Mobile Car Wash Service Market Size, Share & Trends Analysis Report By Service Type (Basic, Interior, Exterior, Premium), By Application (Individual, Fleet), By Booking Mode (Online, Offline), By Mode Of Payment (Cash, Cashless), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-088-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Mobile Car Wash Service Market Trends

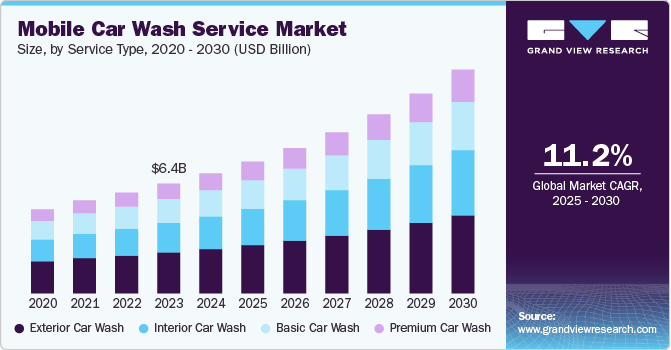

The global mobile car wash service market size was estimated at USD 6.96 billion in 2024 and is expected to grow at a CAGR of 11.2% from 2025 to 2030. Growing awareness about regular vehicle maintenance has led consumers to seek convenient solutions for keeping their vehicles in top condition. Mobile car wash services have gained preference as they provide professional cleaning and detailing at the customer’s chosen location, offering time-saving convenience compared to traditional car wash facilities. This shift is expected to drive market growth in the coming years. In addition, the COVID-19 pandemic significantly impacted the market, as consumers increasingly opted for mobile car wash services to have their vehicles cleaned at home or work, minimizing the need for visits to physical locations.

The increasing internet penetration is fueling the demand for on-demand services, including mobile car wash solutions. With better online access, consumers can easily book services through digital platforms or mobile apps offered by mobile car wash providers. The convenience of online booking, particularly for busy individuals seeking time-saving options, is expected to drive market growth. For example, data from the World Economic Forum in August 2022 shows that over 98% of people aged 30-49 in the U.S. are internet users. In developing countries such as India, Cambodia, and Mexico, where car wash facilities are limited, most vehicles are still cleaned manually, further highlighting the potential growth for mobile services in such regions.

In regions where traditional car wash facilities are limited or difficult to access, on-demand car wash services offer a convenient alternative. Customers can have their vehicles cleaned at their chosen location, such as home or office, eliminating the need to travel and saving time and effort. This convenience is driving demand for mobile car wash services. In addition, water scarcity and extreme climate conditions are contributing to the rise in sustainable mobile car wash solutions. Many providers are adopting waterless cleaning methods or using eco-friendly products, significantly reducing water consumption and minimizing environmental impact, making these services even more appealing to environmentally conscious consumers.

A study by the World Resources Institute (WRI) in January 2021 highlighted that by 2040, countries such as the UAE, Saudi Arabia, Palestine, Bahrain, Qatar, Oman, and Kuwait are among those likely to face a water crisis. In response, governments in these regions are promoting water recycling and sustainable car wash technologies, which are expected to drive market growth. In addition, the growing trend of subscription models is set to further boost the market. These models offer customers the convenience of regular car wash services without the need for repeated bookings. By setting up a recurring plan, customers can automatically schedule services at specified intervals, such as weekly or monthly, ensuring their vehicles are consistently cleaned and maintained with minimal effort.

Service Type Insights

Exterior mobile car wash service accounted for a market share of around 37% in 2024. The high demand for exterior mobile car wash services is largely driven by consumers' increasing concerns about maintaining the visual appeal of their vehicles. A vehicle's exterior plays a pivotal role in its overall aesthetic, and many customers place significant value on the cleanliness and shine of their cars. A well-maintained exterior enhances a vehicle's appearance but also creates a positive impression, reflecting the owner’s attention to detail. Mobile car wash services cater to this desire by offering specialized and convenient solutions that focus on thorough exterior cleaning, including washing, waxing, and polishing. These services ensure a pristine, polished look, helping vehicles maintain shine and making it easy for consumers to keep cars in top condition without visiting a physical car wash.

The demand for interior car wash is expected to grow at CAGR of 12.4% from 2025 to 2030. Increasing consumer awareness of the vehicle cleanliness and occupant health drive the growth. A clean interior is essential for maintaining hygiene, as it helps remove accumulated dirt, dust, allergens, bacteria, and other harmful contaminants that can negatively impact air quality and well-being. The heightened emphasis on health and sanitation, particularly post-pandemic, has made customers more conscious of regularly cleaning and sanitizing vehicle interiors. This growing focus on creating a safe and healthy environment within vehicles is anticipated to drive the demand for interior car wash services, as more consumers seek thorough cleaning and detailing solutions to ensure their vehicles remain fresh, hygienic, and free of contaminants.

Application Insights

Mobile car wash service for individual use accounted for a share of around 61% in 2024. With the growing number of cars on the road, there is a rising need for regular cleaning and maintenance to preserve the vehicle’s appearance and value. Mobile car wash services offer the convenience of on-demand cleaning at the customer’s preferred location, saving time and effort. For instance, data published by Forbes Media LLC in May 2023 indicates that the total number of registered vehicles in the U.S. saw a 3.66% increase, rising from 268,258,178 to 278,063,737 between 2017 and 2021.

The demand for mobile car wash service for fleet use is expected to grow at CAGR of 11.9% from 2025 to 2030. Fleet operators, including rental companies, ride-sharing services, and delivery businesses, require regular cleaning to maintain the appearance, hygiene, and functionality of vehicles. Mobile car wash services offer a convenient solution by providing on-site cleaning, minimizing downtime, and reducing the need for vehicles to be taken to a separate facility. This ensures that fleets remain in top condition but also enhances the brand image of companies by maintaining a consistently clean and professional fleet. As fleet sizes continue to expand, the demand for mobile car wash services tailored to fleet applications is expected to grow significantly.

Booking Mode Insights

Offline booking mode accounted for a share of around 31% in 2024. Many consumers, particularly those less inclined to utilize digital platforms, prefer traditional methods such as phone calls or in-person appointments to schedule their car wash services. This approach allows for personalized interaction, where customers can directly communicate their specific needs and preferences to service providers. In addition, offline booking can enhance trust and build stronger customer relationships, as it offers a more familiar and reassuring experience. To capitalize on this segment, businesses should maintain robust offline booking systems and ensure that their staff is well-trained to provide exceptional service, thereby fostering customer loyalty and satisfaction in a competitive market.

Online booking mode is expected to grow at CAGR of 11.3% from 2025 to 2030. Through user-friendly websites and mobile applications, consumers can effortlessly schedule car wash appointments at preferred time and location, enhancing the overall customer experience. This digital approach allows for real-time availability checks, transparent pricing, and the ability to customize service packages based on individual preferences. In addition, online booking platforms often include features such as customer reviews and service ratings, helping potential clients make informed decisions. By embracing online booking, mobile car wash providers can streamline their operations, reduce administrative overhead, and attract a tech-savvy customer base, ultimately driving business growth and customer satisfaction.

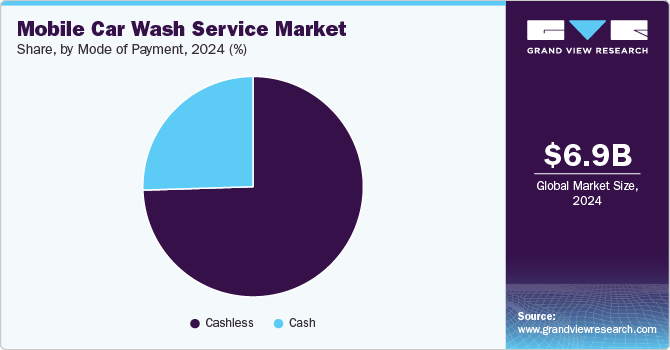

Mode of Payment Insights

Cash mode of payment accounted for a market share of around 75% in 2024. Cash payments in mobile car wash services continue to be a popular option for many customers, particularly those who prefer traditional transaction methods or are less comfortable with digital payment platforms. Offering cash as a payment option enhances customer convenience and accessibility, catering to a diverse clientele, including older customers or those without access to electronic payment methods. Customers often prefer cash payments due to the greater privacy and security they provide compared to digital transactions, a trend that is expected to drive growth in this segment.

Cashless mode of payment is expected to grow at a CAGR of 11.5% from 2025 to 2030. Methods such as credit and debit cards, mobile wallets, and contactless payment systems offer customers convenience, speed, and enhanced security, eliminating the need to carry cash. These cashless solutions streamline the payment process but also facilitate quicker service turnaround times, allowing mobile car wash providers to serve more customers efficiently. In addition, the integration of digital payment platforms can provide valuable data insights into customer preferences and spending patterns, enabling businesses to tailor their services and marketing strategies effectively.

Regional Insights

The mobile car wash service market in North America accounted for a market share of around 45% in 2024 in the global market. North America boasts a substantial number of vehicle owners, supported by a culture that heavily relies on personal transportation. This region has a large population with a high rate of vehicle ownership, resulting in significant demand for mobile car wash services. In addition, there is an increasing focus on environmental sustainability and water conservation among consumers. Traditional car wash facilities often consume large volumes of water, whereas mobile car wash services utilize waterless or eco-friendly cleaning techniques that significantly reduce water usage and waste. This alignment with sustainability goals further enhances the appeal of mobile car wash services in the North American market.

U.S. Mobile Car Wash Service Market Trends

The mobile car wash service market in the U.S. accounted for a market share of around 83% in 2024 in the North American market. The mobile car wash service in the region has witnessed substantial growth, driven by increasing consumer demand for convenient and efficient vehicle maintenance solutions. Major companies in the sector include Mobile Wash, a leading provider known for its eco-friendly practices and extensive range of services, and DetailXPerts, which combines steam cleaning technology with a commitment to sustainability. Other notable players include Washé, which offers a user-friendly app for on-demand car washing, and Spiffy, which focuses on both mobile car washes and detailing services. These companies are leveraging innovative technologies and customer-centric approaches to enhance service delivery and meet the evolving preferences of consumers, positioning themselves as key competitors in the rapidly expanding mobile car wash market in the U.S.

Europe Mobile Car Wash Service Market Trends

The mobile car wash service market in Europe accounted for revenue share of around 22% of global revenue in 2024. Increasing demand for convenient, eco-friendly, and time-efficient car care solutions drives the demand in the region. One of the major companies in this market is Dropless, a UK-based mobile car wash service. Dropless offers waterless car cleaning solutions that use biodegradable products, which help reduce water waste while providing high-quality cleaning. Customers can book services through their app or website, making it convenient to have cars washed at desired location, whether at home or work. This combination of convenience and eco-consciousness has made Dropless a key player in the European mobile car wash sector.

Asia Pacific Mobile Car Wash Service Market Trends

The Asia Pacific mobile car wash service market is expected to grow a CAGR of 13.5% from 2025 to 2030. Increasing awareness of mobile car wash services, combined with a growing willingness to invest in vehicle maintenance, is poised to create significant growth opportunities in the market in the foreseeable future. In addition, the rising rates of car ownership in key countries are expected to further bolster regional market expansion. For instance, an article published by China Daily Information Co. (CDIC) in January 2023 noted that Beijing had the highest car ownership in China, with over 6 million vehicles registered in 2022, followed closely by Chengdu, which boasted more than 5 million cars during the same period. This surge in vehicle ownership highlights the potential demand for mobile car wash services as consumers seek convenient solutions for maintaining their vehicles.

Key Mobile Car Wash Service Company Insights

The mobile car wash service market is highly competitive, driven by increasing consumer demand for convenience and time-saving solutions. The competitive landscape includes a mix of small, independent operators, franchises, and app-based platforms such as Spiffy, Washos, and Wype, which leverage technology to offer on-demand services. Key players differentiate themselves through eco-friendly practices, waterless cleaning technologies, and subscription-based models for regular customers. The market also faces competition from traditional car wash services, pushing mobile operators to focus on customer experience, pricing flexibility, and environmentally conscious offerings to gain a competitive edge. As consumer preferences shift toward sustainable and on-the-go services, companies are increasingly adopting digital platforms and mobile apps to capture market share.

Key Mobile Car Wash Service Companies:

The following are the leading companies in the mobile car wash service market. These companies collectively hold the largest market share and dictate industry trends.

- Washos

- MobileWash

- Get Spiffy, Inc.

- GreenSteam

- DetailXPerts.

- Wave Wash Inc.

- GoWashMyCar Ltd.

- VA MOBILE DETAIL

- Washé

- Washmycar Online

View a comprehensive list of companies in the Mobile Car Wash Service Market

Recent Developments

-

In February 2023, Spiffy raised USD 30 million in its Series C financing round, led by Edison Partners, with participation from Shell Ventures, Goodyear Ventures, and other key investors. The funding will fuel growth in mobile car care services, including expanding Spiffy Tires, Spiffy Brakes, and launching new franchise markets. The company, which has delivered over 2 million services across 45+ markets, aims to further develop its Digital Servicing platform for automotive dealers, offering private-label hardware and software solutions for mobile services.

-

In March 2022, Spiffy launched the Smart Tumbler™, a rechargeable device designed to eliminate vehicle odors using water-activated chlorine dioxide gas. The device targets odors from smoke, food spills, and organic materials, and is aimed at improving customer satisfaction for fleet and rental car companies. It fits into cupholders and completes odor removal in 15 minutes, offering a safe and effective solution. This innovation helps fleet managers address odor issues more easily, contributing to better vehicle utilization and customer experience.

Mobile Car Wash Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.64 billion |

|

Revenue forecast in 2030 |

USD 12.96 billion |

|

Growth rate (Revenue) |

CAGR of 11.2% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, application, booking mode, mode of payment, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; South Africa |

|

Key companies profiled |

Washos; MobileWash; Get Spiffy, Inc.; GreenSteam; DetailXPerts; Wave Wash Inc.; GoWashMyCar Ltd.; VA MOBILE DETAIL; Washé; Washmycar Online |

|

Report Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Mobile Car Wash Service Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global mobile car wash service market report on the basis of service type, application, booking mode, mode of payment, and region:

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Basic Car Wash

-

Interior Car Wash

-

Exterior Car Wash

-

Premium Car Wash

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Individual

-

Fleet

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Mode of Payment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cash

-

Cashless

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile car wash service market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2030 to reach USD 12.96 billion by 2030.

b. The global mobile car wash service market was estimated at USD 6.96 billion in 2024 and is expected to reach USD 7.64 billion in 2025.

b. North America dominated the mobile car wash service market with a share of about 45% in 2024. The growth of the regional market is mainly driven by the growing number of vehicle owners, with a culture that heavily relies on personal transportation.

b. Some of the key players operating in the mobile car wash service market include Washos, MobileWash, Get Spiffy, Inc., GreenSteam, DetailXPerts, Wave Wash Inc., GoWashMyCar Ltd., VA MOBILE DETAIL, Washe, Washmycar Online

b. Key factors that are driving the mobile car wash service market growth include water scarcity with extreme climatic conditions has led to the rise in the demand for sustainable mobile car wash services. Moreover, with increased awareness of regular vehicle maintenance consumers seek convenient solutions to keep their vehicles in good condition likely favoring market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."