- Home

- »

- Renewable Chemicals

- »

-

Middle East Sea Salt Market Size, Industry Report, 2030GVR Report cover

![Middle East Sea Salt Market Size, Share & Trends Report]()

Middle East Sea Salt Market Size, Share & Trends Analysis Report By Application (Food, Industrial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-414-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

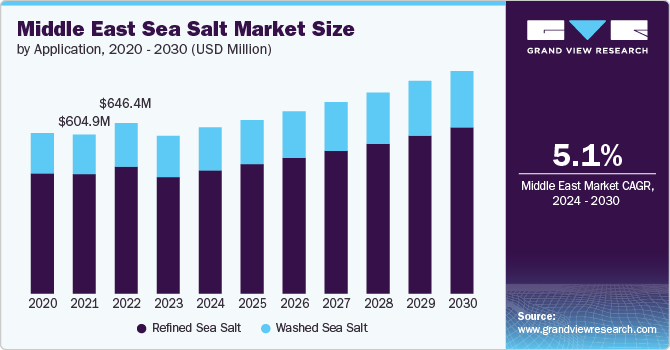

The Middle East sea salt market size was estimated at USD 599.19 million in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. One major driving factor for the growth of sea salt consumption in the Middle East region is the increasing awareness of its health benefits compared to regular products. It is often perceived as more natural and less processed, containing essential minerals like magnesium and calcium.

The global salt market is a significant and growing market that plays a crucial role in chemical processing, food processing, and water treatment. Salt is consumed in different forms by individuals globally and is considered a vital component of the human diet. The market is characterized by its wide range of applications, diverse end users, and the presence of both natural and processed products.

Salt finds applications across various industries and sectors. Salt is used as a flavor enhancer and preservative and in the production of processed foods in the food processing industry. It is also widely used in chemical processing to produce chlorine, soda ash, and other chemicals. Other end users include water treatment plants, pharmaceutical companies, and the cosmetics industry, where the product is used in the production of personal care products.

A major trend is the increasing demand for natural and organic products, including salt. Consumers are showing a preference for products that are perceived as healthier and environmentally friendly. This trend has led to the development of organic and unrefined products to cater to this growing demand. The rise of e-commerce has been a major phenomenon in recent years, which has enabled product manufacturers to reach a wider consumer base and offer a variety of products online.

Drivers, Opportunities & Restraints

The growth of the food & beverages (F&B) industry significantly drives the market in the Middle East. This trend is influenced by various factors, including consumer preferences for natural ingredients, the rise of gourmet dining, and health consciousness among consumers. According to Alpen Capital, Saudi Arabia, the UAE, Bahrain, Kuwait, Oman, and Qatar combined are expected to consume 56.2 million metric tons of F&B products annually by 2027. The Saudi Arabian market, currently valued at USD 28 billion, is expected to lead the Middle East F&B market with a share of 55.5 percent in the region in 2027.

In addition, the demand for chlor-alkali products, particularly caustic soda and chlorine, has surged in recent years due to their extensive applications. Caustic soda is essential in the production of various chemicals, including soaps, detergents, and textiles, while chlorine is crucial for water treatment and the manufacturing of PVC, a widely used plastic in construction. For instance, the rapid expansion of the construction sector in the Gulf Cooperation Council (GCC) countries has significantly increased the consumption of PVC, thereby driving the demand for chlorine and, consequently, the sea salt required for its production.

On the other hand, the product market faces significant challenges from the threat of substitutes, which can undermine its growth and profitability. One of the most prominent substitutes is gourmet salts, including Himalayan pink salt, fleur de sel, and smoked salts. These alternatives have gained immense popularity among consumers who are increasingly seeking unique flavors and health benefits associated with different types of products. For instance, in 2019, the demand for gourmet salts surged by 2600%, driven by consumers' desire to enhance their culinary experiences while reducing overall product consumption.

Market Concentration & Characteristics

The market is moderately consolidated, with a few key players establishing their dominance in the industry. Major companies such as Cargill, Incorporated, Amara Salt Factory, El Nasr Salines Co., SASA Saudi Salt, and Samasalt hold significant shares due to their comprehensive product portfolios and extensive distribution networks. These companies invest heavily in research and development to innovate and improve their product offerings, which helps them maintain a competitive edge.

The expansion of production capacity and the establishment of new production facilities represent a significant strategic initiative undertaken by operating companies to achieve market dominance. For example, in June 2024, QatarEnergy announced its intention to develop a salt production plant in the Um Al Houl area of Qatar. This project will be executed through a joint venture with Mesaieed Petrochemical Holding Company (MPHC), Qatar Industrial Manufacturing Co. (QIMC), and other strategic partners. The new plant aims to enhance Qatar's self-sufficiency by producing both industrial and table products to satisfy domestic market needs while also catering to regional and international markets through exports.

Application Insights

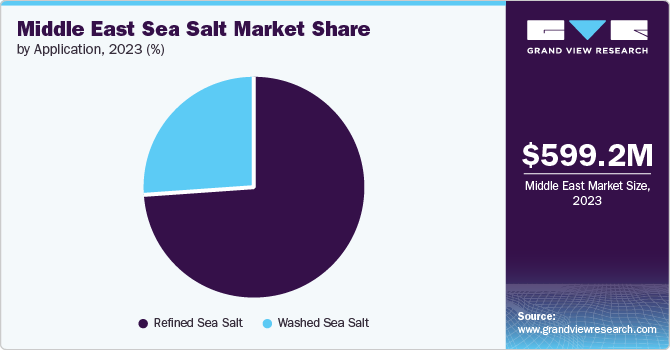

Refined sea salt dominated the market with a revenue share of 74.34% in 2023. It is processed to remove impurities and minerals to form pure sodium chloride. It is widely used in food processing and industrial applications. This processed product is also used as table salt. It is a staple in households and food production units owing to its consistent grain size, high purity, and added iodine for nutritional benefits. The production of the product dates to prehistoric times. Presently, it is produced in the Mediterranean and other warm, dry climates.

The growth of the market for refined sea salt is influenced by the increasing inclination of consumers toward natural and organic products. Retailers worldwide are selling these products on e-commerce sites to provide them with distinct flavors beyond their homeland, thereby catering to conscious and high-income consumers who consider the ethical and social value of products purchased by them.

Washed sea salt is often used as a finishing product that adds a delicate flavor and texture to a wide range of culinary dishes. For instance, in gourmet cooking, the product from the Atlantic Ocean is renowned for its clean taste and is frequently used to enhance the flavors of seafood, such as oysters, scallops, and fish. Its subtle briny flavor and unique texture make it a preferred choice for chefs who aim to elevate the taste and presentation of their dishes.

Country Insights

Egypt sea salt market dominated globally with a revenue share of 39.91% share in 2023. Egypt has an established chemical manufacturing industry, producing chemical goods worth USD 160 million in 2021, as per the Central Agency for Public Mobilization and Statistics (CAPMAS). The petrochemical industry, another major end user of sea salt, represents about 12% of the industrial sector in the country. According to the Egyptian Ministry of Trade and Industry, Egypt’s chemical exports amounted to USD 1.45 billion in the first quarter of 2024. The Chemicals and Fertilizers Export Council has estimated the chemical sector’s export figures to cross USD 9 billion by the end of 2024, growing by a rate of 10% year-on-year. The growth in the chemicals industry has resulted in a spurt in the usage of the product for processing and other applications in the country.

Saudi Arabia's sea salt market is anticipated to grow significantly over the forecast period. The country is the largest producer of desalinated water and operates many desalination plants to sustain its population’s water needs and growing demands from industries. The Saudi Arabian government’s Saline Water Conversion Corporation (SWCC), which makes up around 69% of the total desalinated water in Saudi Arabia, has started working toward using its desalination plants for the extraction of minerals, including sea salt.

Qatar sea salt market is anticipated to grow over the forecast period. It has seen an increasing trend of desalination plants being used for dedicated projects aimed at the production of the product in the country. For instance, in June 2024, Qatar Energy announced plans to set up a new salt production plant with the capacity to produce one million tons per annum, thereby helping to replace the 850,000 tons of industrial and table salts imported annually by the country. The project, built with a cost of USD 275 million, will be a joint venture involving Qatar Industrial Manufacturing Co. (QIMC), Mesaieed Petrochemical Holding Company, and Qatar Energy as the strategic partners.

Key Middle East Sea Salt Company Insights

The Middle East sea salt market is characterized by the dominance of a few globally established players, including Cargill, Incorporated, Amra Salt Factory, SASA SAUDI SALT, Riyadh Salt Industry Company, and Samasalt, among others. These key players have a significant market share and play a pivotal role in shaping the industry's competitive landscape. The industry is witnessing strategic partnerships, collaborations, and joint ventures among major players to enhance their market presence and expand their product offerings.

Some of the key players operating in the market include Cargill, Incorporated, SASA SAUDI SALT, and Riyadh Salt Industry Company.

-

Cargill, Incorporated offers products in several business divisions, including animal nutrition, food & beverage, bio-industrial, food services, agriculture, risk management, meat & poultry, industrial, beauty, pharmaceutical, and transportation. The company’s food & beverage segment operates the food salts division. It has a presence in Africa, Europe, the Middle East, North America, Latin America, and Asia Pacific. It manufactures and markets its products through offices located across China, Thailand, Japan, Korea, Belgium, Austria, Portugal, Romania, Peru, Canada, Mexico, and the U.S.

-

SASA SAUDI SALT specializes in the production of two distinct salt iterations. The company uses the Red Sea as its primary source for extraction. It sells premium iodized products under the brand name SASA and table iodized products under the brand name MASA. Premium iodized products are supplied to the pharmaceutical industry for bone and brain development purposes as well as for the prevention of thyroid. On the other hand, MASA’s products are used in food products such as soups, marinades, and dressings.

-

Riyadh Salt Industry Company is one of the prominent manufacturers of high-quality products and caters to countries in the Gulf Cooperation Council. The company operates its plant in Al-Qaseb, which is equipped with mining technology machines. The procured raw product is then processed in its facility in Riyadh. The company operates the brand RISA in GCC countries and 20 private labels, such as Douha, Senorita, Giant, and others, for exports. The company caters its products to various industries such as chemicals, water treatment, leather, food, agriculture, and domestic usage.

Blue Line Industries, Gulf Salt Co., and ShayanSalt Company are some of the emerging market players.

-

Blue Line Industries is one of the key chemical providers in the UAE. It inaugurated its first salt purification plant in 2001 and expanded it in 2011. The company operates three major refining plants in the Middle East, including one production facility in Salalah, Oman. It has a presence in over 10 locations worldwide, including Canada, Iraq, the U.S., Qatar, India, and Pakistan.

-

Gulf Salt Co. is a private manufacturer of a wide variety of products such as raw salt, food grade, industrial grade, iodized salt, and water softener salt. The company sources its products and refining equipment from Germany and the U.S. to ensure an efficient refining process. It adheres to the Quality & Food Safety Management System (QMS 9001:2015 & FSSC 22000:2018) to ensure the quality of its products. Its strategic location in the eastern province of Saudi Arabia enables it to serve clients based in the Middle East region efficiently. Its clients include major corporations such as Sadara, Veolia, P&G, and Saudi Aramco.

-

ShayanSalt company is an Iran-based manufacturer. Its salt extraction mines are in the Qom, Isfehan, and Semnan provinces of Iran. The company exports to more than ten countries including Georgia, Afghanistan, India, Russia, and Arab countries.

Key Middle East Sea Salt Companies:

- Cargill, Incorporated

- Amra Salt Factory

- El Nasr Salines Co.

- Reefal for Salt

- SASA SAUDI SALT

- Riyadh Salt Industry Company

- Samasalt

- Blue Line Industries

- Gulf Salt Co.

- ShayanSalt company

- Shali Siwa Salt

Recent Developments

-

In July 2024, Saudi Arabia’s Ministry of Industry and Mineral Resources awarded salt ore exploration licenses to four companies, Ibrahim Al-Issa and Partner Salt Company, Rastan Industry Company, Khalid Al-Zahid and Sons Company and Riyadh Salt Manufacturing Company. The licenses allow the companies to extract raw salt from mines located in the Ras Al-Qureia region of Eastern province in the country, four kilometers off the seacoast.

-

In July 2023, the Jazan Chamber of Commerce and Industry presented a strategic investment opportunity in the form of a salt manufacturing facility located in Jazan city and valued at USD 23.9 million. The sea salt producing facility will have the capacity to produce 100,000 tons of slat products on a yearly basis.

-

In November 2021, Duqm Salt factory started its project in Oman producing raw as well as industrial grade salt. The company as invest USD 31.2 million in the manufacturing of the facility, the first of its kind in the country of Oman.

Middle East Sea Salt Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 627.91 million

Revenue forecast in 2030

USD 845.92 million

Growth rate

CAGR of 5.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons; Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, country

Country scope

Oman, Saudi Arabia, UAE, Iran, Jordan, Egypt, Kuwait, Qatar

Key companies profiled

Cargill, Incorporated, Amra Salt Factory, El Nasr Salines Co., Reefal for Salt, SASA SAUDI SALT, Riyadh Salt Industry Company, Samasalt, Blue Line Industries, Gulf Salt Co., ShayanSalt Company, Shali Siwa Salt

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Sea Salt Market Report Segmentation

This report forecasts revenue & volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East sea salt market report based on application and country:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Washed Sea Salt

-

Food

-

Industrial

-

Chemical/Chlor Alkali

-

Oil & Gas

-

Petrochemicals

-

Textile

-

Pharmaceuticals

-

Other Industrial Applications

-

-

-

Refined Sea Salt

-

Food

-

Industrial

-

Chemical/Chlor Alkali

-

Oil & Gas

-

Petrochemicals

-

Fertilizers

-

Plastics

-

Other Industrial Applications

-

-

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Middle East

-

Oman

-

Saudi Arabia

-

UAE

-

Iran

-

Jordan

-

Egypt

-

Kuwait

-

Qatar

-

-

Frequently Asked Questions About This Report

b. Egypt dominated the regional consumption of sea salt in 2023 with a revenue share of 39.91%. The growth in the chemicals industry has resulted in a spurt in the usage of sea salt for processing and other applications in the country.

b. Major companies operating in the market are Cargill, Incorporated, Amra Salt Factory, SASA SAUDI SALT, Riyadh Salt Industry Company, Samasalt, among others.

b. One major driving factor for the growth of sea salt consumption in the Middle East region is the increasing awareness of its health benefits compared to regular table salt. Sea salt is often perceived as more natural and less processed, containing essential minerals like magnesium and calcium.

b. The Middle East sea salt market was valued at USD 599.19 million in 2023 and is expected to reach USD 627.91 million in 2024.

b. The Middle East sea salt market is anticipated to grow at a high CAGR of 5.1% from 2024 to reach USD 845.90 million by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."