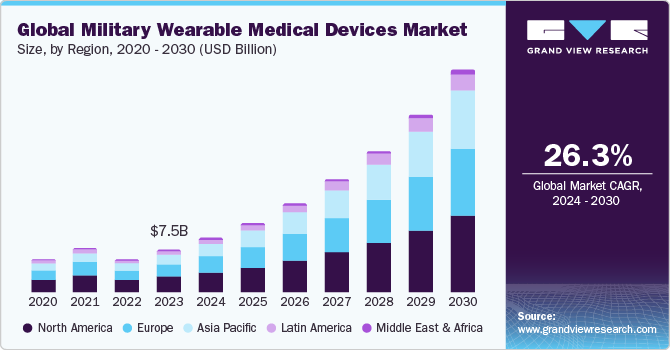

Military Wearable Medical Devices Market Size, Share & Trends Analysis Report By Application (Heart, Performance Monitor), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-586-6

- Number of Report Pages: 164

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global military wearable medical devices market size was valued at USD 7.45 billion in 2023 and is projected to grow at a CAGR of 26.3% from 2024 to 2030. Factor driving this market is the increase in investments on research and developments in new military technologies that emphasize on the safety and health of the soldiers. Furthermore, the market is also growing due to the increased reliance on the data gathered in the form of vital signs that provide important insights about soldier’s physical status. Heart rate, blood pressure, oxygen saturation, and body temperature assist healthcare providers in assessing the health of soldiers and offer prompt medical assistance in real time while the soldier is on-site for a mission.

The growing frequency of global conflicts between various nations has increased demands for military wearable medical devices to track the vital signs of soldiers posted in different locations. Numerous gadgets can be essential additions to a soldier's gear, decreasing the weight they have to carry as these gadgets are linked to cloud servers wirelessly, aiding in tracking health metrics with improved connectivity. These compact and versatile gadgets enhance the soldier's speed and movement. Therefore, many developing countries are willing to invest heavily in this market to have a competitive advantage over other countries at the time of battle situations.

The combination of Artificial Intelligence (AI) and Machine Learning (ML) algorithms has allowed military wearable devices to improve diagnostic abilities and offer precise solutions. These wearables are designed to withstand harsh conditions such as extreme heat, moisture, and vibrations, making them perfect for military use. Numerous competitors in the market are creating gadgets that are lightweight and capable of enduring challenging environments and delivering precise information.

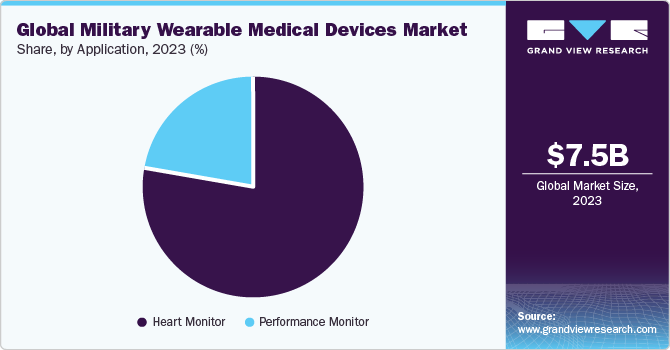

Application Insights

“Performance monitor segment is expected to witness growth at 29.2% CAGR”

Heart monitors accounted for the largest revenue share of 78.3% globally in 2023. The expected rise in demand in the coming years is largely due to the growing importance of heart conditions for on-duty soldiers. Changes in the heartbeat patterns of a soldier can give useful insights about the soldier’s performance. Keeping track of a soldier's heart health in challenging environments enables medical professionals to offer appropriate assistance when needed.

The performance monitor market is expected to expand with a noteworthy CAGR from 2024 to 2030 as countries are focusing more on the monitoring of the performance of army personnel, which gives accurate insights into the efficiency and health complications of the soldier. Metrics such as the sleep-wake cycle, and body temperatures allowing medical professionals to track the mental and physical changes a soldier is experiencing in real-time.

Regional Insights

“Canada to witness market growth of CAGR 25.8%”

North America military wearable medical device market dominated the global market in 2023 with a revenue share of 37.4% and is expected to maintain its lead from 2024 to 2030 due to the advancements in technology and higher investment by the military on wearable medical devices. The presence of key players in this market with a strong distribution channel also contributes to the market growth in this region.

U.S. Military Wearable Medical Devices Market Trends

The military wearable medical devices market in the U.S. accounted for a share of 75.0% in 2023 due to their high investment in military R&D. U.S. has the third largest military in the world and the country also allows civilians to use military grade devices for their protection therefore the market is anticipated to grow in this market.

Europe Military Wearable Medical Devices Market Trends

The Europe military wearable medical devices market is expected to grow with a CAGR of 26.5% from 2024 to 2030 as the need for these devices has risen due to their ability to enable contactless communication and help clinicians track medical conditions and threat protection of their soldiers across all platforms such as air force, navy, and army.

Asia Pacific Military Wearable Medical Devices Market Trends

The military wearable medical devices market in Asia Pacific is anticipated to witness significant CAGR of 29.0% from 2024 to 2030. This growth owes to the significantly increasing investments in military development across the region. Countries like China, and India who has the highest number of military personnel are focusing on developing military technologies, which will give them a competitive advantage in military platforms such as air, sea, and land.

Key Military Wearable Medical Devices Company Insights

Some key companies in the market include Samsung, Bittium, Garmin, Apple Inc., Fitbit, and GOQii. Companies are focusing on longer battery life, connectivity, and accurate readings in the devices.

-

Garmin has been deploying products in segments such as automotive, marine, aviation, sports & outdoor with a focus on rugged use and long battery life providing a wide range of services through their devices such asMulti-GNSS Support, ABC sensors, trackback routing, geocaching, point-to-point navigation, compass, GPS compass.

-

Apple Inc. monitors heart rates, fall detection, blood oxygen level, and AFib history with the help of an electrical heart sensor in their product.

Key Military Wearable Medical Devices Companies:

The following are the leading companies in the military wearable medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- Bittium

- Polar Electro

- Oura

- Garmin

- NeuroMetrix

- GOQii

- Apple Inc.

- Samsung

- Fitbit

- Zephyr Technology Corporation

- Camntec

Recent Developments

-

In July 2023, Biostrap USA LLC, a provider of customizable biosensor-based precision health monitoring solutions, introduced their latest wearable device, Biostrap Kairos. Biostrap introduces data visualization of the autonomic nervous system through their Vital Science app, providing quantification of the sympathetic and parasympathetic branches from a wearable wrist device.

-

In May 2023, Medtronic made a series of final agreements to purchase EOFlow Co. Ltd., the creator of the EOPatch device, which is a tubeless, wearable, and entirely disposable insulin delivery device. The inclusion of EOFlow, in combination with Medtronic's Meal Detection Technology algorithm and new CGM, is projected to enhance the corporation's capacity to cater to a broader range of diabetes patients, regardless of their stage in treatment or insulin delivery preference.

Military Wearable Medical Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.55 billion |

|

Revenue forecast in 2030 |

USD 38.77 billion |

|

Growth rate |

CAGR of 26.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; Japan; China; Australia; South Korea; Thailand; Brazil, Argentina; South Africa; Saudi Arabia; Kuwait; UAE |

|

Key companies profiled |

Bittium; Polar Electro; Oura; Garmin; NeuroMetrix; GOQii; Apple Inc.; Samsung; Fitbit; Zephyr Technology Corporation; Camntec |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. |

Global Military Wearable Medical Device Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global military wearable medical devices market report based on the application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Heart Monitor

-

Sick Alert

-

Heart Rate Variability

-

-

Performance Monitor

-

Sleep-wake Cycle Alert

-

Core Body Temperature Monitoring

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global military wearable medical devices market size was estimated at USD 7.45 billion in 2023 and is expected to reach USD 9.55 billion in 2024.

b. The global military wearable medical device market is expected to grow at a compound annual growth rate of 26.3% from 2024 to 2030 to reach USD 38.77 billion by 2030.

b. Heart monitor dominated the military wearable medical devices market with a share of over 80.0% in 2023. This is attributable by the fact that the system can directly detect any uncertain change in the health of an individual and the patient can be treated as early as possible.

b. Some key players operating in the military wearable medical devices market include Fitbit, Zephyr Technology Corporation, Camntech, Bittium, Polar Electro, Oura, Garmin, NeuroMetrix, GOQii, Apple Inc.

b. Key factors that are driving the military wearable medical devices market growth include the rising R&D investment of military modernization program and the growing need of advance technology to overcome the limitations of previous wearable device and safety & security features of the device.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."