Mobile Mapping Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology Type (GNSS, RADAR, LiDAR), By Mounting Type, By Application, By Industry Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-063-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

Mobile Mapping Market Size & Trends

The global mobile mapping market size was valued at USD 31.78 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 16.4% from 2024 to 2030. The mobile mapping market growth is propelled by the widespread adoption of satellite mapping technology, seamlessly integrated into smartphones and Internet of Things (IoT) connected devices. This has resulted in an increased demand for this market, driven by using the Global Navigation Satellite System (GNSS) for environmental monitoring, 3D mapping, accident investigation, disaster response, and machinery control. This market is also encouraging the development of new automated and fast data collection approaches facilitated by the latest 5G internet technology. These systems provide valuable insights for decision-makers in transportation, construction, and urban planning, helping inform planning, design, and resource allocation.

A mobile mapping system is a technology that uses various sensors, such as GPS, LiDAR, cameras, and Inertial Measurement Units (IMUs), mounted on a vehicle or mobile platform to collect accurate and up-to-date geographic data. The data collected by these systems are typically processed and integrated into a digital map or 3D model, providing a comprehensive view of the mapped area. These systems are often more cost-effective than traditional surveying methods, as they require fewer resources and can cover larger areas in less time. They also provide real-time data, allowing for more efficient navigation and location-based services. These systems can be integrated with other technologies, such as drones and IoT sensors, to provide even more detailed and comprehensive mapping data. They are valuable tools in various industries, and their continued development promises even more possibilities for innovation and advancement. Moreover, these systems are widely used in agriculture and environmental management to map land use, monitor crop growth, and track environmental changes. This improves crop yields, reduces waste, and supports sustainable environmental practices.

Moreover, these systems provide highly accurate and up-to-date geographic data, allowing for more efficient navigation, location-based services, and infrastructure planning and management. Additionally, these systems can be used to monitor environmental changes, such as deforestation or water pollution, and support sustainable environmental practices. However, concerns around privacy and data security, as well as the high cost of implementing these solutions, are anticipated to hinder the market's growth. Nonetheless, integrating mobile mapping with wearable smart devices and the growth of mapping analytics are expected to present lucrative development opportunities for this market in the forecasted period.

Market Concentration & Characteristics

The mobile mapping market growth stage is medium, and the pace of the market growth is accelerating. The global mobile mapping market can be described as a fragmented market characterized by the presence of several market players. Major players are investing in Research & Development (R&D) to introduce new products. The mobile mapping market is highly dependent on technological innovations. Advancements in sensors, LiDAR technology, and data processing algorithms significantly impact the market's capabilities and competitiveness.

The market players are launching new products to meet customer's requirements. For instance, in February 2023, Teledyne Geospatial announced the launch of Galaxy Onboard, an airborne survey solution. Galaxy Onboard is designed for airborne Light Detection and Ranging (LiDAR) applications requiring real-time data. With this launch, the company aimed to help customers automate manual work and reduce information processing time.

With increasing concerns about data privacy, many regions and countries have enacted regulations to protect individuals' location and geospatial data. The European Union's General Data Protection Regulation (GDPR) and similar laws in other jurisdictions require companies to obtain clear user consent for data collection and provide transparent data usage policies. Mobile mapping providers need to comply with these regulations, leading to the development of more robust privacy features and user controls.

The threat of substitutes for mobile mapping solutions is low. Traditional surveying methods and legacy mapping technologies can be substitutes for mobile mapping solutions. However, the accuracy, efficiency, and real-time capabilities of mobile mapping often make it the preferred choice. Some organizations may opt for in-house development of mapping technologies, but this approach may not provide the same level of sophistication and cost-effectiveness as specialized suppliers.

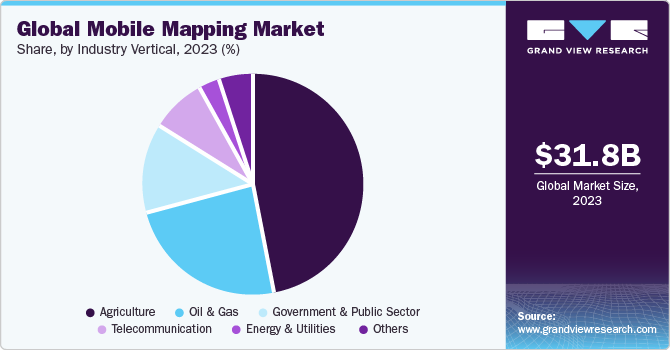

Mobile mapping solutions are used across sectors, including agriculture, oil & gas, and government & public sector, among others. Mobile mapping technology is used in the oil & gas industry to enhance operational efficiency by using location intelligence. Meanwhile, in the energy & utilities sector, mobile mapping solutions are used to manage assets and conduct routine maintenance by collecting data of energy & utility assets.

Component Insights

The hardware segment dominated the market, gaining a revenue share of over 53.0% in 2023 and witnessing a CAGR of 15.5% during the forecast period. By component segment, the mobile mapping market is bifurcated into hardware, software, and services. The hardware segment is further categorized into cameras, sensors, Inertial Measurement Units (IMU), and others (GPS, scanner, mobile phones). These systems are becoming increasingly popular due to their ability to quickly and efficiently collect and analyze accurate and comprehensive mapping data quickly and efficiently. However, the performance and accuracy of these systems depend on the quality of their hardware components. Integrating mobile mapping hardware with other technologies, such as artificial intelligence, the Internet of Things (IoT), and big data analytics, is driving the demand for mobile mapping hardware. This integration enables more advanced data analysis, real-time monitoring, and decision-making, making these hardware more valuable to businesses and organizations.

The software segment is anticipated to witness the fastest CAGR of 17.7% throughout the forecast period. Mobile mapping software offers a range of benefits to businesses and organizations. For instance, increasing adoption of mobile mapping, integration with other technologies, cost-effectiveness, and technological advancements are likely to fuel the growth of the mobile mapping software market in the coming years. For instance, the growing adoption of mobile devices such as tablets & smartphones is driving the demand for software. Mobile mapping software can be easily installed and used on mobile devices, enabling real-time data collection and analysis in the field.

Technology Type Insights

The GNSS technology type segment of this market dominated in 2023, gaining a market share of over 48.0%. Global Navigation Satellite System (GNSS) plays a significant role in mobile mapping systems by providing precise location information. In terms of technology type, the market is classified into GNSS, RADAR, and LiDAR. These systems utilize GNSS to determine the position and orientation of the platform, which is typically a vehicle or a handheld device. GNSS technology allows these systems to determine the position of the platform with high accuracy, which is critical for mapping applications. With GNSS, these systems can precisely capture the geographic location of features and assets. This information can then be used to create accurate maps, perform spatial analysis, and support various other applications.

The mobile mapping LiDAR technology type segment is expected to witness the highest growth rate of 17.4% during the forecast period. LiDAR (Light Detection and Ranging) utilizes lasers to measure distances and create precise 3D models of objects and environments. LiDAR has become an important technology in mobile mapping systems because it allows for highly accurate and detailed mapping of the surrounding environment. LiDAR can be used in various mobile mapping applications, including airborne, ground-based, and handheld systems. This allows for flexibility in mapping different types of environments and infrastructure. Moreover, LiDAR is capable of capturing millions of data points per second with sub-centimeter accuracy and precision. This level of accuracy and precision enables these systems to create highly accurate and detailed 3D models of the surrounding environment, including buildings, infrastructure, and natural features.

Mounting Type Insights

The drone-mounted segment dominated the market and accounted for the highest market share of over 33.0%. In terms of mounting type, the market is classified into vehicle-mounted, railway-mounted, drone-mounted, and others. Drone-mounted cameras and sensors have become an important technology in mobile mapping systems, providing significant advantages over traditional techniques. Drone-mounted cameras are capable of capturing high-resolution imagery, allowing for highly detailed mapping of the environment. This level of detail is not achievable with traditional mapping techniques, such as satellite imagery or ground-based surveys. Drone-mounted mapping systems can be used in various environments, including urban, rural, and remote areas. They can also be deployed quickly and easily, making them a valuable tool for emergency response and disaster management.

The vehicle mounted segment is anticipated to expand at a significant CAGR of 17.3% over the forecast period. A vehicle-mounted mobile mapping system is a sophisticated technology used to collect detailed geospatial data while traveling. It is mounted on a vehicle, such as a car or a truck. It enables data to be captured at high speeds, making it an efficient and cost-effective solution for collecting large amounts of data over long distances. The mounting type primarily includes high-resolution cameras, lidar sensors, and GPS receivers, which work together to capture 3D data of the surrounding environment. This data is further utilized for a variety of applications, including road maintenance and construction, urban planning, and asset management.

Application Insights

The automotive navigation application segment dominated the mobile mapping market and accounted for a market share of over 21.0%. In terms of application, the market is classified into asset management, automotive navigation, infrastructure maintenance, topographic mapping, 3D modeling, road surveys, and others. Automotive navigation systems leverage satellite navigation to get the position and location data gathered from mobile mapping solutions and utilize it to determine the route. Given that automotive navigation systems are crucial for autonomous cars, the segment is poised for significant growth as autonomous driving continues to evolve. The availability of various solutions that can enhance the data collection capabilities of mobile mapping systems to facilitate automotive navigation bodes well for the growth of the segment.

Mobile mapping system land surveying applications include creating highly accurate and detailed maps of the road network, including information about the road surface, signs, signals, and other infrastructure. Mobile mapping solutions can also help capture surface cracks, ditches, and road barriers. They can equally aid in inspecting bridges without disrupting the traffic. The strong emphasis on ensuring adequate safety of roads for public use by proactively identifying defects is expected to drive the growth of the road surveys segment.

The 3D modeling segment is expected to witness the highest growth rate of 18.4% during the forecast period. The growing adoption of 3D modeling across various industries and industry verticals bodes well for the growth of the segment. 3D modeling is used across various industries and industry verticals, such as construction, automotive, and product design & manufacturing. Architecture and real estate businesses also utilize 3D modeling to create detailed representations of various assets, such as landscapes, buildings, and interiors. 3D modeling also presents an effective way of visualizing product ideas and developing prototypes. In the automotive industry, 3D modeling aids in the design and testing of vehicles and components and enables realistic simulations.

Industry Vertical Insights

The agriculture segment dominated the market and accounted for a market share of over 47.0%. The segment is expected to expand at a CAGR of 15.8% throughout the forecast period. In terms of industry vertical, the market is classified into agriculture, oil and gas, government and public sector, telecommunication, energy and utilities, and others. Mobile mapping systems have significant importance in agriculture, where they are used to map and analyze crops, soil conditions, and other factors that impact crop yields. These systems can create highly detailed maps of soil conditions, moisture levels, and other factors that impact crop growth, providing farmers with a detailed understanding of crop conditions. This data can be used to identify areas of stress or disease, enabling farmers to take corrective action before crop yields are impacted. These systems can provide real-time data on crop yields and identify potential risks to crops, such as weather events or pest outbreaks.

The government and public sector industry vertical segment is expected to witness the highest growth rate of 18.5% during the forecast period. Mobile mapping systems have significant importance in the government & public sector, where they are used to map and analyze a wide range of infrastructure and public services. These systems can be deployed quickly in emergency situations to provide real-time data on infrastructure damage, hazardous conditions, and other factors that impact response efforts. Additionally, these systems can be used to map and analyze public health and safety data, such as disease outbreaks, crime patterns, and traffic accidents.

Regional Insights

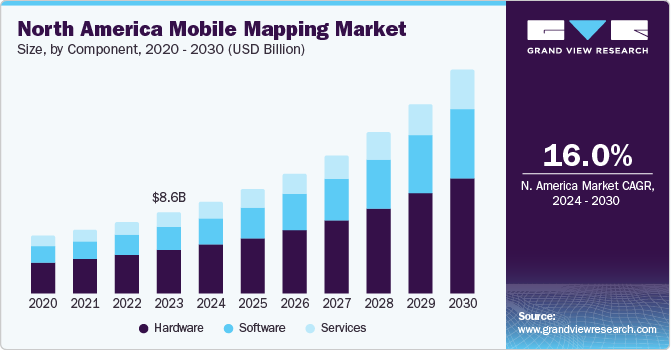

North America led the overall market in 2023, with a market share of over 27.0%. The North America region is equipped with well-developed infrastructure and spends large amounts on extensive research and development base, which makes the region to be the top revenue contributor in this market during the projected period. Moreover, the presence of small and medium players in North America, which offer components and services to the giants such as Trimble Inc., Topcon, and Teledyne Technologies Incorporated have also propelled the market growth. The U.S. is expected to retain its dominance over the forecast period owing to large scale adoption of mobile mapping as they are highly scalable, convenient, cost-effective, and efficient. As the demand for geospatial tools continues to grow, the demand of this market in U.S. is expected to increase in the forecasted period.

Asia Pacific is expected to develop considerably by the projection period and expand at a CAGR of 18.2%. Asia Pacific is poised for the fastest growth as several end-use industries in the region are adopting advanced technologies to rake in a variety of benefits, such as improved scanning efficiency and accurately gather and analyze geospatial data in real-time offered by these systems, thereby driving the adoption of these mapping systems across the Asia Pacific. Market players are acting in response to the present situation by instituting groundbreaking solutions in line with the changing demands of the end-use industries. The growing demand for real-time data analysis and enhanced visualization for various mapping and surveying needs in countries such as China and India is expected to fuel the demand for the market over the forecast period.

U.S. Mobile Mapping Market Trends

The mobile mapping market in the U.S. is projected to grow at a CAGR of 15.7% from 2024 to 2030. In the U.S., mobile mapping is mostly driven by the proliferation of smartphones, which have gradually evolved into multifunctional devices for data collection and location-based services because of their pervasiveness. Advances in the Internet of Things (IoT) and connected car technologies are also driving the growth of the U.S. mobile mapping market.

China Mobile Mapping Market Trends

The mobile mapping market in China is projected to grow at a CAGR of 17.2% from 2024 to 2030. It is driven by the proliferation of smartphones and the strong emphasis China is putting on digitalization and infrastructure development. Companies such as Baidu Maps have expanded their offerings to provide comprehensive solutions integrated with Augmented Reality (AR) and AI to enhance user experience.

Japan Mobile Mapping Market Trends

The mobile mapping market in Japan is witnessing significant growth owing to challenging urban surroundings and intricate transit networks, necessitating mobile mapping applications for seamless navigation. The Japanese mobile mapping market is poised for continued growth in line with the advances in technology and the evolving needs of a tech-savvy and highly connected populace.

India Mobile Mapping Market Trends

The mobile mapping market in India is expected to grow significantly over the forecast period owing to the proliferation of smartphones, digitalization initiatives, and India’s challenging topography. The adoption of mobile mapping in ride-sharing services and delivery logistics underscores the rising significance of location-based services in the nation’s evolving digital ecosystem.

The mobile mapping market in Europe was valued at USD 8.36 billion in 2023. Advances in the latest technologies, such as Machine Learning (ML), cloud computing, Artificial Intelligence (AI), and data analytics, are driving the growth of the European mobile mapping market.

U.K. Mobile Mapping Market Trends

The mobile mapping market in the U.K. accounted for over 31.0% share of the European market in 2023. As the U.K. continues to emphasize smart city and IoT rollouts, mobile mapping is gaining noticeable traction in urban planning and transportation.

Germany Mobile Mapping Market Trends

The mobile mapping market in Germany is expected to grow at a CAGR of 16.7% from 2024 to 2030. The German mobile mapping market is highly competitive owing to the presence of several major domestic and foreign market players, including Trimble Inc. and TOPCON CORPORATION. The presence of these market players drives the market’s growth.

France Mobile Mapping Market Trends

The mobile mapping market in France can be described as a dynamic market owing to the strong emphasis the government is putting on pursuing smart city initiatives, IoT rollouts, and efficient urban planning. In France, mobile mapping services are increasingly leveraging sensors, digital cameras, and GPS/INSS data to gather information, which is then processed and analyzed using mobile mapping software.

The mobile mapping market in Middle East and Africa (MEA) is anticipated to reach USD 8.75 billion by 2030. The rapid growth of the Middle East and Africa (MEA) mobile mapping market can be attributed to the proliferation of smartphones, the continued infrastructure development, and the critical role mobile mapping can play in disaster management and precision agriculture.

Saudi Arabia Mobile Mapping Market Trends

The mobile mapping market in Saudi Arabia is witnessing significant growth owing to several pivotal factors. Infrastructure projects in Saudi Arabia, such as those related to transportation and smart cities, are driving the need for precise mapping data, which is beneficial for urban planning, construction, and transportation management. Additionally, mobile mapping is also being incorporated into precision agriculture, improving crop management and resource allocation.

Key Mobile Mapping Market Company Insights

Some of the key mobile mapping vendors operating in the market include Google (Alphabet), Trimble Inc., Teledyne Geospatial, and TOPCON CORPORATION.

-

TOPCON CORPORATION provides medical equipment, ophthalmic instruments, machine control, and Global Positioning System (GPS)-related solutions. The company operates through three business segments, namely Eye Care, Positioning, and Smart Infrastructure. Through the Positioning segment, the company offers Global Navigation Satellite System (GNSS) receivers for surveying and 3D mobile mapping systems.

-

Teledyne Geospatial, a subsidiary of Teledyne Technologies Incorporated, is a developer and manufacturer of advanced Light Detection and Ranging (LiDAR) instruments. The company offers fully integrated camera and LiDAR solutions for terrestrial laser scanning, mine cavity monitoring, and mobile mapping, among others.

GreenValley International and imajing SAS are some of the emerging mobile mapping vendors.

-

imajing SAS is a company that offers an end-to-end mobile mapping toolchain. The company is also involved in the development of geospatial data collection and processing technologies to fulfill the needs of customers in various sectors, such as engineering & construction and transportation. It provides a mobile mapping system called imajbox. Moreover, it offers support, processing, and training services.

-

GreenValley International provides terrestrial, aerial, and mobile laser scanning solutions. The company develops hardware for Light Detection and Ranging (LiDAR) scanning systems. In addition, it offers solutions for various applications, such as autonomous driving, topographic surveying, and forestry.

Key Mobile Mapping Companies:

The following are the leading companies in the mobile mapping market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these mobile mapping companies are analyzed to map the supply network.

- Trimble Inc.

- Google (Alphabet)

- Leica Geosystems AG (Hexagon AB)

- TOPCON CORPORATION

- Teledyne Geospatial

- imajing SAS

- RIEGL Laser Measurement Systems GmbH

- Hi-Target

- GreenValley International

- Klau Geomatics Pty Ltd.

Recent Developments

-

In June 2023, TOPCON CORPORATION announced the acquisition of SATEL, a Finland-based wireless technology company. SATEL is a developer and manufacturer of connectivity solutions that enable mission-critical connections. Through the acquisition, TOPCON CORPORATION aimed to utilize SATEL’s advanced communication technology to strengthen its high-accuracy positioning solutions.

-

In April 2023, Teledyne Geospatial announced the launch of three applications, CARIS S-57 ENC Service, CARIS Chart Data Service, and CARIS Bathy Data Service, on its CARIS Cloud platform. The CARIS Cloud platform enables the processing, management, and distribution of hydrospatial data. The services would help streamline the distribution of digital charts for stakeholders. The CARIS Bathy Data Service would automate the distribution and generation of bathymetry products.

-

In November 2022, GreenValley International entered into a strategic partnership with GDU TECHNOLOGY, a China-based Unmanned Aerial Vehicle (UAV) company. Through the partnership, the companies aimed to provide an efficient solution for Architecture, Engineering, and Construction (AEC) surveying by using GreenValley International’s expertise in high-precision 3D mapping hardware solutions and GDU TECHNOLOGY’s expertise in unmanned systems.

Mobile Mapping Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 31.78 Billion |

|

Revenue forecast in 2030 |

USD 89.74 Billion |

|

Growth rate |

CAGR of 16.4% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, Technology Type, Mounting Type, Application, Industry Vertical, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, U.K., Germany, France, India, China, Japan, South Korea, Australia, Brazil, Mexico, Kingdom of Saudi Arabia (KSA), UAE, South Africa |

|

Key companies profiled |

Trimble Inc., Google (Alphabet), Leica Geosystems AG (Hexagon AB), TOPCON CORPORATION, Teledyne Geospatial, imajing SAS, RIEGL Laser Measurement Systems GmbH, Hi-Target, GreenValley International, and Klau Geomatics Pty Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Mobile Mapping Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mobile mapping market report based on component, technology type, mounting type, application, industry vertical, and region.

-

Component Outlook (Revenue, USD Million; 2017 - 2030)

-

Hardware

-

Cameras

-

Sensors

-

Inertial Measurement Unit (IMU)

-

Others

-

-

Software

-

Services

-

Consulting Services

-

Support & Maintenance Services

-

Training Services

-

Others

-

-

-

Technology Type Outlook (Revenue, USD Million; 2017 - 2030)

-

GNSS

-

RADAR

-

LiDAR

-

-

Mounting Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Vehicle-Mounted

-

Railway-Mounted

-

Drone-Mounted

-

Others

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Asset Management

-

Automotive Navigation

-

Infrastructure Maintenance

-

Topographic Mapping

-

3D Modeling

-

Road Surveys

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million; 2017 - 2030)

-

Agriculture

-

Oil & Gas

-

Government & Public Sector

-

Telecommunication

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile mapping market size was estimated at USD 24.18 billion in 2022 and is expected to reach USD 27.38 billion in 2023.

b. The global mobile mapping market is expected to grow at a compound annual growth rate of 16.2% from 2023 to 2030 to reach USD 78.33 billion by 2030.

b. North America is expected to dominate the market and grow at a CAGR of 16.6%. The North American region is equipped with well-developed infrastructure and spends a large amount on extensive research and development base, making the region the top revenue contributor in the mobile mapping market during the projected period.

b. Some prominent players in the market include Trimble Inc., Google (Alphabet Inc.), Leica Geosystems AG (Hexagon Geosystems), Topcon, Teledyne Technologies Incorporated, imajing SAS, RIEGL Laser Measurement Systems GmbH, Hi-Target, GreenValley International, and Klau Geomatics Pty Ltd among others

b. Key factors driving the mobile mapping market growth includes the widespread adoption of satellite mapping technology, seamlessly integrated into smartphones and Internet of Things (IoT) connected devices.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."