- Home

- »

- Network Security

- »

-

Mobile Security Market Size, Share And Growth Report, 2030GVR Report cover

![Mobile Security Market Size, Share & Trends Report]()

Mobile Security Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Solutions, By Services, By Operating System, By Deployment, By Enterprise Size By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-570-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Security Market Summary

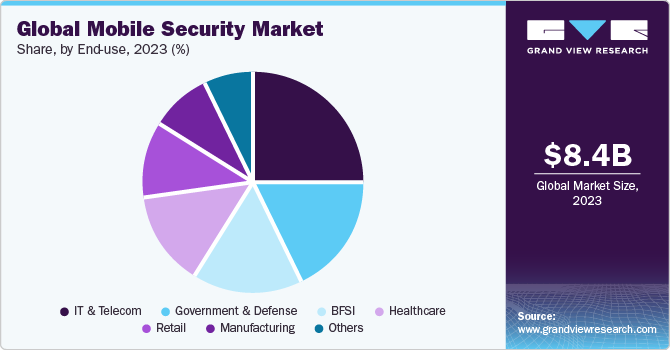

The global mobile security market size was estimated at USD 8,365.2 million in 2023 and is projected to reach USD 30,803.0 million by 2030, growing at a CAGR of 20.5% from 2024 to 2030. An increase in mobile security breaches, data thefts, malware attacks, and phishing attacks continues to rise with the growing number of portable or mobile devices.

Key Market Trends & Insights

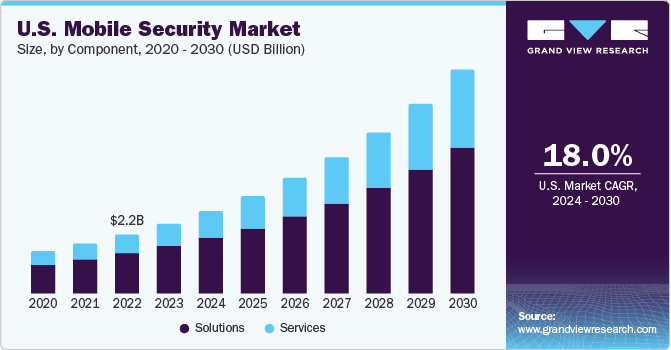

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, solution accounted for a revenue of USD 5,683.2 million in 2023.

- Services is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 8,365.2 Million

- 2030 Projected Market Size: USD 30,803.0 Million

- CAGR (2024-2030): 20.5%

- North America: Largest market in 2023

Further, growing stringency in regulations, and increasing IT complexities in business environments also drive the demand for mobile security solutions and services.

Moreover, sophisticated cyberattacks from organized and skilled groups are growing. The threat actors are increasingly targeting consumers and businesses of all sizes by taking advantage of their vulnerabilities in mobile device infrastructures, solutions, and online services.

Unified Endpoint Management (UEM) and Mobile Device Management (MDM) systems are seamlessly integrated by with mobile security solutions in a decentralized, zero-touch process that saves time. The integration of mobile security solutions ensures the device is protected. For instance, in June 2023, Check Point Software Technologies Ltd., a mobile security hardware and software products provider, partnered with a Everyphone, an all-in-one mobile device service provider, to provide advanced threat prevention for corporate smartphones. Check Point Harmony Mobile, a Mobile Threat Defense (MTD) solution that offers comprehensive defense against a range of cyber threats, would be integrated into Ever phone’s DaaS offering through the partnership. Hence, market players are collaborating to introduce new products and services, thus, driving the market growth of the segment.

Businesses are streamlining administration and security with a solitary, user-friendly interface. For a variety of industries, including government employees, healthcare providers, transportation and logistics firms, and retailers, this has reduced total cost of ownership (TCO) and increased return on investment (ROI). For instance, in December 2023, Honeywell International Inc., a mobile security solution provider, partnered with SOTI Inc., mobile security provider, to support companies in protecting sensitive data and improving operational efficiency.

Furthermore, due to the collaboration between SOTI's mobility management solutions and Honeywell's mobile computers, allowing for remote monitoring, diagnosis, and repair, businesses may be able to outlive traditional hardware lifecycles. The SOTI ONE Platform protects corporate data on mobile devices while streamlining software installations, enhancing data security, and providing seamless integration with enterprise IT systems. Introduction of these products and services is expected to drive market demand.

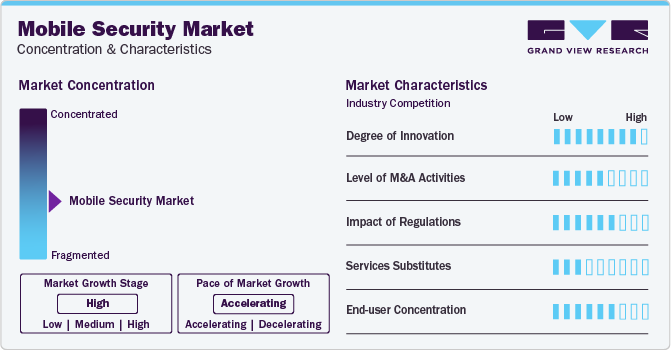

Market Concentration & Characteristics

The market growth is high and the growth’s pace is accelerating. The increasing need for improved network security, data privacy, and security is predicted to increase the use of mobile device security solutions. Additionally, businesses are considering the security and privacy of mobile devices in addition to network infrastructure, which will fuel the expansion of the market.

Businesses are increasingly seen to be investing to innovate mobile-first security platform in order to maintain their market competitiveness. As a result, businesses appear to be introducing an end-to-end platform to maximize the potential of a business plan driven by mobile technology. The most extensive mobile capabilities for risk reduction, worldwide visibility, threat detection, and response for both endpoints and apps are exclusively offered by the mobile security platform.

The market is also witnessing a high level of merger and acquisition (M&A) activity by key players. For instance, in April 2023, Lookout, Inc., mobile security provider, announced an agreement to sell its consumer mobile security business segment to F-Secure, a supplier of consumer security goods and services. With this complementary acquisition, F-Secures market share increases. Furthermore, these players are focusing on acquiring technology providers to optimize their research& development (R&D) costs and expand their business presence into untapped markets.

The market is also subject to rules and regulations set by international, regional, and country-level regulatory bodies. For instance, in November 2021, The European Telecommunications Standards Institute (ETSI), a non-profit organization, unveiled a new standard ETSI TS 103 732, Consumer Mobile Device Protection Profile. The new standard offers suitable protection and identifies the main security and privacy risks for user data.

There are no direct substitutes for mobile security solutions. The mobile security products come in various platforms such as, Unified Threat Management, and mobile threat defense (MTD), among others. Mobile security solutions increase user authentication security using multi-factor authentication (MFA), and ensures the software supply chain is secure.

End-users serve a broad spectrum of industry verticals, such as public sector, healthcare, media and entertainment, manufacturing and retail, finance and insurance, information technology (IT), and telecommunications. Bring Your Own Device (BYOD) security and enterprise mobility management allow for the flexibility of remote work while maintaining enterprise security due to the platform.

End-use Insights

Based on the end-use, the IT & Telecom segment led the market with the largest revenue share of 24.58% in 2023. IT & telecom industry are increasingly using a managed, risk-based mobile security solutions for security and privacy implementation where requirements are tailored to the target environment and demands. This approach helps meet IT & telecom industry expectations and cater for the rapid evolution of technology and the continuous changes in legislation globally. Thus, driving the market growth of the segment.

The BFSI segment is projected to witness fastest CAGR over the forecast period. The BFSI vertical is one of the most common industries susceptible to application attacks in today's digitally connected world. Sensitive consumer financial data, such as account numbers, trading activity, credit and debit card details, payment information, and money transaction details, is handled and stored by banks and other financial institutions in substantial quantities.

Component Insights

Based on the components, the solutions segment led the market in 2023 with a largest revenue share of 67.0%. Owing to the increase in malware, trojans, and phishing attacks on mobile devices, the solutions segment held the largest market share. Organizations and individuals are adopting mobile security solutions due to the growing demand for device security and mobile security to decrease vulnerabilities from third-party apps and data breaches. In addition, there is a rise in mobile-related cyberattacks via unaffiliated apps and a requirement for immediate attack remediation within an organization's network.

The service segment is anticipated to witness the fastest CAGR from 2024 to 2030 in global market. The need for an effective remediate solution from data breaches, theft, and cyberattacks in personal mobility devices related to organizational workspaces has motivated SMEs and large enterprises to opt for consulting implementation, and maintenance services. The mobile security vendors analyze the existing infrastructure and policies of organizations and provide tailored security solutions that fit their requirements. The security vendors also offer training and support services to the IT departments of organizations to efficiently implement security solutions within their infrastructure.

Regional Insights

North America dominated the market with a revenue share of 38.85% in 2023. The region is anticipated to grow at a considerable rate owing to the rise in spending on information security solutions among enterprises.Growing adoption of mobility devices from government & defense sector to the retail sector is driving the regional market. The high adoption of this technology in North America is attributable to the government's encouragement of initiatives aimed at preserving and enhancing cybersecurity throughout all federal departments and agencies. In the US and Canada, this would spur the use of mobile security solutions.

Asia Pacific is anticipated to witness significant CAGR over the forecast period. The businesses in Asia-Pacific must create a strong cyber-defense plan to combat data breaches and thefts. The absence of a unified legal framework among the Asian-Pacific nations has resulted in a heterogeneous and intricate cyber environment within the region, compelling businesses to adopt cutting-edge cybersecurity measures. The governments of Asian nations, including China, Singapore, and Japan, are allocating substantial federal budgets towards enhancing their countries cybersecurity.

Solutions Insights

Based on the solutions, the network security segment led the market with the largest revenue share of 26.16% in 2023. The use of 5G technology is expanding quickly in mobile devices. 5G offers improved network solutions that increase bandwidth usage, dependability, and latency, and allow devices to operate at high speeds. More data sharing over the network is anticipated as 5G network is more thoroughly integrated with mobile devices, presenting new risks to data security. Cybercriminals are a threat to users as well as 5G service providers. The need for mobile device security solutions is predicted to rise as 5G services become more widely used.

The data security and encryption segment is expected to register the fastest CAGR during the forecast period. Mobile devices are always gathering and exchanging data that can be used to share personal information or track end-users location. Mobile devices gather location and user data, which can be shared with outside parties for a number of uses, such as ad targeting. All of these factors are creating several profitable growth opportunities for the data security and encryption segment in the global market over the projected period.

Services Insights

Based on the services, the professional services segment led the market in 2023 with the largest revenue share of.65.25% The anticipating and mitigating the complex and rapidly evolving mobile security and compliance risks associated with end-user software portfolios can be made easier with the programming and experience that mobile security professional services provide. It also helps end-user prioritize funding for security programs, maximize resource utilization, and lower the overall risk of application vulnerabilities by providing a comprehensive plan with helpful guidance. Thus, driving the market growth of the professional services for mobile devices.

The managed services segment is expected to register the fastest CAGR during the forecast period. Managed security services provide guidance to manage appsec risk and minimize complexity. In order to progress the program, the comprehensive managed services approach involves working with the end-user team to configure, schedule, and monitor scans. Using managed application security services, security teams can more accurately and reliably scan modern mobile applications.

Operating System Insights

Based on the operating system, android operating system segment led the market with the largest market revenue share of 57.18% in 2023. The usage of the android operating system increased significantly, such as, improved customer service and convenience, Thus, android frauds are also on rise. Mobile operating system security has been completely transformed by a number of technologies, including Runtime Application Self Protection (RASP) technology. Through threat detection and mitigation while, the app is operating, it guarantees run-time protection. Thus, driving the market growth of the segment.

The iOS segment is expected to register the fastest CAGR during the forecast period. Features such as, face ID & touch ID services, better protection of email ID, and protecting of web browsing is expected to drive market growth of the segment. Furthermore, iOS has built in privacy and security protection. Thus, above features collectively driving the market growth of the segment.

Deployment Insights

Based on the deployment, the on-premises segment led the market in 2023 with the largest revenue share of 50.56%. In order to have complete control over the data, end-users are becoming more inclined to on-premise mobile security systems. They can also put in place the necessary rules and processes to maximize security. Furthermore, industry regulations or client contracts may require the protection of specific categories of sensitive information. The management and maintenance of the systems are always the responsibility of the end-user. As a result, this gives the business total control and oversight over its security. Consequently, the market for on-premises mobile security is growing.

The cloud deployment is expected to register the fastest CAGR during the forecast period. With a cloud mobile security system, there is no requirement for infrastructure or physical servers to be present. The storage and management systems are located in the cloud environment, which is frequently managed by a third party. Depending on end-user subscription, they can store an infinite number of different security feeds in the cloud. Since data is transferred directly from the security source to the cloud via the Internet, cloud security systems do not require an internal network for storage. Data can be reviewed using an on-site monitor or mobile devices with a remote connection. As a result, there is a growing need for cloud application security.

Enterprise Size Insights

Based on the enterprise size, the large enterprises segment led the market in 2023 with the largest revenue share of 51.97%. Large businesses use many business-critical tasks, such as placing orders for goods and services or handling payment processing, which makes various applications' security threats. As a result, funding for application security system applications is rising among large corporations. Consequently, propelling the segment's expansion.

The small and medium enterprises segment is expected to register the fastest CAGR during the forecast period. Small clients in the small and medium-sized business sector who are investing in mobile security due to the increasing usage of hybrid work and the rapid adoption of new technologies. Therefore, for small and medium-sized businesses, outdated antivirus software is replaced with enterprise-grade security for end-users mobile apps, identities, data, and devices. As a result, industry participants are offering SMEs both fully featured packages and easy-to-use standalone products that are specifically tailored for application security. Consequently, propelling the segment's market expansion.

Key Mobile Security Company Insights

Some of the key players operating in the market include Microsoft Corporation, International Business Machines Corporation, and Samsung Electronics Co Ltd.

-

Microsoft Corporation provides Microsoft Endpoint Manager as a mobile device security solution. Microsoft Corporation provides integrated management solution to provide its mobile security solutions. Enterprise mobility and security features are combined in this integrated platform

-

International Business Machines Corporation provides various mobile security solutions, such as, IBM Security MaaS360, a Mobile Threat Management (MTM) solution. It has the ability to identify and remove malware from suspicious apps before it causes issues. By providing insights into potential threats to enrolled devices and users, IBM Security MaaS360 Advisor helps End-users maintain a strong security posture. These insights are supported furthered by the MaaS360 User Risk Management functionality, which creates a constantly updated risk score for every enrolled user

BETTER Mobile Security, Inc., and Coro Cybersecurity are some of the emerging market participants in the global market.

-

The BETTER Mobile Security, Inc. offers a range of mobile security solutions for mobile threats and defense. For instance, BETTER Console (Web) provides an instant visibility, intelligence, and control over threats and risks to devices. Rich information and simple policy management are offered by the console

-

Coro Cybersecurity mobile security solutions provide advanced protection, the highest and unified management. Its endpoint security provides network security, data security, remote access, and threat prevention

Key Mobile Security Companies:

The following are the leading companies in the mobile security market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these mobile security companies are analyzed to map the supply network.

- BETTER Mobile Security, Inc.

- BlackBerry Limited

- Check Point Software Technologies Ltd

- Coro Cybersecurity

- CrowdStrike Holdings, Inc.

- ESET, s.r.o.

- F-Secure Corporation

- International Business Machines Corporation

- Kaspersky Lab, Inc.

- McAfee Corp.

- Microsoft Corporation

- MobileIron, Inc.

- Samsung Electronics Co Ltd.

- Sophos

- Trend Micro Inc.

Recent Developments

-

In September 2023, Uniken, security platform provider, is selected as a strategic mobile and cybersecurity partner with the Indian Citizen Assistance for Mobile Privacy and Security (I-CAMPS). The Indian government's I-CAMPS project aims to establish a platform for citizen advice on mobile security and privacy. Through this collaboration, Uniken and I-CAMPS would ensure Indian citizens are safeguarding themselves against privacy and mobile security risks

-

In July 2023, Approov, the end-to-end mobile security provider, launched its global partner program to provide reseller, qualified business, and technology vendors with access to Approov's mobile security and comprehensive support

-

In July 2023, Samsung Electronics Co., Ltd., a consumer electronics provider, partnered with Microsoft Corporation, software technology provider, to optimize enterprise mobile device security for the modern workplace. Through this partnership, the first mobile hardware-backed on-device attestation solution for both company-owned and privately owned devices has been developed

Mobile Security Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.07 billion

Revenue forecast in 2030

USD 30.80 billion

Growth rate

CAGR of 20.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, solutions, services, operating systems, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; and South Africa

Key companies profiled

BETTER Mobile Security, Inc.; BlackBerry Limited ; Check Point Software Technologies Ltd; Coro Cybersecurity; CrowdStrike Holdings, Inc.; ESET, s.r.o.; F-Secure Corporation; International Business Machines Corporation; Kaspersky Lab, Inc.; McAfee Corp. ; Microsoft Corporation; MobileIron, Inc. ; Samsung Electronics Co Ltd.; Sophos ; Trend Micro Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global mobile security market report based on component, solutions, services, operating system, deployment, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Services

-

-

Solutions Outlook (Revenue, USD Billion, 2018 - 2030)

-

Data Security & Encryption

-

Cloud Security

-

Web Security

-

Identity & Access Management

-

Network Security

-

Application Security

-

Endpoint Security

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Services

-

Managed Services

-

-

Operating System Outlook (Revenue, USD Billion, 2018 - 2030)

-

iOS

-

Android

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile security market is expected to grow at a compound annual growth rate of 20.5% from 2024 to 2030 to reach USD 30.80 billion by 2030.

b. North America dominated the mobile security market in 2023. The region is anticipated to grow at a considerable rate owing to the rise in spending on information security solutions among enterprises. Growing adoption of mobility devices from government & defense sector to the retail sector is driving the regional market. The high adoption of this technology in North America is attributable to the government's encouragement of initiatives aimed at preserving and enhancing cybersecurity throughout all federal departments and agencies. In the US and Canada, this would spur the use of mobile security solutions.

b. Some key players operating in the mobile security market include BlackBerry Limited , Check Point Software Technologies Ltd, CrowdStrike Holdings, Inc., ESET, s.r.o., F-Secure Corporation, International Business Machines Corporation, Kaspersky Lab, Inc., McAfee Corp. , Microsoft Corporation, MobileIron, Inc. , Samsung Electronics Co Ltd., Sophos , Symantec Corp., Trend Micro Inc., and VMware, Inc.

b. Increase in mobile security breaches, data thefts, malware attacks, and phishing attacks continues to rise with the growing number of portable or mobile devices. Further, growing stringency in regulations, and increasing IT complexities in business environments also drives the demand for mobile security market.

b. The global mobile security market size was estimated at USD 8.37 billion in 2023 and is expected to reach USD 10.07 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.