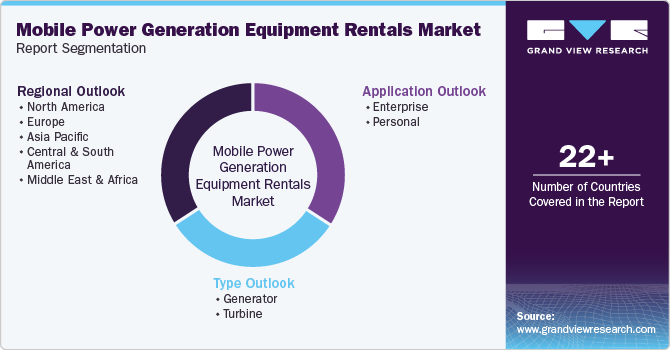

Mobile Power Generation Equipment Rentals Market Size, Share & Trends Analysis Report By Application (Enterprise, Personal), By Type (Generator, Turbine), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-533-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

Market Size & Trends

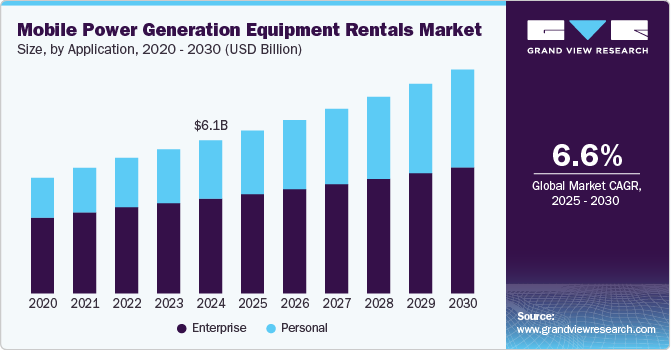

The global mobile power generation equipment rentals market size was estimated at USD 6,095.81 million in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. This growth is fueled by the increasing demand for flexible, reliable, and temporary power solutions across various industries, including construction, oil & gas, events, and emergency response. As infrastructure development accelerates globally, particularly in emerging economies, the need for mobile power generation equipment to support remote and off-grid operations is rising significantly. In addition, the growing frequency of natural disasters and power outages is driving demand for rental power solutions to ensure uninterrupted operations during emergencies.

Governments and private sectors are increasingly adopting mobile power generation equipment rentals as a cost-effective and scalable alternative to permanent power installations. This trend is further supported by stringent environmental regulations that encourage the use of cleaner and more efficient temporary power solutions. Rental companies are investing in advanced technologies, such as hybrid and solar-powered generators, to meet the demand for sustainable and eco-friendly power options. These innovations are making mobile power generation equipment more efficient, reducing emissions, and aligning with global sustainability goals.

Technological advancements in power generation equipment are also playing a critical role in market growth. Modern generators are becoming more compact, fuel-efficient, and capable of delivering higher power outputs, making them suitable for a wide range of applications. The integration of IoT and smart technologies is enabling remote monitoring and predictive maintenance of rental equipment, enhancing operational efficiency and reducing downtime. Furthermore, the rise of renewable energy integration in mobile power systems is creating new opportunities for market expansion, as industries seek to balance reliability with environmental responsibility.

The growing awareness of the benefits of renting over owning power generation equipment is another key driver of market growth. Renting offers flexibility, reduced capital expenditure, and access to the latest technologies without the burden of maintenance and storage. This is particularly appealing to small and medium-sized enterprises (SMEs) and industries with fluctuating power needs. As global energy demand continues to rise and the transition toward cleaner energy sources gains momentum, the mobile power generation equipment rentals industry is poised to play a pivotal role in ensuring energy security and supporting sustainable development worldwide.

Application Insights

Based on application, the market is segmented into enterprise, personal. The enterprise segment led the market with the largest revenue share of 61.83% in 2024, is primarily driven by the extensive demand for temporary and reliable power solutions across various industries. Enterprises in sectors such as construction, oil & gas, manufacturing, and events heavily rely on mobile power generation equipment to ensure uninterrupted operations, especially in remote or off-grid locations. Construction projects, for instance, often require temporary power during the initial phases before permanent power infrastructure is established. Similarly, the oil & gas industry utilizes mobile power solutions to support drilling and exploration activities in remote areas. The flexibility, scalability, and cost-effectiveness of renting power equipment make it an ideal choice for enterprises, allowing them to meet fluctuating power demands without significant capital investment.

Moreover, the increasing frequency of power outages and the need for emergency backup power in critical industries further bolster the demand for mobile power generation equipment rentals among enterprises. Industries such as healthcare, data centers, and telecommunications require continuous power supply to maintain operations, and mobile generators serve as a reliable solution during grid failures or natural disasters. Moreover, stringent environmental regulations and the push for sustainable practices have led enterprises to adopt cleaner and more efficient rental power solutions, such as hybrid and solar-powered generators. This shift not only aligns with corporate sustainability goals but also enhances operational efficiency, making the enterprise segment the largest and fastest-growing application in the mobile power generation equipment rentals industry.

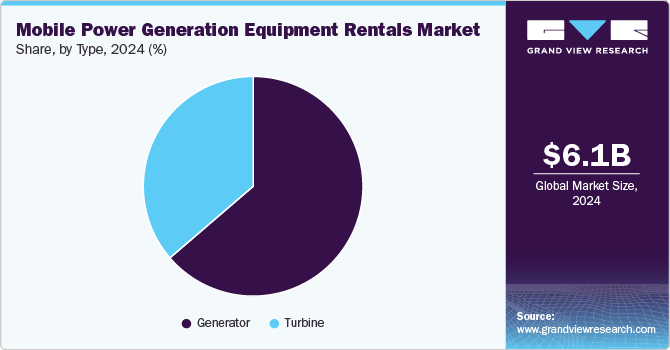

Type Insights

Based on type, the market is segmented into generator, turbine. The generator segment led the market with the largest revenue share of 63.70 % in 2024. This segment's dominance is attributed to its versatility, reliability, and widespread applicability across various industries. Generators are the most commonly used mobile power solutions, offering a broad range of power outputs to meet diverse needs, from small-scale events to large industrial operations. Their ability to provide immediate and consistent power in remote locations, during power outages, or in areas with unreliable grid infrastructure makes them indispensable for industries such as construction, oil & gas, healthcare, and events. The flexibility of generators, which can run on multiple fuel types including diesel, natural gas, and biofuels, further enhances their appeal, allowing users to choose options that align with their operational and environmental requirements.

Another key factor driving the dominance of the generator segment is the continuous advancements in generator technology, which have improved their efficiency, durability, and environmental performance. Modern generators are designed to be more fuel-efficient and produce lower emissions, addressing growing concerns about sustainability and regulatory compliance. In addition, the integration of smart technologies, such as IoT-enabled monitoring and predictive maintenance, has made generators more reliable and easier to manage, reducing downtime and operational costs. The rental model for generators also offers significant advantages, such as reduced upfront costs, access to the latest technology, and the ability to scale power solutions based on project requirements. These factors collectively contribute to the generator segment's leading position in the mobile power generation equipment rentals industry, making it the preferred choice for a wide range of applications.

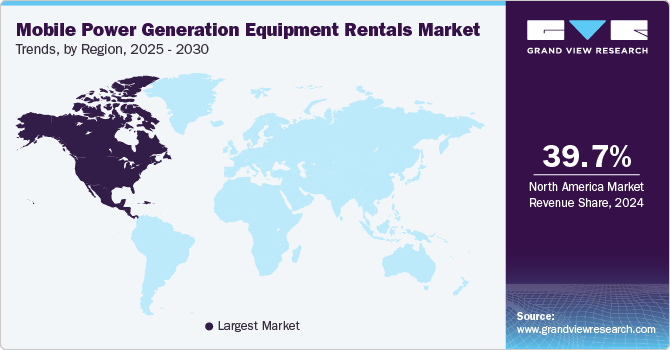

Regional Insights

North America mobile power generation equipment rentals market dominated with the largest revenue share of 39.71% in 2024. This dominance is largely driven by the region's robust industrial infrastructure, frequent natural disasters, and stringent regulatory environment. The United States and Canada have a high demand for temporary power solutions across key sectors such as construction, oil & gas, healthcare, and events, where uninterrupted power supply is critical. In addition, the region's susceptibility to extreme weather events, such as hurricanes and winter storms, has increased the need for reliable backup power solutions during emergencies. The presence of major market players, advanced technological adoption, and a strong focus on sustainability further contribute to North America's leading position, as industries increasingly opt for rental solutions to meet their power needs efficiently and cost-effectively.

U.S. Mobile Power Generation Equipment Rentals Market Trends

The mobile power generation equipment rentals market in the U.S. is thriving, fueled by the country’s robust industrial sector and increasing demand for flexible and reliable power solutions. The construction and oil & gas industries are major contributors to market growth, as they require temporary power for remote and off-grid operations. The U.S. government’s focus on infrastructure development and disaster preparedness has further boosted the demand for mobile power generation equipment. In addition, advancements in generator technology, such as improved fuel efficiency and reduced emissions, are making rental equipment more attractive to businesses. The growing adoption of renewable energy solutions, such as solar-powered generators, is also shaping the market, positioning the U.S. as a leader in the global mobile power generation equipment rentals industry.

Asia Pacific Mobile Power Generation Equipment Rentals Market Trends

The mobile power generation equipment rentals market in Asia Pacific is experiencing significant growth, driven by rapid industrialization, urbanization, and infrastructure development across the region. Countries like China, India, and Southeast Asian nations are witnessing a surge in construction projects, particularly in remote and off-grid areas, where mobile power solutions are essential for uninterrupted operations. The region’s increasing focus on renewable energy and sustainability is also boosting the adoption of advanced rental equipment, such as hybrid and solar-powered generators. In addition, frequent natural disasters and power outages in countries like Japan and the Philippines are driving demand for reliable backup power solutions. Government initiatives promoting infrastructure development and clean energy, coupled with technological advancements in generator efficiency and IoT-enabled monitoring, are further propelling the market, positioning Asia Pacific as a key growth hub in the global mobile power generation equipment rentals industry.

The China mobile power generation equipment rentals market is experiencing robust growth, driven by the country’s rapid industrialization, infrastructure development, and increasing demand for reliable power solutions. The Chinese government’s focus on renewable energy and sustainable development has led to a surge in construction projects, particularly in remote and off-grid areas, where mobile power solutions are essential. In addition, the growing adoption of advanced technologies, such as hybrid and solar-powered generators, is enhancing the efficiency and environmental performance of rental equipment. China’s emphasis on reducing carbon emissions and improving energy efficiency is further propelling the demand for mobile power generation equipment rentals, positioning the country as a key player in the global market.

Europe Mobile Power Generation Equipment Rentals Market Trends

The mobile power generation equipment rentals market in Europe is growing steadily, supported by the region’s commitment to sustainability and renewable energy. Countries like Germany, France, and the UK are investing heavily in infrastructure projects and clean energy initiatives, driving the demand for temporary power solutions. The construction and events sectors are key contributors to market growth, as they rely on mobile generators for reliable and flexible power supply. Europe’s stringent environmental regulations are also encouraging the adoption of cleaner and more efficient rental equipment, such as hybrid and solar-powered generators. The region’s focus on reducing carbon emissions and improving energy efficiency is further propelling the market, making Europe a significant player in the global mobile power generation equipment rentals industry.

The UK mobile power generation equipment rentals market is expanding rapidly, driven by the country’s focus on infrastructure development and sustainability. The construction sector is a major driver of market growth, as it requires temporary power solutions for large-scale projects. The UK government’s commitment to reducing carbon emissions and promoting renewable energy is also boosting the demand for cleaner and more efficient rental equipment, such as hybrid generators. In addition, the growing adoption of advanced technologies, such as IoT-enabled monitoring and predictive maintenance, is enhancing the efficiency and reliability of rental equipment. These factors are positioning the UK as a key player in the European market.

Middle East & Africa Mobile Power Generation Equipment Rentals Market Trends

The mobile power generation equipment rentals market in Middle East and Africa is gaining momentum, driven by the region’s focus on infrastructure development and energy security. Countries like the UAE and Saudi Arabia are investing heavily in construction and industrial projects, creating a strong demand for temporary power solutions. The region’s harsh climate and remote locations further increase the need for reliable and flexible power generation equipment. In addition, the growing adoption of renewable energy solutions, such as solar-powered generators, is shaping the market. Africa’s focus on improving access to reliable energy in underserved areas is also driving market growth, positioning the region as a key player in the global mobile power generation equipment rentals industry.

Key Mobile Power Generation Equipment Rentals Company Insights

The competitive landscape of the mobile power generation equipment rentals industry is evolving rapidly, driven by the increasing demand for flexible and reliable power solutions across industries such as construction, oil & gas, events, and emergency response. Key players range from global rental giants to regional specialists, all competing to capitalize on the growing need for temporary power solutions.

Market dynamics are shaped by technological advancements, such as hybrid and solar-powered generators, and the integration of IoT-enabled monitoring systems. Strategic partnerships with construction firms, energy providers, and infrastructure developers are becoming crucial in strengthening market positions. In addition, the focus on sustainability and regulatory compliance is driving innovation and investment in cleaner and more efficient rental equipment, further intensifying market competition.

Key Mobile Power Generation Equipment Rentals Companies:

The following are the leading companies in the mobile power generation equipment rentals market. These companies collectively hold the largest market share and dictate industry trends.

- Aggreko

- Caterpillar Inc.

- Cummins Inc.

- Generac Holdings Inc.

- Atlas Copco AB

- United Rentals, Inc.

- Herc Rentals Inc.

- APR Energy

- Kohler Co.

- Wacker Neuson SE

- Sunbelt Rentals

- Hertz Equipment Rental

- Multiquip Inc.

- Bredenoord

- Altaaqa Global

View a comprehensive list of companies in the Mobile Power Generation Equipment Rentals Market

Recent Developments

-

In March 2024, Aggreko launched a hybrid power systems combining solar panels, battery storage, and diesel generators to help industries reduce carbon emissions while ensuring reliable power. This newly launched product will reduce approx 30% of carbon emissions.

-

In November 2024, Cummins Inc. launched a pay-per-use rental model for mobile power generators, enabling clients to pay only for the energy consumed, with flexible contracts and no upfront costs. This initiative aims to make power generation rentals more accessible to small and medium-sized businesses, with an expected 20% increase in market penetration among SMEs.

Mobile Power Generation Equipment Rentals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6,482.84 million |

|

Revenue forecast in 2030 |

USD 8,906.29 million |

|

Growth rate |

CAGR of 6.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Application, type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Aggreko; Caterpillar Inc.; Cummins Inc.; Generac Holdings Inc.; Atlas Copco AB; United Rentals, Inc.; Herc Rentals Inc.; APR Energy; Kohler Co.; Wacker Neuson SE |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Mobile Power Generation Equipment Rentals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile power generation equipment rentals market report based on the application, type, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprise

-

Personal

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Generator

-

Turbine

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile power generation equipment rental market was estimated at around USD 6,095.81 million in 2024 and is expected to reach around USD 6,482.84 million in 2024.

b. The global mobile power generation equipment rental market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030, reaching around USD 8,906.29 million by 2030.

b. The enterprise application segment had the highest revenue market share, over 61.0%, in 2024. This dominance was driven by increasing adoption across industries, reflecting strong demand for scalable and efficient enterprise solutions.

b. Key players in the market include Aggreko, Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Atlas Copco AB, United Rentals, Inc., Herc Rentals Inc., APR Energy, Kohler Co., Wacker Neuson SE.

b. The global mobile power generation equipment rental market is primarily driven by rising demand for temporary power solutions across construction, events, and disaster recovery. Increasing industrial activities and grid instability further boost market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."