- Home

- »

- Advanced Interior Materials

- »

-

Mining Drills & Breakers Market Size, Industry Report, 2030GVR Report cover

![Mining Drills And Breakers Market Size, Share & Trends Report]()

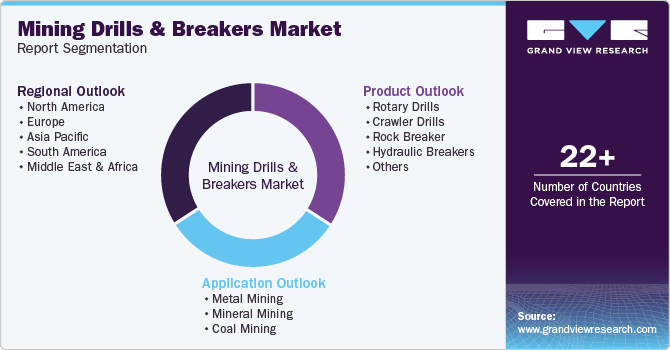

Mining Drills And Breakers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Rotary Drills, Crawler Drills, Rock Breaker, Hydraulic Breakers), By Application (Metal Mining, Mineral Mining, Coal Mining), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-608-0

- Number of Report Pages: 171

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mining Drills And Breakers Market Trends

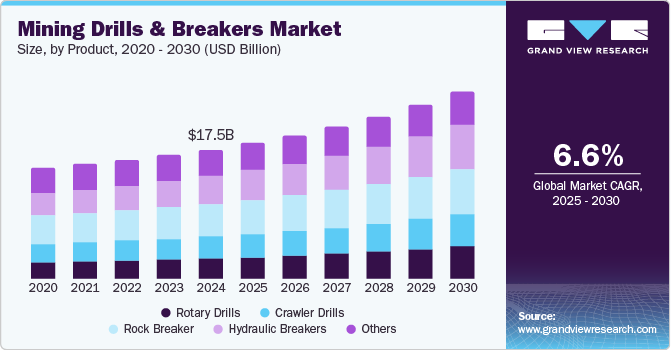

The global mining drills and breakers market size was estimated at USD 17,492.9 million in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. The growth of the mining drills and breakers market is primarily driven by the rising demand for minerals and metals across various sectors, including construction, automotive, and electronics. Rapid urbanization and industrialization worldwide have intensified the need for resources such as iron, copper, coal, and precious metals, spurring investments in mining activities.

In addition, as countries strive for resource independence, there is an increasing focus on domestic mineral production, which fuels demand for efficient and high-performing drilling and breaking equipment. Safety and productivity concerns are further encouraging mining companies to adopt advanced, automated drills and breakers that reduce manual labor and enhance operational efficiency, contributing significantly to mining drills and breakers industry growth.

Governments across various regions are introducing supportive policies and incentives to boost the mining industry, which in turn positively impacts the sales of mining drills and breakers. These initiatives often include tax incentives, subsidies for local manufacturing of mining equipment, and relaxed regulations to encourage foreign investment in mining activities. For instance, governments in countries such as India, Australia, and Brazil are actively promoting mineral exploration to support economic growth, which increases the demand for advanced mining machinery. In addition, governmental emphasis on sustainable mining practices encourages the adoption of eco-friendly and energy-efficient drilling and breaking equipment, driving further the mining drills and breakers industry expansion.

The mining drills and breakers industry has significant growth opportunities, especially in emerging economies where large, untapped mineral reserves are now being explored. Countries in the Asia Pacific and Africa regions are experiencing a surge in mining activities to meet the global demand for minerals. Technological advancements, such as autonomous drilling systems and remotely operated breakers, present another growth opportunity by enabling mining companies to improve operational efficiency and safety. In addition, the push toward sustainable mining creates opportunities for eco-friendly equipment, as companies are encouraged to adopt solutions that reduce emissions and environmental impact.

Manufacturers in the mining drills and breakers market are increasingly focusing on growth strategies, such as expanding their product portfolio, investing in research and development, and forming strategic partnerships. To meet the evolving demands of the mining industry, companies are developing more efficient, durable, and technologically advanced equipment that can withstand harsh mining environments. Many manufacturers are also exploring partnerships with tech firms to incorporate AI, IoT, and automation into their machinery. In addition, some companies are expanding their reach in high-growth regions such as Asia Pacific and Latin America, where mining activities are increasing, to capture a larger market share.

Technological innovation is a key driver in the mining drills and breakers market, as advanced technologies improve equipment efficiency, safety, and environmental compliance. Innovations such as autonomous drills, GPS-guided drilling systems, and IoT-enabled equipment allow for real-time monitoring, precise operations, and predictive maintenance, reducing downtime and operational costs. The shift toward eco-friendly technology has also led to the development of electric-powered and hybrid equipment that lowers carbon emissions. These innovations are transforming traditional mining practices, helping companies meet stringent environmental standards and enhance productivity in complex mining operations, thus driving the mining drills and breakers industry.

Product Insights

The rock breaker segment holds a substantial share of over 25% in 2024, in the mining drills and breakers market, driven by its versatility and effectiveness in breaking large rocks into manageable sizes in mining operations. Rock breakers are essential in various mining applications, especially in secondary breaking processes, where they are used to reduce the size of oversized rocks. This segment's growth is fueled by rising mining activities globally, as companies seek to enhance productivity and minimize downtime. In addition, the adoption of automated and remotely operated rock breakers has expanded their utility, making them indispensable in harsh mining environments that prioritize safety and operational efficiency.

The hydraulic breakers segment has witnessed a CAGR of over 8% from 2025 to 2030 in the mining drills and breakers market due to the equipment's high-impact energy and efficiency in breaking hard materials. Hydraulic breakers are favored in the mining industry for their power, precision, and ability to perform in challenging conditions. They are increasingly used in both surface and underground mining, as they enhance operational productivity while reducing manual labor. The demand for environmentally friendly and energy-efficient mining equipment further drives this segment, as hydraulic breakers produce fewer emissions and operate with less noise compared to traditional explosives. In addition, advancements in hydraulic technologies have improved the durability and versatility of these breakers, contributing to their growing popularity.

Application Insights

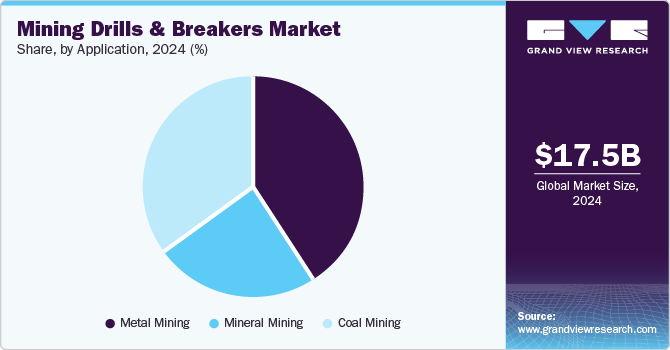

The metal mining segment holds a high share in the mining drills and breakers market due to the rising demand for metals used in construction, manufacturing, and technology industries. With the global increase in urbanization and infrastructure development, the need for metals like iron, copper, and aluminum continues to rise, supporting significant investments in metal mining activities. Mining drills and breakers play a crucial role in metal extraction processes, aiding in both exploration and extraction stages. The adoption of advanced drilling and breaking technologies in metal mining further boosts this segment, as companies prioritize efficiency, safety, and cost-effectiveness in their operations.

The coal mining segment is witnessing substantial growth within the mining drills and breakers market, driven by the sustained demand for coal as a primary energy source, particularly in developing economies. Despite the global shift towards renewable energy, coal remains a critical resource for electricity generation in many countries, especially in Asia Pacific. Mining drills and breakers are essential for efficient coal extraction, especially in deep and underground mining environments. Technological advancements, such as automated and remotely controlled drilling and breaking equipment, have also propelled this segment forward by improving safety and productivity in coal mining. In addition, the trend towards modernizing coal mining equipment for lower environmental impact has boosted the adoption of high-efficiency drills and breakers in this segment.

Regional Insights

The North American mining drills and breakers market will witness a CAGR of over 6% in 2024, due to the region's extensive mineral resource base, especially in the U.S. and Canada, where large mining operations require heavy-duty equipment. This region's market growth is significantly influenced by technological advancements in automation and precision in drilling and breaking equipment, improving efficiency and safety for operators. In addition, growing investments in mineral exploration and development, supported by favorable government policies, bolster the demand for advanced drills and breakers. Environmental regulations also push for efficient, less wasteful machinery, which helps drive demand for high-tech, durable, and eco-friendly equipment.

U.S. Mining Drills And Breakers Market Trends

In the United States, the mining drills and breakers market is largely driven by substantial investments in natural resource exploration and a rise in mining activities across states such as Nevada, Arizona, and Texas. The U.S. market benefits from a supportive regulatory environment and government incentives that encourage the expansion of mining operations, especially for essential minerals such as copper, lithium, and rare earth elements. Furthermore, the adoption of advanced drilling technologies, including wireless monitoring and autonomous control systems, contributes to the market's growth as companies prioritize productivity and safety.

Europe Mining Drills And Breakers Market Trends

The European mining drills and breakers market is experiencing notable growth due to an increased emphasis on sustainable mining practices. Strict environmental regulations in Europe push mining companies to adopt advanced equipment that reduces emissions and minimizes environmental impact. Countries such as Germany, Russia, and Poland are prominent contributors to this market growth, with a rising demand for minerals that support renewable energy technologies and electric vehicles. The European Union’s push for resource independence and increased domestic production of essential minerals also supports the growth mining drills and breakers industry.

The Germany mining drills and breakers market held a substantial market share in 2024 due to the country's strong mining industry, supported by technological advancements and a focus on automation to improve efficiency and safety. Rising investments in mineral exploration and infrastructure development, coupled with strict regulations promoting sustainable mining practices, drove the adoption of advanced drilling and breaking equipment. In addition, Germany's position as a manufacturing hub for high-quality machinery contributed to the mining drills and breakers industry growth.

The UK mining drills and breakers market held a substantial market share in 2024 due to increased investments in infrastructure and construction projects, driving demand for advanced mining equipment. The country's focus on sustainable mining practices and adoption of modern, energy-efficient technologies further boosted market growth. In addition, advancements in automation and the presence of established manufacturers offering innovative solutions supported the mining drills and breakers industry expansion.

Asia Pacific Mining Drills And Breakers Market Trends

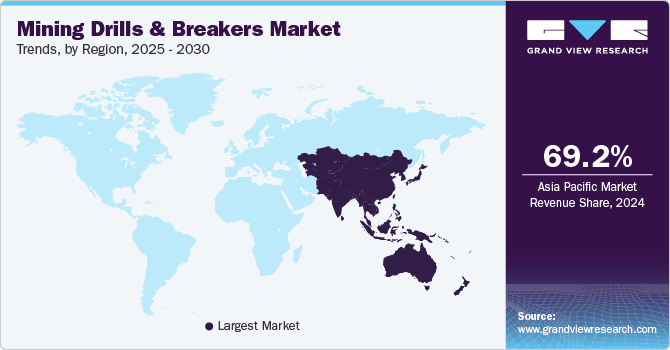

Asia Pacific is one of the fastest-growing markets and holds a significant share of over 69% in the year 2024, for mining drills and breakers, driven by rapid industrialization and urbanization in countries such as China, India, and Australia. These nations are witnessing significant investments in mining activities to meet the high demand for metals and minerals for infrastructure and manufacturing. In addition, the growth of the construction sector in this region drives demand for minerals and metals, thereby boosting the need for efficient drilling and breaking equipment. Technological advancements and an increasing focus on energy-efficient machinery also play a role in propelling the market forward.

China holds a significant share of the mining drills and breakers market due to its massive demand for raw materials to support its rapidly growing construction and industrial sectors. China is the world’s largest producer of coal and also mines a substantial amount of other minerals such as iron ore, copper, and rare earth elements. The country’s focus on modernization and upgrading mining equipment for enhanced productivity is also contributing to its significant share in the market. In addition, government support for domestic mining equipment manufacturers and subsidies for innovation plays a crucial role in this market's expansion.

India’s mining drills and breakers market is seeing rapid growth driven by an increasing demand for minerals in construction, automotive, and electronics sectors. The Indian government’s initiatives, such as “Make in India” and reforms to encourage foreign investment in mining, have boosted exploration and mining activities, particularly for coal, iron ore, and bauxite. This growth is further supported by investments in infrastructure development, which raises the demand for essential raw materials. The adoption of new drilling technologies and mechanized solutions in mining is also growing as companies focus on improving efficiency, safety, and productivity in mining operations.

Key Mining Drills And Breakers Company Insights

The major players in the market are concentrating on business strategies such as mergers, partnerships, and acquisitions for their businesses along with developing innovative mining drills and breakers to attract a larger customer base and gain a competitive edge in the market.

-

Hitachi Construction Machinery Co., Ltd. is a leading global manufacturer and supplier of construction and mining equipment, including high-quality mining drills and breakers. The company is known for its advanced technology and commitment to innovation, providing efficient, durable, and environmentally friendly machinery tailored for mining applications.

-

Komatsu Ltd. is a prominent player in the global mining equipment market, offering a wide range of mining drills and breakers designed for efficiency and sustainability. Known for its expertise in manufacturing heavy-duty machinery, Komatsu provides high-performance mining drills and breakers that are optimized for challenging mining conditions.

Key Mining Drills And Breakers Companies:

The following are the leading companies in the mining drills and breakers market. These companies collectively hold the largest market share and dictate industry trends.

- Atlas Copco AB

- Boart Longyear Ltd.

- Cabo Drilling Corp.

- Caterpillar, Inc.

- Energold Drilling Corp.

- FLSmidth & Co. A/S

- Geodrill Limited

- Hitachi Construction Machinery Co. Ltd

- Komatsu Ltd.

- Metso Corporation

Recent Development

-

In October 2023, Sandvik Mining and Rock Solutions has introduced a performance upgrade package for its 2700 series underground drills, including a single-boom jumbo, rock bolter, and top hammer production drill. This series was developed with input from the company’s Finnish, French, and Chinese teams.

-

In July 2023, Caterpillar debuted its first semi-autonomous construction equipment, the Cat 299D3 Compact Track Loader (CTL), at the Cat Trial 12 demo in Arizona. This remote-operated and semi-autonomous CTL marks a new era for construction technology.

-

In May 2024, Komatsu Ltd launched the second generation of its Z2 line of small-class underground drill and bolting equipment, featuring battery-electric models, a pumpable resin system, and improved ergonomics, expanding its hard rock mining solutions.

Mining Drills And Breakers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18,379.8 million

Revenue forecast in 2030

USD 25,310.0 million

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; UAE; South Africa; Saudi Arabia

Key companies profiled

Atlas Copco AB; Boart Longyear Ltd.; Cabo Drilling Corp.; Caterpillar, Inc.; Energold Drilling Corp.

FLSmidth & Co. A/S; Geodrill Limited; Hitachi Construction Machinery Co. Ltd; Komatsu Ltd.; Metso Corporation

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Mining Drills & Breakers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mining drills and breakers market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotary Drills

-

Crawler Drills

-

Rock Breaker

-

Hydraulic Breakers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Mining

-

Mineral Mining

-

Coal Mining

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

ANZ

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mining drills and breakers market size was estimated at USD 17,492.9 million in 2024 and is expected to reach USD 18,379.8 million in 2025.

b. The global mining drills and breakers market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 25,310.0 million by 2030.

b. The rock breakers segment dominated the global mining drills & breakers market with a share of 25% in 2024. This is attributable to the increasing demand for backhoe loaders and excavators, rising demand for underground mining equipment, and government initiatives supporting metal exploration in developing nations.

b. Some of the key players in the global mining drills & breakers market include Komatsu Ltd.; Caterpillar, Inc.; Sandvik AB; Atlas Copco AB; Doosan Corporation; Epiroc AB; and Boart Longyear Ltd.

b. Key factors that are driving the global mining drills & breakers market growth include technological innovations driving demand for heavy equipment and increasing mining activities across the globe

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.