- Home

- »

- Communications Infrastructure

- »

-

Millimeter Wave Technology Market Size, Share Report, 2030GVR Report cover

![Millimeter Wave Technology Market Size, Share & Trends Report]()

Millimeter Wave Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Component, By Frequency Band, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-796-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Millimeter Wave Technology Market Summary

The global millimeter wave technology market size was estimated at USD 3.75 billion in 2023 and is projected to reach USD 38.55 billion by 2030, growing at a CAGR of 39.7% from 2024 to 2030. Millimeter wave (mmWave) is the band spectrum with wavelengths between 30 GHz to 300 GHz.

Key Market Trends & Insights

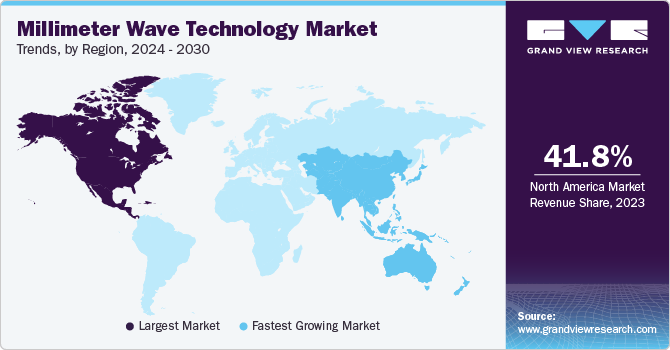

- North America dominated the market and accounted for a 41.8% share in 2023.

- Asia Pacific is anticipated to witness significant growth in the artificial intelligence market.

- Based on product, the telecommunication equipment segment led the market and accounted for 57.8% of the global revenue in 2023.

- Based on component, the antennas and transceivers segment accounted for the largest market share of 42.08% in 2023.

- Based on frequency band, the E-band segment accounted for the largest market revenue share of 62.64% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.75 Billion

- 2030 Projected Market Size: USD 38.55 Billion

- CAGR (2024-2030): 39.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The mmWave technology has gained popularity owing to its potential for high data rates, low latency, and capacity to support a massive number of devices simultaneously. Rising demand for bandwidth-intensive applications, use of mmWave in 5G communications, and demand for high speed for the Internet of Things (IoT) are contributing to the market’s growth.The International Telecommunication Union (ITU) reported a significant surge in international bandwidth usage from 292 Tbit/s in 2017 to 1,230 Tbit/s in 2022. This escalating demand for bandwidth is a key driver propelling the growth of the millimeter wave (mmWave) technology market. As data consumption skyrockets, especially with the rise of high-definition video streaming, cloud services, and IoT devices, mmWave technology's ability to offer higher data transfer rates and accommodate increased traffic becomes crucial. It’s potential to satisfy the escalating need for faster, more robust wireless connectivity is driving the growth of the mmWave technology market.

The emergence of 5G technology is fueling the demand for mmWave technology, driving market growth substantially. 5G mmWave facilitates faster and more responsive internet connections, accommodating the surge in users and reliance on wireless technology. Furthermore, 5G mmWave technology is capable of addressing the increasing demand for high speed data which is driven by escalating use of internet-connected devices, the development of smart cities, the rise of connected vehicles, and the expansion of industrial automation. As 5G becomes integral to daily life and industry, the need for mmWave technology intensifies, thus driving its market growth to meet the growing demands of a hyper-connected world.

In February 2023, Fibocom Wireless Inc., a global leader in IoT wireless solutions, unveiled its latest 5G Sub-6GHz and mmWave module series, the Fx190(W)/Fx180(W), during MWC Barcelona 2023. These modules aim to enhance cellular performance for data-intensive applications like mobile broadband, enterprise 5G, and Industrial IoT. By launching such advanced solutions, market leaders like Fibocom are significantly contributing to the growth of the mmWave technology market. These initiatives cater to diverse sectors, supporting their specific needs and driving the expansion of mmWave technology's applications and adoption across industries.

Despite the growing demand for mmWave technology, constraints such as limited range, direct line-of-sight dependency, and susceptibility to environmental interference during signal transmission are hampering the market's growth. These issues hamper signal reach, disrupt connectivity without direct visibility, and face disruptions due to weather or physical barriers. However, key market players are undertaking research & development initiatives that aim to mitigate these limitations, thus fostering the development of robust mmWave solutions for diverse applications.

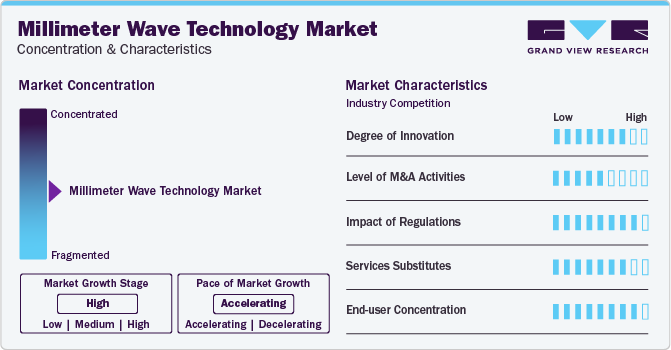

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The market can be characterized by a high degree of innovation that is driven by the growing demand for faster data speeds and the need for higher connectivity from various industries. Innovations in antenna designs and signal processing, among others, are improving the overall mmWave technology.

The market is characterized by a high level of merger & acquisition activities. Large telecommunication companies, semiconductor manufacturers, and technology firms are actively involved in M&A activities to bolster their market position, expand their product portfolios, and gain access to new technologies and capabilities.

The impact of regulations is significant in the market. Various regulations regarding spectrum allocation, compliance standards, infrastructure deployment, and privacy & security, among others, play a significant role in shaping the deployment, utilization, and expansion of mmWave technology across regions.

The millimeter wave technology has multiple substitutes, including the Sub-6 GHz spectrum, LTE, Wi-Fi 6/6E, and satellite communications. However, mmWave technology offers distinct benefits, such as high data transfer rates, and it supports a massive number of connected devices simultaneously, making it a preferred choice for technologies that depend on the specific application needs.

End-use concentration in the mmWave technology market varies across multiple industries and applications. Some key sectors contributing to end-use concentration include telecommunications, consumer electronics, the automotive industry, industrial IoT, and healthcare. The mmWave technology adoption is overall widespread across these industries.

Product Insights

Telecommunication equipment led the market and accounted for 57.8% of the global revenue in 2023. Millimeter wave technology plays an essential role in increasing spectrum utilization and increasing spectrum bandwidth. The usage of millimeter wave technology across telecommunication equipment has revolutionized the telecom sector. Additionally, millimeter waves are creating revolutions across the fifth generation (5G) cellular communication, owing to their ability to transfer gigabits of data per second. The growing demand for MMW technology in 5G applications is anticipated to propel the growth of the telecommunication equipment segment over the forecast period.

The imaging & scanning segment is anticipated to register a significant growth rate over the forecast period. The growing application of MMW technology in imaging and scanning systems has enhanced the features of these systems by providing stability and reliability. Furthermore, the accuracy of the security systems is enhanced with the adoption of mmWave in scanners. Radio and satellite communication systems are integral to a nation’s national security. With the application of millimeter wave technology in radar and satellite communication, security systems have become more efficient and reliable, modernizing defense techniques. These applications are anticipated to further drive the growth of the imaging and scanning segment over the forecast period.

Component Insights

The antennas & transceivers segment accounted for the largest market share of 42.08% in 2023. The segment is expected to maintain its dominance over the forecast owing to the massive adoption of mmWave technology across industries such as telecommunications and security. Both telecommunication and defense sectors are immensely flourishing across the globe. Hence, the demand from these industries is expected to grow significantly in the coming years, propelling the segment’s growth.

The frequency converters segment is anticipated to witness the highest CAGR over the forecast period. Frequency converters convert the frequency of alternating current. Frequency converters can minimize electrical as well as mechanical stress. Frequency converter plays a vital role in extending the life of components and equipment. The efficiency of signals produced by MMW technology depends on the nature of frequencies, and hence, it is an essential component. The increasing demand for high-bandwidth applications and small-cell backhaul applications, where frequency plays a vital role, are the factors driving the growth of this segment.

Frequency Band Insights

The E-band segment accounted for the largest market revenue share of 62.64% in 2023. The segment's growth can be attributed to the availability of unlicensed spectrum in the E band, which enables cost-effective deployment of wireless networks for high-speed data transfer. With the increasing demand for high-bandwidth applications such as cloud computing, video streaming, and IoT, the E band is becoming a critical component of 5G networks, offering faster data rates and reduced latency. Overall, the adoption of E band MMW technology is driven by its ability to offer high-speed data transfer, low latency, and cost-effective deployment, making it an attractive option for various applications, including 5G wireless networks, wireless backhaul, and indoor wireless networks.

The V-Band segment is anticipated to witness a significant growth rate over the forecast period. The segment's growth is fueled by the use of the V band in point-to-point communication applications, such as wireless backhaul and fiber extension. The high-frequency range of the V band enables high-capacity, long-range communication with low interference, making it ideal for applications such as wireless backhaul for 5G networks and fiber extension for broadband connectivity in rural areas. Moreover, the V band is used for satellite communication, providing high-speed connectivity for remote locations and supporting emerging applications such as connected cars and drones.

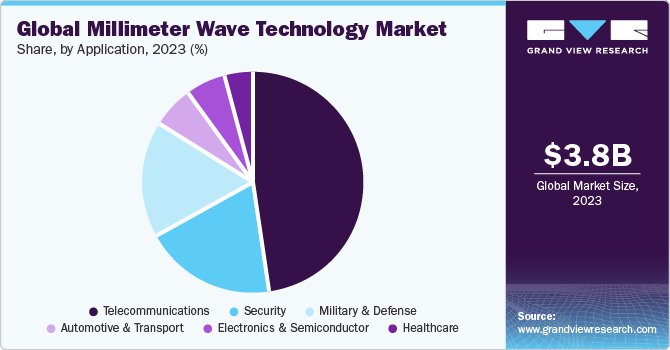

Application Insights

The telecommunications segment accounted for largest market revenue share in 2023. The segment's growth can be attributed to the increased demand for high-speed data transfer and communication arising from the residential and commercial sectors, such as data centers and IT offices. Additionally, 5G providers are looking for infrastructure technologies to help them achieve high bandwidth data transmission while keeping low costs and power consumption, increasing the demand for MMW technology from the telecommunication segment, thus propelling the segment's growth.

The military & defense segment is anticipated to register the highest growth rate over the forecast period. Millimeter wave scanners are in high demand and are being adopted by international airport authorities worldwide. This increasing adoption of the MMW scanners, on account of the global terrorism issue, is expected to propel the use of millimeter wave technology in military & defense applications. In addition, the increasing adoption of MMW technology in various applications, such as inter-satellite links, point-to-point communications, and others, is anticipated to propel the segment's growth over the forecast period.

Regional Insights

North America dominated the market and accounted for a 41.8% share in 2023. The growth of the North American millimeter wave technology market can be attributed to the broader acceptance of technology in the region. North American countries such as the U.S. and Canada are prominent early adopters of upcoming and emerging technologies. Additionally, the region houses several key market players that are harnessing the region’s growth. Thus, these factors create opportunities for MMW technology in different applications in the region, propelling its growth over the forecast period.

Asia Pacific is anticipated to witness significant growth in the artificial intelligence market. This rapid growth of the Asia Pacific region can be attributed to the developments and upgrades in its telecom infrastructures. Additionally, the rapid deployment of 5G technology in major countries, such as South Korea and India, creates a greater demand for MMW technology. Further, installing new telecom equipment based on millimeter wave technology is also expected to drive the overall market across the region at a significant pace.

Key Companies & Market Share Insights

Some of the key players operating in the market include NEC Corporation, Keysight Technologies, Bridgewave Communications, and Aviat Networks, Inc. among others.

-

NEC Corporation is a global technology leader that pioneers mmWave technology solutions for 5G networks, IoT, and radar systems, leveraging innovative advancements in telecommunications and wireless communication.

-

Keysight Technologies, a prominent player in the mmWave technology market, specializes in test and measurement solutions for high-frequency applications. Their expertise aids the development and validation of mmWave devices and networks, crucial for advancing 5G and IoT technologies.

-

Millitech, Inc., E-Band Communications, LLC, Trex Enterprises Corporation, and Siklu Communication Ltd. are some of the emerging market participants in the millimeter wave technology market.

-

Millitech, Inc., a renowned company in the mmWave technology market, specializes in designing and manufacturing high-performance millimeter-wave components and systems. Their expertise spans radar systems, satellite communications, and defense applications, contributing significantly to advancing mmWave technology.

- E-band Communications, LLC is a key player in the mmWave technology market, focusing on delivering innovative millimeter-wave communication solutions. Specializing in E-band frequencies, the company offers high-capacity wireless systems for backhaul, providing critical infrastructure support for 5G networks and beyond.

Key Millimeter Wave Technology Companies:

- Aviat Networks, Inc.

- BridgeWave Communications

- E-Band Communications, LLC

- Farran Technology

- Keysight Technologies

- LightPointe Communications, Inc.

- Millitech, Inc.

- NEC Corporation

- QuinStar Technology, Inc.

- Eravant

- Siklu Communication Ltd.

- Trex Enterprises Corporation

Recent Developments

-

In December 2023, T-Mobile made public its attainment of another milestone in 5G technology within the United States. This achievement involved a test that utilized 5G standalone millimeter wave (mmWave) on its operational network. Through a partnership with Qualcomm Technologies, Inc. and Telefonaktiebolaget LM Ericsson, the company combined eight channels of mmWave spectrum, resulting in download speeds exceeding 4.3 Gbps, all achieved without the need for other mid-band or low-band spectrum.

-

In August 2023, Fujitsu Limited revealed the development of a 5G millimeter wave chip capable of multiplexing up to four beams through a singular millimeter-wave chip designed for the radio units (RU) of 5G base stations. This advancement was conducted as part of the Research & Development Project for the Enhanced Infrastructure for Post 5G.

-

In February 2023, Qualcomm Technologies, Inc., and Telefonaktiebolaget LM Ericsson announced the launch of the first mobile 5G mmWave network commercially available at an event held in Barcelona, Spain, at MWC 2023. The network will allow compatible user device partners to access the Ericsson-powered 5G mmWave network at the event. The event showcased the range of 5G mmWave devices of Qualcomm Technologies powered by Snapdragon mobile platforms.

Millimeter Wave Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.18 billion

Revenue forecast in 2030

USD 38.55 billion

Growth Rate

CAGR of 39.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, component, frequency band, application, and region

Regional scope

North America, Europe, Asia Pacific, South America, and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Aviat Networks, Inc.; BridgeWave Communications; E-Band Communications, LLC; Farran Technology; Keysight Technologies; LightPointe Communications, Inc.; Millitech, Inc.; NEC Corporation; QuinStar Technology, Inc.; Eravant; Siklu Communication Ltd.; Trex Enterprises Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Millimeter Wave Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global millimeter wave technology market based on product, component, frequency band, application, and region:

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Telecommunication Equipment

-

Imaging & Scanning Systems

-

Radar & Satellite Communication Systems

-

-

Component Outlook (Revenue, USD Million; 2017 - 2030)

-

Antennas & Transceivers

-

Amplifiers

-

Oscillators

-

Control Devices

-

Frequency Converters

-

Passive Components

-

Others (Ferrite Devices, Radiometers, etc.)

-

-

Frequency Band Outlook (Revenue, USD Million; 2017 - 2030)

-

V-Band

-

E-Band

-

Other Frequency Bands

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Telecommunications

-

Military & Defense

-

Automotive & Transport

-

Healthcare

-

Electronics & Semiconductor

-

Security

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global millimeter wave technology market size was estimated at USD 3.75 billion in 2023 and is expected to reach USD 5.18 billion in 2024.

b. The global millimeter wave technology market is expected to grow at a compound annual growth rate of 39.7% from 2024 to 2030 to reach USD 38.55 billion by 2030.

b. North America dominated the millimeter wave technology market in 2023 owing to the broader acceptance of technology in the region. North American countries such as the U.S. and Canada are prominent early adopters of upcoming and emerging technologies. Additionally, the region houses several key market players that are harnessing the region’s growth.

b. Some key players operating in the millimeter wave technology market include Aviat Networks, Inc., BridgeWave Communications, E-Band Communications, LLC, Farran Technology, Keysight Technologies, LightPointe Communications, Inc., Millitech, Inc., NEC Corporation, QuinStar Technology, Inc., Eravant, Siklu Communication Ltd., and Trex Enterprises Corporation.

b. The increasing research & development activities in the mmWave (MMW) technology and the continuously rising demand for mmWave technology in the telecommunications sector are anticipated to propel the global market’s growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.