Mobile Computer Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Enterprise Size (Large Enterprises, SMEs), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-703-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Mobile Computer Market Size & Trends

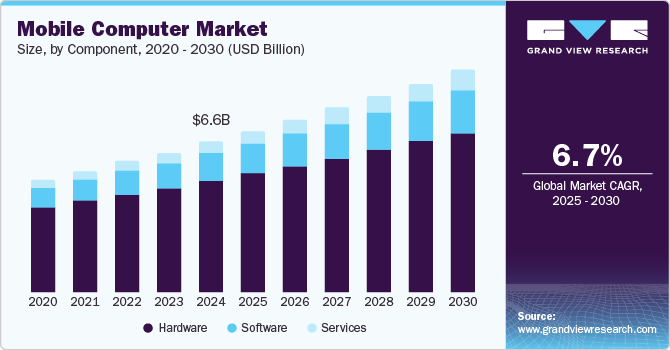

The global mobile computer market size was valued at USD 6.61 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The increasing demand for portable computing devices, such as smartphones, tablets, and laptops, has been a primary driver of market growth. This surge is attributed to the rapid expansion of consumer electronics, rising disposable incomes, and growing internet penetration. In addition, the COVID-19 pandemic accelerated the need for mobile computing solutions as remote work and online learning became prevalent. Industries such as healthcare, retail, and logistics have also adopted mobile computers to enhance operational efficiency and improve customer engagement.

Several factors are expected to drive growth in the mobile computer industry. The ongoing advancement of technology, including the development of new chip technologies and improved connectivity options, will enhance device performance and functionality. Furthermore, the increasing number of internet users worldwide is expected to boost demand for mobile computing devices as more individuals engage in online activities. The rise of e-commerce and digital services will also contribute to this growth as businesses seek efficient tools to manage inventory and customer interactions. Moreover, the emphasis on rugged mobile computers capable of operating in harsh environments is expected to expand market opportunities, particularly in industries such as manufacturing and transportation, where durability is critical.

Hence, the mobile computer industry is set for sustained growth driven by technological advancements, increasing internet penetration, and evolving industry needs. As businesses adapt to changing consumer behaviors and operational requirements, mobile computing devices will play a crucial role in facilitating efficient workflows and enhancing user experiences across various sectors. The combination of rising disposable incomes and growing demand for innovative features will further invigorate this dynamic market landscape.

Component Insights

The hardware segment of the mobile computer industry dominated the market with a revenue share of 73.7% in 2024. This segment includes essential components such as handheld terminals, smartphones, tablets, and accessories, which are critical for enhancing operational efficiency across various sectors. The strong demand for these devices is driven by their ability to support manufacturing, logistics, and retail tasks. Furthermore, technological advancements continue to improve hardware performance, further solidifying its market position. As businesses increasingly rely on mobile computing solutions, the hardware segment is expected to maintain its significant contribution to overall market growth.

The services segment is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to the rising adoption of mobile computing solutions, which require ongoing support and maintenance. As organizations integrate more mobile technologies into their operations, the demand for services such as device management, software updates, and technical support will increase. This trend underscores the importance of effective service offerings in maximizing device performance and ensuring customer satisfaction. Hence, the services segment is set to emerge as a critical component of the mobile computer industry’s evolution and success.

Enterprise Size Insights

The large enterprises segment held the largest market share in 2024. This dominance can be attributed to the high demand for mobile computing solutions to manage extensive inventories and streamline operations across various departments. Large businesses utilize advanced mobile computers to enhance productivity and efficiency, enabling them to handle significant volumes of data and transactions. Furthermore, these enterprises often invest in robust mobile technologies to support their expansive operations and improve customer service. As a result, the large enterprises segment plays a pivotal role in driving overall market growth.

The Small and Medium Enterprises (SME) segment is projected to grow at the fastest CAGR during the forecast period. This growth is expected to be driven by the increasing adoption of mobile computing solutions among SMEs, which seek to improve operational efficiency and customer engagement. Mobile technologies enable these businesses to streamline processes, manage inventory effectively, and enhance customer communication. As SMEs leverage mobile solutions to remain competitive in their respective markets, their contribution to the mobile computer industry is expected to rise significantly.

End-use Insights

The warehouse segment held a significant revenue share in 2024. This growth can be attributed to the sector's heavy reliance on mobile computing solutions to manage inventory, streamline operations, and enhance efficiency in storage and logistics. Mobile devices such as handheld terminals and rugged tablets play a critical role in real-time inventory tracking, order fulfillment, and shipment verification. With the continued growth of e-commerce, the demand for efficient warehousing solutions is expected to rise, further solidifying the warehouse segment's leading position in the market. Furthermore, the integration of advanced technologies in warehouses is driving the adoption of mobile computers, enabling more efficient and automated operations.

The healthcare segment is projected to grow at the fastest CAGR during the forecast period. This growth can be attributed to the increasing demand for mobile computing solutions that support patient care and enhance operational efficiency. In addition, mobile computers enable healthcare providers to manage patient data, track medical equipment, and facilitate communication across healthcare teams. Furthermore, as healthcare organizations adopt more advanced technologies to improve care delivery and streamline processes, the role of mobile computing in this sector is expected to become even more critical. Consequently, the healthcare segment is anticipated to make a significant contribution to the overall growth of the mobile computing market in the coming years.

Regional Insights

The North America mobile computer market held a 41.5% revenue share in 2024. This dominance is attributable to the increasing demand for mobile computing solutions across various industries, including retail, healthcare, and logistics. The region benefits from a robust infrastructure and high adoption rates of advanced technologies, further enhancing its market position. In addition, the development of e-commerce has led to a growing number of warehouses, boosting the demand for mobile devices. As businesses seek to improve efficiency and streamline operations, North America is expected to continue its growth trajectory. Overall, the significant investment in mobile computing technology solidifies the region's status as a key player in the global landscape.

U.S. Mobile Computer Market Trends

The U.S. mobile computer market dominated the regional market in 2024, accounting for a substantial share in North America. The country's extensive network of manufacturing and warehousing facilities drives the demand for mobile computing solutions that enhance operational efficiency. Generally, businesses rely on handheld devices and rugged computers to manage inventory and improve customer service. However, online shopping has led to an increase in warehouse operations, fueling the need for mobile technology. As companies adapt to changing consumer behavior and operational requirements, the U.S. market is expected to thrive in the coming years.

Europe Mobile Computer Market Trends

Europe mobile computer market is a significant player in the market, driven by the increasing demand for portable computing solutions across various industries. The region is expected to witness substantial growth during the forecast period. This growth is supported by the rising adoption of mobile computers in the retail, healthcare, and logistics sectors, where efficiency and real-time data access are crucial. Countries such as Germany and the U.K. are leading the way in implementing advanced mobile technologies, enhancing operational capabilities in manufacturing and warehousing. Furthermore, the growing e-commerce sector is boosting the need for mobile devices to manage inventory and streamline operations. As a result, Europe is expected to experience steady growth.

Asia Pacific Mobile Computer Market Trends

The Asia Pacific mobile computer market is anticipated to experience the highest CAGR during the forecast period. This growth can be attributed to rapid technological advancements and the increasing demand for portable computing solutions across various sectors. The region's expanding e-commerce landscape and the growing need for efficient inventory management drive businesses to adopt mobile computing technologies. Countries such as China, Japan, and India are making significant investments in mobile devices to enhance operational efficiency in the retail, healthcare, and logistics sectors. Moreover, the rise of IoT and smart technologies is further fueling the adoption of mobile computers, enabling real-time data access and improved communication. Consequently, substantial growth is expected in the Asia Pacific market in the coming years.

The China mobile computer market dominated the regional market in 2024. This dominance can be attributed to the Chinese electronic manufacturing sector. Major companies such as Huawei and Lenovo have driven innovation, contributing to the country’s success in this sector. Industries seeking to improve productivity and streamline operations are driving the growing demand for handheld devices and rugged tablets. With its advanced technology and robust supply chain, China is expected to maintain its significant share in the mobile computer industry.

Key Mobile Computer Company Insights

Some key companies in the mobile computer market are Advantech Co., Ltd.; CASIO COMPUTER CO., LTD.; CipherLab Co., Ltd; Handheld Group; and Datalogic S.p.A. These organizations are focusing on expanding their customer base and gaining a competitive edge in the market. In order to achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies.

-

CASIO COMPUTER CO., LTD. is renowned for its mobile computing solutions. The company has developed portable electronic devices, including the Cassiopeia series of handheld computers based on the Windows CE platform. Casio integrates advanced technologies into its products, enhancing their functionality in industries such as retail and logistics. Its devices also feature wireless communication capabilities, enabling seamless connectivity with smartphones and applications. The company offers solutions for both consumer and business markets.

-

Handheld Group specializes in manufacturing rugged mobile computers, including tablets and handheld devices designed for use in challenging environments. It provides robust solutions for industries such as logistics, construction, and public safety. The company strongly emphasizes durability and performance, ensuring its products withstand extreme conditions while delivering reliable functionality.

Key Mobile Computer Companies:

The following are the leading companies in the mobile computer market. These companies collectively hold the largest market share and dictate industry trends.

- Advantech Co., Ltd.

- CASIO COMPUTER CO., LTD.

- CipherLab Co., Ltd.

- Datalogic S.p.A.

- Handheld Group

- Honeywell International Inc.

- KEYENCE CORPORATION

- Opticon

- Panasonic Connect Co., Ltd.

- Zebra Technologies Corp.

Recent Development

-

In September 2024, CipherLab Co., Ltd. announced a partnership with Springdel to enhance Mobile Device Management (MDM) solutions for its Android mobile computers. This collaboration aims to improve device monitoring, content delivery, and remote support across various industries, including retail, logistics, and manufacturing. By integrating CipherLab's hardware expertise with Springdel's advanced software capabilities, the partnership seeks to deliver innovative MDM solutions that address the evolving demands of the mobile computer market.

-

In October 2024, Honeywell introduced three new handheld computers—CT37, CK67, and CK62—to optimize workflows in warehouses and retail environments. These devices are designed to support Artificial Intelligence (AI) applications, enhancing process efficiency and employee productivity. The CT37 is tailored for retail and healthcare sectors, while the CK67 and CK62 are engineered for warehouse operations, offering advanced connectivity and robust durability. In addition, Honeywell announced plans to develop an AI-powered Multi-Modal Intelligent Agent to further assist workers in demanding operational settings.

Mobile Computer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.09 billion |

|

Revenue forecast in 2030 |

USD 9.82 billion |

|

Growth rate |

CAGR of 6.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, enterprise size, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa |

|

Key companies profiled |

Advantech Co., Ltd.; CASIO COMPUTER CO., LTD.; CipherLab Co., Ltd.; Datalogic S.p.A.; Handheld Group; Honeywell International Inc.; KEYENCE CORPORATION; Opticon; Panasonic Holdings Corporation; and Zebra Technologies Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Mobile Computer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile computer market report based on component, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Manufacturing

-

Healthcare

-

Warehouse

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."