- Home

- »

- Smart Textiles

- »

-

Military Personal Protective Equipment Market Report, 2028GVR Report cover

![Military Personal Protective Equipment Market Size, Share & Trends Report]()

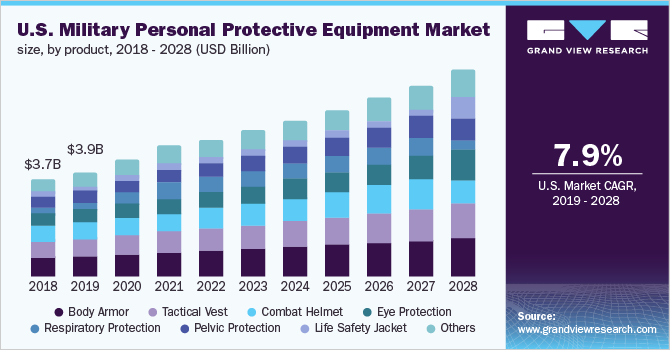

Military Personal Protective Equipment Market Size, Share & Trends Analysis Report By Product (Body Armor, Tactical Vest), By End Use (Army, Navy), By Region (North America, APAC), And Segment Forecasts, 2019 - 2028

- Report ID: GVR-4-68038-772-8

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

Report Overview

The global military personal protective equipment market size was valued at USD 13.47 billion in 2020 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.8% from 2019 to 2028. Body armor, eye protection, tactical vests, advanced combat helmets, breathing devices, gloves, and footwear are examples of military PPE worn by soldiers during battle or training. Personal Protective Equipment (PPE) is designed to protect soldiers from biological, chemical, physical, and radioactive threats. The rising focus of defense agencies on troop safety and security, as well as higher military budgets, are expected to fuel market growth over the forecast period. Despite the COVID-19 pandemic, global military spending has increased significantly as compared to 2019. This can be attributed to the growing geopolitical instability, internal conflicts, border disputes, rising terrorism, and increased spending on NATO. Thus, increased military spending is likely to boost the product demand in the coming years.

The COVID-19 pandemic has resulted in the increased adoption of Respiratory Protective Equipment (RPE) and PPE for eyes in the military to safeguard soldiers from coming in contact with the virus. RPE includes gas masks, filters, powered air respirators, and self-contained breathing equipment, among others. The growing demand for masks and eyewear is expected to boost market growth over the forecast period.

The U.S. is a major market for military PPE. In 2020, the U.S. was the world’s top country that spent around USD 778 billion on the military. The high spending in the U.S. is attributed to strong investments in R&D and modernization of equipment and nuclear arsenals The U.S Armed Forces are the world’s third-largest military force, and the country’s rising defense spending is expected to propel the product demand.

China’s increased military spending is attributed to the country’s economic prosperity and strong presence in the Indian Ocean region to execute its String of Pearls policy. The rising tensions between China and India along the Sino-India disputed border have resulted in a significant rise in military spending in both nations, thereby complementing the market growth.

Product Insights

The body armor product segment accounted for the largest share of 19.8% of the global market in 2020 as a result of the increased demand for ballistic protection equipment that offers protection in various hostile environments. The growth in asymmetric warfare in several countries, including the U.S, India, and China is expected to boost segment growth further.

The demand for PPE for eyes is estimated to witness growth at a CAGR of 7.5% over the forecast period. Eyewear offers protection to soldiers from potential injuries during training and combat. Military-grade eyewear also offers visibility enhancement, UV reduction, and ballistic protection from fragments & projectiles in a tactile environment.

A combat helmet is an essential piece, which is used to improve the impact and ballistic protection of soldiers. Combat helmets are being widely adopted by defense agencies to protect personnel from machine-gun bullets, IED blasts, and shrapnel that may cause severe head injuries. The segment is expected to be driven by the rising demand for lightweight helmets that reduce fatigue and tactical helmets.

The respiratory protection segment is estimated to register the fastest CAGR due to the high demand for RPE, which is attributed to the increasing threat of chemical, biological, and radiological warfare across the globe. Furthermore, the rising prevalence of COVID-19 resulted in boosting the demand for RPE, thereby driving the segment growth.

End-use Insights

The army end-use segment led the market and accounted for 54.9% of the global revenue share in 2020. Various defense agencies in developed countries, such as the U.S., U.K., France, and Germany, prioritize the safety of ground troops and armed forces to upgrade conventional protective equipment, which is expected to drive market growth over the forecast period.

The increased importance of ground troops in operations in Iraq, Afghanistan, Syria, and Yemen has also fueled the market growth. The expansion of guerrilla tactics and Improvised Explosive Devices (IEDs) has increased the risk to ground forces in their operations, causing a significant need for army protective equipment. Furthermore, rising demand for lightweight and improved PPE by defense personals in both hostile and non-hostile circumstances is expected to drive the segment.

The navy end-use segment is estimated to register the second-fastest CAGR over the forecast period. The U.S. is spending heavily on Naval warships to assert its presence in the Persian Gulf and Indian Ocean region to counter Iran and China. China has increased its naval presence in the Indian Ocean region to arrest its presence and look after its commercial interests in the region. Many governments are investing heavily to improve their naval strength. These factors are likely to boost the product demand in the navy end-use segment over the forecast period.

The air force segment is likely to have a significant growth at a CAGR of 7.4% over the forecast period. Air force personnel are required to work in physically challenging conditions. The ongoing military operations in Afghanistan and other conflict areas have increased the importance of air support for evacuation and transporting soldiers, in turn, boosting the product demand in the air force end-use segment.

Regional Insights

North America led the market and accounted for 36% of the global revenue share in 2020 owing to increased defense spending in the U.S. and Canada. Military spending in Canada has increased in recent years to meet the NATO spending benchmark of 2% of GDP. The U.S. military spending has increased to counter assertiveness from its strategic contenders, such as China and Russia.

Asia Pacific military personal protective equipment market is estimated to witness the fastest CAGR of 8.1% over the forecast period. Rising instances of warfare and border disputes in countries, such as China, India, and Pakistan, are anticipated to boost the product demand in the region over the forecast period.

The market in Europe is expected to witness substantial growth over the forecast period due to the increased spending, which is attributed to the military upgradation in terms of aircraft procurement and weapons upgrades. European countries, such as Germany, France, and Italy, contribute a part of their defense spending on NATO, which is likely to boost the product demand over the forecast period.

The Middle East & Africa has witnessed significant terrorist activity in the past few years. The ongoing Yemen conflict and rise of far-right terrorism have posed security challenges in the region. This has led to increased government spending on the military in the region, in turn, boosting the demand for military PPE.

Key Companies & Market Share Insights

The market is highly competitive with the presence of both global and regional companies. To meet the increasing demand from end-users, key manufacturers are involved in constant research and development and the implementation of new designs to create products using innovative and high-quality materials. The industry is focusing on activities that will lead to the development of new technologies, such as the use of nanotechnology materials to create flexible and lightweight armors, which is one of the trends that will help in market expansion. Some prominent players in the global military personal protective equipment market include:

-

3M

-

Honeywell International

-

ArmorWorks

-

Eagle Industries

-

BAE Systems

-

DuPont

-

DSM

-

Armorsource

-

MSA Safety

-

Revision Military

-

Gentex Corporation

-

Ansell

-

MKU Ltd.

-

Avon Protection Systems, Inc.

-

Ballistic Body Armor Pty

Military Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 15.03 billion

Revenue forecast in 2028

USD 23.55 billion

Growth rate

CAGR of 7.8% from 2019 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2019 - 2028

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2028

Report coverage

revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; U.K.; China; India; Japan; South Korea; Australia; Brazil; Argentina; Israel; Saudi Arabia

Key companies profiled

3M Company; Honeywell International; ArmorWorks; Eagle Industries; BAE Systems; DuPont; DSM; Armorsource; MSA Safety; Revision Military; Gentex Corp.; Ansell; MKU Ltd.; Avon Protection Systems, Inc.; Ballistic Body Armor Pty.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global military personal protective equipment market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2028)

-

Body Armor

-

Tactical Vest

-

Eye Protection

-

Combat Helmet

-

Life Safety Jacket

-

Pelvic Protection

-

Respiratory Protection

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2028)

-

Army

-

Navy

-

Air Force

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global military personal protective equipment market size was estimated at USD 13.47 billion in 2020 and is expected to reach USD 15.03 billion in 2021.

b. The military personal protective equipment market is expected to grow at a compound annual growth rate of 7.8% from 2019 to 2028 to reach USD 23.55 billion by 2028.

b. North America is the largest military personal protective equipment market and accounted for 36% of the total demand in 2020 owing to higher military spending in countries including U.S. and Canada in the region.

b. Some of the key players operating in the military personal protective equipment market include 3M Company, Honeywell International, ArmorWorks, Eagle Industries, BAE Systems, DuPont, DSM, Armorsource, MSA Safety, Revision Military, Gentex Corporation, Ansell, MKU Limited, Avon Protection Systems, Inc., Ballistic Body Armor Pty.

b. The key factors that are driving the military personal protective equipment market rising focus of defense agencies to ensure soldier survivability; and increased spending on military activities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."