Military Embedded Systems Market Size, Share & Trends Analysis Report By Product (VME Bus, Open VPX), By Installation Type, By Application, By Platform (Land, Airborne, Naval), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-403-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Military Embedded Systems Market Trends

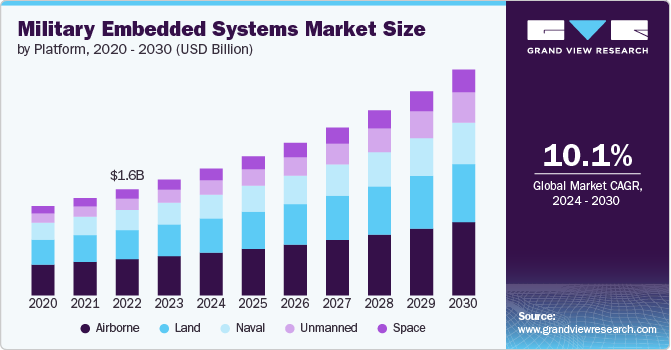

The global military embedded systems market size was valued at USD 1.77 billion in 2023 and is projected to grow at a CAGR of 10.10% from 2024 to 2030. The rise in global military spending, driven by geopolitical tensions and security threats, is pushing the demand for advanced defense technologies. Militaries worldwide are investing in sophisticated embedded systems to enhance capabilities such as real-time data processing, surveillance, and communication. These systems are crucial for improving situational awareness, precision targeting, and mission success rates. The integration of advanced technologies like artificial intelligence, machine learning, and data analytics into embedded systems is transforming military operations, driving the demand for high-performance, dependable, and secure systems that can operate in complex and dynamic environments.

Technological advancements in electronics, semiconductors, and software are significantly driving the growth of the market. Innovations such as more powerful processors, enhanced miniaturization techniques, and advanced communication technologies are enabling the development of sophisticated embedded systems with increased processing capabilities and functionality. These advancements are critical for developing next-generation defense systems that offer improved performance, reliability, and interoperability. The continuous evolution of technologies like IoT, edge computing, and real-time analytics is also contributing to the development of more advanced and capable embedded systems.

As military systems become increasingly connected and data-driven, ensuring robust cybersecurity is becoming a top priority. Embedded systems are integral to the protection of sensitive military information and communication networks. The need to safeguard against cyber threats and attacks drives the demand for advanced, secure embedded systems designed with cutting-edge encryption and threat detection capabilities. Investments in cybersecurity solutions for embedded systems help protect against unauthorized access, data breaches, and cyber-attacks, ensuring the integrity and confidentiality of critical military operations and information. This growing focus on cybersecurity is fueling the development and adoption of advanced embedded systems.

Market Concentration & Characteristics

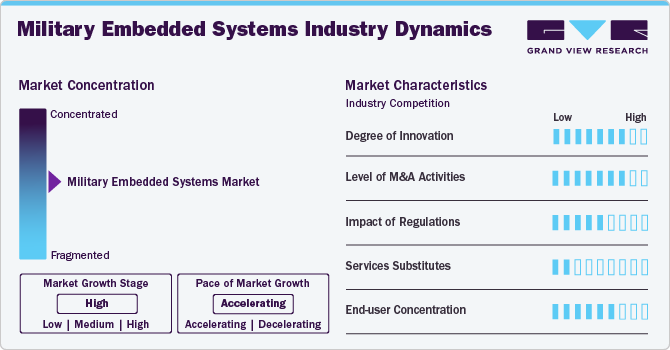

The market is characterized by a high degree of innovation, driven by advancements in technology and increasing defense requirements. Innovations include enhanced processors, miniaturized components, and sophisticated software that improve performance and functionality. Innovative technologies like AI, IoT, and edge computing are integrated into embedded systems to boost capabilities in real-time data processing, communication, and surveillance. This continuous technological evolution is crucial for developing next-generation defense solutions that meet the demands of modern military operations and enhance overall mission effectiveness and reliability.

The market is seeing an increasing number of merger and acquisition (M&A) activities, underscoring its exponential growth stage and ever-expanding potential. Companies are consolidating resources and expertise to enhance their technological capabilities and market presence. This trend highlights the sector’s dynamic evolution and the increasing value placed on advanced embedded solutions, as industry players seek to leverage synergies and drive innovation in defense technologies.

The market is also subject to moderate regulatory scrutiny and is impacted by its operations and strategic decisions. Compliance with defense regulations and standards is crucial for ensuring system reliability, security, and interoperability. Regulatory oversight impacts aspects such as procurement processes, technology deployment, and data protection. Companies must navigate these requirements carefully to maintain operational effectiveness and secure government contracts. Strategic decisions, including partnerships and technology investments, are often shaped by the need to meet regulatory obligations and industry standards.

Military embedded systems face minimal competition from product substitutes in the market due to their specialized nature and critical role in defense operations. The advanced technology, reliability, and integration required for military applications limit viable alternatives. Substitutes in the broader electronics market generally lack the tailored features and performance necessary for defense needs, making military embedded systems uniquely suited to fulfill these specific and demanding requirements.

End-user concentration is a moderate factor in the military embedded systems market, as it is predominantly driven by government and defense agencies. While a few large organizations dominate the market, there is still a diverse range of end-users within the defense sector. This concentration influences market dynamics, as changes in defense budgets, procurement policies, and strategic priorities can significantly impact demand and procurement patterns for embedded systems.

Platform Insights

Airborne platform accounted for the largest market revenue share in 2023. The increasing demand for advanced avionics and communication systems in modern aircraft drives the market. Enhanced situational awareness, navigation precision, and electronic warfare capabilities necessitate sophisticated embedded systems. Additionally, the growing need for drones and uncrewed aerial vehicles (UAVs) in military operations boosts this segment, requiring compact, rugged, and reliable systems that can operate in harsh environments and provide real-time data processing and decision-making support.

Unmanned platforms are expected to register the fastest CAGR from 2024 to 2030. The market is growing rapidly due to their increasing deployment in surveillance, reconnaissance, and combat operations. The demand for advanced sensors, real-time data processing, and AI integration in unmanned systems is driving the market. These systems require lightweight, power-efficient, and robust embedded solutions capable of handling complex tasks such as navigation, targeting, and communication, enhancing their operational efficiency and effectiveness in diverse military scenarios.

Installation Type Insights

Upgradations accounted for the largest market revenue share of 56.0% in 2023. The market is driven by the need to modernize aging defense equipment and platforms. This involves integrating new technologies such as AI, cybersecurity, and advanced communication systems into existing systems to enhance their capabilities. Upgrading embedded systems ensures compatibility with new standards and technologies, extending the lifespan and functionality of military hardware. This is crucial for maintaining operational readiness and effectiveness in modern warfare environments.

New installations are expected to register the fastest CAGR of over 10.0% from 2024 to 2030. The ongoing development and deployment of next-generation military platforms and systems fuels market growth. This includes new aircraft, vehicles, and naval vessels that require state-of-the-art embedded systems for navigation, communication, and control. The need for advanced cybersecurity measures, real-time data processing, and AI-driven analytics in these new installations drives the demand for innovative embedded solutions, ensuring superior performance and reliability in mission-critical applications.

Application Insights

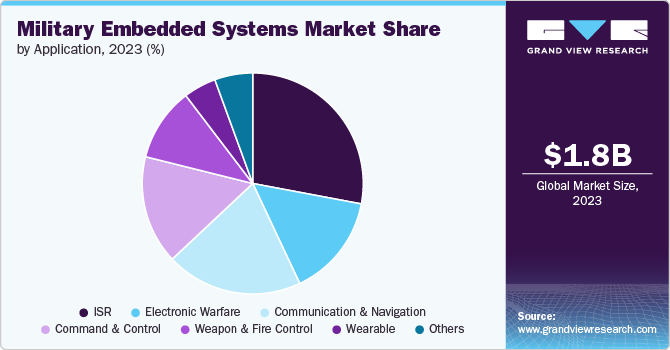

Intelligence, Surveillance, & Reconnaissance (ISR) accounted for the largest market revenue share in 2023. The increasing need for real-time data collection, analysis, and dissemination in military operations drives market growth. Advanced embedded systems enable enhanced imaging, signal intelligence, and data processing capabilities in ISR platforms, including UAVs and satellites. The demand for high-resolution sensors, robust communication systems, and AI-powered analytics drives the need for sophisticated embedded solutions, supporting decision-making and situational awareness in complex and dynamic environments.

Electronic warfare is expected to register the fastest CAGR from 2024 to 2030. The market growth is due to the growing importance of electronic attack, defense, and support systems in modern military strategies. Embedded systems play a crucial role in electronic warfare, providing capabilities for signal jamming, interception, and countermeasures. The demand for advanced processing power, miniaturization, and rapid response capabilities drives innovation in embedded technologies, enabling effective electronic warfare operations and enhancing the survivability and effectiveness of military assets.

Product Type Insights

The VME Bus segment accounted for the largest market revenue share in 2023. The market is growing due to its established presence in military applications, which provide a reliable and versatile architecture for embedded systems. The demand for high-performance computing, robust data handling, and compatibility with legacy systems drives the continued use of VME bus technology. Its adaptability for customization and long lifecycle support make it a preferred choice for upgrading existing systems and integrating new technologies, ensuring ongoing operational efficiency and cost-effectiveness.

Compact-PCI (CPCI) serial segment is expected to grow at the highest CAGR from 2024 to 2030. The market is growing due to its advantages in high-speed data transfer, modularity, and ruggedness, making it ideal for military applications. CPCI Serial systems are used in mission-critical applications, including communication, control, and data acquisition. Their robust design and ability to handle harsh environments drive their adoption in defense projects. The growing need for high-bandwidth, dependable, and scalable solutions in military embedded systems further fuels the demand for CPCI Serial technology.

Regional Insights

North America military embedded systems market accounted for the highest market revenue share in 2023. The driving force for the military embedded systems market is the increasing defense budgets and modernization programs by the U.S. and Canadian governments. Advancements in technology, including AI, cybersecurity, and IoT, are pushing the demand for advanced embedded systems. The focus on enhancing military capabilities and maintaining technological superiority supports significant investment in R&D and procurement of high-performance military systems.

U.S. Military Embedded Systems Market Trends

The military embedded systems market in the U.S. is expected to have a notable CAGR from 2024 to 2030. The market is driven due to substantial defense budget allocated to modernization and technological innovation. The emphasis on integrating advanced technologies such as AI, machine learning, and cybersecurity into military platforms fuels demand. Additionally, the U.S. military's focus on maintaining a technological edge and enhancing system interoperability and resilience drives growth in this market.

Asia Pacific Military Embedded Systems Market Trends

The military embedded systems market in Asia Pacific accounted for a significant revenue share in 2023. The market growth is driven by increasing defense spending, geopolitical tensions, and modernization of military infrastructure. Countries like India, South Korea, and Australia are investing heavily in upgrading their defense systems with advanced embedded technologies. The region's strategic focus on enhancing defense capabilities and improving technological integration contributes to the market's expansion.

Japan military embedded systems market is estimated to grow significantly from 2024 to 2030. The growth is focused on enhancing defense capabilities and modernizing its military technology. Increased defense spending, driven by regional security concerns and the need for advanced systems, supports the demand for high-performance embedded solutions. Japan's investments in advanced technologies, including cybersecurity and AI, further drive the growth of this market.

The military embedded systems market in India is estimated to record a notable CAGR from 2024 to 2030. The Indian government's focus on upgrading military technology, including advanced avionics and communication systems, fuels demand. Additionally, the push towards indigenization and the development of defense manufacturing capabilities within the country contribute to market growth.

China military embedded systems market had the largest revenue share in 2023. China's focus on advancing military technology, including artificial intelligence and cybersecurity, supports the demand for sophisticated embedded systems. The strategic emphasis on technological superiority and the development of next-generation defense capabilities contribute to the market's growth.

Europe Military Embedded Systems Market Trends

The military embedded systems market in Europe is anticipated to grow at a moderate CAGR from 2024 to 2030—the market focuses on enhancing defense capabilities and integrating advanced technologies. Increased defense budgets and collaborative defense projects within the European Union, along with NATO modernization efforts, support the demand for high-performance embedded solutions. The emphasis on interoperability and upgrading military infrastructure drives market expansion.

France military embedded systems market accounted for a significant revenue share in 2023. The country's commitment to defense modernization and technological innovation. Increased defense spending and the focus on integrating advanced systems, such as secure communications and real-time processing, support market growth. France's strategic investments in enhancing military capabilities and maintaining technological superiority contribute to the demand for embedded systems.

The military embedded systems market in the U.K. is estimated to grow at the highest CAGR from 2024 to 2030. The emphasis is on modernizing defense infrastructure and integrating cutting-edge technologies. The UK's defense strategy includes significant investments in advanced systems such as AI, cybersecurity, and autonomous technologies. These efforts, along with increasing defense budgets and collaborative defense programs, drive the demand for high-performance embedded solutions.

Germany military embedded systems market is estimated to grow at a moderate CAGR from 2024 to 2030. The focus is on enhancing defense capabilities and integrating advanced technologies. Germany's commitment to modernizing its military infrastructure and participating in NATO defense initiatives supports the demand for sophisticated embedded solutions. Increased defense budgets and investments in technology-driven upgrades contribute to market growth.

Middle East & Africa (MEA) Military Embedded Systems Market Trends

The military embedded systems market in the Middle East and Africa (MEA) region is estimated to grow significantly from 2024 to 2030 due to the rising defense expenditure and modernization of military equipment. Regional geopolitical tensions and security concerns lead to increased investments in advanced defense technologies. The focus on upgrading military systems and enhancing operational capabilities supports the demand for high-performance embedded solutions.

Saudi Arabia military embedded systems market accounted for a considerable revenue share in 2023. The Saudi government's investment in advanced military technology and infrastructure, driven by regional security concerns and strategic defense initiatives, supports the demand for sophisticated embedded systems. The emphasis on enhancing military capabilities and integrating innovative technologies drives market growth.

Key Military Embedded Systems Company Insights

Some of the key players operating in the market include Lockheed Martin, General Dynamics, Airbus, and Raytheon Company.

-

Lockheed Martin's growth strategy in military embedded systems focuses on leveraging advanced technologies like AI, cybersecurity, and open system architectures. They aim to enhance system interoperability, reliability, and resilience for various military applications. The company emphasizes partnerships and innovation to deliver innovative solutions, ensuring they meet evolving defense needs. Their strategy also includes investing in research and development to maintain technological leadership and support modernization efforts across defense platforms.

-

Airbus's growth strategy in military embedded systems focuses on developing advanced avionics, secure communications, and mission systems. The company emphasizes innovation in areas such as cybersecurity, data analytics, and artificial intelligence to enhance operational efficiency and effectiveness. Airbus collaborates with defense organizations and industry partners to create integrated, scalable solutions for a range of military aircraft and platforms. Additionally, they invest in R&D to support digital transformation and maintain a competitive edge in the defense sector.

Xilinx, Kontron AG, and Concurrent Technologies plc are some of the emerging market participants in the military embedded systems market.

-

Xilinx focuses on growth in military embedded systems through its advanced FPGA (Field-Programmable Gate Array) technology. Their strategy includes enhancing the performance and versatility of embedded systems for defense applications by providing customizable, high-performance processing solutions. Xilinx emphasizes the integration of its FPGAs with advanced algorithms, high-speed interfaces, and secure communications to meet the complex requirements of military systems.

-

Concurrent Technologies plc specializes in providing high-performance embedded computer solutions, including military-grade systems. Their growth strategy in military embedded systems focuses on delivering rugged, reliable, and high-performance hardware that meets the stringent requirements of defense applications. They emphasize innovation in areas such as modular design, enhanced security features, and compliance with military standards.

Key Military Embedded Systems Companies:

The following are the leading companies in the military embedded systems market. These companies collectively hold the largest market share and dictate industry trends.

- Advantech Co. Ltd.

- Airbus

- BAE Systems

- Concurrent Technologies PLC

- Curtiss-Wright Corporation

- Eurotech S.p.A

- General Dynamics

- Honeywell International

- Intel Corporation

- Kontron AG

- Lockheed Martin

- Mercury Systems Inc.

- Microsemi Corporation

- North Atlantic Industries Inc.

- Northrop Grumman

- QinetiQ

- Radisys Corporation

- Raytheon Company

- Thales Group

- Xilinx

Recent Developments

-

In July 2024, General Dynamics Mission Systems' Progeny Systems was awarded a USD 11,996,038 cost-plus, fixed-fee modification to a prior contract for engineering and technical support in modernizing Virginia Class Block I/II submarines with the Common Weapon Launcher (CWL) system, alongside other ongoing projects. Navy submarine combat systems. Progeny Systems, acquired by General Dynamics in 2022, provided extensive capabilities and lifecycle support services.

-

In June 2024, Northrop Grumman Corporation delivered the first production Integrated Battle Command System (IBCS) Engagement Operations Center (EOC) and Integrated Fire Control Network (IFCN) Relay to the U.S. Army. This delivery, along with the Integrated Collaborative Environment (ICE), completed the first full set of IBCS under the low-rate initial production (LRIP) award.

Military Embedded Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.93 billion |

|

Revenue Forecast in 2030 |

USD 3.45 billion |

|

Growth Rate |

CAGR of 10.10% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Platform, application, installation type, product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Advantech Co. Ltd.; Airbus; BAE Systems; Concurrent Technologies PLC; Curtiss-Wright Corporation; Eurotech S.p.A; General Dynamics; Honeywell International; Intel Corporation; Kontron AG; Lockheed Martin; Mercury Systems Inc.; Microsemi Corporation; North Atlantic Industries Inc.; Northrop Grumman; QinetiQ; Radisys Corporation; Raytheon Company; Thales Group; Xilinx |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Military Embedded Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global military embedded systems market report based on platform, application, installation type, product type, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Land

-

Airborne

-

Naval

-

Unmanned

-

Space

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Intelligence, Surveillance, & Reconnaissance (ISR)

-

Electronic Warfare

-

Communication & Navigation

-

Command & Control

-

Weapon & Fire Control

-

Wearable

-

Others

-

-

Installation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

New Installation

-

Upgradation

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Telecom Computing Architecture (ATCA)

-

Compact-PCI (CPCI) Boards

-

Compact-PCI (CPCI) Serial

-

VME Bus

-

Open VPX

-

Motherboard

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global military embedded systems market size was estimated at USD 1.77 billion in 2023 and is expected to reach USD 1.93 billion in 2024.

b. The global military embedded systems market is expected to grow at a compound annual growth rate of 10.10% from 2024 to 2030 to reach USD 3.45 billion by 2030.

b. North America accounted for the highest market revenue share in 2023. The driving force for the military embedded systems market is the increasing defense budgets and modernization programs by the U.S. and Canadian governments. Advancements in technology, including AI, cybersecurity, and IoT, are pushing the demand for advanced embedded systems.

b. Some key players operating in the military embedded systems market include Lockheed Martin, General Dynamics, Airbus, Raytheon Company, Xilinx, Kontron AG, Concurrent Technologies plc and among others

b. The rise in global military spending, driven by geopolitical tensions and security threats, is pushing the demand for advanced defense technologies. Militaries worldwide are investing in sophisticated embedded systems to enhance capabilities such as real-time data processing, surveillance, and communication.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."