- Home

- »

- Next Generation Technologies

- »

-

Military Drone Market Size, Share, Industry Report, 2033GVR Report cover

![Military Drone Market Size, Share & Trends Report]()

Military Drone Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Fixed-wing, Rotary Blade, Hybrid), By Operation Mode, By Range, By Application, By Maximum Take-off Weight, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-394-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Military Drone Market Summary

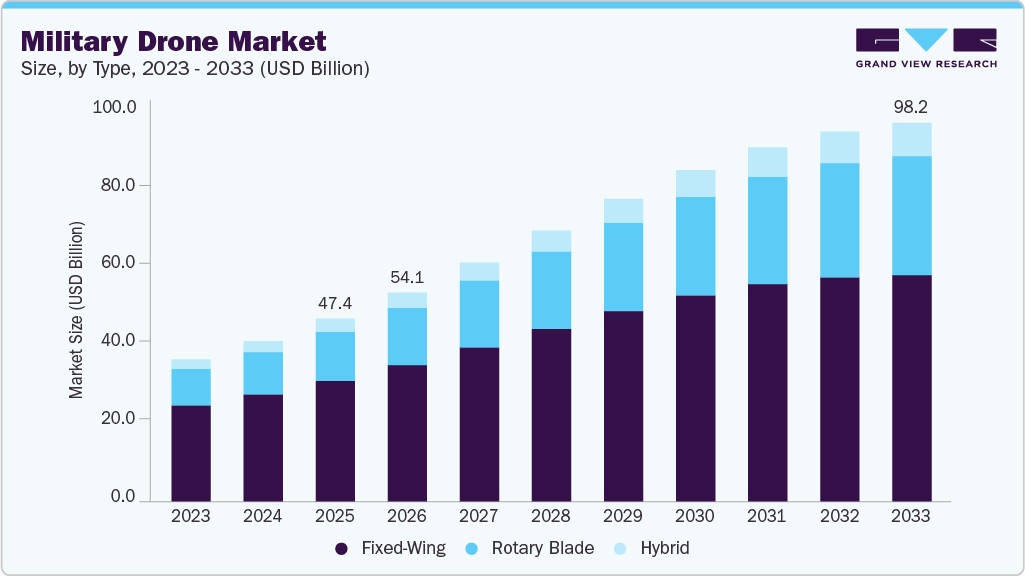

The global military drone market size was estimated at USD 47.38 billion in 2025 and is projected to reach USD 98.24 billion by 2033, growing at a CAGR of 8.9% from 2026 to 2033. The market growth is driven by rapid technological advancements in AI, machine learning, and autonomous navigation, enabling real-time decision-making and swarm operations, as well as escalating demands for border security, counterterrorism, and electronic warfare capabilities that leverage long-endurance platforms with enhanced payload capacities.

Key Market Trends & Insights

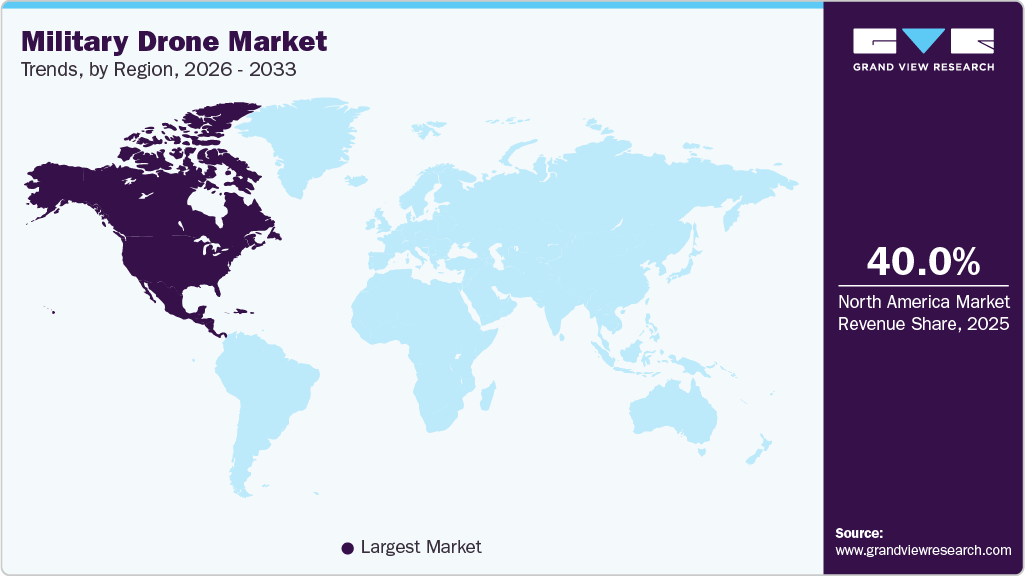

- The military drone market in North America accounted for the largest revenue share of over 40% in 2025.

- The U.S. military drone market dominated the market with a share of over 85% in 2025.

- Based on type, the fixed-wing segment accounted for the largest revenue share of over 66% in 2025.

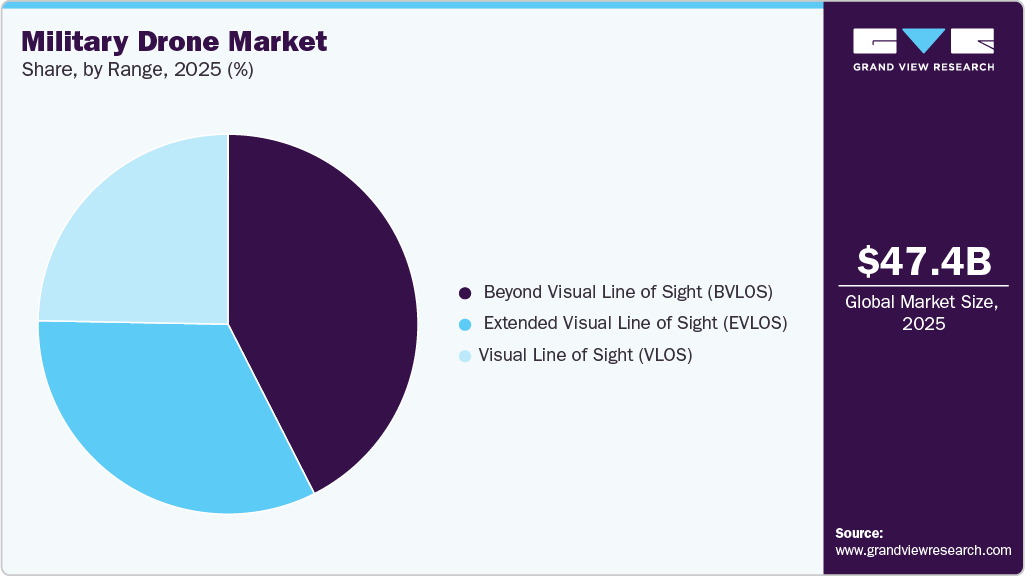

- Based on range, the beyond visual line of sight segment is expected to grow at the highest CAGR of over 12% in 2025.

- Based on application, the Intelligence, Surveillance and Reconnaissance (ISR) segment accounted for the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 47.38 Billion

- 2033 Projected Market Size: USD 98.24 Billion

- CAGR (2026-2033): 8.9%

- North America: Largest market in 2025

Rising investments from major players such as the U.S. DoD's Replicator initiative, NATO modernization programs, and partnerships between defense contractors and tech firms are accelerating R&D in stealth, 5G-enabled real-time communication, and counter-drone defenses.The adoption of military drones is also being propelled by technological innovations that enhance operational capabilities, such as improved sensor systems, high-resolution cameras, advanced avionics, and seamless integration with real-time data networks, including 5G. These advancements enable drones to perform a variety of critical missions, including intelligence, surveillance, and reconnaissance (ISR), target acquisition, and precision strikes with increased accuracy and efficiency, thereby driving the military drone industry.

Additionally, the strategic importance of drones in modern warfare, with their ability to conduct multi-domain operations and swarm tactics, is leading to increased military procurement and modernization programs. Governments worldwide are recognizing the cost-effectiveness of unmanned systems compared to traditional manned aircraft, which motivates substantial investments to expand military drone fleets. The Asia Pacific region, particularly countries such as India and China, is experiencing rapid growth due to ongoing defense modernization initiatives and increasing regional security concerns, making it one of the fastest-growing markets for military drones in the years to come. These combined factors create a dynamic and expanding market landscape for the military drone industry.

Furthermore, the growing focus on advanced C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) capabilities is a critical driver reshaping modern military operations. The rapid advancement of C4ISR capabilities is transforming modern military operations by enabling seamless manned-unmanned teaming, greater situational awareness, and mission adaptability. A leading example is the U.S. Department of Defense’s Collaborative Combat Aircraft (CCA) Program, launched in 2025, which focuses on developing semi-autonomous, jet-powered drones to serve as loyal wingmen alongside manned fighters. Such factors are expected to drive the military drone industry in coming years.

Moreover, the escalating geopolitical tensions are enhancing defense budgets by prompting nations to prioritize investments in advanced military technologies, particularly in the development and deployment of sophisticated unmanned aerial systems. Countries are allocating greater portions of their GDP to defense in response to emerging threats, contested borders, and the need for technologically advanced armed forces. According to the Stockholm International Peace Research Institute (SIPRI), global military spending reached a record high in 2025, driven largely by major powers such as the U.S., China, Russia, and Germany, among others. These rising expenditures reflect traditional security challenges and the urgency to modernize militaries with cutting-edge technologies such as AI-driven C4ISR systems, autonomous drones, and hypersonic weapons.

Type Insights

The fixed-wing segment dominated the market, accounting for over 66% of the market share in 2025, driven by its superior endurance, long-range capabilities, and efficiency in intelligence, surveillance, and reconnaissance (ISR) missions, which align with rising defense budgets and demand for persistent aerial coverage in contested environments. Continued investments in MALE and HALE UAV programs, along with rising border security and defense modernization initiatives, have further reinforced the dominance of fixed-wing military drones.

The hybrid segment is expected to register the fastest CAGR of 12% from 2026 to 2033, driven by its unique versatility in combining fixed-wing range with rotary-wing hover precision for vertical takeoffs and pinpoint landings, enabling multi-mission adaptability for tactical strikes, logistics resupply in rugged terrain, and urban counter-insurgency operations. This is further accelerated by breakthroughs in lightweight composite materials, high-density lithium-sulfur batteries that extend flight times by 30-50%, and AI-driven flight controls that optimize energy use in dynamic battlefields.

Operation Mode Insights

The remotely piloted segment dominated the market in 2025, driven by its proven reliability in providing real-time human oversight for high-stakes combat scenarios, precision targeting with minimal collateral damage via laser-guided munitions, and substantial risk reduction to human pilots through ground control stations, bolstered by mature satellite communication networks like Link 16, extensive training ecosystems, and widespread adoption across NATO and Indo-Pacific forces for ISR, electronic warfare, and armed overwatch roles in asymmetric conflicts.

The fully autonomous segment is expected to register the fastest CAGR from 2026 to 2033, driven by exponential progress in AI algorithms, edge computing, and machine learning for real-time object recognition and path planning, enabling scalable swarm tactics involving hundreds of low-cost drones overwhelming air defenses, independent decision-making in GPS-denied environments via inertial navigation, and resilience in high-threat zones, spurred by geopolitical flashpoints such as Ukraine and Taiwan Strait tensions alongside U.S. DoD's Replicator initiative investing billions in attritable autonomous systems.

Range Insights

The beyond visual line of sight (BVLOS) segment dominated the market in 2025, driven by its capacity for extended operational ranges beyond 100 km using high-altitude long-endurance (HALE) designs, persistent surveillance over expansive theaters like maritime domains, and seamless integration with low-earth orbit satellite constellations for global command-and-control, addressing escalating requirements for power projection in hybrid warfare, border patrol against smuggling, and strategic deterrence amid rising investments from China, Russia, and the U.S. in networked kill chains.

The extended visual line of sight (EVLOS) segment is expected to register a significant CAGR from 2026 to 2033, driven by its lower regulatory complexity compared to BVLOS and growing use in tactical surveillance, training, and localized military operations. EVLOS offers an effective balance between operational range and control, supporting cost-efficient deployments. Increasing adoption of portable ground control systems, improved sensor integration, and networked battlefield operations is further accelerating demand for EVLOS-capable military drones.

Application Insights

The intelligence, surveillance, and reconnaissance (ISR) dominated the market in 2025, driven by rising defense investments in real-time battlefield awareness, miniaturized high-resolution sensors, and AI-enhanced data analytics for target detection and rapid decision-making. The proliferation of lightweight tactical ISR drones and enhanced swarming capabilities further propels deployment across diverse theaters. Integrated battlefield connectivity and secure C2 (command-and-control) systems reinforce operational resilience. This reflects the segment’s strategic upward trajectory and adoption in the military drone industry.

The logistics & supply segment is expected to register a significant CAGR from 2026 to 2033, driven by the growing need for efficient and rapid delivery of supplies and equipment in military operations. Military drones are increasingly being utilized for transporting critical supplies, equipment, and medical aid to remote or combat zones where traditional supply chains face challenges. Militaries seek to streamline and optimize their supply chains, the demand for drones in logistics is expected to surge, driving robust growth in this segment. The adoption of autonomous aerial cargo systems is also being accelerated by defense modernization programs worldwide.

Regional Insights

North America dominated the market with a share of over 40% in 2025, driven by the growing need for efficient and rapid delivery of supplies and equipment in military operations. Military drones are increasingly being utilized for transporting critical supplies, equipment, and medical aid to remote or combat zones where traditional supply chains face challenges. Militaries seek to streamline and optimize their supply chains, the demand for drones in logistics is expected to surge, driving robust growth in this segment. The adoption of autonomous aerial cargo systems is also being accelerated by defense modernization programs worldwide.

U.S. Military Drone Market Trends

The U.S. military drone market dominated the market with a share of 85% in 2025, driven by the growing need for efficient and rapid delivery of supplies and equipment in military operations. Military drones are increasingly being utilized for transporting critical supplies, equipment, and medical aid to remote or combat zones where traditional supply chains face challenges. Militaries seek to streamline and optimize their supply chains, the demand for drones in logistics is expected to surge, driving robust growth in this segment. The adoption of autonomous aerial cargo systems is also being accelerated by defense modernization programs worldwide.

Europe Military Drone Market Trends

The Europe military drone market accounted for a share of over 23% in 2025, driven by a strong defense modernization agenda and efforts to enhance strategic autonomy. The drivers include sustained funding and procurement for joint drone development, substantial grants for UAV research and innovation, streamlined defense procurement processes, and increased venture capital investment, fostering agile drone technologies. Cross-border drone training centers and airspace integration trials improve interoperability and operational readiness in the region. The surge in production contracts supports the market expansion of the military drone. These factors collectively fuel the region’s rapid advancement in military drone capabilities.

The Germany military drone market is expected to grow significantly in the coming years, driven by the government’s strategic focus on autonomous defense technologies and modernizing armed forces with advanced UAVs. Increasing investment in AI-driven drone systems and indigenous defense capabilities is boosting domestic development. The emphasis on real-time battlefield intelligence and enhanced situational awareness fuels demand for high-performance drones.

The UK military drone market is rapidly expanding, driven by the government’s strategic focus on autonomous defense technologies and modernizing armed forces with advanced UAVs. Increasing investment in AI-driven drone systems and indigenous defense capabilities is boosting domestic development. The emphasis on real-time battlefield intelligence and enhanced situational awareness fuels demand for high-performance drones.

Asia Pacific Military Drone Market Trends

The Asia Pacific market is expected to grow at the fastest CAGR of over 10% from 2026 to 2033, driven by rising geopolitical tensions in the Indo-Pacific region, government-led defense modernization programs, and increasing demand for advanced surveillance and reconnaissance capabilities. The adoption of UAVs with enhanced payload capacity, endurance, and autonomous operation is further propelling the market.

The China military drone market is driven by rising geopolitical tensions in the Indo-Pacific region, government-led defense modernization programs, and increasing demand for advanced surveillance and reconnaissance capabilities. The adoption of UAVs with enhanced payload capacity, endurance, and autonomous operation is further propelling the market.

The Japan military drone market is rapidly expanding, owing to the Japan's strategic emphasis on enhancing national security and defense capabilities, particularly in response to regional. The nation's advanced technological infrastructure, coupled with a strong focus on innovation, supports the development and deployment of sophisticated unmanned aerial systems (UAS).

Key Military Drone Company Insights

Some of the key players operating in the market include Northrop Grumman Corporation, and Lockheed Martin Corporation., among others.

-

Northrop Grumman Corporation provides advanced aerospace and defense technology solutions to government, military, and commercial customers worldwide. The company operates across key segments including unmanned systems, autonomous technologies, C4ISR, cybersecurity, mission systems, and space systems. Its product offerings span military aircraft, missile defense, advanced weapons, space technologies, and specialized engineering, logistics, and modernization services.

-

Lockheed Martin Corporation provides advanced technology systems, products, and services focused on aerospace and defense. The company segments its operations into areas such as aeronautics, missiles and fire control, rotary and mission systems, and space. Its product portfolio includes military aircraft, rotary-wing aircraft, airlifters, ground vehicles, missiles, radar systems, sensors, unmanned systems, and naval systems.

Shield AI Inc. and SZ DJI Technologies Co., Ltd. are some of the emerging market participants in the military drone market.

-

Shield AI is an artificial intelligence robotics company that develops autonomous AI pilots for aircraft and drones to enhance surveillance and security operations. The company primarily serves the defense and security sectors, offering intelligent systems designed to protect military personnel and civilians. Its key products include AI-powered autonomous flight systems, such as Nova, an advanced drone capable of operating in GPS-denied environments for reconnaissance and tactical missions.

-

SZ DJI Technologies Co. Ltd is a prominent manufacturer of drones and handheld imaging devices, offering solutions for aerial photography, videography, and industrial applications. The company serves various sectors, including consumer, commercial, and industrial markets such as agriculture, construction, and emergency services. Its product lineup includes popular drone models like the DJI Mini 3, Mavic 3, and Air 2S, as well as imaging devices such as the Osmo Action 3 and Ronin 4D.

Key Military Drone Companies:

The following are the leading companies in the military drone market. These companies collectively hold the largest market share and dictate industry trends.

- Northrop Grumman Corporation

- RXT Corporation

- Israel Aerospace Industries Ltd.

- General Atomics Aeronautical Systems Inc.

- Teledyne FLIR LLC

- Lockheed Martin Corporation

- Boeing

- BAE Systems plc

- Elbit Systems Ltd.

- Thales Group

- Textron Inc

- AeroVironment Inc

- Leonardo S.p.A.

- Turkish Aerospace Industries

- Insitu Inc

- Shield AI Inc.

- Baykar

- SZ DJI Technologies Co. Ltd

Recent Developments

-

In November 2025, BAE Systems PLC signed a Memorandum of Understanding (MoU) with Turkish Aerospace Industries (TAI) to explore the joint development of advanced uncrewed air systems (UAS). The goal is to merge UK combat air integration expertise with Turkish drone manufacturing for next-generation joint drones for NATO and other allied fleets.

-

In July 2025, Northrop Grumman Corporation partnered with Red 6 to integrate its Advanced Tactical Augmented Reality System (ATARS) into Northrop’s Beacon autonomous mission testbed. This collaboration enables realistic virtual training environments that replicate complex, near-peer threat scenarios while reducing safety risks and airspace limitations.

-

In June 2025, General Atomics Aeronautical Systems Inc. unveiled the PELE Small UAS, a versatile, uncrewed launched effect designed for multi-mission capabilities. The PELE is tailored for international customers seeking adaptable unmanned aerial solutions. This launch underscores GA-ASI's commitment to expanding its small UAS portfolio.

Military Drone Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 54.15 billion

Revenue forecast in 2033

USD 98.24 billion

Growth rate

CAGR of 8.9% from 2026 to 2033

Base Year of estimation

2025

Actual Data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Operation Mode, Range, Application, Maximum Take-off Weight, End Use, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Northrop Grumman Corporation, RXT Corporation, Israel Aerospace Industries Ltd., General Atomics Aeronautical Systems Inc., Teledyne FLIR LLC, Lockheed Martin Corporation, Boeing, BAE Systems plc, Elbit Systems Ltd., Thales Group, Textron Inc., AeroVironment Inc., Leonardo S.p.A., Turkish Aerospace Industries, Insitu Inc., Shield AI Inc., Baykar, and SZ DJI Technologies Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Military Drone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global military drone market report based on type, operation mode, range, application, maximum take-off weight, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed-Wing

-

Rotary Blade

-

Hybrid

-

-

Operation Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Remotely Piloted

-

Partially Autonomous

-

Fully Autonomous

-

-

Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Visual Line of Sight (VLOS)

-

Extended Visual Line of Sight (EVLOS)

-

Beyond Visual Line of Sight (BVLOS)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Intelligence, Surveillance and Reconnaissance (ISR)

-

Logistics & Supply

-

Others

-

-

Maximum Take-off Weight Outlook (Revenue, USD Million, 2021 - 2033)

-

<150 Kg

-

150 - 1000 Kg

-

>1000 Kg

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Air Force

-

Army

-

Navy

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global military drone market size was estimated at USD 47.38 billion in 2025 and is expected to reach USD 41.66 billion in 2026.

b. The global military drone market is expected to grow at a compound annual growth rate of 9.2% from 2026 to 2033 to reach USD 77.27 billion by 2033.

b. The military drone market in North America accounted for a significant revenue share of over 39% in 2025. The region's focus on technological innovation, strategic defense initiatives, and the modernization of military assets have driven high demand and market growth for military drones.

b. Some key players operating in the military drone market include AeroVironment, Inc., Elbit Systems Ltd., Lockheed Martin Corporation, Nothrop Grumman Corporation, RTX Corporation, Shield AI, SZ DJI Technologies Co. Ltd., Teal Drones, Inc., Thales Group, The Boring Company

b. Key factors that are driving military drone market growth include rapid technological advancements, growing trend towards the adoption of autonomous and semi-autonomous drone systems in military operations, and an increased focus on developing counter-drone technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.