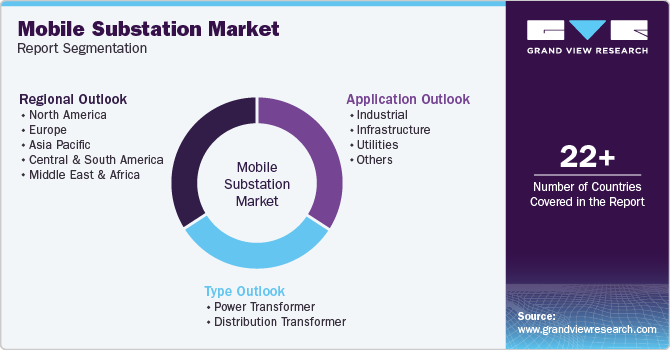

Mobile Substation Market Size, Share & Trends Analysis Report By Type (Power Transformer, Distribution Transformer), By Application (Industrial, Infrastructure, Utilities), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-533-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

Mobile Substation Market Size & Trends

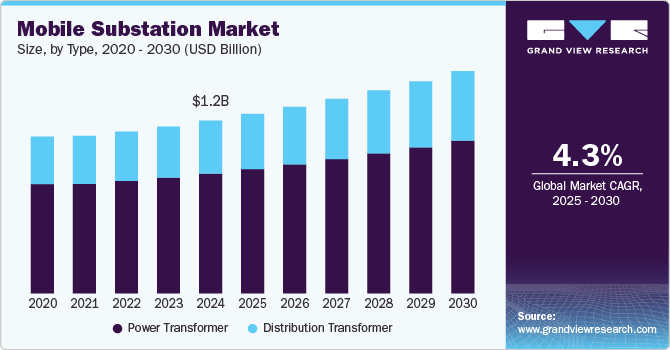

The global mobile substation market size was estimated at USD 1,212.91 million in 2024 and is projected to grow at a CAGR of 4.37% from 2025 to 2030. The market is driven by the increasing demand for reliable and flexible power solutions in emergency situations, grid expansion, and temporary power supply needs. Growing investments in renewable energy integration, rapid urbanization, and industrialization are further boosting demand, particularly in regions with weak grid infrastructure or high disaster risks.

Utilities and industries are adopting mobile substations for quick deployment and minimal downtime during maintenance, outages, or natural disasters. Additionally, advancements in modular and compact designs, along with government initiatives for rural electrification and smart grid deployment, are accelerating market growth globally.

Drivers, Opportunities & Restraints

The growing demand for reliable and flexible power solutions drives the mobile substation market, particularly in disaster recovery, emergency grid failures, and remote area electrification. Increasing investments in power infrastructure modernization, coupled with rising electricity demand across industrial and commercial sectors, fuel market growth. Additionally, the rapid expansion of renewable energy projects necessitates mobile substations for temporary grid integration. Technological advancements in compact, modular designs and smart grid integration further enhance market adoption. Government regulations favoring grid resilience and electrification initiatives in emerging economies also contribute to market expansion.

Significant opportunities lie in the increasing adoption of mobile substations for renewable energy projects, where temporary grid connectivity is essential for solar and wind farms. The rising electrification of remote and rural areas, particularly in developing countries, creates a demand for cost-effective and rapid deployment solutions. The push for grid modernization and digital substations, integrating IoT and AI-based monitoring systems, presents lucrative prospects for advanced mobile substations. Additionally, strategic partnerships between manufacturers and utilities for emergency power restoration and defense applications provide new revenue streams. Emerging markets in Africa, Southeast Asia, and Latin America offer high-growth potential due to infrastructure development initiatives.

Despite strong demand, the high initial investment and maintenance costs of mobile substations pose a major challenge for widespread adoption. Regulatory complexities, including stringent grid compliance standards and safety regulations, can delay deployment. Limited awareness and reluctance among utilities to shift from conventional substations to mobile alternatives also hinder growth. Moreover, supply chain disruptions and the dependence on specialized components, such as transformers and switchgear, can lead to cost fluctuations and longer lead times. Additionally, cybersecurity risks associated with digital and remotely monitored mobile substations pose concerns for utilities and power companies.

Type Insights

The power transformer segment in the mobile substation market is driven by the increasing need for rapid and flexible power restoration in case of grid failures, natural disasters, and emergency maintenance. Growing investments in renewable energy integration require mobile substations equipped with power transformers to provide temporary grid support for solar and wind farms.

Additionally, the expansion of industrial and infrastructure projects, particularly in remote and off-grid locations, increases demand for mobile substations with high-capacity power transformers. Technological advancements in compact, high-efficiency transformers, along with the adoption of smart grid solutions, enhance performance and reliability. Moreover, rising government initiatives to improve grid resilience and energy security, especially in emerging economies, further accelerate market growth for power transformers in mobile substations.

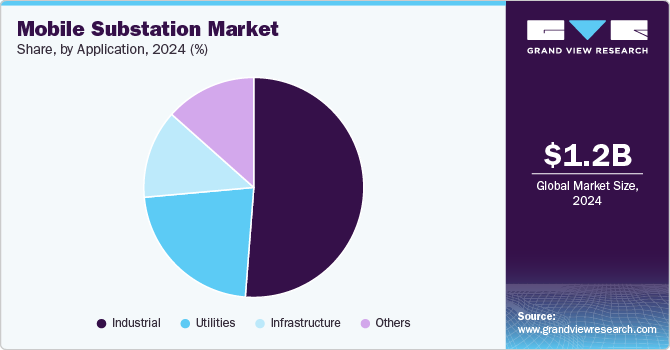

Application Insights

The industrial sector drives the mobile substation market due to its need for uninterrupted power supply in energy-intensive industries such as oil & gas, mining, manufacturing, and construction. These sectors often operate in remote locations where permanent substations are not feasible, making mobile substations a cost-effective and rapid deployment solution.

The infrastructure segment is driven by rapid urbanization, industrialization, and large-scale infrastructure development projects, particularly in emerging economies. Expanding smart cities, metro rail networks, airports, and highway electrification require mobile substations for temporary or backup power solutions.Additionally, the increasing electrification of remote construction sites and mining operations necessitates mobile substations for efficient power supply. The push for disaster preparedness and emergency power solutions in critical infrastructure, such as hospitals, data centers, and defense installations, further strengthens market growth.

Regional Insights

Mobile Substation market in North America is driven by the increasing need for grid resilience and emergency power solutions, particularly in response to extreme weather events such as hurricanes, wildfires, and winter storms that frequently disrupt power supply. Rising investments in grid modernization and renewable energy integration are further fueling demand, as utilities seek flexible and rapid deployment solutions for temporary power distribution.

U.S. Mobile Substation Market Trends

The U.S. mobile substation market is experiencing notable growth, driven by several key factors. Frequent power outages caused by natural disasters have heightened the demand for mobile substations, which provide temporary power solutions during such events. Additionally, aging grid infrastructures necessitate costly upgrades, making mobile substations a viable alternative to ensure a continuous power supply. Technological advancements, particularly in digital control systems and high-efficiency transformers, have enhanced the performance and reliability of mobile substations, increasing their appeal to utility companies and industrial users. Furthermore, the integration of renewable energy sources into the power grid has created a need for flexible and reliable power distribution solutions, further propelling the adoption of mobile substations

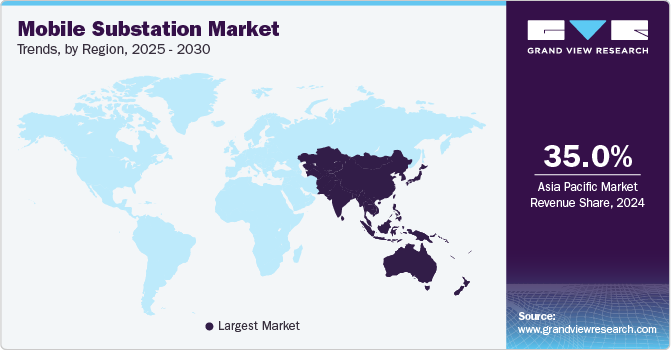

Asia Pacific Mobile Substation Market Trends

The Asia-Pacific mobile substation market held the market with the revenue share of over 35.0% and is driven by rapid urbanization, industrialization, and increasing electricity demand, particularly in countries like China, India, and Southeast Asian nations. Government initiatives for rural electrification and smart grid development are accelerating the adoption of mobile substations, especially in regions with weak grid infrastructure.

Europe Mobile Substation Market Trends

The European mobile substation market is driven by increasing investments in grid modernization and renewable energy integration, as countries transition toward sustainable energy sources like wind and solar. The aging power infrastructure across several European nations necessitates temporary and flexible power solutions, boosting demand for mobile substations.

Central & South America Mobile Substation Market Trends

The mobile substation market in Central & South America is driven by increasing investments in grid modernization and electrification projects, particularly in remote and underserved areas. Frequent natural disasters such as earthquakes, hurricanes, and floods create a strong demand for mobile substations as emergency power solutions. The region's growing renewable energy sector, especially in Brazil, Chile, and Argentina, is boosting the need for mobile substations to support temporary grid connections for solar and wind farms.

Middle East & Africa Mobile Substation Market Trends

The mobile substation market in the Middle East & Africa (MEA) is driven by the region's increasing investments in power infrastructure to support economic growth, urbanization, and industrialization. The rising demand for emergency and temporary power solutions, especially in conflict-prone and disaster-affected areas, boosts adoption. The rapid expansion of the oil & gas sector, mining operations, and large-scale construction projects further drives demand for mobile substations to ensure uninterrupted power supply.

Key Mobile Substation Company Insights

Some of the key players operating in the market include ABB Ltd., Aktif Elektroteknik A.S., Delta Star Inc., Eaton Corporation plc, EFACEC Power Solutions SGPS S.A., EKOSinerji, Elgin Power Solutions, and among others. These companies are driving innovation, expanding production capacities, and forming strategic partnerships to strengthen their market positions.

Key Mobile Substation Companies:

The following are the leading companies in the mobile substation market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Aktif Elektroteknik A.S.

- Delta Star Inc.

- Eaton Corporation plc

- EFACEC Power Solutions SGPS S.A.

- EKOSinerji

- Elgin Power Solutions

Recent Developments

-

In July 2024, WEG launched its new digital mobile substation in the Brazilian market. The solution enables real-time monitoring, control, and automation of operationsin both preventive and emergency situations.

Mobile Substation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1,259.73 million |

|

Revenue forecast in 2030 |

USD 1,560.35 million |

|

Growth rate |

CAGR of 4.37% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative Units |

Revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE |

|

Key companies profiled |

ABB Ltd.; Aktif Elektroteknik A.S.; Delta Star Inc.; Eaton Corporation plc; EFACEC Power Solutions SGPS S.A.; EKOSinerji; Elgin Power Solutions; General Electric Company; Matelec Group; Meidensha Corporation; Powell Industries Inc.; Siemens Energy AG; WEG Industries |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Mobile Substation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile substation market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Transformer

-

Distribution Transformer

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Infrastructure

-

Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mobile substation market size was estimated at USD 1,212.91 million in 2024 and is expected to reach USD 1,259.73 million in 2025.

b. The global mobile substation market is expected to grow at a compound annual growth rate of 4.37% from 2025 to 2030 to reach USD 1,560.35 million by 2030.

b. Based on type segment, Power Transformer held the largest revenue share of more than 69.0% in 2024 owing to rapid utilization of mobile power transformers in utilities to address specific power requirements in different locations is creating lucrative opportunities in this segment.

b. Some of the key vendors of the global mobile substation market are ABB Ltd., Aktif Elektroteknik A.S., Delta Star Inc., Eaton Corporation plc, among others.

b. The key factors driving the Mobile Substation market include the increasing occurrences of natural disasters, grid failures, and temporary power outages drive the need for mobile substations as a rapid and flexible power solution.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."