Middle East Intelligent Transportation Systems Market Size, Share & Trends Analysis Report By Transportation Mode, By Offering, By System, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-606-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Middle East ITS Market Size & Trends

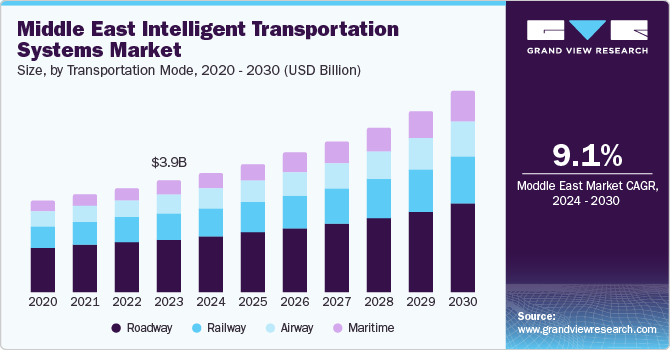

The Middle East intelligent transportation systems market size was valued at USD 3.93 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. This growth can be credited to the increasing adoption of smart city initiatives across the region. Governments in countries such as the United Arab Emirates, Saudi Arabia, and South Africa have heavily invested in smart infrastructure to enhance urban living standards, improve public services, and optimize resource management. These initiatives have created a significant demand for intelligent systems, including smart grids, intelligent transportation systems (ITS), and advanced surveillance technologies.

Another crucial market driver is the rising need for efficient traffic management solutions. With urbanization and the growing number of vehicles on the roads, traffic congestion has become a major issue in several MEA cities. Intelligent transportation systems (ITS) have been increasingly deployed to address this challenge by providing real-time traffic information, optimizing traffic flow, and enhancing road safety. The integration of technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) in ITS has further boosted their effectiveness and adoption.

Additionally, the increasing environmental concerns to reduce greenhouse gas emissions and the resulting climate change have been major contributing factors in the market growth. Governments across the MEA region have led to the implementation of ITS for smoother traffic flow through the use of public transport. In addition, the growth of tourism in countries including the UAE and Saudi Arabia has created a demand for efficient and modern transportation systems to enhance visitor experiences and manage increased traffic volumes.

Transportation Mode Insights

Roadways dominated the market and accounted for 47.1% share in 2023 owing to the increasing urbanization and the subsequent need for efficient traffic management solutions. With cities expanding rapidly, the demand for ITS that can manage traffic flow, reduce congestion, and enhance road safety has been on the rise. Technologies such as artificial intelligence (AI), the Internet of Things (IoT), and big data analytics have been increasingly integrated into traffic management systems to provide real-time traffic information and optimize traffic signals. In addition, the adoption of advanced public transportation systems, including smart buses and metro systems, is aimed at improving the efficiency and reliability of public transit. Moreover, extreme weather conditions across the MEA region have required the use of ITS technology. These systems use real-time data to optimize routes, manage schedules, and provide passengers with accurate arrival times, warning signs, sandstorms, and extreme heat climate, enhancing the overall user experience.

The maritime segment is expected to register the fastest CAGR during the forecast period due to the increasing maritime trade volume and the need for efficient port management systems. With the MEA region being a critical hub for global shipping routes, there is a growing demand for ITS that can enhance port operations, streamline cargo handling, and improve overall logistical efficiency. Moreover, the rise in maritime piracy and the need to protect critical maritime infrastructure has led to the adoption of advanced surveillance and monitoring systems. Intelligent systems equipped with radar, sonar, and satellite communication technologies have been deployed to monitor maritime activities, detect potential threats, and ensure the safety of vessels and cargo.

Roadway Offering Insights

The hardware segment accounted for the largest market revenue share in 2023. This can be credited to the increasing need for advanced traffic management solutions to address the growing urbanization and traffic congestion in major cities. ITS hardware, such as traffic signal controllers, sensors, and cameras, have been widely deployed to monitor and manage traffic flow efficiently. These devices collect real-time data, which is crucial for optimizing traffic signals, reducing congestion, and enhancing road safety. Moreover, the rising investment in smart city projects across the MEA region has driven the market. Governments have increasingly focused on developing smart infrastructure, including the implementation of intelligent roadways. Hardware components such as smart traffic lights, automated toll collection systems, and vehicle detection sensors are integral to these projects. These technologies improve traffic management and contribute to energy efficiency and environmental sustainability.

Services are expected to emerge as the fastest-growing segment at a CAGR of 8.7% during the forecast period. The market observed such growth due to the growing demand for specialized services such as system integration, customization, maintenance, and upgrades. These services can design, implement, and maintain ITS to optimize traffic flow, reduce congestion, and enhance road safety. Furthermore, the rapid use of technological advancements in ITS coupled with continuous improvements has boosted the market growth. Additionally, the increasing focus on data-driven decision-making in transportation management has fueled the need for data analytics and interpretation services.

Roadway System Insights

The Advanced Traffic Management System (ATMS) segment has accounted for the propellant market revenue share in 2023 owing to the increasing urbanization and the resulting traffic congestion in major cities. To address these challenges, governments and municipalities have invested in ATMS to optimize traffic flow, reduce congestion, and enhance road safety. These systems leverage technologies such as artificial intelligence (AI), the Internet of Things (IoT), and big data analytics to provide real-time traffic information, dynamic signal control, and incident management and monitor, control, and manage the traffic in the MEA region. Technologies such as sensors, cameras, and adaptive signal control for real-time traffic are included in ATMS. Regional governments have increasingly sought ATMS to increase safety on roads, reduce emissions, and optimize transport systems, thus providing better facilities further boosting this segment.

Advanced Public Transportation System (APTS) is expected to register the fastest CAGR of 9.1% during the forecast period owing to the increased demand for efficient public transportation solutions with enhanced efficiency, reliability, and convenience. Technologies such as real-time passenger information systems, automated fare collection, and advanced vehicle tracking have been adopted to improve the overall user experience and operational efficiency.

Roadway Application Insights

Traffic management dominated the market with a 32.1% share in 2023. There is a widening base of inhabitants in the region owing to attractive employment opportunities in countries such as the United Arab Emirates, Kuwait, Oman, and Saudi Arabia. The rise in population has resulted in an increase in passenger cars on roads, despite improving public transportation. This has triggered situations such as traffic congestion, eventually resulting in increased pollution and the need for effective traffic management systems. Governments and municipalities have made significant investments to combat the increased traffic congestion, optimize traffic flow, and enhance road safety.

Automotive Telematics is expected to grow substantially over the forecast period. Increasing stringency in regulations pertaining to the safety and security of vehicles, passengers, and pedestrians has contributed to the segment's growth. Constant evolution in connectivity between vehicle-to-vehicle (V2V) and vehicle-to-everything (V2X) has augmented the efficient implementation of intelligent transportation systems. Moreover, with the rise in commercial transportation and logistics activities, businesses have adopted telematics systems to monitor vehicle performance, optimize routes, and ensure driver safety. These systems provide real-time data on vehicle location, fuel consumption, and maintenance needs, enabling fleet managers to make informed decisions and improve operational efficiency.

Railway Offering Insights

Hardware accounted for the largest market revenue share of 48.8% in 2023 due to the increased investment in railway infrastructure modernization. Governments and private entities have significantly funded the upgrade of rail networks to enhance efficiency, safety, and connectivity. This includes the deployment of advanced hardware components such as smart signaling systems, automated train control systems, and real-time monitoring devices. These technologies are essential for improving operational performance and ensuring the safety of railway operations.

Services are expected to emerge as the fastest-growing segment in 2023 with significant funding from governments to cater to the rising demand for effective implementation, maintenance, and optimization. Additionally, the digital transformation and the adoption of cloud-based solutions in the railway sector have further boosted the market growth. Predictive maintenance technologies, such as sensors and IoT devices, have been integrated into railway infrastructure to monitor the condition of assets and predict potential failures. This proactive approach helps reduce downtime, extending the lifespan of railway components, and minimizing maintenance costs.

Railway System Insights

Advanced Traffic Management System (ATMS) accounted for the largest market revenue share of 27.3% in 2023. It is attributable to the increased focus on railway efficiency, safety, and capacity in the region. Furthermore, technologies such as real-time monitoring and automated control systems to optimize train improvements by reducing delays and increasing overall network performance have fueled the market growth.

Advanced Public Transportation System (APTS) is expected to register the fastest CAGR during the forecast period. It provides enhanced visibility into the overall timelines of buses and trains. The rising number of passengers traveling through public transportation and increasing investments in real-time information systems are poised to contribute to the growth of the segment. The segment is also expected to dominate the Middle East ITS market throughout the forecast period.

Railway Application Insights

Rail-running operation and collision avoidance held the dominant market share in 2023. This can be credited to the growing emphasis on safety and operational efficiency in the railway network in the region. Furthermore, advanced technologies such as GPS, sensors, and AI-driven algorithms to monitor train movements and prevent collisions, have driven the market growth. In addition, the expanding railway network has demanded better collision avoidance systems, further boosting the market growth.

Smart ticketing is expected to grow at a CAGR of 10.1% during the forecast period. This can be credited to the increased digitalization in public transportation services coupled with the increasing demand for convenient, contactless payment. Furthermore, smart ticketing includes a wide number of technologies including mobile ticketing, contactless smart cards, and near–field communication which enhance the overall passenger experience. These factors collectively are expected to augment the market demand.

Airway Offering Insights

Hardware dominated the market revenue share of 45.5% in 2023 owing to the increased demand for advanced air traffic management systems. With the rise in air travel and the complexity of airspace management, the market saw a growing need for sophisticated hardware solutions such as radar systems, communication devices, and navigation aids. These technologies are essential for ensuring the safety and efficiency of air traffic operations. Furthermore, governments and private entities have invested heavily in modernizing airports to accommodate the increased number of passengers and cargo. This includes the deployment of advanced hardware components such as automated baggage handling systems, biometric security systems, and smart check-in kiosks.

Services are expected to emerge as the fastest-growing CAGR segment during the forecast period owing to the increasing complexity in the aviation industry. The rising air travel and the complexity of airspace management have resulted in a growing need for specialized services that ensure the safety and efficiency of air traffic operations. These services include air traffic control, flight planning, and real-time monitoring, which are essential for managing the increased volume of air traffic in the region.

Airway System Insights

Advanced Traffic Management System (ATMS) secured the dominant market share in 2023. This can be credited to the increasing demand for efficient air traffic management due to the rising volume of air travel. This includes the deployment of advanced ATMS hardware and software components including radar systems, communication devices, and navigation aids. These technologies are essential for improving operational performance and ensuring the safety of air traffic operations.

Advanced Traveler Information System (ATIS) is anticipated to grow at a CAGR of 11.6 % during the forecast period. The increasing demand for real-time travel information has primarily driven the market. As air travel continues to grow, passengers have increasingly sought up-to-date information on flight schedules, delays, gate changes, and other travel-related details. ATIS solutions provide this information through various platforms, including mobile apps, digital displays, and websites, enhancing the overall passenger experience and reducing travel-related stress.

Airway Application Insights

Aircraft Management accounted for the largest market revenue share of 24.6% in 2023 due to the increasing demand for efficient air traffic management to combat the rising volume of air travel. These systems leverage advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics to provide real-time traffic information, optimize flight paths, and manage air traffic flow. Additionally, the focus on cost reduction and operational efficiency in a highly competitive market has driven airlines to invest heavily in advanced aircraft management solutions.

Traveler information management is expected to secure the fastest CAGR during the forecast period owing to the increasing demand for real-time, personalized information among air travelers in the region. Furthermore, the increasing investments in advanced traveler information systems further boosted the market growth. These systems provide information from various platforms, including mobile apps, digital displays, and websites. In addition, the rising adoption of smart technologies and the growing expectations for seamless, digitalized travel experiences have fueled the expansion of traveler information management systems.

Maritime Offering Insights

Hardware held the dominant market share in 2023 owing to the increasing demand for advanced navigation and communication systems. The rising global maritime trade and the complexity of managing large fleets have led to a growing need for sophisticated hardware solutions such as radar systems, GPS and GNSS systems, and sonar systems. These technologies are essential for ensuring the safety and efficiency of maritime operations by providing real-time data on vessel positions, potential collision risks, and navigational hazards.

Services are expected to register the fastest CAGR of 12.0% during the forecast period. This growth is attributable to the increasing demand for efficient port management services. With the MEA region being a critical hub for global shipping routes, there is a growing need for services that can enhance port operations, streamline cargo handling, and improve overall logistics efficiency. These services include system integration, real-time data analytics, and ongoing maintenance, which are essential for managing the complex operations of modern ports.

Maritime System Insights

Advanced Traffic Management System (ATMS) dominated the market with 25.0% of the share in 2023. ATMS plays a crucial role in optimizing vessel traffic flow, enhancing maritime safety, and improving overall operational efficiency in ports and waterways. These solutions equipped with radar, sonar, and satellite communication technologies have been deployed to monitor maritime activities, detect potential threats, and ensure the safety of vessels and cargo.

Advanced Traveler Information System (ATIS) is expected to grow exponentially during the forecast period. This can be credited to the rise of autonomous and connected vessels. These vessels rely on a robust infrastructure of sensors, communication devices, and data processing units to operate safely and efficiently. This also caters to the increasing demand for real-time, accurate information among maritime passengers and cargo stakeholders in the region. Additionally, the rising adoption of digital platforms and the growing expectations for seamless, data-driven maritime experiences have fueled the expansion of ATIS.

Maritime Application Insights

Emergency notification accounted for the largest market revenue share in 2023 owing to the increasing volume of maritime trade and the need for efficient and reliable communication systems that ensure the safety of vessels and crew. Additionally, emergency notification systems encompass a range of technologies designed to alert relevant authorities, crew members, and nearby vessels about potential threats, accidents, or distress situations at sea has increased the market growth.

Container movement scheduling is expected to emerge as the fastest-growing segment at a CAGR of 12.1 % during the forecast period. The increasing focus on optimizing port operations and enhancing supply chain efficiency in the region has primarily fueled the market growth. The rising adoption of smart port technologies and the growing emphasis on just-in-time logistics have driven the demand for sophisticated container movement scheduling systems. Additionally, the ability of these systems to reduce congestion, improve resource utilization, and increase overall port productivity is driving their rapid adoption across MEA ports.

Country Insights

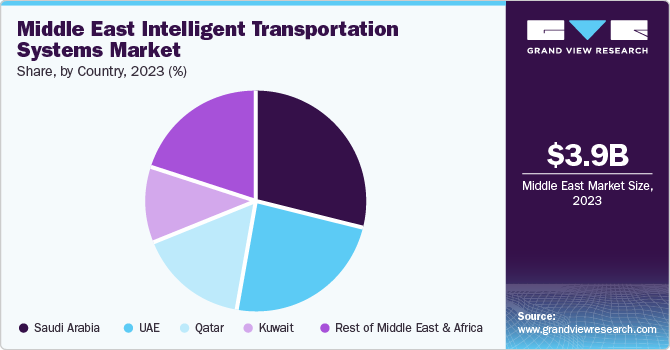

The Saudi Arabia intelligent transportation systems market held 29.1% of the share in 2023. The growth was primarily propelled by the government’s strong commitment to urban development and smart city initiatives, as outlined in the Vision 2030 plan. The plan aims to diversify the economy and reduce dependence on oil by investing heavily in infrastructure, including advanced transportation systems. The increasing urbanization and population growth in major cities including Riyadh and Jeddah have led to significant traffic congestion, necessitating the adoption of ITS solutions to improve traffic flow and enhance road safety.

The Kuwait intelligent transportation systems market is expected to grow substantially during the forecast period with the increased need for sustainable and efficient transportation solutions. With rising environmental concerns and the need to reduce carbon emissions, ITS offers a viable solution by optimizing traffic flow and reducing idle times, thereby lowering fuel consumption and emissions. In addition, the private sector’s involvement, including major players such as Siemens, Kapsch TrafficCom, and Cubic Transportation Systems, Inc., also contributed to the market’s growth by providing cutting-edge technologies and solutions.

Key Middle East Intelligent Transportation Systems Company Insights

Some of the key companies in the Middle East intelligent transportation systems (ITS) marketinclude Siemens AG, Thales, IBM Corporation, and Hitachi Ltd. Organizations have focused on undertaking several organic, strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Siemens AG is a German multinational conglomerate and one of the largest industrial manufacturing companies in Europe. The company is organized into several key divisions: Digital Industries, Smart Infrastructure, Mobility, and Siemens Healthineers. The Mobility division offers intelligent and efficient mobility solutions and freight transportation covering the entire gamut of rail infrastructure comprising signaling and electrification and Rolling Stock components and systems.

-

Huawei Technologies Co., Ltd. is a global provider of information and communications technology (ICT) infrastructure and smart devices. They offer Telecommunications network equipment, Smartphones and tablets, Cloud computing services, Enterprise networking solutions, Internet of Things (IoT) technologies, and Artificial Intelligence (AI) solutions. Huawei has historically engaged in numerous strategic partnerships with telecom operators, technology companies, and research institutions worldwide to enhance its technological capabilities and market presence.

Key Middle East Intelligent Transportation Systems Companies:

- Siemens AG

- Thales

- ALSTOM SA

- Cubic Transportation Systems, Inc.

- Kapsch TrafficCom AG

- Indra

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Hitachi, Ltd.

- Xerox Corporation

Recent Developments

-

In May 2024, Hitachi Rail announced its acquisition of Thales’ Ground Transportation Systems (GTS) business, broadening its global footprint to 51 countries. This move significantly boosts Hitachi’s market presence, with a substantial portion of its revenue now stemming from high-return signaling and systems. The acquisition enhances Hitachi’s digital services by integrating IT, OT, and products across a larger installed base in the mobility sector. Additionally, Hitachi aims to address global social challenges through collaborative efforts with customers.

Middle East Intelligent Transportation Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 4.21 billion |

|

Revenue forecast in 2030 |

USD 7.09 billion |

|

Growth rate |

CAGR of 9.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Transportation mode ,roadway offering, roadway system type, roadway application, railway offering, railway system type, railway application, airway offering, airway system type, airway application, maritime offering, maritime system type, maritime application |

|

Country scope |

Qatar, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Siemens; Thales; ALSTOM SA; Cubic Transportation Systems, Inc.; Kapsch TrafficCom AG; Indra; Huawei Technologies Co., Ltd.; IBM Corporation; Hitachi, Ltd.; Xerox Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Middle East Intelligent Transportation Systems Market Report Segmentation

This report forecasts revenue growth at regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East intelligent transportation systems market report based on transportation mode, roadway offering, roadway system, roadway services, railway offering, railway system, railway services, airway offering, airway system, airway services, maritime offering, maritime system, maritime, services, and country.

-

Transportation Mode Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Roadway

-

Railway

-

Airway

-

Maritime

-

-

Roadway Offering Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Roadway System Type Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Traveler Information System (ATIS)

-

Advanced Traffic Management System (ATMS)

-

Advanced Transportation Pricing System (ATPS)

-

Advanced Public Transportation System (APTS)

-

Emergency Medical System (EMS)

-

-

Roadway Application Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Traffic Management

-

Road Safety and Security

-

Freight Management

-

Public Transport

-

Environment Protection

-

Automotive Telematics

-

Parking Management

-

Road Tolling Systems

-

Others

-

-

Railway Offering Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Railway System Type Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Traveler Information System (ATIS)

-

Advanced Traffic Management System (ATMS)

-

Advanced Transportation Pricing System (ATPS)

-

Advanced Public Transportation System (APTS)

-

Emergency Medical System (EMS)

-

-

Railway Application Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Rail-running Operation and Collision Avoidance

-

Passenger Information Management

-

Smart Ticketing

-

Security Surveillance

-

Emergency Notification

-

Others

-

-

Airway Offering Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Airway System Type Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Traveler Information System (ATIS)

-

Advanced Traffic Management System (ATMS)

-

Advanced Transportation Pricing System (ATPS)

-

Advanced Public Transportation System (APTS)

-

Emergency Medical System (EMS)

-

-

Airway Application Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Security Surveillance

-

Shuttle Bus Tracking

-

Traveler Information Management

-

Aircraft Management

-

Smart Ticketing

-

Emergency Notification

-

Others

-

-

Maritime Offering Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Maritime System Type Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Traveler Information System (ATIS)

-

Advanced Traffic Management System (ATMS)

-

Advanced Transportation Pricing System (ATPS)

-

Advanced Public Transportation System (APTS)

-

Emergency Medical System (EMS)

-

-

Maritime Application Insights Outlook (Revenue, USD Million, 2018 - 2030)

-

Freight Arrival & Transit

-

Real-time Weather Information Tracking

-

Container Movement Scheduling

-

Emergency Notification

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Middle East and Africa (MEA)

-

Qatar

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."