Mining Logistics Market Size, Share & Trends Analysis Report By Type (Transportation Service, Warehousing & Storage Service, Value-added Service), By Application (Iron Ore, Metals, Coal, Gold), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-450-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Mining Logistics Market Size & Trends

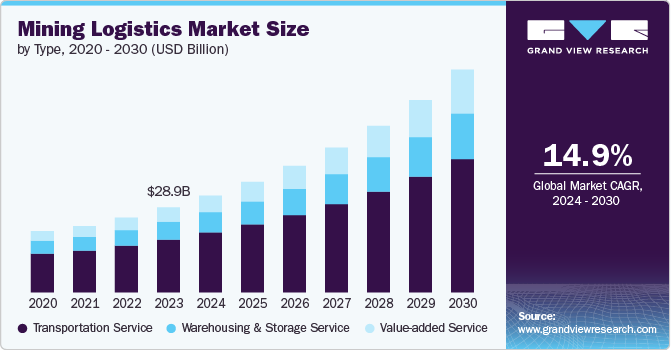

The global mining logistics market size was estimated at USD 28.86 billion in 2023 and is projected to grow at a CAGR of 14.9% from 2024 to 2030. The market growth can be attributed to the increasing demand for metals and minerals, expansion of mining activities in remote areas, and technological advancements. Countries, like China, India, and Brazil are witnessing rapid industrialization and urbanization, leading to increased consumption of raw materials. This in turn, is driving the demand for efficient logistics solutions to transport these materials from mines to processing plants and end-users.

The expansion of mining activities in remote and hard-to-reach areas is another key market growth driver. As easily accessible mineral deposits are depleted, mining companies are exploring new regions, often located in challenging terrains with limited infrastructure. This necessitates the development of specialized logistics solutions to ensure the smooth transportation of raw materials. Furthermore, government policies and infrastructure development initiatives are playing a crucial role in shaping the mining logistics market. Governments across the globe are investing in the development of transportation networks, including road, railways, and ports, to support the mining industry.

One of the most significant trends in the market for mining logistics is the shift towards automation and smart logistics. Companies are increasingly adopting automated vehicles, drones, and robotics to streamline operations, reduce labor costs, and improve safety. Furthermore, integration of AI and machine learning in supply chain management enable companies in the market to optimize logistics operations by predicting demand, managing inventory, and identifying potential disruptions in real-time.

Blockchain technology is gaining traction in the market due to its ability to provide transparent and secure supply chains. By recording every transaction on a decentralized ledger, blockchain ensures the authenticity and traceability of raw materials from the mine to end-user. This is gaining traction for industries such as diamonds and rare earth metals, where the provenance of materials is crucial.

Sustainability is becoming a key consideration in the mining logistics market, driven by growing environmental awareness and strict government regulations. Companies are investing in eco-friendly solutions, such as electric vehicles and green supply chain practices, to reduce their carbon footprint. For instance, in Australia, the government investment in the Northern Australia Infrastructure Facility (NAIF) aims to boost infrastructure development in the region, including mining-related projects. Such initiatives are expected to enhance the logistics network, making it easier and more cost effective for mining companies to transport their products.

Type Insights

In terms of type, the market is classified into transportation service, warehousing & storage service, and value-added service. The transportation service segment dominated the market in 2023 and accounted for more than 62.0% share of global revenue. The increasing global demand for minerals and raw materials, particularly from emerging economies in Asia and Africa is driving the demand for transportation services. Furthermore, the rising consumptions of metals such as copper, lithium, and cobalt, driven by the growth of industries like electric vehicles and renewable energy, is propelling the need for efficient transportation services.

The value-added service segment is projected to witness the highest CAGR of 17.4% from 2024 to 2030. This growth can be attributed to the growing focus of market players on reducing waste, optimizing packaging, and implementing environmentally friendly practices in their logistics operations. This shift is driven by both regulatory pressures and the growing demand for sustainable mining practices from stakeholders and investors. Moreover, the rise of digitalization in the mining sector is fueling the demand for value-added services. Technologies such as data analytics and machine learning are enabling more precise and efficient logistics operations, allowing for real-time monitoring an optimization of the supply chain.

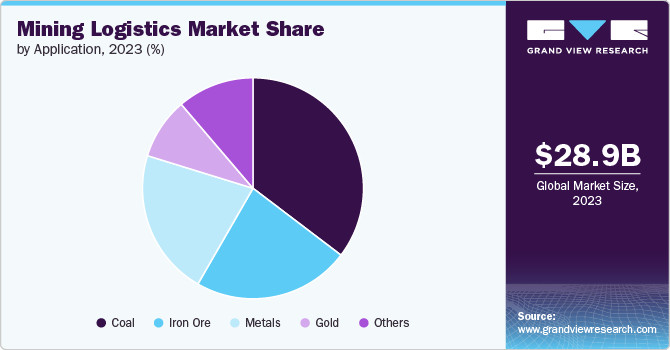

Application Insights

In terms of application, the market is classified as iron ore, metals, coal, gold, and others. The coal segment dominated the market in 2023 and accounted for more than 35.0% share of global revenue. The demand for power generation, particularly in developing countries where coal remains as a key energy source is driving the demand for coal logistics segment. Additionally, the metallurgical industry relies heavily on coal, specifically coking coal for steel production particularly in countries like India and China is further driving the segment demand.

The metals segment is projected to register a significant growth rate from 2024 to 2030. The segment growth is driven by the demand for raw materials in various industries, including construction, automotive, electronics, and renewable energy. The transition to green energy is particularly significant, as it has led to increased demand for metals such as copper, lithium, and rare-earth elements, which are essential for production of electric vehicles. Furthermore, urbanization and industrialization in emerging markets also contribute to the growing demand for metal logistics, as these regions require significant amounts of metals for infrastructure development.

Regional Insights

The mining logistics market in North America is expected to grow at a CAGR of 13.2% from 2024 to 2030. The increasing demand for critical minerals, driven by the growing electric vehicles and renewable energy sectors, has spurred investments in mining activities, subsequently boosting the logistics market.

U.S. Mining Logistics Market Trends

The mining logistics market in the U.S. is expected to grow at a CAGR of 12.8% from 2024 to 2030. The growing demand for critical minerals like lithium and cobalt, essential for battery production, has led to increased mining activities and, consequently, a heightened need for efficient logistics solutions. Additionally, government support for infrastructure modernization, as outlines in the Bipartisan Infrastructure Law, is enhancing the capacity and efficiency of transportation networks, benefiting the market.

Asia Pacific Mining Logistics Market Trends

Asia Pacificdominated the global mining logistics market and accounted for a revenue share of over 37.0% in 2023. The economic growth particularly in China and India, has led to a surge in infrastructure development, driving demand for raw materials and associated logistics services. Furthermore, supporting government policies to promote mining activities such as Australia’s Exploration Incentive Scheme and China’s Belt and Road initiative, are providing a favorable environment for the market growth.

Europe Mining Logistics Market Trends

The mining logistics market in Europe is expected to grow at a notable growth rate from 2024 to 2030. The regional growth is driven by the growing demand for critical minerals, essential for the region’s transition to renewable energy and electric vehicles. Additionally, stringent environmental regulations in the region drive the adoption of greener logistics. In support to this, companies in the region increasingly use intermodal transport, combining road, rail, and waterways, to reduce emissions and optimize supply chains.

Key Mining Logistics Company Insights

Some of the key companies operating in the mining logistics market include A.P. Moller - Maersk, ATG Australian Transit Group, Bis Industries, Blue Water Shipping, Centurion, Linfox Pty Ltd., PLS Logistics, TIBA, Tranz Logistics, and Vale.

-

Blue Water Shipping is a provider of logistics services across the globe. The company’s logistics expertise includes aerospace logistics, mining logistics, chemical logistics, energy logistics, and solar energy logistics, among others. The company’s capacity for bulk cargo, cost-effectiveness, and access to specialized port infrastructure make it the most reliable and economical option for moving mined materials internationally.

CSM Tech, Centurion, and Tranz Logistics are some of the emerging companies in the target market.

-

CSM Tech is engaged in providing specialized technology solutions for industries including agriculture, mining, education, healthcare, hospitality, and food security, among others. The company drives digital transformation through IoT, AI, and data analytics, offering innovative, customizable services tailored to mining companies’ needs.

Key Mining Logistics Companies:

The following are the leading companies in the mining logistics market. These companies collectively hold the largest market share and dictate industry trends.

- A.P. Moller - Maersk

- ATG Australian Transit Group

- Bis Industries

- Blue Water Shipping

- Centurion

- Linfox Pty Ltd.

- PLS Logistics

- TIBA

- Tranz Logistics

- Vale

Recent Developments

-

In May 2024, Bralorne Gold Mines Ltd., a subsidiary of Talisker Resources Ltd signed an ore hauling agreement with Stromsten Enterprises, a trucking service provider, in partnership with Bridge River Management Corporation. Through the agreement the material from Mustang Mine will be transported to Craigmont milling facility.

-

In March 2024, TIBA starts operations in Turkey. The operation in Turkey helps the company to strengthen the traffic between Turkey/Europe and Asia/Turkey, and also connect Turkey with Latin America and Africa.

Mining Logistics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 32.89 billion |

|

Revenue forecast in 2030 |

USD 75.66 billion |

|

Growth rate |

CAGR of 14.9% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

A.P. Moller - Maersk; ATG Australian Transit Group; Bis Industries; Blue Water Shipping; Centurion; Linfox Pty Ltd.; PLS Logistics; TIBA; Tranz Logistics; Vale |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Mining Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mining logistics market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Transportation Service

-

Warehousing & Storage Service

-

Value-added Service

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Iron Ore

-

Metals

-

Coal

-

Gold

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The transportation service segment dominated the market in 2023 and accounted for more than 62.0% share of global revenue. The increasing global demand for minerals and raw materials, particularly from emerging economies in Asia and Africa is driving the demand for transportation services.

b. Some of the companies operating in the mining logistics market include A.P. Moller – Maersk, ATG Australian Transit Group, Bis Industries, Blue Water Shipping, Centurion, Linfox Pty Ltd., PLS Logistics, TIBA, Tranz Logistics, and Vale.

b. The global mining logistics market size was estimated at USD 28.86 billion in 2023 and is expected to reach USD 32.89 billion in 2024.

b. The global mining logistics market is expected to grow at a compound annual growth rate of 14.9% from 2024 to 2030 to reach USD 75.66 billion by 2030.

b. The market growth can be attributed to the increasing demand for metals and minerals, expansion of mining activities in remote areas, and technological advancements. Countries, like China, India, and Brazil are witnessing rapid industrialization and urbanization, leading to increased consumption of raw materials. This in turn, is driving the demand for efficient logistics solutions to transport these materials from mines to processing plants and end-users.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."