- Home

- »

- Electronic Devices

- »

-

Mobile Chargers Market Size, Share & Growth Report, 2030GVR Report cover

![Mobile Chargers Market Size, Share & Trends Report]()

Mobile Chargers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Charger Type, By Distribution Channel, By Number Of Ports, By Power Output, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-342-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Chargers Market Summary

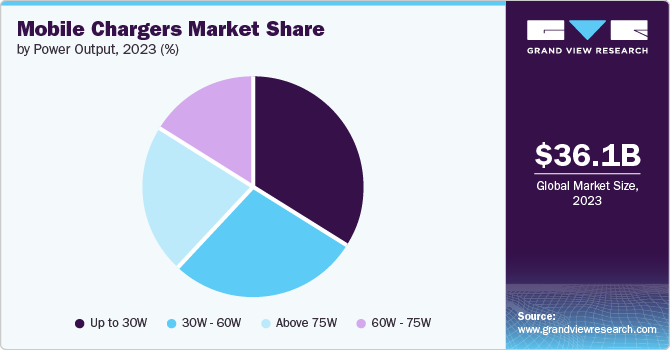

The global mobile chargers market size was estimated at USD 36,060.7 million in 2023 and is projected to reach USD 55,563.6 million by 2030, growing at a CAGR of 6.4% from 2024 to 2030. The market is rapidly expanding due to the widespread adoption of mobile phones, including smartphones and tablets, which are crucial for communication, work, and entertainment.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Mexico is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, wired chargers accounted for a revenue of USD 26,228.5 million in 2023.

- Wireless Chargers is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 36,060.7 Million

- 2030 Projected Market Size: USD 55,563.6 Million

- CAGR (2024-2030): 6.4%

- Asia Pacific: Largest market in 2023

The growing ownership of multiple devices, each with unique charging requirements, further escalates the demand for diverse charging solutions, including standard, fast, and wireless chargers. Technological advancements, such as Gallium Nitride (GaN) technology and universal USB-C standards, enhance charging efficiency and compatibility, while environmental initiatives drive the development of eco-friendly chargers. This dynamic market growth is propelled by the continuous proliferation of mobile devices and innovations.

The growing reliance on mobile devices shows the need for portable and convenient charging solutions. As users engage with their devices throughout the day for work, communication, entertainment, and more, there is a pressing demand for chargers that sustain device uptime on the go. This necessity has elevated portable power banks and car chargers to essential status, spurring the market toward compact, lightweight designs with substantial battery capacity and quick charging capabilities. This evolution shows the market's emphasis on providing chargers that meet the mobility and connectivity needs of modern consumers. Moreover, the incorporation of smart technologies in chargers, such as intelligent power management systems and adaptive charging protocols, enhances energy efficiency and user convenience. These advancements improve charging speeds and prolong battery life, addressing significant consumer concerns about device longevity and performance.

The market is experiencing growth fueled by the increasing popularity of wireless charging solutions, which provide enhanced convenience and ease of use for consumers. As more electronic devices integrate wireless charging capabilities, from smartphones to wearables and even some laptops, there is a growing demand for chargers that support this technology. Companies across the industry are investing heavily in the development of advanced wireless charging products to meet this demand. These innovations aim to improve charging efficiency, expand compatibility across devices, and enhance user experience by eliminating the need for cables. With consumers embracing the simplicity and flexibility of wireless charging, this trend is expected to continue driving the market expansion in the coming years.

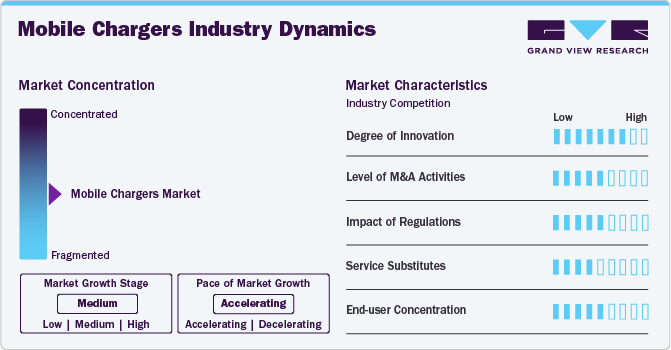

Market Concentration & Characteristics

The mobile chargers market exhibits substantial innovation, driven by the need for diverse, efficient, and versatile charging solutions. GaN technology leads the charge with high efficiency and compact designs, enabling faster and smaller chargers. Wireless charging and modular solutions have evolved to provide seamless, cable-free power and customizable setups. Multi-device chargers and sophisticated power banks cater to users with multiple gadgets, offering high capacity and fast charging on the go. Moreover, smart technologies and eco-friendly designs enhance charging efficiency, adapt to device needs, and promote sustainability.

The level of merger and acquisition activities is substantial, driven by the growing demand for high-quality animated content and the need for studios to stay competitive. For instance, in November 2021, Navitas Semiconductor, a power semiconductor company in the U.S., and Anker Innovations formed a strategic partnership to co-develop next-generation GaNFast chargers, starting with a focus on mobile chargers and expanding into energy storage. This collaboration aims to accelerate the time-to-market for innovative fast-charging solutions.

Standardization mandates, such as those for universal charger interfaces like USB-C, can reduce electronic waste, streamline user experience, and enhance compatibility with devices. However, these regulations may also stifle innovation by imposing constraints on charger designs and technologies. Compliance costs could rise for manufacturers, potentially increasing product prices, but could also level the playing field, benefiting smaller companies and fostering a more competitive market. Overall, such regulation aims to balance consumer convenience, environmental sustainability, and fair competition, though its success depends on careful implementation and adaptation by industry stakeholders.

The substitution in the mobile chargers market, where alternatives replace traditional wall chargers, portable power banks, and car chargers, drives significant shifts in technology adoption, consumer behavior, and environmental considerations. Wireless charging technologies, integrated power solutions in smart furniture and vehicles, and advancements in battery life reduce the dependency on conventional chargers, leading to a gradual decline in their demand. This shift encourages manufacturers to innovate and diversify their product lines, focusing on more versatile and sustainable charging solutions.

End user concentration in the market for mobile chargers shows a diverse yet fragmented consumer base with varying needs and preferences. High-end users, such as frequent travelers, gamers, and tech enthusiasts, often seek fast, multi-port, and high-capacity charging solutions, driving demand for advanced, premium products. Meanwhile, the broader consumer market typically favors more affordable and standardized chargers. Geographic and demographic factors also influence concentration, with urban, tech-savvy regions exhibiting higher adoption rates for cutting-edge charging technologies.

Type Insights

The wired charger segment led the market and accounted for 72.8% of the global revenue in 2023. Wired chargers dominate the mobile chargers market due to their superior efficiency, reliability, and cost-effectiveness compared to wireless alternatives. Wired solutions offer faster and more consistent charging speeds, crucial for devices with high power demands, such as smartphones, tablets, and laptops. They are also generally more affordable and widely compatible across various devices and brands, making them the preferred choice for consumers. Moreover, the existing infrastructure and user habits are heavily oriented towards wired connections, further reinforcing their market dominance despite the growing interest in wireless technologies.

The wireless chargers segment is expected to grow over the forecast period, due to their convenience, versatility, and the increasing adoption of Qi-enabled devices. They offer the significant advantage of cable-free operation, reducing clutter and wear on charging ports and simplifying the user experience. With more smartphones, wearables, and other gadgets incorporating wireless charging capabilities, consumers are drawn to the ease of placing their devices on a pad or stand without needing to plug in a cable. Innovations in efficiency, faster charging speeds, and broader compatibility are further propelling their popularity, making wireless charging an appealing alternative for both personal and automotive settings.

Charger Type Insights

The wall charger segment accounted for the largest market revenue share in 2023. Wall chargers are growing in the mobile chargers market due to their unmatched efficiency, convenience, and evolving technological advancements. As the primary and most reliable power source for fast and high-capacity charging, wall chargers are increasingly integrating advanced technologies like GaN (Gallium Nitride) to offer faster charging in a more compact form factor. They provide stable and continuous power, essential for rapidly charging modern, high-energy devices, including smartphones, tablets, and laptops. Their ubiquitous availability and capability to support the latest charging standards, such as USB-C Power Delivery, make them indispensable for both home and office use, driving their growing preference among consumers.

The car charger segment is projected to grow significantly over the forecast period. The car chargers segment is growing due to their essential role in providing on-the-go power for mobile devices. As vehicles are integral to daily commutes and travel, car chargers offer a practical and accessible solution for maintaining battery life, particularly for navigation, communication, and entertainment needs during trips. Their integration with a vehicle's power system ensures continuous charging without the need for additional cables or power sources, making them indispensable for users who spend significant time driving. This convenience, coupled with the increasing reliance on mobile devices, drives the prevalent use of car chargers in the market.

Distribution Channel Insights

The online segment accounted for the largest market revenue share in 2023. Online sales are growing in the mobile chargers market due to the expanding reach and convenience of e-commerce platforms. Consumers benefit from a broader selection of products, competitive pricing, and the ability to easily compare features and reviews from the comfort of their homes. Online retailers often offer exclusive deals, faster delivery options, and detailed product information, enhancing the shopping experience. The rise of online marketplaces and direct-to-consumer brands has also contributed to increased accessibility and variety, making it easier for consumers to find chargers that fit their specific needs, thereby driving growth in online sales within this market segment.

The offline segment is projected to grow significantly over the forecast period. Offline retail provides consumers with the opportunity for hands-on interaction and immediate product availability. Physical stores allow customers to test and compare chargers, ensuring compatibility and functionality before purchase. Moreover, brick-and-mortar retailers often offer personalized customer service, expert advice, and the convenience of in-store pickup or returns. For many consumers, especially those seeking immediate solutions or preferring face-to-face interactions, offline channels remain essential in meeting their mobile charging needs. Moreover, offline retailers are increasingly adapting by integrating digital technologies and omnichannel strategies to enhance the overall shopping experience and cater to a broader customer base.

Number of Ports Insights

The one port segment accounted for the largest revenue share in 2023. Advancements in charging technology have enabled one port chargers to deliver faster charging speeds and higher power outputs. This appeals to consumers who prioritize rapid and efficient charging for their devices, including smartphones, tablets, and laptops. One port chargers are also preferred for their simplicity and compactness, making them ideal for users seeking lightweight and portable charging solutions. Moreover, the trend towards minimalism and reduced clutter in electronic accessories has bolstered the popularity of one port chargers, as they offer a streamlined and straightforward charging experience without the complexity of multiple ports. Moreover, manufacturers are increasingly focusing on optimizing the design and functionality of one port chargers to enhance reliability and compatibility across a wide range of devices.

The two port segment is projected to grow significantly over the forecast period. The increasing prevalence of devices requiring simultaneous charging, such as smartphones and tablets, has driven demand for chargers equipped with two ports. Moreover, advancements in technology have enabled two-port chargers to maintain high charging speeds across both ports, ensuring that users do not experience a slowdown in charging performance even when charging two devices at once. Furthermore, manufacturers are responding to consumer preferences for versatile charging solutions that accommodate diverse usage scenarios, whether at home, in the car, or while traveling. As a result, the two-port segment is growing due to its ability to meet the increasing demand for efficient, multi-device charging solutions in a variety of settings.

Power Output Insights

The up to 30W segment accounted for the largest revenue share in 2023. The up to 30W range is particularly attractive for charging smartphones, tablets, and smaller laptops swiftly and effectively. Moreover, the increasing adoption of USB-C Power Delivery (PD) standards among devices has further fueled demand for chargers in this segment, as USB-C PD supports higher wattages and faster charging protocols. Moreover, the compact size and versatility of up to 30W chargers make them suitable for both home use and travel, catering to consumers seeking portable yet powerful charging solutions. As a result, the up to 30W segment is growing rapidly, driven by technological innovation, consumer demand for fast charging, and the expanding ecosystem of USB-C PD-compatible devices.

The 60W - 75W segment is projected to grow significantly over the forecast period. The 60W - 75W segment is seeing growth in the mobile chargers market due to its ability to meet the changing needs of increasingly powerful and versatile devices. As laptops, tablets, and other electronics require higher wattages for efficient charging, especially during intensive use or while multitasking, chargers in this segment provide the necessary power without compromising on speed or reliability. USB-C Power Delivery technology, which is prevalent in this wattage range, supports fast charging protocols and ensures compatibility across a wide range of devices, enhancing its appeal to consumers seeking versatile charging solutions. Moreover, the compact designs of these chargers make them convenient for both home and travel use, accommodating the growing trend of portable computing devices that require high-power charging capabilities.

Regional Insights

In response to the growing demand for faster charging solutions in North America, manufacturers are expanding their offerings of wall chargers and power banks equipped with advanced technologies such as USB Power Delivery. These innovations cater to consumers who prioritize convenience and efficiency in keeping their devices charged both at home and on the go. Wall chargers provide a reliable source of power in households, while car chargers offer mobility and flexibility during travel, reducing the reliance on finding available outlets. This shift shows a broader trend where technological advancements in charging devices aim to enhance user experience by delivering faster charging speeds and greater convenience in everyday life.

U.S. Mobile Chargers Market Trends

The Mobile Chargers market in the U.S. is expected to grow significantly over the forecast period. The widespread adoption of smartphones, which are becoming more powerful and feature-rich, has led to greater battery consumption. Modern smartphones often include high-resolution screens, advanced processors, and extensive app usage, all of which demand efficient charging solutions.

Asia Pacific Mobile Chargers Market Trends

Asia Pacific dominated the market and accounted for a 41.2% of the revenue share in 2023. The Asia Pacific region benefits from a robust presence of major consumer electronics giants such as Samsung and Qualcomm. These industry leaders are actively investing in the development and manufacturing of advanced charging technologies, which significantly contribute to the growth of the regional market. Their investments focus on enhancing charging efficiency, developing fast-charging protocols, and ensuring compatibility across a wide range of devices, including smartphones, tablets, and wearable gadgets.

The China mobile chargers market is expected to grow significantly over the forecast period. The country's robust manufacturing capabilities and technological innovation drive the production of high-quality chargers that are competitively priced and cater to both domestic and international markets. Chinese manufacturers utilize advancements in fast charging technologies and compatibility with a wide range of devices to meet consumer demands.

The mobile chargers market in India is expected to grow substantially over the forecast period. India has experienced rapid growth in smartphone adoption, driven by increasing internet penetration, declining device costs, and the availability of affordable data plans. As more people across urban and rural areas embrace smartphones for communication, entertainment, and digital services, the demand for reliable charging solutions like wall chargers, portable power banks, and car chargers has surged.

Europe Mobile Chargers Market Trends

In Europe, the increasing adoption of electronic gadgets and wearable devices is significantly driving the demand for mobile chargers. As consumers integrate more electronic gadgets into their daily routines, the necessity for reliable and efficient chargers such as wall chargers, portable power banks, and car chargers continues to grow.

The mobile chargers market in the U.K. is experiencing robust growth driven by technological advancements in charging technologies. Consumers are increasingly seeking advanced wall chargers and versatile portable power banks that offer fast charging capabilities and compatibility with a wide range of electronic gadgets. This demand shows a growing trend towards integrating more electronic devices into daily life, requiring reliable and efficient charging solutions that can keep pace with modern technology requirements.

The Germany mobile chargers market held the significant share of the Europe market. The growing adoption of electronic gadgets and wearable devices in Germany is driving significant demand for mobile chargers such as wall chargers, portable power banks, and car chargers. These devices, ranging from smartphones and tablets to smartwatches and fitness trackers, require frequent charging due to their advanced functionalities and continuous usage throughout the day.

Key Mobile Chargers Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in August 2023, Belkin unveiled the BoostCharge Pro 2-in-1 Wireless Charging Pad with MagSafe. This sleek and portable device allows users to charge both their iPhone and AirPods at the same time, offering up to 15W fast charging for iPhone models from the 12 to the 15 series and up to 5W for AirPods or AirPods Pro. Utilizing MagSafe technology ensures a secure and precise connection for efficient charging on the go.

Key Mobile Chargers Companies:

The following are the leading companies in the mobile chargers market. These companies collectively hold the largest market share and dictate industry trends.

- Alpha Group

- Fantasia Trading LLC (Anker Innovations)

- Apple Inc.

- AUKEY Official

- Baseus.com

- Belkin

- ELECOM CO., LTD.

- Hama GmbH & Co KG

- Inter IKEA Systems B.V.

- Intenso International GmbH

- j5create

- Mazer

- ZAGG Inc.

- NANAMI

- RavPower

- RORRY.net

- SAMSUNG

- Sitecom Europe BV

- CHEERO USA INC

- Ugreen Limited

- Xiaomi

Recent Developments

-

In April 2024, Belkin launched the Qi2 collection, featuring a variety of charging solutions, including wireless charging pads, stands, and power banks. The collection is designed to meet the needs of modern consumers who rely on their mobile devices for work, entertainment, and communication. It includes a range of innovative products that leverage the new Qi2 standard for faster and more efficient wireless charging.

-

In November 2023, Anker Innovations, a renowned Chinese electronics manufacturer, introduced the Anker 335 Power Bank to global markets after its successful launch in China. This power bank features a 20,000mAh capacity and a 22.5W output, offering a reliable and powerful charging solution.

-

In August 2023, Belkin unveiled eight new products across its power, audio, and connectivity categories at IFA 2023. The new products include innovative Qi2 chargers, USB-C solutions, and immersive audio products designed to enhance the user experience and provide reliable performance. The Qi2 chargers offer faster and more efficient wireless charging, while the USB-C solutions provide high-speed data transfer and power delivery.

-

In January 2022, Apple Inc. announced the launch of a new series of USB chargers, featuring advanced charging technology and enhanced safety features. These chargers are designed for fast and efficient power delivery across a variety of devices, including smartphones, tablets, and laptops. Their sleek design and compact form factor provide convenience and portability for users on the move.

-

In March 2022, Anker Innovations introduced a 35W USB Type-C wall charger in India. This charger, equipped with two ports delivering 20W and 15W, is part of Anker’s strategy to enhance its presence in the Asia-Pacific region.

Mobile Chargers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.25 billion

Revenue forecast in 2030

USD 55.56 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in thousand units, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, charger type, distribution channel, number of ports, power output, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Netherlands; China; Japan; India; South Korea; Australia; Singapore; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Alpha Group; Fantasia Trading LLC (Anker Innovations); Apple Inc.; AUKEY Official; Baseus.com; Belkin, ELECOM CO., LTD.; Hama GmbH & Co KG; Inter IKEA Systems B.V.; Intenso International GmbH; j5create; Mazer; ZAGG Inc.; NANAMI; RavPower; RORRY.net; SAMSUNG; Sitecom Europe BV; CHEERO USA INC.; America Ugreen Limited; Xiaomi

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Chargers Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile chargers market report based on type, charger type, distribution channel, number of ports, power output, and region:

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Wired Charger

-

Wireless Charger

-

-

Charger Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Wall Charger

-

Portable Power Banks

-

Car Charger

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Number of Ports Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

One Port

-

Two Port

-

Three Port

-

Four Port

-

Others

-

-

Power Output Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Up to 30W

-

30W - 60W

-

60W - 75W

-

Above 75W

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Latin America

-

Brazil

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The global mobile chargers market size was estimated at USD 36.06 billion in 2023 and is expected to reach USD 38.25 billion in 2024.

b. The global mobile chargers market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 55.56 billion by 2030.

b. Asia Pacific dominated the mobile chargers market with a share of 41.2% in 2023. This is investments focus on enhancing charging efficiency, developing fast-charging protocols, and ensuring compatibility across a wide range of devices, including smartphones, tablets, and wearable gadgets

b. Some key players operating in the mobile chargers market include Alpha Group, Fantasia Trading LLC (Anker Innovations), Apple Inc., AUKEY Official, Baseus.com, Belkin, ELECOM CO., LTD., Hama GmbH & Co KG, Inter IKEA Systems B.V., Intenso International GmbH, j5create, Mazer, ZAGG Inc., NANAMI, RavPower, RORRY.net, 14SAMSUNG, Sitecom Europe BV, CHEERO USA INC, America Ugreen Limited, Xiaomi

b. Key factors that are driving the market growth include rising urbanization and disposable income, rising adoption of smartphones and mobile devices, and advancements in mobile device technology

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.