- Home

- »

- Next Generation Technologies

- »

-

Military Electro-Optical And Infrared Systems Market Report 2033GVR Report cover

![Military Electro-Optical And Infrared Systems Market Size, Share & Trend Report]()

Military Electro-Optical And Infrared Systems Market (2026 - 2033) Size, Share & Trend Analysis Report By Platform (Airborne, Land), By Application, By Imaging Technology, By Colling Technology, By Sensor Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-461-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Military Electro-Optical And Infrared Systems Market Summary

The global military electro-optical and infrared systems market size was estimated at USD 8.77 billion in 2025 and is projected to reach USD 12.68 billion by 2033, growing at a CAGR of 4.9% from 2026 to 2033. Market growth is driven by the increasing need for advanced surveillance and reconnaissance capabilities, and the growing focus on precision targeting and intelligence gathering, which has further fueled the adoption of EO/IR systems across various platforms, including aircraft, naval vessels, and ground vehicles.

Key Market Trends & Insights

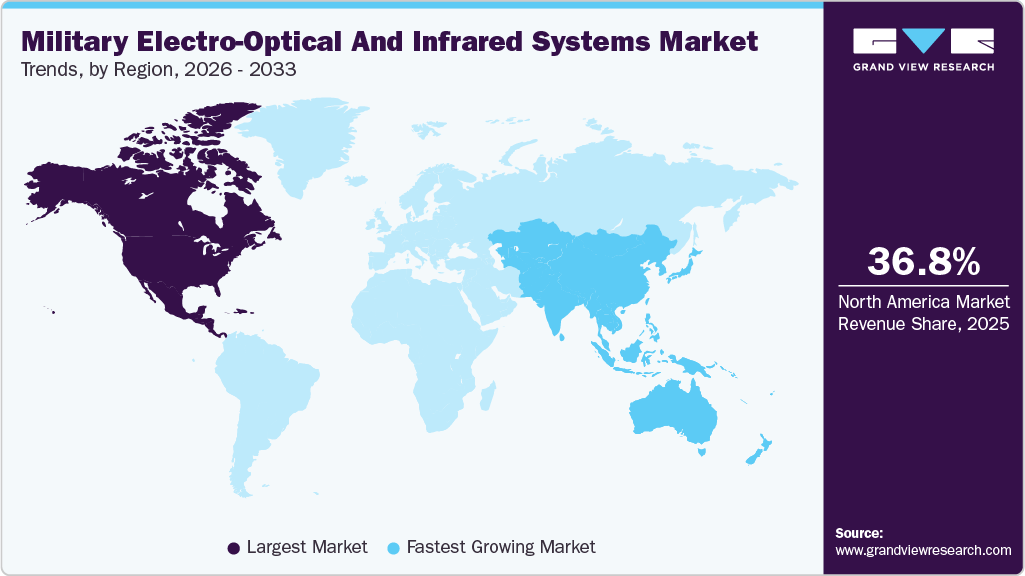

- North America dominated the global military electro-optical and infrared systems market with the largest revenue share of 36.8% in 2025.

- Based on platform, the airborne segment led the market with the largest revenue share of 62.8% in 2025.

- Based on application, the surveillance and reconnaissance segment is expected to grow at the fastest CAGR of 5.5% in 2025.

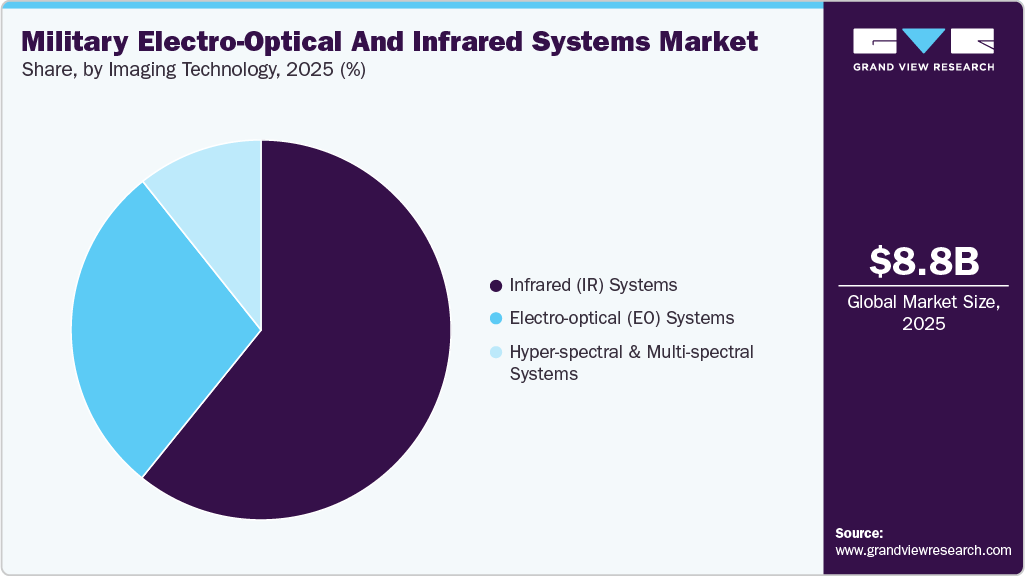

- Based on imagine technology, the infrared (IR) systems segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 8.77 Billion

- 2033 Projected Market Size: USD 12.68 Billion

- CAGR (2026-2033): 4.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The ability of these systems to operate in diverse environmental conditions, including low visibility and nighttime scenarios, makes them indispensable for modern military operations, which further drives the growth of the military electro-optical and infrared systems industry.The growing advancements in military electro-optical and infrared systems are becoming more efficient, reliable, and versatile. Innovations such as high-resolution imaging sensors, advanced signal processing, and the integration of artificial intelligence (AI) have enhanced the performance of these systems. The development of multispectral and hyperspectral imaging technologies enables better target identification and discrimination, even in cluttered environments. Furthermore, component miniaturization has enabled the development of compact, lightweight systems that can be easily integrated into various platforms, thereby expanding their operational scope and driving the military electro-optical and infrared systems industry expansion.

Governments worldwide have been actively promoting the acquisition and development of Military EO and IR Systems as part of their defense modernization programs. Many nations are increasing their defense budgets and prioritizing the procurement of advanced surveillance and targeting systems to enhance their military capabilities. Initiatives such as funding for research and development, partnerships with private defense contractors, and streamlined procurement processes have been instrumental in driving the sales of EO/IR systems. In addition, government-led programs to improve border security, counterterrorism, and homeland defense are further contributing to the growing demand within these military electro-optical and infrared systems industry.

Manufacturers of military EO and IR systems are increasingly focusing on developing next-generation solutions that cater to the evolving needs of modern warfare. Companies are investing heavily in research and development to create systems with enhanced performance characteristics, such as higher resolution, longer range, and improved data processing capabilities. There is also a growing emphasis on developing systems that can be easily integrated with other defense technologies, such as unmanned systems and network-centric warfare platforms. By offering customizable and modular EO/IR solutions, manufacturers are positioning themselves to meet the specific requirements of different military customers.

The military electro-optical and infrared systems industry offers several key opportunities for growth, particularly in the areas of emerging technologies and new applications. The increasing adoption of unmanned aerial vehicles (UAVs) and drones for surveillance and reconnaissance missions presents a significant opportunity for the integration of EO and IR systems. In addition, the growing focus on space-based EO and IR systems for missile defense and early warning systems opens up new avenues for market expansion.

Platform Insights

The airborne segment led the market with the largest revenue share of 62.8% in 2025, driven by the increasing reliance on advanced airborne surveillance and targeting systems. These systems are crucial for enhancing the capabilities of modern aircraft, including fighter jets, drones, and reconnaissance planes, allowing for superior situational awareness and precision in both offensive and defensive operations. The growing focus on modernizing air force fleets across various nations, coupled with the rising demand for enhanced reconnaissance and targeting capabilities, has further solidified the Air Base system's dominant position in the EO and IR market.

The naval segment is anticipated to grow at the fastest CAGR of 4.0% from 2025 to 2033, fueled by rising maritime security demands and naval modernization programs. Geopolitical tensions and territorial disputes in key maritime regions, such as the Indo-Pacific, drive investments in advanced EO/IR systems for surveillance and threat detection on naval vessels. The modernization of fleets, including upgrades to mast-mounted sensors and integration with unmanned surface vehicles, supports this growth amid increasing piracy and illicit activities.

Application Insights

The surveillance and reconnaissance segment accounted for the largest market revenue share in 2025. This dominance is driven by the increasing demand for advanced situational awareness and intelligence gathering in modern warfare. EO and IR systems are crucial for surveillance and reconnaissance missions as they provide real-time data, high-resolution imagery, and enhanced night vision capabilities, which are essential for identifying and tracking potential threats. The growing need for border security, monitoring of critical infrastructure, and the rise in asymmetric warfare tactics have further propelled the demand for these systems.

The weapon sighting and fire control segment is expected to record at the fastest CAGR from 2025 to 2033, within the military electro-optical and infrared systems industry, driven by advancements in precision targeting and integration with network-centric warfare systems. Rising demand for electro-optical/infrared sensors in fire control enhances real-time target acquisition, ballistic computation, and low-visibility operations across land, air, and naval platforms. Modernization programs incorporate AI-driven sensor fusion and laser rangefinders, improving firing accuracy amid geopolitical tensions and increased defense spending.

Imaging Technology Insights

The Infrared (IR) systems segment accounted for the largest market revenue share in 2025, driven by the increasing demand for advanced thermal imaging and night vision capabilities, growing technological advancements that have led to the development of more sensitive and accurate IR sensors, and the miniaturization of these systems. Furthermore, the increasing global focus on enhancing border security and surveillance has driven the demand for IR systems, thereby accelerating their adoption in the defense sector. As a result, the IR systems segment is poised to continue its rapid expansion, playing a crucial role in modern military strategies and operations.

The hyperspectral and multispectral systems segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing demand in defense surveillance, reconnaissance, and threat detection applications. These systems excel in capturing high-resolution spectral data for material identification, camouflage detection, and real-time battlefield mapping, driven by rising defense budgets and the increasing demands for ISR (intelligence, surveillance, and reconnaissance) capabilities. Integration with AI, drones, and satellites enhances their utility in modern warfare, outpacing traditional imaging due to superior accuracy in contested environments.

Cooling Technology Insights

The cooled segment accounted for the largest market share in 2025, driven by its superior image resolution, sensitivity for long-range detection, and ability to identify faint thermal signatures in challenging environments such as extreme heat or cold. Cooled EO/IR systems utilize cryogenic cooling to minimize sensor noise, thereby enabling precise target acquisition, surveillance, and reconnaissance in military applications, including airborne platforms and sniper sights. Demand surges from defense modernization programs prioritizing high-performance thermal imaging for situational awareness, thereby driving segmental growth.

The uncooled segment is expected to record the highest CAGR from 2026 to 2033, driven by its cost-effectiveness, compact design, lower power consumption, and suitability for portable soldier systems, drones, and man-portable applications where weight and battery life are critical. Uncooled EO/IR systems eliminate the need for cryogenic cooling, reducing size, weight, and logistical burdens while enabling rapid deployment in tactical scenarios, such as dismounted infantry sights and small UAVs. Advancements in microbolometer technology improve resolution to near-cooled levels at lower costs, fueling adoption in budget-constrained programs and dual-use applications, such as border security.

Sensor Technology Insights

The staring segment accounted for the largest market share in 2025, driven by its ability to capture full-field images simultaneously without mechanical scanning, delivering higher frame rates, real-time situational awareness, and superior sensitivity for military surveillance, targeting, and missile guidance applications. These focal plane arrays utilize thousands of detectors to provide instantaneous wide-area coverage, reducing latency critical for fast-moving threats such as drones or hypersonic missiles, while lower maintenance needs and compact integration into gimbals, helmets, and UAV payloads boost adoption across air, land, and naval platforms.

The scanning segment is expected to record a significant CAGR from 2025 to 2033, driven by cost advantages, simpler design for long-range linear detection, and growing integration into unmanned systems, drones, and border patrol, where wide-area coverage outweighs the need for instantaneous full-frame imaging. Scanning systems excel at persistent, wide-swath monitoring over hundreds of kilometers, such as maritime patrol or perimeter security. Advancements in MEMS mirrors and linear arrays enable lighter, more affordable upgrades for legacy platforms amid rising demand for cost-effective ISR in budget-constrained militaries.

Regional Insight

North America dominated the global military electro-optical and infrared systems market with the largest revenue share of 36.8% in 2025, owing to advancements in technology and increasing defense budgets. The region's focus on enhancing national security and maintaining technological superiority has spurred significant investment in advanced electro-optical and infrared systems. Innovations in sensor technology, along with the growing need for precision targeting and enhanced surveillance capabilities, are key factors contributing to this expansion. Furthermore, ongoing modernization programs and the strategic importance of maintaining an advanced defense infrastructure are expected to fuel the market growth further.

U.S. Military Electro-Optical And Infrared Systems Market Trends

The military electro-optical and infrared systems market in the U.S. accounted for the largest market revenue share in North America in 2025, driven by the country's commitment to maintaining technological superiority and enhanced defense capabilities. The U.S. defense sector is heavily investing in next-generation systems that offer enhanced imaging, targeting, and surveillance functionalities. This growth is further supported by the increasing demand for advanced reconnaissance and situational awareness tools in various military operations. In addition, the U.S. military's focus on integrating these advanced systems into existing platforms and developing new, high-performance systems underscores the market's expansion and its strategic importance to national security.

Europe Military Electro-Optical And Infrared Systems Market Trends

The military electro-optical and infrared systems market in Europe held a significant share in 2025, fueled by heightened security concerns and the need for advanced defense technologies. European nations are investing in modernizing their military capabilities to address evolving threats and improve operational effectiveness. The increased adoption of cutting-edge electro-optical and infrared technologies is driven by the need for enhanced surveillance, reconnaissance, and precision targeting. Furthermore, collaborative defense initiatives and joint programs among European countries are accelerating the development and deployment of advanced systems, contributing to the overall market expansion in the region.

Asia Pacific Military Electro-Optical And Infrared Systems Market Trends

The military electro-optical and infrared systems market in the Asia Pacific is expected to grow at the fastest CAGR of 6.2% from 2025 to 2033, owing to the region's increasing defense budgets, territorial disputes, and the need for advanced military capabilities. Countries including China, India, Japan, and South Korea are leading the charge in acquiring and developing sophisticated EO/IR systems to bolster their defense forces. The growing focus on maritime security and the rising geopolitical tensions in the region have further fueled the demand for EO/IR systems in the Asia Pacific.

The Japan military electro-optical and infrared systems market is expected to grow rapidly in the coming years, driven by the modernization of defense infrastructure, AI/machine learning integration for real-time processing, and adoption in drones, UGVs, naval vessels, and maritime surveillance to bolster ISR and target acquisition. Geopolitical tensions further accelerate R&D in lightweight, multi-functional systems for unmanned and network-centric operations.

The military electro-optical and infrared systems market in China is expected to grow at a significant CAGR during the forecast period, driven by surging defense budgets, aggressive armed forces modernization, and indigenous innovation aimed at reducing foreign technology dependence. Regional security threats, border tensions, and geopolitical conflicts drive investments in advanced surveillance, ISR platforms, precision targeting, and AI-integrated multi-spectral systems for UAVs, armored vehicles, and naval assets. These factors enhance battlefield awareness, threat detection, and operational efficiency in response to the demands of hybrid warfare.

Key Military Electro-Optical And Infrared Systems Company Insight

Some of the key players operating in the market include Lockheed Martin Corporation, Northrop Grumman Corporation, among others.

-

Lockheed Martin Corporation is an aerospace and defense company with operations across air, land, sea, and space domains. The company provides advanced military electro-optical and infrared (EO/IR) systems, including targeting pods, infrared search and track sensors such as IRST21, and multi-sensor suites like the F‑35 Electro‑Optical Targeting System (EOTS), delivering long-range detection, tracking, and precision engagement capabilities for air, land, and maritime platforms.

-

Northrop Grumman Corporation is a defense technology company active in aeronautics, mission systems, and space systems. The company provides EO/IR sensors and payloads integrated into missile warning, targeting, and ISR architecture, supplying infrared detectors, targeting systems, and space-based payloads that enhance situational awareness, precision engagement, and persistent surveillance.

Some of the emerging market players in the military electro-optical and infrared systems industry include Teledyne FLIR LLC, and Leonardo DRS, Inc.

-

Teledyne FLIR LLC is a subsidiary of Teledyne Technologies focused on sensing and imaging solutions. The company offers a wide range of EO/IR products, including thermal imaging cameras, gimballed sensor payloads, and soldier-borne and vehicle-mounted sights that support day/night surveillance, target acquisition, and force protection for ground, airborne, and unmanned platforms used by defense and security agencies.

-

Leonardo DRS, Inc. is a defense electronics company that is majority-owned by Leonardo S.p.A. The company provides military EO/IR solutions, including thermal weapon sights, long-range surveillance systems, and infrared sensors, which are integrated into ground combat vehicles, aircraft, and naval platforms. This support enables military forces to enhance their targeting, reconnaissance, and situational awareness capabilities.

Key Military Electro-Optical And Infrared Systems Companies:

The following are the leading companies in the military electro-optical and infrared systems market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales Group

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- Teledyne FLIR LLC

- BAE Systems Plc

- Leonardo S.p.A.

- Rheinmetall AG

- Saab AB

- Micron Technology, Inc.

Recent Developments

-

In October 2025, Lockheed Martin Corporation was awarded a USD 233 million contract by the U.S. Navy and Air National Guard (ANG) to initiate full-rate production of its IRST21 Block II systems and associated spares. The IRST21 Block II is an advanced long-wave infrared search and track sensor that operates passively, allowing it to detect and track airborne targets at extended ranges without emitting a radar signal, thus ensuring effectiveness in radar-denied or heavily jammed environments.

-

In October 2025, Northrop Grumman Corporation partnered with Red 6 to integrate its Advanced Tactical Augmented Reality System (ATARS) into Northrop’s Beacon autonomous mission testbed. This collaboration enables the creation of realistic virtual training environments that replicate complex, near-peer threat scenarios, while reducing safety risks and airspace limitations. The partnership aims to accelerate the development of autonomous systems and enhance mission readiness for future combat operations.

-

In June 2025, Leonardo DRS, Inc. secured a USD 41 million contract to continue delivering critical combat management system hardware for the U.S. Navy and allied forces, including multi-screen consoles and displays. Although primarily a hardware/computing contract, these systems are essential components that process and display the massive amounts of data collected by the Navy's advanced sensing systems, including EO/IR surveillance and targeting systems deployed on surface combatants.

Military Electro-Optical And Infrared Systems Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9.09 billion

Revenue forecast in 2033

USD 12.68 billion

Growth rate

CAGR of 4.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, application, imaging technology, cooling technology, sensor technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Lockheed Martin Corporation; Northrop Grumman Corporation; Raytheon Technologies Corporation; Thales Group; Leonardo S.p.A.; L3Harris Technologies, Inc.; Teledyne FLIR LLCBAE Systems Plc; Leonardo S.p.A.; Rheinmetall AG; Micron Technology, Inc.; Saab AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Military Electro-Optical And Infrared Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global military electro-optical and infrared systems market report based on platform, application, imaging technology, cooling technology, sensor technology, and region.

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Airborne

-

Land

-

Naval

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Surveillance and Reconnaissance

-

Target Acquisition And Designation

-

Weapon Sighting And Fire Control

-

Navigation and Guidance

-

-

Imaging Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Electro-optical (EO) Systems

-

Infrared (IR) Systems

-

Hyper-Spectral And Multi-Spectral Systems

-

-

Cooling Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Cooled

-

Uncooled

-

-

Sensor Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Staring

-

Scanning

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global military electro-optical and infrared systems market size was estimated at USD 8.77 billion in 2025 and is expected to reach USD 9.08 billion in 2026.

b. The global military electro-optical and infrared systems market is expected to grow at a compound annual growth rate of 4.9% from 2026 to 2033 to reach USD 12.68 billion by 2033.

b. The airborne segment dominated the market, accounting for over 62.8% of the market share in 2025, driven by the increasing reliance on advanced airborne surveillance and targeting systems.

b. Some of the key players operating in the military electro-optical and infrared systems market include Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, Leonardo S.p.A., L3Harris Technologies, Inc., FLIR Systems, Inc. BAE Systems Plc, Leonardo S.p.A. and Rheinmetall AG and Saab AB.

b. Military Electro-Optical and Infrared (EO/IR) Systems market is driven by the increasing need for advanced surveillance and reconnaissance capabilities. As global tensions rise, and asymmetric warfare becomes more prevalent, military forces require enhanced situational awareness to effectively monitor and respond to potential threats. Additionally, the growing focus on precision targeting and intelligence gathering has further fuelled the adoption of EO/IR systems across various platforms, including aircraft, naval vessels, and ground vehicles. The ability of these systems to operate in diverse environmental conditions, including low visibility and night-time scenarios, makes them indispensable for modern military operations

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.