Middle East Drilling Fluid Market Trends

The Middle East drilling fluid market size was valued at USD 1.96 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. The market growth is driven by the rise in oil and gas exploration and production activities, increased onshore and offshore drilling activities in response to rising energy demand, and the surge in demand for shale gas.

The industry is witnessing a surge in demand due to the increasing focus on unconventional sources of oil and gas, driven by the depletion of conventional reserves. The rising exploration activity in the region is fueling the demand for drilling fluids, which are essential for maintaining wellbore stability, controlling pressure, and simplifying the extraction process.

The growth in energy demand and the enhancement of drilling processes in oil and gas exploration and production are key drivers for the drilling fluids market. Moreover, there is a trend towards the adoption of water-based drilling fluids, which are eco-friendly and cost-effective. The Middle East remains the largest market for drilling fluids, with energy firms relying on these fluids for efficient and effective well drilling.

The increasing need for advanced drilling fluids has arisen from the rise in shale gas production, particularly in managing the challenges of shale formations, such as high temperatures, pressures, and varied rock compositions. The shale gas revolution requires specialized fluid solutions to address the specific needs of unconventional drilling. As a result, companies are investing in research and development to create innovative drilling fluids that meet the unique demands of this sector.

Product Insights

Water-based fertilizers (WBFs) dominated the market and accounted for a share of 49.3% in 2023. WBFs are a more economical option compared to oil-based fertilizers (OBF), particularly in areas with abundant water resources. WBFs offer a lower environmental impact, reducing disposal costs and responsibilities. Advancements in WBF technology have improved their efficiency in challenging drilling conditions, enhancing wellbore stability and debris removal.

SBF is expected to grow significantly, with a CAGR of 4.5% during the forecast period, owing to its superior thermal stability, borehole control, penetration rates, and lubricity, which leads to reduced operational costs. As oil-based fluids have a negative environmental impact, the sector is anticipated to transition gradually towards synthetic-based fluids, driving growth throughout the forecast period.

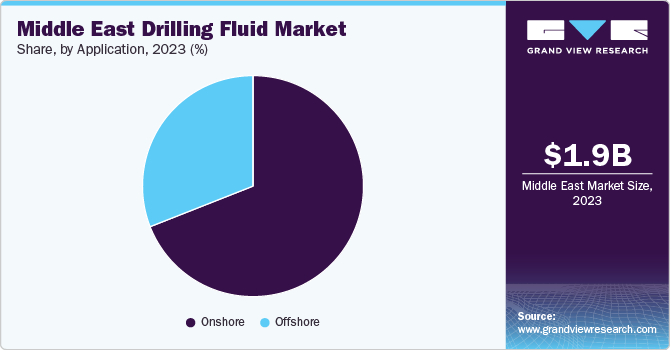

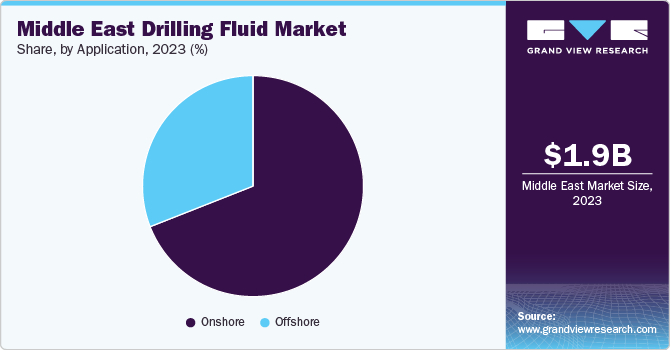

Application Insights

Onshore accounted for the largest market revenue share of 69.5% in 2023. Onshore drilling is more cost-efficient due to lower operational expenses and easy access, driving market growth. Convenient transportation to land locations and advancements in hydraulic fracturing methods, particularly in extracting onshore shale gas and tight oil, have contributed to the surge in drilling activity.

Offshore is projected to grow at the fastest CAGR of 4.9% over the forecast period. The drilling industry has witnessed advancements in equipment, such as rigs, wellheads, and downhole tools, enhancing the safety and efficiency of offshore operations. Moreover, the development of customized drilling fluids tailored to offshore environments, featuring improved salt tolerance and corrosion resistance, has mitigated the challenges associated with offshore drilling.

Regional Insights

Saudi Arabia Drilling Fluid Market Trends

Saudi Arabia drilling fluid market dominated the Middle East drilling fluid market with a revenue share of 28.3% in 2023, driven by the presence of major oil and gas producers with significant petroleum reserves. The region’s offshore oil and gas production is expected to increase due to factors such as reviving abandoned oil wells in the Persian Gulf and the sale of existing rig activities.

Key Middle East Drilling Fluid Company Insights

Some key companies in the Middle East drilling fluids market include OiLSERV; ALI & SONS; Al Ghaith Energy LLC; Baker Hughes; Halliburton Inc; SLB; Weatherford and others. These companies engage in manufacturing, utilization, and distribution of drilling fluid products, supporting E&P activities globally through raw material production.

-

OiLSERV is provider of oilfield services aiming to cater to customers throughout the Middle East and North Africa region. The company provides a variety of services such as well logging and testing, production improvement, drilling, surface production management, and integrated oilfield services, providing personalized, competitive, and cost-efficient services that meet clients’ requirements.

-

Al Ghaith Energy LLC offers complete drilling solutions such as equipment installation, commissioning, and post-sale service for a range of drilling systems and equipment. Provides innovative tools and systems for monitoring and controlling processes in a range of industries such as oil and gas, water, sewage, and irrigation networks.

Key Middle East Drilling Fluid Companies:

- OiLSERV

- ALI & SONS

- Al Ghaith Energy LLC

- Baker Hughes

- Halliburton Inc

- SLB

- Weatherford

- Newpark Resources, Inc.

- ChampionX (Anchor Drilling fluid USA, Inc.)

- TETRA Technologies, Inc.

- MAZRUI INTERNATIONAL (Petrochem Performance Chemicals Ltd. LLC)

- EMEC

- IDEC

- OREN HYDROCARBONS

- Flotek Industries, Inc.

- MB Petroleum Services LLC

- Diamoco Group

- Oman Drilling Mud Products Co LLC.

- Catalyst LLC

Recent Developments

-

In April 2024, Halliburton Inc secured a deepwater contract with Rhino Resources Ltd. in Africa, partnering to optimize Namibia’s oil and gas industry.

-

In January 2024, ADNOC Drilling acquired 16 hybrid-powered rigs for USD 327 million, boosting its fleet and decarbonization efforts, with two rigs commencing operations in Abu Dhabi.

Middle East Drilling Fluid Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 2.05 billion

|

|

Revenue forecast in 2030

|

USD 2.68 billion

|

|

Growth rate

|

CAGR of 4.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million, CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region

|

|

Regional scope

|

MEA

|

|

Country scope

|

Saudi Arabia, UAE, Kuwait, Qatar, Iran, Iraq

|

|

Key companies profiled

|

OiLSERV; ALI & SONS; Al Ghaith Energy LLC; Baker Hughes; Halliburton Inc; SLB; Weatherford; Newpark Resources, Inc.; ChampionX (Anchor Drilling fluid USA, Inc.); TETRA Technologies, Inc.; MAZRUI INTERNATIONAL (Petrochem Performance Chemicals Ltd. LLC); EMEC; IDEC; OREN HYDROCARBONS; Flotek Industries, Inc.; MB Petroleum Services LLC; Diamoco Group; Oman Drilling Mud Products Co LLC.; Catalyst LLC

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Middle East Drilling Fluid Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East drilling fluid market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)