- Home

- »

- Next Generation Technologies

- »

-

Military Sensors Market Size, Share & Growth Report, 2030GVR Report cover

![Military Sensors Market Size, Share & Trends Report]()

Military Sensors Market Size, Share & Trends Analysis Report By Application (Communication & Navigation, Combat Operations), By Type, By End-use (Airborne, Land, Naval), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-415-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Military Sensors Market Size & Trends

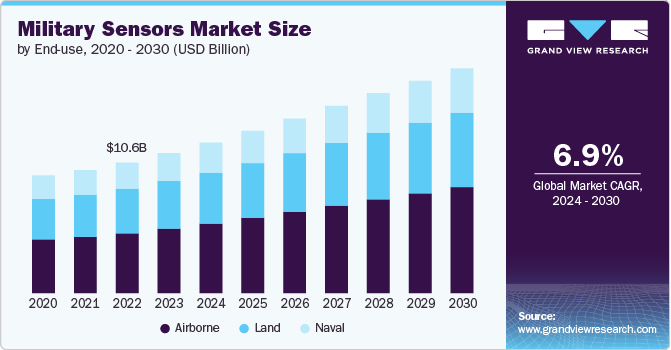

The global military sensors market size was estimated at USD 11.40 billion in 2023 and is expected to grow at a CAGR of 6.9% from 2024 to 2030. The growth is attributed to the continuous advancements in sensor technology. Innovations such as miniaturization, enhanced sensitivity, and improved data processing capabilities are enabling more precise and reliable sensor systems. These advancements allow for better performance in challenging environments, such as extreme temperatures, high altitudes, and underwater. As a result, military forces can deploy sensors in a wider range of applications, from intelligence gathering to target recognition, thereby driving market growth.

Moreover, the increasing adoption of unmanned systems, including drones and autonomous vehicles, is a major driver for the market. These platforms rely heavily on advanced sensors for navigation, surveillance, and combat operations. As military organizations shift towards automation and remote warfare to reduce risks to personnel, the demand for sensors that can provide accurate real-time data is growing significantly. This trend is expected to propel the growth of the market.

The expanding scope of electronic warfare (EW) is fueling the demand for specialized military sensors. In modern warfare, the ability to detect, jam, and counter enemy electronic systems is crucial. Sensors that can identify and analyze electromagnetic signals, such as radar and communication signals, are essential components of EW systems. The growing emphasis on EW capabilities to gain a strategic advantage on the battlefield is driving investments in advanced sensors, contributing to the market growth.

Additionally, the rising defense budgets globally are a significant growth driver for the market. Governments are allocating more funds towards modernizing their armed forces, including the acquisition of advanced sensor technologies. This is particularly evident in regions facing heightened geopolitical tensions, where nations are investing heavily in upgrading their defense capabilities. The increased spending on military sensors, whether for intelligence, surveillance, or combat applications, is directly boosting market growth.

Furthermore, the demand for improved situational awareness is driving the adoption of advanced military sensors. In complex and dynamic combat environments, real-time awareness of the battlefield is crucial for making informed decisions. Sensors that provide accurate data on enemy movements, environmental conditions, and other critical factors enable military forces to respond effectively to threats. The growing need for situational awareness in modern warfare, where rapid and precise information is paramount, is a key factor augmenting the market.

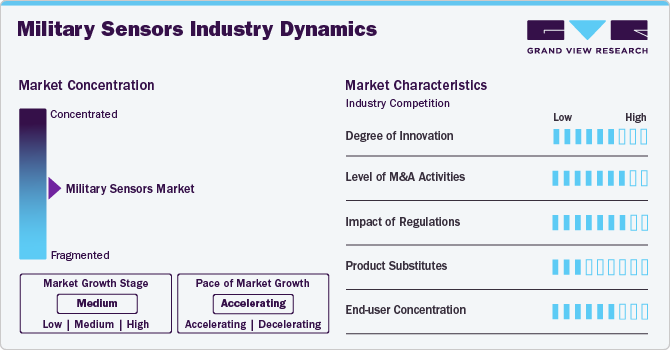

Market Concentration & Characteristics

The degree of innovation is high in the market. The degree of innovation within the market significantly impacts its growth and dynamic nature. Advanced technologies not only push the boundaries of surveillance, reconnaissance, and defense capabilities but also drive competitive advantage and strategic superiority on the global stage.

The impact of regulations in high. Regulations play a crucial role in shaping the market, influencing design, development, and deployment processes. These legal frameworks ensure the integration of cutting-edge technologies complies with international standards, safeguarding operational integrity and security while promoting responsible innovation.

The level of mergers & acquisitions in the market is high. The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The impact of product substitutes is low to moderate. The emergence of product substitutes poses both a challenge and an opportunity for the market, compelling manufacturers to innovate continually. This competition stimulates advancements in sensor technologies, improving performance and cost-effectiveness, thereby reshaping market dynamics and defense strategies.

The end user concertation is high in the market. High concentrations of end users in the market can lead to intensified demand for specialized and advanced sensor technologies. This focused demand drives innovation and customization in sensor solutions, tailoring products to meet the precise requirements of a select group of powerful buyers, thereby shaping market trends and development priorities.

Application Insights

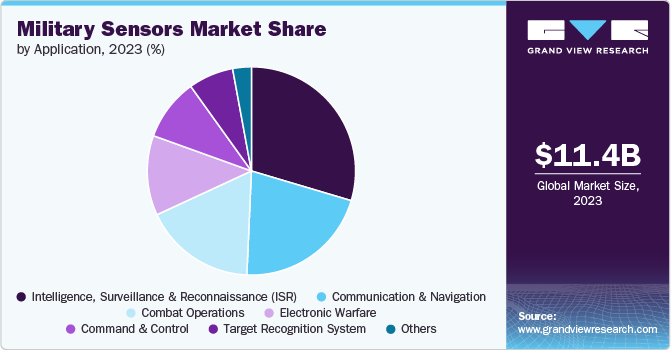

The Intelligence, Surveillance & Reconnaissance (ISR) segment dominated the market in 2023 with a market share of around 29%, due to increasing defense budgets and the growing emphasis on real-time data collection and analysis. The demand for advanced sensors that enhance situational awareness, target detection, and intelligence gathering has driven this growth. Additionally, technological advancements in sensor miniaturization and data processing capabilities are further propelling the expansion of ISR applications. The ongoing modernization of military forces globally also contributes to the rising adoption of ISR sensors, thereby driving the segment growth.

The electronic warfare segment is expected to record the highest CAGR of over 8% from 2024 to 2030, due to the increasing demand for advanced threat detection and countermeasure capabilities. As modern warfare increasingly relies on electronic systems, the need for sensors that can detect, identify, and counteract electronic threats has intensified. Technological advancements in sensor miniaturization and enhanced sensitivity are further driving this segment. Additionally, the rising geopolitical tensions and the modernization of military forces globally are contributing to the expansion of the electronic warfare segment.

Type Insights

The imaging sensors segment held the highest revenue share in 2023, due to the increasing demand for advanced surveillance and reconnaissance capabilities. These sensors are critical for enhancing situational awareness and target identification, driving their adoption in modern military applications. Technological advancements, such as higher resolution and improved sensitivity, are further propelling their integration across various platforms, including airborne, naval, and ground systems. Additionally, the rising focus on border security and defense modernization programs globally is boosting the demand for the imaging sensors segment.

The gyroscopes segment is estimated to register a considerable growth rate from 2024 to 2030, driven by the increasing demand for precision navigation and stabilization systems in modern military platforms. As military operations rely more on advanced guidance and control technologies, the need for accurate and reliable gyroscopes has increased considerably. These sensors are crucial in applications such as missile guidance, unmanned systems, and avionics, where precise orientation and stability are vital. Additionally, technological advancements in MEMS-based gyroscopes are enhancing their performance and durability, further fueling their adoption in various military applications.

End-use Insights

The airborne segment held the highest revenue share in 2023, due to the increasing demand for advanced sensor technologies in modern aircraft. These sensors are critical for enhancing capabilities in intelligence, surveillance, reconnaissance (ISR), and electronic warfare. The ongoing advancements in unmanned aerial vehicles (UAVs) and the integration of sophisticated sensor systems are also driving this growth. Additionally, the rising defense budgets across various countries are further fueling investments in airborne sensor technologies, contributing to segment growth.

The naval segment is estimated to register a significant growth rate from 2024 to 2030, driven by increased investments in modernizing naval fleets and enhancing underwater surveillance capabilities. With rising geopolitical tensions and the need for advanced maritime security, there is a growing demand for sensors that support anti-submarine warfare, mine detection, and naval intelligence operations. Innovations in sensor technology, including improved sonar and radar systems, are further propelling this growth.

Regional Insights

The military sensors market in North America accounted for the highest revenue share of nearly 37% in 2023. The market in North America is propelled by technological advancements in sensor technologies and their integration into a wide range of military platforms. Increased defense spending, particularly in the U.S., to upgrade and procure advanced military equipment, supports this growth.

U.S. Military Sensors Market Trends

The U.S. military sensors marketis anticipated to grow at a CAGR of around 4% from 2024 to 2030. The relentless pursuit of technological superiority, particularly in enhancing battlefield awareness and combat readiness, exponentially drives the growth of the market in the U.S., emphasizing cutting-edge applications like unmanned systems and AI-driven solutions.

Asia Pacific Military Sensors Market Trends

The military sensors market in Asia Pacific is anticipated to grow at the highest CAGR of over 9% from 2024 to 2030. In Asia Pacific, the expansion of the market is driven by rising security concerns and increasing military expenditures by countries, especially China and India. The region's focus on modernizing its armed forces and enhancing border surveillance capabilities also plays a crucial role.

India military sensors market is estimated to record a significant growth rate from 2024 to 2030. India's growth in the market is largely fueled by its strategic focus on bolstering border security and modernizing its defense capabilities, which includes significant investments in surveillance, reconnaissance technologies, and indigenous defense manufacturing projects.

The military sensors market in China is expected to grow considerably from 2024 to 2030. China's ambitious military modernization efforts, aimed at establishing a technologically advanced military force capable of network-centric operations, significantly propel the market, focusing on developments in stealth, drone technology, and cyber warfare capabilities.

Japan military sensors market is projected to witness a considerable growth rate from 2024 to 2030. Japan's strategic towards enhanced maritime security and deterrence, in response to regional threats, drives the expansion of the market with investments in sophisticated surveillance and reconnaissance systems, particularly for island defense and undersea warfare.

Europe Military Sensors Market Trends

Europe military sensors market accounted for a notable revenue share of over 24% in 2023. Europe's market growth is supported by the region's emphasis on strengthening its defense capabilities in response to growing security threats. Collaborative defense projects across European Union member states and investments in research and development of advanced sensor technologies are key growth drivers.

The military sensors market in UK is projected to grow considerably from 2024 to 2030. The UK's commitment to maintaining a leading edge in defense technology, exemplified by its focus on integrating cyber, space, and artificial intelligence capabilities into military operations, fuels growth in the market, aligning with its vision of future warfare.

Germany military sensors market is expected to record significant growth from 2024 to 2030. Germany's market growth is attributed to a comprehensive approach to modernizing its armed forces, with a strong emphasis on interoperability, enhanced situational awareness, and the deployment of advanced sensor technologies for a range of military applications.

Middle East and Africa (MEA) Military Sensors Market Trends

The military sensors market in Middle East and Africa (MEA) is anticipated to grow at a significant CAGR of around 9% from 2024 to 2030. The MEA region witness’s growth due to the increasing demand for enhanced surveillance, reconnaissance, and targeting capabilities amidst ongoing regional conflicts and tensions. Rising defense budgets and foreign investments in military infrastructures are significant contributors to the market's growth.

Military sensors market in Saudi Arabia accounted for a considerable revenue share in 2023. Saudi Arabia's substantial investments in defense procurement, aimed at modernizing its military infrastructure and enhancing its defensive and offensive capabilities, drive the growth of the market, with a significant focus on surveillance systems and electronic warfare.

Key Military Sensors Company Insights

Some of the key players operating in the market are BAE Systems plc, Honeywell International Inc., and RTX Corporation, among others.

-

BAE Systems plc is a multinational defense, security, and aerospace company. It is among the world's largest defense contractors, providing a range of products and services for air, land, and naval forces, as well as advanced electronics, security, information technology solutions, and support services. The company operates in multiple countries and has a wide-ranging portfolio that includes military aircraft, ships, submarines, and advanced electronics and communications systems.

-

RTX Corporation is a multinational conglomerate that specializes in aerospace and defense. The company's operations include the design, development, and manufacturing of advanced systems for global defense and intelligence applications, including radars, missiles, aircraft engines, and cybersecurity products. Raytheon Technologies Corporation serves customers worldwide, providing a broad spectrum of services and solutions to meet a variety of modern challenges in the aerospace and defense industries.

Curtiss-Wright Corporation, TE Connectivity Ltd., and Teledyne Technologies Incorporated, among others are some of the emerging market participants in the market.

-

Curtiss-Wright Corporation is a company that specializes in the design and manufacture of highly engineered, precision technologies for a diverse range of industrial applications. Over the years, it has established a reputation for innovation and reliability in providing advanced solutions that meet the stringent requirements of its global customer base in aerospace and defense.

-

TE Connectivity Ltd. is a global technology and manufacturing company that specializes in connectors and sensors for various industries, including automotive, industrial equipment, data communication systems, aerospace, defense, medical, oil & gas, energy, and consumer electronics.

Key Military Sensors Companies:

The following are the leading companies in the military sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Lockheed Martin Corporation

- BAE Systems plc

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Teledyne Technologies Incorporated

- Safran S.A.

- Textron Inc.

- Curtiss-Wright Corporation

- TE Connectivity Ltd.

- Thales Group

- General Electric Company

- Crane Aerospace & Electronics

- IMPERX, INC.

- RTX Corporation

Recent Developments

-

In June 2024, MatrixSpace received USD 1.25 million by AFWERX to build Direct-to-Phase II Small Business Innovation Research grant. This funding is aimed at creating a new prototype that features both low Size, Weight, Power, and Cost (SWaP-C) characteristics. This innovative, multi-function, multi-band antenna payload will be built upon the MatrixSpace Radar hardware platform.

-

In May 2024, Engineering and scientific technology company Leidos was granted a contract worth USD 631 million by the U.S. Army Contracting Command – Aberdeen Proving Grounds. This contract is for services related to the Army's DIABLO (Development, Integration, Acquisitions, Bridging to Logistics & Operations) sensors initiative.

-

In July 2023, RTX Corporation secured a contract worth USD 117.5 million from the U.S. Army for the early production phase of the 3rd Generation Forward Looking Infrared (FLIR) B-Kit sensors. These state-of-the-art targeting sensor systems are designed to improve the efficiency of military ground combat platforms by enhancing their lethality, survivability, and situational understanding in challenging environments, ensuring superior combat capability for the Army.

Military Sensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.26 billion

Revenue forecast in 2030

USD 18.31 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Honeywell International Inc.; Lockheed Martin Corporation; BAE Systems plc; L3Harris Technologies; Inc.; Leonardo S.p.A.; Teledyne Technologies Incorporated; Safran S.A.; Textron Inc.; Curtiss-Wright Corporation; TE Connectivity Ltd.; Thales Group; General Electric Company; Crane Aerospace & Electronics; IMPERX; INC.; RTX Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Military Sensors Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global military sensors market report based on application, type, end-use, and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Intelligence, Surveillance & Reconnaissance (ISR)

-

Communication & Navigation

-

Combat Operations

-

Electronic Warfare

-

Command & Control

-

Target Recognition System

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Imaging Sensors

-

Magnetic Sensors

-

Acoustic Sensors

-

Pressure Sensors

-

Temperature Sensors

-

Torque Sensors

-

Gyroscopes

-

Position Sensors

-

Proximity Sensors

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Airborne

-

Land

-

Naval

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the military sensors market include Honeywell International Inc., Lockheed Martin Corporation, BAE Systems plc, L3Harris Technologies, Inc., Leonardo S.p.A., Teledyne Technologies Incorporated, Safran S.A., Textron Inc., Curtiss-Wright Corporation, TE Connectivity Ltd., Thales Group, General Electric Company, Crane Aerospace & Electronics, IMPERX, INC., RTX Corporation.

b. Key factors that are driving the military sensors market growth include the advancements in sensor technology, increasing adoption of unmanned systems, and expanding scope of electronic warfare (EW).

b. The global military sensors market size was estimated at USD 11.40 billion in 2023 and is expected to reach USD 12.26 billion in 2024.

b. The global military sensors market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 18.31 billion by 2030.

b. The military sensors market in North America accounted for a significant revenue share of over 36% in 2023. The market in North America is propelled by technological advancements in sensor technologies and their integration into a wide range of military platforms. Increased defense spending, particularly in the U.S., to upgrade and procure advanced military equipment, supports this growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."