Middle East Feeder And Distribution Pillar Market Size, Share & Trends Analysis Report By Type (Single Phase, Three Phase), By Application (Smart Grid, Commercial Premises), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-637-0

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

The Middle East feeder and distribution pillar market size was valued at USD 263.2 million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 5.9% from 2025 to 2030. The presence of several well-planned cities in economies such as Saudi Arabia and UAE, coupled with the promising growth of Qatar in terms of urbanization and industrialization, has driven the need for feeder pillars to ensure efficient and reliable electricity distribution while also ensuring the safety of electrical components. Additionally, emerging trends such as innovative grid technologies, integration of renewable energy sources, and the development of eco-friendly grid designs are anticipated to influence market expansion in the coming years.

The rapidly increasing demand for residential, commercial, and light industrial applications in the region, coupled with a constant requirement of reliable power delivery, is expected to drive innovations in this industry. Companies are extensively utilizing superior quality raw materials to ensure reliability of feeder and distribution pillars with low ownership costs, reduced maintenance requirements and improved service life, reduced cabling and indoor floor space, and safe and easy usability. Furthermore, end-users are demanding optimal protection for transformers and cables from electrical faults, which is anticipated to aid product demand over the forecast period. These systems offer several notable benefits, such as the capability to be installed in both indoor and outdoor environments, thus saving valuable indoor space in facilities such as hospitals and retail stores.

Innovations in feeder pillars are expected to encourage competition in the regional market, leading to an increase in the number of products offered by companies that cater to different requirements. For instance, feeder pillars are increasingly integrating features such as remote control systems, allowing operators to manage and monitor the system performance remotely. Additionally, the integration of Internet of Things (IoT) technologies allows them access to data in real-time, enabling instantaneous performance of diagnostics that leads to enhanced efficiency and reduced downtimes. Smart feeder pillars are equipped with advanced metering infrastructure (AMI) for real-time monitoring of energy consumption, allowing for better demand management. Future trends, such as incorporation of artificial intelligence (AI) for predictive maintenance and advanced grid management, along with microgrid compatibility, are projected to shape regional industry growth positively in the coming years.

Type Insights

The three phase segment accounted for a dominant revenue share of 73.2% in 2024 and is expected to maintain its leading position during the forecast period. A three-phase feeder pillar is a key component in electrical distribution systems, especially in industrial, commercial, and high-demand residential applications. The Middle East has witnessed the initiation and completion of several large-scale projects over the past few decades, aided by significant investments and financial initiatives by regional governments, leading to the use of efficient electrical infrastructure. Three phase feeder pillars offer a range of advantages, such as a secure and reliable power supply, low maintenance requirements, and the ability to be designed keeping future requirements in mind. Moreover, they offer reduced power losses and voltage fluctuations when compared to single phase feeder pillars, making them ideal for bulk power distribution.

Single phase feeder and distribution pillars are expected to witness moderate growth in demand in the coming years, owing to their usage in the residential segment and cost-efficiency when compared to three-phase systems. Additionally, they are much easier to install and maintain and offer a stable power supply that is required for general household appliances and lighting equipment. However, they have a much lower power capacity than three-phase feeder pillars, limiting their usage in large commercial and industrial settings. Moreover, single-phase power distribution can result in higher energy losses, particularly over long distances. The voltage drop is more significant in single-phase systems, especially under heavy loads. Also, these systems may require multiple feeder pillars or transformers to accommodate increased demand in developing areas, leading to potential inefficiencies. As these issues are not associated with three-phase feeder pillars, their demand is expected to remain comparatively higher during the forecast period.

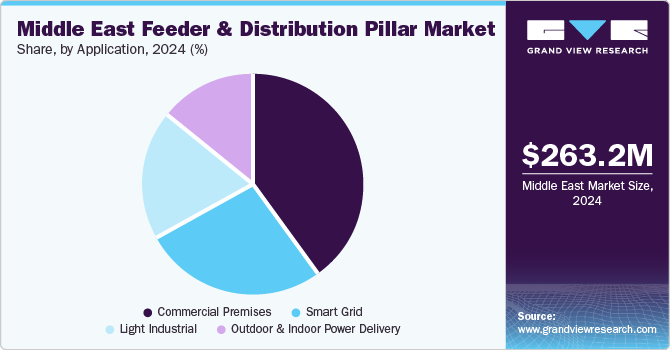

Application Insights

The commercial premises segment accounted for the largest revenue share in 2024. Economies such as the UAE and Saudi Arabia have become well-known for building advanced infrastructure in the commercial space. The increasing presence of private offices, restaurants, supermarkets, and retail stores in the region has boosted the demand for feeder and distribution pillars, particularly three-phase systems, as they can handle heavy loads efficiently while also ensuring a balanced power distribution, thus reducing losses. With advancements in technology and the emergence of more commercial establishments in the Middle East in the coming years, the segment is anticipated to remain a major end-user of feeder pillars during the forecast period.

On the other hand, the smart grid segment is anticipated to advance at the fastest growth rate from 2025 to 2030. The increasing population and urbanization in major regional cities such as Riyadh and Abu Dhabi, along with the rising focus on the use of renewable energy sources by governments, have created substantial interest regarding the installation of smart grids. For instance, the UAE has launched the Smart Dubai initiative, aiming to transform Dubai into a smart city. This includes the deployment of smart meters and enhancing energy efficiency. The Dubai Electricity and Water Authority (DEWA) is implementing smart grid technologies to optimize energy management and integrate renewable resources. Consequently, the demand for feeder pillars has witnessed healthy growth, as they act as distribution points that connect substations to local networks, distributing electricity to end-users efficiently. Moreover, they enable seamless connection of distributed energy resources such as solar panels and wind turbines into the grid.

Country Insights

Saudi Arabia Feeder And Distribution Pillar Market

In the Middle East region, Saudi Arabia accounted for a leading revenue share of 23.0% in the feeder and distribution pillar market in 2024. The rapid growth in the countrywide population due to extensive modernization and infrastructure development, along with expansion of urban areas, has created substantial demand for a robust electrical infrastructure. Furthermore, the country is moving away from its dependency on oil resources through diversification by investing heavily in utilities and infrastructure as part of its ‘Saudi Vision 2030’ initiative. The large-scale development of commercial premises, venues, and residential complexes has driven electrical installation manufacturers to develop advanced feeder and distribution pillars in the economy.

UAE Feeder And Distribution Pillar Market

The UAE, meanwhile, is anticipated to witness fastest growth in the regional market during the forecast period. The economy has witnessed significant urban growth, led by globally renowned cities such as Dubai and Abu Dhabi. Similar to Saudi Arabia, UAE has launched a number of initiatives that aim to move its reliance away from oil & gas to other sectors, such as finance, tourism, and real estate, as a measure of its progress. The economy has hosted several major sports events, cultural programs, exhibitions, and trade expos in recent years, creating a substantial demand for electrical networks and efficient distribution systems. These factors are anticipated to aid market expansion in the UAE in the coming years.

Key Middle East Feeder And Distribution Pillar Company Insights

Some key companies involved in the Middle East feeder and distribution pillar market include Federal Switchgear, Hager Group, and Qatar International Electrical Co. WLL, among others.

-

Federal Switchgear is involved in the development of Switchgear products, with its manufacturing facility situated in the Middle East. It is a part of Zubair Corporation, an Oman-based diversified business group. The company has established its busway manufacturing facilities via a partnership with the U.S.-based Wilmar International. Federal Switchgear manufactures feeder pillars up to 3000 A, control cabinets, main distribution boards, and different ratings of busways with aluminum or steel enclosures. These products are designed, manufactured, and tested to strictly adhere to various national and international standards, including IEC – 61439-1 / IEC 61439-5.

-

Hager Group is a German electrical installation manufacturer catering to commercial, industrial, and residential end-users. The company conducts operations in the Middle East through Hager Middle East, which is headquartered in Dubai. The company has regional offices in Qatar and Saudi Arabia. It offers products in the areas of energy distribution, wiring accessories, lighting control, cable management, building automation, and security. In the energy distribution segment, the company offers final distribution boards, sub-main distribution boards, and main distribution boards, along with other solutions.

Key Middle East Feeder And Distribution Pillar Companies:

- Charles Endirect

- Emirates Transformer and Switchgear Ltd.

- Federal Switchgear

- Hager Group

- Khalid Electrical & Mechanical Co. (KEMCO)

- Qatar International Electrical Co. WLL

- Schneider Electric

- Verger Delporte UAE Ltd.

- Al-Salam Industrial And Trading Est

- TechnoGroup

Recent Developments

-

In December 2023, Charles Endirect announced the launch of its online shop that includes products catering to the street lighting and public sector markets. The company launched this distribution channel with feeder pillars of different sizes and finishes, as well as efficient and innovative photocell solutions. It plans to expand its online portfolio further in 2024 with the addition of more product ranges.

Middle East Feeder and Distribution Pillar Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 277.2 million |

|

Revenue Forecast in 2030 |

USD 369.8 million |

|

Growth rate |

CAGR of 5.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Type, application, region |

|

Country scope |

Qatar, Saudi Arabia, UAE |

|

Key companies profiled |

Charles Endirect; Emirates Transformer and Switchgear Ltd.; Federal Switchgear; Hager Group; Khalid Electrical & Mechanical Co. (KEMCO); Qatar International Electrical Co. WLL; Schneider Electric; Verger Delporte UAE Ltd.; Al-Salam Industrial And Trading Est; TechnoGroup |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Middle East Feeder And Distribution Pillar Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Middle East feeder and distribution pillar market report based on type, application, and country.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Phase

-

Three Phase

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Smart Grid

-

Commercial Premises

-

Light Industrial

-

Outdoor And Indoor Power Delivery

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

Qatar

-

Saudi Arabia

-

UAE

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."