Mirin Market Size, Share & Trends Analysis Report By Type (Aji-mirin, Hon-mirin), By Application (Residential, Commercial), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-381-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Mirin Market Size & Trends

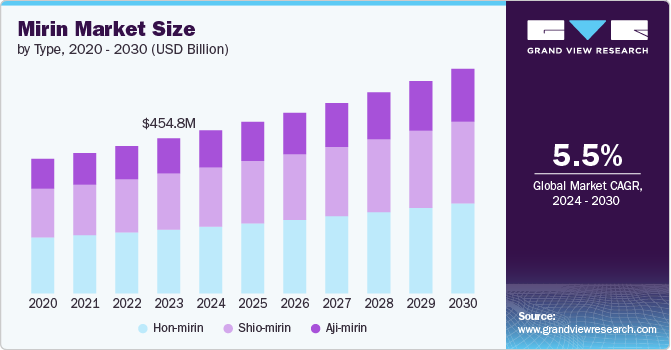

The global mirin market size was estimated at USD 454.8 million in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. As consumers become more health-conscious, there is a growing preference for natural and traditional ingredients. Mirin, known for its amino acids and antioxidants, is seen as a healthier alternative to artificial sweeteners and additives. Additionally, the global proliferation of Japanese cuisine, including sushi and teriyaki dishes, has led to increased demand for authentic Japanese ingredients like mirin.

The market for mirin, a traditional Japanese sweet rice wine, is experiencing a significant rise due to various factors and trends influencing its consumption in both residential and commercial applications. One major factor is the globalization of cuisine, which has led to an increased demand for authentic Japanese ingredients like mirin. As Japanese dishes such as teriyaki, sukiyaki, and various sauces gain popularity worldwide, mirin becomes a staple in kitchens aiming to replicate these flavors. Additionally, the health consciousness movement has driven consumers to seek healthier alternatives to sugar, and mirin, with its lower glycemic index and additional nutrients from fermented rice, fits this preference well.

Another factor contributing to the increased consumption of mirin is culinary innovation. Both professional chefs and home cooks are experimenting with mirin in unconventional recipes, integrating it into fusion cuisine, dressings, marinades, and even desserts.

The improved availability of mirin in supermarkets and online stores has also made it more accessible to a broader audience. Furthermore, the growing influence of Japanese culture through media, such as anime, movies, and culinary shows, has sparked interest in Japanese cooking ingredients, including mirin.

Moreover, there is a clear trend towards premium, artisanal, and organic mirin products, with consumers willing to pay more for high-quality, authentic, and natural options. The demand for convenient, ready-to-use sauces and marinades containing mirin is on the rise, catering to busy consumers looking for quick and easy meal solutions without compromising on flavor. The pandemic has also played a role in increasing home cooking, with more people experimenting with different cuisines, including Japanese, leading to higher residential use of mirin.

Furthermore, Japanese and Asian fusion restaurants globally are driving the demand for mirin as they require authentic ingredients to maintain the quality and authenticity of their dishes. Food manufacturers are also using mirin in sauces, marinades, and ready-to-eat meals to enhance flavor and appeal.

Type Insights

Hon-mirin dominated the market and accounted for a share of 41.2% in 2023. Hon-mirin, a traditional Japanese sweet rice wine used primarily in cooking, typically contains around 14% alcohol. Hon-mirin is also used to create glazes and marinades for meats, fish, and vegetables, enhancing their flavor and texture. It adds depth to soups and stews, enriches dressings and dipping sauces with its subtle sweetness, and contributes to the light, crispy texture of tempura batter. Its alcohol content not only aids in flavor extraction but also helps in tenderizing ingredients and creating complex, balanced flavors in Japanese cuisine.

Aji-mirin is expected to grow at a CAGR of 6.0% from 2024 to 2030. Aji-mirin is perceived as a healthier alternative to other sweeteners and flavor enhancers. It contains amino acids and antioxidants, contributing to its appeal among health-conscious consumers who prefer natural and traditional ingredients. Chefs and home cooks are increasingly incorporating aji-mirin into non-traditional recipes. Its versatility makes it a popular ingredient in fusion cuisine, dressings, marinades, and even desserts. This experimentation is driving demand as consumers explore new culinary possibilities.

Application Insights

Commercial application accounted for a revenue share of 67.9% in 2023. Mirin is predominantly favored in commercial applications due to its consistency, convenience, and cost efficiency. Its ready availability reduces preparation time in busy kitchens, where efficiency is paramount. Moreover, bulk purchasing and standardized production processes make commercial mirin more economical than homemade alternatives, especially in large-scale food production.

Residential application is expected to grow at a CAGR of 6.1% from 2024 to 2030. Mirin finds widespread use in home kitchens due to its versatility and flavor-enhancing qualities. Unlike professional settings that may opt for more specialized ingredients, mirin is valued by home cooks for its ability to sweeten and enrich a wide range of dishes subtly. Its ease of incorporation into recipes, without the need for extensive preparation, makes it particularly convenient for everyday cooking. Its long shelf life also makes it a practical choice for households, allowing it to be kept on hand and used as needed to enhance homemade sauces, marinades, and traditional dishes.

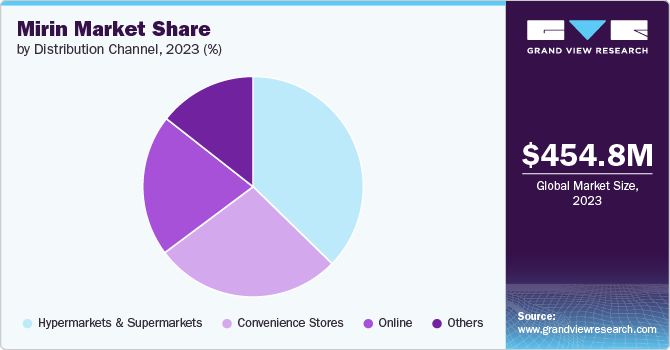

Distribution Channel Insights

Sales through hypermarkets & supermarkets accounted for a revenue share of 37.3% in 2023. Supermarkets and hypermarkets offer a one-stop shopping experience where customers can find a wide variety of products, including mirin, alongside other groceries and household items. This convenience saves time and effort for shoppers. These large retail stores typically stock a range of mirin brands and types, giving consumers more options to choose from. Whether looking for a specific brand or a particular type of mirin, shoppers are more likely to find what they need in a well-stocked supermarket or hypermarket.

Sales through online stores is expected to grow at a CAGR of 6.4% from 2024 to 2030. Online stores often provide a broader range of mirin brands and types, including rare or premium varieties that might not be available in local supermarkets. This variety gives consumers more options to find the specific type of mirin they prefer. Shopping online makes it easy to compare prices, reviews, and product details across different brands and retailers. Consumers can make more informed purchasing decisions based on the information available at their fingertips.

Regional Insights

The mirin market in North America captured a revenue share of over 20% in the global market. Increased cultural exchange and globalization have led to a greater appreciation for international cuisines, particularly Japanese cuisine, which has unique flavors and health benefits. Additionally, the surge in Japanese restaurants, including sushi bars and ramen shops, has popularized authentic dishes that use mirin, inspiring home cooks to experiment with Japanese recipes. Furthermore, health-conscious consumers in North America are increasingly favoring natural, less processed ingredients.

U.S. Mirin Market Trends

In the U.S., the availability of mirin in mainstream grocery stores and online platforms has significantly improved. Specialty Asian grocery stores, as well as major supermarket chains, now stock mirin, making it easier for consumers to purchase. The convenience of online shopping has also played a crucial role in its increased usage. The U.S. is known for its innovation in fusion cuisine, blending different culinary traditions to create new and exciting dishes. Mirin is frequently used in fusion dishes, combining elements of Japanese cuisine with American or other international flavors. This culinary creativity has led to an increased demand for mirin as chefs and home cooks experiment with new recipes.

Europe Mirin Market Trends

The mirin market in Europe is expected to grow significantly during the forecast period. The growing popularity of Japanese food culture in Europe has been fueled by the rise of Japanese restaurants, cooking classes, and food festivals. These platforms introduce European consumers to authentic Japanese ingredients like mirin, increasing their awareness and usage of this versatile ingredient.

Asia Pacific Mirin Market Trends

The Asia Pacific mirin market accounted for a revenue share of 31.4% in 2023. In this region, countries like China, South Korea, and Thailand share cultural and culinary similarities with Japan. This cultural proximity makes ingredients like mirin more familiar and acceptable. Traditional dishes in these countries often incorporate similar ingredients, making it easier for consumers to adopt mirin in their cooking.

Additionally, In Japan, mirin is a staple in traditional cooking. It is used in a wide range of dishes, from sauces and marinades to soups and glazes. The continued practice of traditional Japanese cooking methods ensures that mirin remains a central ingredient in Japanese households and restaurants.

Key Mirin Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Mirin Companies:

The following are the leading companies in the mirin market. These companies collectively hold the largest market share and dictate industry trends.

- Kikkoman Corporation

- Eden Foods

- Mizkan Holdings

- Sakura Foods Corporation

- Higashimaru Shoyu Co., Ltd.

- Takara Sake

- Yutaka

- Kankyo Shuzo

- Urban Platter

- Soeos

Recent Developments

- In February 2024, Sung Si-Kyung, a popular South Korean balladeer, launched a new liquor brand called "Kyung" and its first product, makgeolli (Korean rice wine), called "Kyungtakju." The makgeolli has an alcohol content of 12%, higher than the typical 6-9% found in commercially produced makgeolli.

Mirin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 478.0 million |

|

Revenue forecast in 2030 |

USD 658.1 million |

|

Growth rate |

CAGR of 5.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; and South Africa |

|

Key companies profiled |

Kikkoman Corporation; Eden Foods; Mizkan Holdings; Sakura Foods Corporation; Higashimaru Shoyu Co., Ltd.; Takara Sake, Yutaka; Kankyo Shuzo; Urban Platter; Soeos |

|

Customization scope |

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options. |

Global Mirin Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mirin market report based on type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Aji-mirin

-

Hon-mirin

-

Shio mirin

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mirin market size was estimated at USD 454.8 million in 2023 and is expected to reach USD 478.0 million in 2024.

b. The global mirin market is expected to grow at a compounded growth rate of 5.5% from 2024 to 2030 to reach USD 658.1 million by 2030.

b. Hon-mirin accounted for a share of 41.2% in 2023. Hon-mirin is a key ingredient in making teriyaki sauce, providing a sweet and rich flavor that balances the savory soy sauce. Its natural sweetness and umami make hon-mirin ideal for glazing and marinating meats, fish, and vegetables, enhancing the overall taste and texture.

b. Some key players operating in mirin market include Kikkoman Corporation, Eden Foods, Mizkan Holdings, Sakura Foods Corporation, and others.

b. Key factors that are driving the market growth include increasing health consciousness among consumers and rising globalization of Japanese cuisine

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."